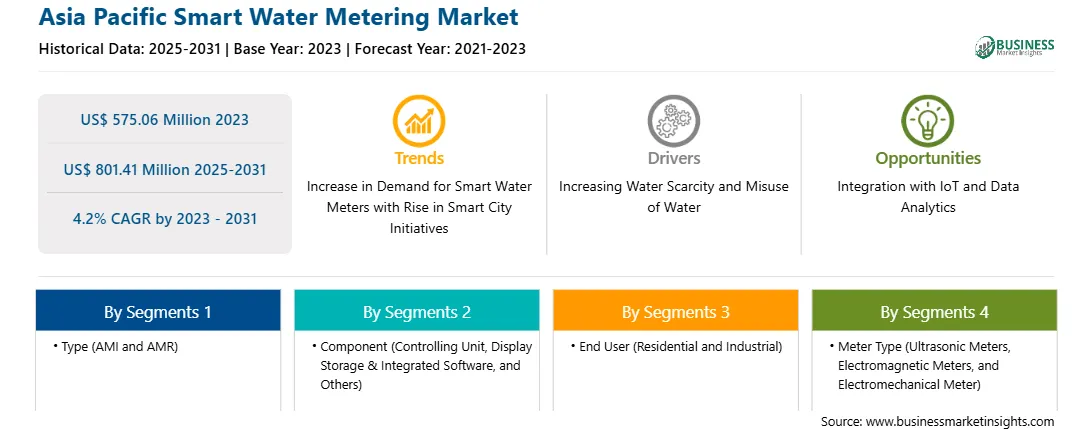

The Asia Pacific smart water metering market was valued at US$ 575.06 million in 2023 and is expected to reach US$ 801.41 million by 2031; it is estimated to register a CAGR of 4.2% from 2023 to 2031.

The integration of smart water meters with the Internet of Things (IoT) and advanced data analytics platforms presents a significant opportunity for the growth of the smart water metering market. IoT-enabled smart meters collect real-time data on water usage, providing utilities with immediate insights into consumption patterns, system performance, and potential issues such as leaks or irregular usage. This seamless connectivity allows for remote monitoring, eliminating the need for manual meter readings and enabling more efficient management of water resources. Data analytics platforms enhance the value of this integration by processing the vast amounts of data generated by smart meters. These platforms can identify trends, forecast demand, detect anomalies, and optimize water distribution in real-time. For example, utilities can use predictive analytics to proactively address maintenance needs, reducing downtime and preventing costly repairs. Additionally, consumers can access personalized usage data through apps or online portals, empowering them to make informed decisions about water conservation and potentially lower their utility bills.

This integration not only improves the operational efficiency of utilities but also promotes transparency and accountability. It offers a more sustainable approach to water management by reducing waste, enhancing resource allocation, and increasing customer satisfaction. As IoT and data analytics technologies continue to evolve, their role in optimizing smart water metering systems will become increasingly crucial in modern water management strategies.

Asia Pacific remains the world's most vulnerable region to water security and thus needs to address this issue for the economic growth of countries. As per research conducted by the Asian Development Bank, close to 3.4 billion people in Asia Pacific will be living in water-stressed areas by 2050, while the demand for water is expected to increase by 55%. Asia Pacific is home to around 60% of the world's population, which needs access to clean water for potable uses, as well as for other household purposes. Additionally, climate change plays another critical role in the water supply crisis in the region. Some areas of the region remain heavily flooded, whereas a few faces huge water scarcity problems. Therefore, there is a dire need for government intervention in Asian countries to minimize water wastage and maintain water assets to ensure long-term sustainability of water supply. A large population in China and India, the expanding middle-class population in these countries, and the growing manufacturing sector in both countries are poised to foresee a bright future for the deployment of smart water meters in the countries. Water is a pressing priority in most of the manufacturing industries, and also many Asian countries are agrarian economies where water is a prime requirement. The scarcity of water resources in the current times demands a more robust and efficient water distribution system. The efficient water distribution system ensures proper accountability and supply of water and becomes extremely critical in areas that face draught-like situations. Smart water meters coupled with analytics software for control management empower the concerned authorities to plan well in advance on the volume of water to be distributed in a particular area, depending upon the availability of water. Climatic conditions play an important role in annual water forecasts. Thus, smart water metering systems can be useful for municipal corporations and water utilities in planning the volumes of water for urban distributions. Supportive digitalization policies and enhanced focus on the development of smart cities in countries such as Japan, China, India, Singapore, Australia, and South Korea will boost the demand for smart water meters. Countries such as Vietnam, Cambodia, and the Philippines will follow suit in the adoption of smart water meters post the success of IIoT in Asia, increasing overall supply chain efficiency in the region.

Ambitious digital initiatives in countries of Southeast Asia have spurred government support for smart water meter rollout. There are a few Asian countries, including Singapore, taking significant steps to promote digital water technologies. Singapore's national water agency, PUB, is utilizing an Itron industrial IoT network canopy for smart water metering applications from SP Group in November 2022. This network would connect around 300,000 C&I and residential smart water meters while fueling water conservation goals. The installation of new water technologies is an integral part of PUB's Smart Water Meter Program that is projected to change the organization into a smart utility. The first phase of a smart water meter program will be introduced in Bukit Batok, Jurong West, Hougang, Tampines, and Tuas, along with real state parts, including Tampines North and Tengah. Such developments drive the demand for smart water meters across the region. Kamstrup, Sensus Technologies, Itron, Aichi Tokei Denki, and Elster Group are among the prominent market players in Asia Pacific. Japan, New Zealand, and Australia are a few advanced countries in the region that lead the adoption of smart water metering systems. Also, IoT integrations and LPWAN integrations have been ramped up in these countries. Other Southeast Asian countries, including Singapore, South Korea, Vietnam, Hong Kong, India, and China, are on the verge of rapid growth for the deployment of smart water meters in industrial and agricultural sectors, as well as households.

Strategic insights for the Asia Pacific Smart Water Metering provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Asia Pacific Smart Water Metering refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.Asia Pacific Smart Water Metering Strategic Insights

Asia Pacific Smart Water Metering Report Scope

Report Attribute

Details

Market size in 2023

US$ 575.06 Million

Market Size by 2031

US$ 801.41 Million

CAGR (2023 - 2031) 4.2%

Historical Data

2021-2023

Forecast period

2025-2031

Segments Covered

By Type

By Component

By End User

By Meter Type

Regions and Countries Covered

Asia-Pacific

Market leaders and key company profiles

Asia Pacific Smart Water Metering Regional Insights

The Asia Pacific smart water metering market is categorized into type, component, end user, meter type, and country.

Based on type, the Asia Pacific smart water metering market is bifurcated into AMI and AMR. The AMR segment held a larger market share in 2023.

In terms of component, the Asia Pacific smart water metering market is categorized into controlling unit, display storage & integrated software, and others. The display storage & integrated software segment held the largest market share in 2023.

By end user, the Asia Pacific smart water metering market is bifurcated into residential and industrial. The residential segment held a larger market share in 2023.

Based on meter type, the Asia Pacific smart water metering market is categorized into ultrasonic meters, electromagnetic meters, and electromechanical meter. The ultrasonic meters segment held the largest market share in 2023.

By country, the Asia Pacific smart water metering market is segmented into Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific. China dominated the Asia Pacific smart water metering market share in 2023.

Kamstrup AS, Mueller Water Products Inc, Badger Meter Inc, Itron Inc, Arad Ltd, Sensus USA Inc, WAVIoT Integrated Systems LLC, and Diehl Stiftung & Co KG., are among the leading companies operating in the Asia Pacific smart water metering market.

The Asia Pacific Smart Water Metering Market is valued at US$ 575.06 Million in 2023, it is projected to reach US$ 801.41 Million by 2031.

As per our report Asia Pacific Smart Water Metering Market, the market size is valued at US$ 575.06 Million in 2023, projecting it to reach US$ 801.41 Million by 2031. This translates to a CAGR of approximately 4.2% during the forecast period.

The Asia Pacific Smart Water Metering Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Smart Water Metering Market report:

The Asia Pacific Smart Water Metering Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Smart Water Metering Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Smart Water Metering Market value chain can benefit from the information contained in a comprehensive market report.