Heavy Commercial Vehicles Powertrain Market Outlook (2021-2031)

No. of Pages: 200 | Report Code: BMIPUB00031704 | Category: Automotive and Transportation

No. of Pages: 200 | Report Code: BMIPUB00031704 | Category: Automotive and Transportation

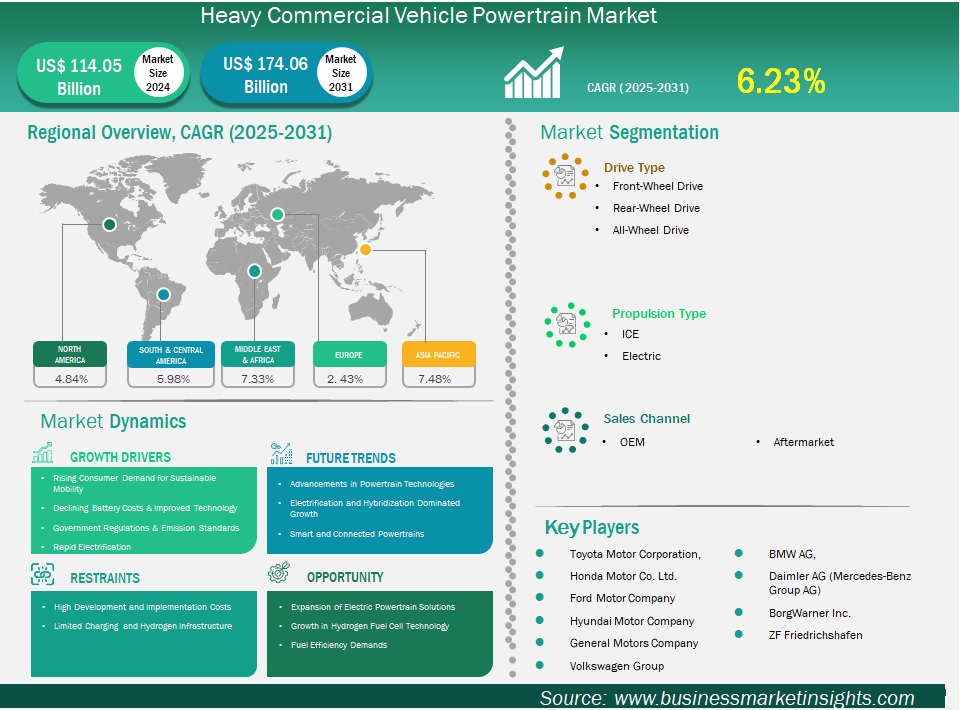

The Heavy Commercial Vehicle powertrain market size is expected to reach US$ 174.06 billion by 2031 from US$ 114.05 billion in 2024. The market is estimated to record a CAGR of 6.23% from 2025 to 2031.

The global Heavy Commercial Vehicle (HCV) powertrain market is undergoing a profound transformation, shifting from traditional internal combustion engine (ICE) dominance towards a future increasingly shaped by electrification and alternative fuels.

This evolution is primarily driven by stringent global emission regulations, the imperative for improved fuel efficiency, the booming e-commerce and logistics sectors, significant infrastructure development, and continuous technological advancements. The market is highly competitive, with major OEMs investing heavily in R&D for cleaner, more efficient powertrains, and the aftermarket playing a crucial role in maintaining the existing fleet.

Asia Pacific stands as the leading region in the global Heavy commercial vehicle (HCV) powertrain market, expected to maintain its top position in market share. Its dynamics are shaped by a unique blend of robust economic growth, massive infrastructure development, a booming e-commerce sector, and increasingly aggressive environmental regulations.

Europe stands as a mature yet highly dynamic region in the Heavy Commercial Vehicle (HCV) powertrain market, characterized by stringent environmental regulations.

North America represents a critical and evolving market for Heavy Commercial Vehicle (HCV) powertrains, characterized by a unique blend of strong demand for heavy-duty trucks (especially pickups and Class 8), a robust existing diesel fleet, and an accelerating transition towards electrification and alternative fuels.

Key segments that contributed to the derivation of the Heavy Commercial Vehicle Powertrain market analysis are drive type, propulsion, sales channel, and geography.

Governments worldwide are implementing stricter emission standards (e.g., Euro 7, CARB regulations) to combat air pollution and climate change, forcing manufacturers to innovate cleaner powertrain technologies.

Escalating fuel costs necessitate more fuel-efficient powertrains, driving the adoption of advanced ICE technologies (turbocharging, direct injection) and the shift towards electric and hybrid solutions.

By drive type, Front-Wheel Drive (FWD), Rear-Wheel Drive (RWD), and All-Wheel Drive (AWD) – RWD is the most prevalent and dominant drive type in the heavy commercial vehicle market. This configuration is standard for most heavy trucks, buses, and other large commercial vehicles. With weight transferring to the rear during acceleration, RWD provides excellent traction for getting a heavy load moving efficiently.

By propulsion type, ICE holds the largest market share in HCVs (approximately 80% automotive powertrain market in 2024), primarily diesel. This dominance is due to proven reliability, extensive fuelling infrastructure, and established performance for heavy loads and long distances. However, its share is declining due to emission regulations and the push for electrification. Battey Electric Vehicles (BEV) are expected to become the fastest-growing segment in HCVs. Driven by zero tailpipe emissions, lower operating costs (fuel and maintenance), and government incentives. Ideal for short-haul and urban delivery applications. Significant OEM investment is observed (e.g., Daimler Truck's new heavy-duty electric truck with a modular electric powertrain).

By sales channel, OEMs dominate the HCV powertrain market, representing the sale of completely new vehicles with integrated powertrains. OEMs are at the forefront of investing in and integrating advanced technologies, especially in electrification, to meet regulations and customer demands. This segment held the Lion’s share in the overall automotive powertrain market value in 2024. The growth of the aftermarket is linked to the size and age of the existing HCV fleet. Electrification is creating new opportunities in the aftermarket for specialized EV powertrain parts, diagnostics, and battery repair/replacement services.

By geography, Asia Pacific is the largest and most dominant region in the global HCV market, and the leader in electric Commercial Vehicle adoption, driven by rapid industrialization, urbanization, e-commerce boom, and strong government support for EVs (especially China & India).

Heavy Commercial Vehicles Powertrain Market Report Highlights

Report Attribute

Details

Market size in 2024

US$ 114.05 Billion

Market Size by 2031

US$ 174.064 Billion

Global CAGR (2025 - 2031) 6.23%

Historical Data

2021-2023

Forecast period

2025-2031

Segments Covered

By Drive Type

By Propulsion Type

By Sales Channel

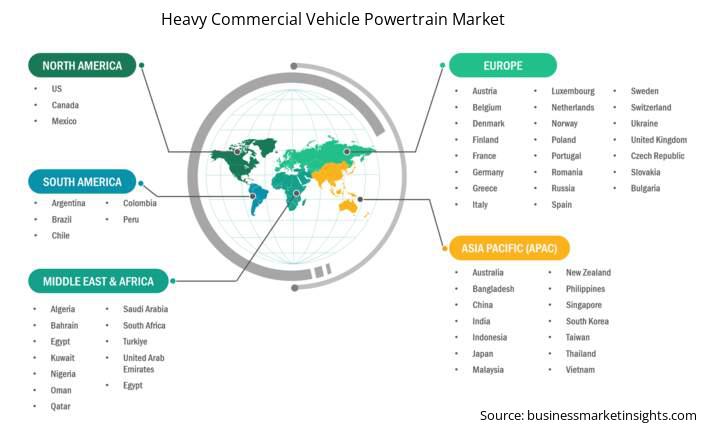

Regions and Countries Covered

North America

Europe

Asia-Pacific

South and Central America

Middle East and Africa

Market leaders and key company profiles

The "Heavy Commercial Vehicle Powertrain Market Outlook (2021–2031)" report provides a detailed analysis of the market covering below areas:

The geographical coverage of the Heavy Commercial Vehicle Powertrain market report is divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America. The Heavy Commercial Vehicle Powertrain market in Asia Pacific is expected to grow significantly during the forecast period.

The Heavy Commercial Vehicle (LCV) powertrain market displays significant regional disparities driven by unique economic, regulatory, and logistical factors. The Asia-Pacific (APAC) region is the clear frontrunner in the global Heavy Commercial Vehicle (HCV) market and plays a significant role in advancing HCV powertrain technologies. This leadership is driven by a combination of strong economic expansion, extensive infrastructure projects, rapid growth in e-commerce, and increasingly stringent environmental regulations.

Europe represents a mature yet highly dynamic market for Heavy Commercial Vehicle (HCV) powertrains, distinguished by rigorous environmental standards, a strong commitment to decarbonization, and substantial public and private investment in zero-emission transportation solutions. Europe has some of the world's most aggressive emission standards. The Euro 7 regulation, agreed upon in 2024 and coming into force for new HCV models by May 29, 2028 (and for all new registrations by May 29, 2029), is a major driver.

North America is a vital and rapidly evolving market for Heavy Commercial Vehicle (HCV) powertrains, marked by strong demand for heavy-duty trucks—particularly pickups and Class 8 vehicles—a substantial existing diesel fleet, and a swift shift toward electrification and alternative fuel solutions.

Meanwhile, South and Central America, and Middle East & Africa (MEA) present diverse heavy commercial vehicle (HCV) powertrain markets, each with unique growth drivers, challenges, and evolving technology adoption patterns. The South and Central American commercial vehicle market, including HCVs, is experiencing growth driven by infrastructure investment, mining development and exports, multimodal transportation projects, and expansion of e-commerce. The MEA commercial vehicles market is driven by increasing demand across industries such as logistics, construction, waste management, and petrochemicals. Heavy-duty commercial vehicles are gaining prominence due to rising investments in large-scale infrastructure projects.

The Heavy Commercial Vehicle Powertrain market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the key developments in the Heavy Commercial Vehicle Powertrain market are:

The Heavy Commercial Vehicles Powertrain Market is valued at US$ 114.05 Billion in 2024, it is projected to reach US$ 174.064 Billion by 2031.

As per our report Heavy Commercial Vehicles Powertrain Market, the market size is valued at US$ 114.05 Billion in 2024, projecting it to reach US$ 174.064 Billion by 2031. This translates to a CAGR of approximately 6.23% during the forecast period.

The Heavy Commercial Vehicles Powertrain Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Heavy Commercial Vehicles Powertrain Market report:

The Heavy Commercial Vehicles Powertrain Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Heavy Commercial Vehicles Powertrain Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Heavy Commercial Vehicles Powertrain Market value chain can benefit from the information contained in a comprehensive market report.