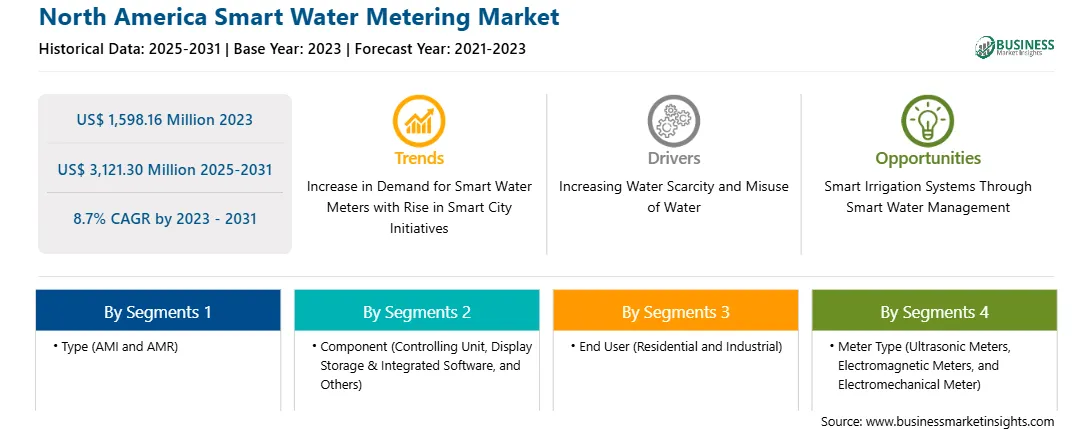

The North America smart water metering market was valued at US$ 1,598.16 million in 2023 and is expected to reach US$ 3,121.30 million by 2031; it is estimated to register a CAGR of 8.7% from 2023 to 2031.

Practices such as illegal tapping, tampering with pipelines, leakage, and others cause water scarcity. According to the World Wildlife Fund (WWF), ∼ 1.1 billion individuals across the world lack access to water, resulting in 2.7 billion finding water scarce. According to UNESCO, the global urban population confronting water scarcity is expected to quadruple from 930 million people in 2016 to 1.7–2.4 billion by 2050. Also, the increasing frequency of extreme and persistent droughts is pressuring ecosystems, with disastrous repercussions for plant and animal species. Furthermore, another major issue faced by various regions is the misuse of water, which has significantly increased the demand for advanced solutions to maintain the consumption pattern from source to destination. The significant demand for an advanced solution has led to the development and implementation of smart water meters, as they can monitor consumption patterns and monitor leakage, theft, and illegal tampering. Smart water meters are equipped with wired or wireless devices that are integrated with data management programs, which enable the user or operator to examine/check the consumption pattern. Technological advancements in the field of water conservation can help in fighting water scarcity. Thus, various governments of developed and developing regions across the world are constantly increasing their desire to adopt these robust technologies to provide enough water to the public. Additionally, numerous private organizations are striving to implement technologically advanced smart water management systems to address water scarcity issues across the globe. Therefore, increasing water scarcity and misuse propels the demand for proper maintenance of water consumption patterns, which bolsters the adoption of smart water meters.

North America comprises the US, Canada, and Mexico. The US is a developed country in terms of the adoption of modern technology, standard of living, infrastructure development, and others. Also, affordability concerns regarding the development of water infrastructures have reached a critical stage. The US Environmental Protection Agency (EPA) manages two State Revolving Fund programs — the Clean Water State Revolving Fund (CWSRF) and the Drinking Water State Revolving Fund (DWSRF). In addition, DWSRF is co-funded by the federal and state governments, with 80% and 20%, respectively. The water industry's investors have focused on opportunistic upgrades—primarily to support smart meter installation and data collection and visualization rather than full network optimization. Governments of the region continue to take measures to reduce unyielding water usage and undergo modernization and replace older water meters with avant-garde smart water meters, which is becoming a major trend in North America. Various public–private partnerships can help reduce the issues concerning efficient water management. The regional product manufacturers aim to develop varied types of smart water meters. Private companies have invested in R&D activities to develop innovative products and gain leadership to strengthen the growth of the North American smart water metering market. In September 2022, Saint-Gobain installed a smart water meter system and upgraded equipment in Social Circle, Georgia, through its building products subsidiary CertainTeed LLC. In addition, the installation focuses on reducing the site's water consumption by more than two million gallons per year. Saint-Gobain continues to work on reducing the company's water consumption at its manufacturing sites.

The technology providers, water utilities, and investors comprise the stakeholder ecosystem in the North American smart water metering market. Municipal water sectors in the region are financially risk averse as they look at low-cost bids that do not always provide water utilities with proper resources. In August 2023, WaterMeter Corp., in conjunction with WND Mexico and UnaBiz, announced the signing of a Memorandum of Understanding (MoU) to transform water management in Mexico. The strategic cooperation seeks to implement one million water meters using Sigfox 0G technology in Mexico over the next ten years, enabling novel solutions for precise, efficient, and sustainable water monitoring. Badger Meter, Inc.; Itron Inc.; WAVIoT; and Sensus are among the prominent players in the North America smart water metering market.

Strategic insights for the North America Smart Water Metering provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the North America Smart Water Metering refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.North America Smart Water Metering Strategic Insights

North America Smart Water Metering Report Scope

Report Attribute

Details

Market size in 2023

US$ 1,598.16 Million

Market Size by 2031

US$ 3,121.30 Million

CAGR (2023 - 2031) 8.7%

Historical Data

2021-2023

Forecast period

2025-2031

Segments Covered

By Type

By Component

By End User

By Meter Type

Regions and Countries Covered

North America

Market leaders and key company profiles

North America Smart Water Metering Regional Insights

The North America smart water metering market is categorized into type, component, end user, meter type, and country.

Based on type, the North America smart water metering market is bifurcated into AMI and AMR. The AMR segment held a larger market share in 2023.

In terms of component, the North America smart water metering market is categorized into controlling unit, display storage & integrated software, and others. The display storage & integrated software segment held the largest market share in 2023.

By end user, the North America smart water metering market is bifurcated into residential and industrial. The residential segment held a larger market share in 2023.

Based on meter type, the North America smart water metering market is categorized into ultrasonic meters, electromagnetic meters, and electromechanical meter. The ultrasonic meters segment held the largest market share in 2023.

By country, the North America smart water metering market is segmented into the US, Canada, and Mexico. The US dominated the North America smart water metering market share in 2023.

Kamstrup AS, Mueller Water Products Inc, Badger Meter Inc, Itron Inc, Neptune Technology Group Inc, Arad Ltd, Sensus USA Inc, WAVIoT Integrated Systems LLC, and Diehl Stiftung & Co KG., are among the leading companies operating in the North America smart water metering market.

The North America Smart Water Metering Market is valued at US$ 1,598.16 Million in 2023, it is projected to reach US$ 3,121.30 Million by 2031.

As per our report North America Smart Water Metering Market, the market size is valued at US$ 1,598.16 Million in 2023, projecting it to reach US$ 3,121.30 Million by 2031. This translates to a CAGR of approximately 8.7% during the forecast period.

The North America Smart Water Metering Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Smart Water Metering Market report:

The North America Smart Water Metering Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Smart Water Metering Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Smart Water Metering Market value chain can benefit from the information contained in a comprehensive market report.