IoT Hearing Devices Market Outlook (2022-2033)

No. of Pages: 200 | Report Code: BMIPUB00031913 | Category: Life Sciences

No. of Pages: 200 | Report Code: BMIPUB00031913 | Category: Life Sciences

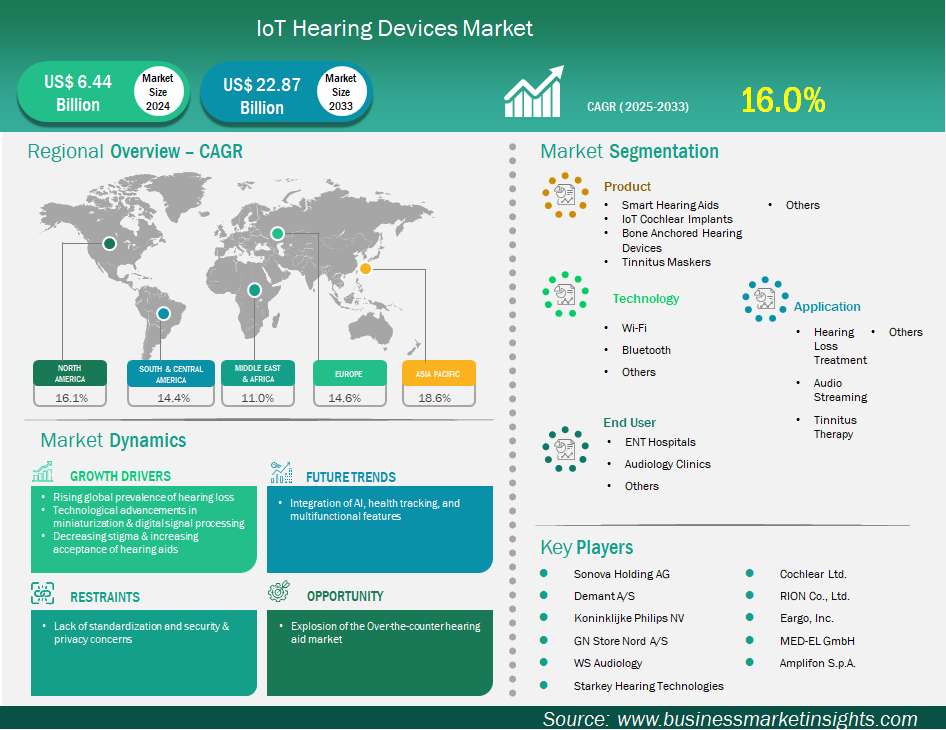

The IoT hearing devices market size is expected to reach US$ 22,871.0 million by 2033 from US$ 6,443.1 million in 2024. The market is estimated to record a CAGR of 16.0% from 2025 to 2033.

The global IoT hearing devices market is experiencing significant growth driven by rising global prevalence of hearing loss, technological advancements in miniaturization & digital signal processing, decreasing stigma & increasing acceptance of hearing aids. However, the lack of standardization and associated security and privacy concerns are slowing market evolution. Geographically, the largest market share was in North America due to a strong healthcare infrastructure, increased public awareness and acceptance of newer technology related to medical needs, large manufacturers in the region, and a pro-regulatory environment, with the passing and approval of over-the-counter (OTC) hearing aids recently. The fastest-growing region is the Asia-Pacific (APAC) region, due to a rapidly changing healthcare infrastructure, a massive aging population, increasing disposable incomes, and a growing awareness of health and well-being campaigns. The leading companies in this space are Sonova Holding AG, GN Store Nord A/S, Demant A/S, WS Audiology, Starkey Hearing Technologies, and Cochlear Ltd., with all of these companies looking to innovate and work with new technologies in order to expand their market and global reach as a company.

Key segments that contributed to the derivation of the IoT Hearing Devices market analysis are product, technology, application, and end user.

The increasing prevalence of hearing loss globally is a foundational and powerful driver for the expansion of the IoT hearing devices market. Current statistics estimate that a significant number of the world's population has some form of hearing impairment and predicted forecasts show the number of people who will need some form of hearing rehabilitation is expected to grow substantially over the next decades. This growing and widespread burden of health represents a persistent and growing demand for effective solutions. Hearing loss impacts communication, social interaction, cognition, and quality of life, and it has never been more urgent to provide high quality, accessible, and user-friendly hearing solutions. One of the main contributors to the rising prevalence of hearing loss is the rapidly growing elderly population in the world. Age-related hearing loss, called presbycusis, is one of the most prevalent sensory deficits in the elderly population and the prevalence rises significantly with age. Age is not the only factor related to the increase in hearing loss, as exposure to loud noise is more prevalent than ever (e.g. personal audio technology, occupational exposure), chronic diseases, and ototoxic drugs are also contributions to the numbers rising across all ages. As more people are aware of the impact of their hearing impairment and adopt solutions, the potential for IoT hearing devices to provide users with more than just basic amplification should be a constant trend in the progress of IoT hearing devices.

The enormous growth of the over-the-counter (OTC) hearing aid category is a major opportunity for the IoT hearing devices industry. Until recently, the common experience of purchasing hearing aid involved a lengthy process that cost thousands of dollars and potentially carried a social stigma of "needing a hearing aid", as it required professional consultation, testing, and fitting by a certified audiologist. This process acted as a roadblock for the millions of people with mild to moderate hearing loss. However, due to changes in regulations, particularly the FDA's announcement that it would create an OTC category for hearing aids in the US, the process of accessing the benefits of hearing aids has been dramatically simplified, placing these devices in consumers' hands without them requiring a prescription or a visit to a hearing professional. Tying this increased access and ease of purchasing with significantly lower price points being offered against traditional prescription hearing aids, this category of devices is now becoming accessible by massive populations who would not have otherwise sought treatment.

The IoT hearing devices market is classified according to products into smart hearing aids, IoT cochlear implants, bone anchored hearing devices, tinnitus maskers, and others. The smart hearing devices segment led the market in 2024 and beyond. Smart hearing devices are the largest product segment because they will meet the complete needs of people with hearing loss, particularly those with a mild to moderate loss, which constitutes the vast majority of hearing losses. Smart hearing aids simply augment hearing health by combining with sophisticated digital sound processing with IoT features – Bluetooth connectivity on smart hearing aids allows audio streaming and hands-free calling, smartphone applications for personal settings, and even AI-driven sound environments. Considering all of the benefits and ease of use it is easy to see how smart hearing aids vastly improve an existing hearing aid process by not only offering better hearing but convenience and connectedness to our routines and lifestyles. Their non-invasive continued technological advancements in miniaturization and development in the over-the-counter (OTC) market offer more selection and a barrier to finding and using a hearing aid accessible.

By technology, the market is segmented into Wi-Fi, Bluetooth, and others. The Bluetooth segment held the largest share of the market in 2024. Bluetooth, notably Bluetooth Low Energy (BLE) is the leading technology in IoT hearing devices for its most optimal utilization of low energy usage, short-range wireless communication, and compatibility with all of the other connected personal devices. For small devices that use small batteries like hearing aids and are designed to work all day and need constant charging BLE range is critical to maximizing battery life. BLE also allows users to connect directly to their personal smart devices like smartphones, tablets, and smart TVs.

In terms of applications, the market is segmented into hearing loss treatment, audio streaming, tinnitus therapy, and others. The hearing loss treatment segment had the largest market share in 2024. Hearing loss treatment is the primary and biggest application segment for IoT hearing devices because their central purpose is to compensate for hearing loss and enhance auditory performance. All other applications, including audio streaming and tinnitus treatment, are merely supporting features of this main purpose. The number of people globally with hearing loss is growing rapidly from aging and noise, so the majority of people who buy them to hear and understand speech better in all environments. The IoT features can help with that treatment, personalization, and usability, but their purpose is still to manage hearing loss.

By end user, the market is segmented into ENT hospitals, audiology clinics, and others. The audiology clinics segment held the largest share of the market in 2024. Audiology clinics continue to have the largest end-user market for IoT hearing devices. Hearing healthcare is specialized and personalized, and while other over-the-counter options are available, the service and expertise available from audiologists in audiology clinics is invaluable for the accurate identification of a hearing loss, selection, fitting, and programming of complex IoT hearing aids to individual needs and the process of rehabilitation and providing support. In audiology clinics, the initial evaluation, making custom molds (for some styles), and programing of complex digital features and settings.

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 6,443.1 Million |

| Market Size by 2033 | US$ 22,871.0 Million |

| Global CAGR (2025 - 2033) | 16.0% |

| Historical Data | 2022-2023 |

| Forecast period | 2025-2033 |

| Segments Covered |

By Product

|

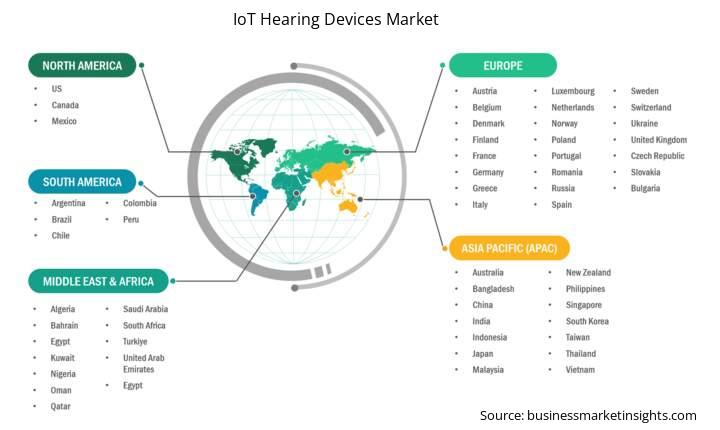

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

|

The "IoT Hearing Devices Market Size and Forecast (2022–2033)" report provides a detailed analysis of the market covering below areas:

The geographical scope of the IoT hearing devices market report is divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America. The IoT Hearing Devices market in Asia Pacific is expected to grow significantly during the forecast period.

Asia Pacific IoT hearing devices market includes China, Japan, India, South Korea, Australia, Bangladesh, New Zealand, Philippines, Singapore, Indonesia, Taiwan, Malaysia, Vietnam, and the rest of Asia Pacific. The Asia Pacific region is witnessing the highest growth in the IoT hearing devices market due to a unique combination of demographic shifts, a growing burden of disease, and considerable improvements in healthcare technology infrastructure and technology adoption.

Within APAC region, specific countries are taking the lead in this pace of growth. China is recognized as the most influential player in this market driven by its huge population, growing chronic disease burden, and government-led push to improve access to healthcare and the quality of healthcare services -- while also emphasizing greater focus on home healthcare. In addition, strong R&D and growing focus on digital health innovation will continue to drive adoption of smart hearing devices. India is also a rapidly expanding market, with a vast pool of chronic condition patients, increased awareness, and investment in improvements to medical infrastructure. The growing number of surgical procedures and a significant shift to treating chronic patients in their homes are major drivers of the demand for IoT hearing devices in India. Japan, although a mature market, is continuing to see solid growth in the market for IoT hearing devices, especially for insulin pumps, in response to the high ages population and others driving the demand.

The IoT hearing devices market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the key developments in the IoT Hearing Devices market are:

The IoT Hearing Devices Market is valued at US$ 6,443.1 Million in 2024, it is projected to reach US$ 22,871.0 Million by 2033.

As per our report IoT Hearing Devices Market, the market size is valued at US$ 6,443.1 Million in 2024, projecting it to reach US$ 22,871.0 Million by 2033. This translates to a CAGR of approximately 16.0% during the forecast period.

The IoT Hearing Devices Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the IoT Hearing Devices Market report:

The IoT Hearing Devices Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The IoT Hearing Devices Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the IoT Hearing Devices Market value chain can benefit from the information contained in a comprehensive market report.