Europe Piling Machines Market Report (2021-2031) by Scope, Segmentation, Dynamics, and Competitive Analysis

No. of Pages: 221 | Report Code: BMIRE00028219 | Category: Manufacturing and Construction

No. of Pages: 221 | Report Code: BMIRE00028219 | Category: Manufacturing and Construction

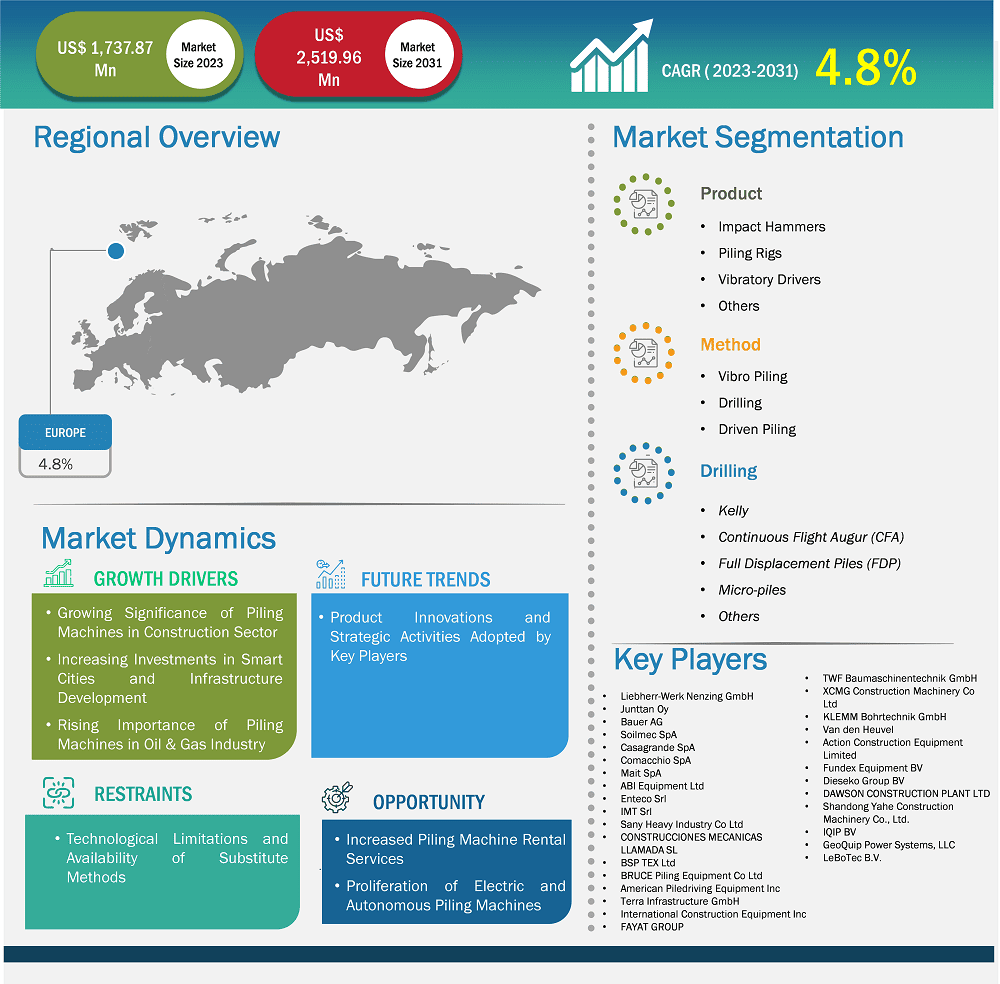

The Europe piling machines market size is expected to reach US$ 2,519.96 million by 2031 from US$ 1,737.87 million in 2023. The market is estimated to record a CAGR of 4.8% from 2023 to 2031.

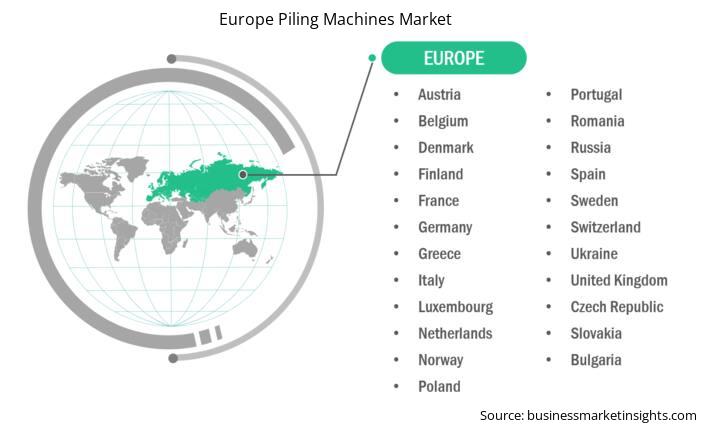

The European piling machines market is segmented into Germany, France, Italy, the UK, Russia, Sweden, Norway, Denmark, Belgium, the Netherlands, Finland, and the Rest of Europe. The construction industry contributes 10% to the GDP of the region. Rapid growth in construction activities in Europe is one of the significant factors contributing to the growth of the piling machines market. A few European countries, such as Germany, the UK, and Russia, witnessed significant growth in the construction industry. In 2021, various construction projects were commenced that included A303/A30/A358 Road Corridor Improvement; E39 Herdal-Royskar Motorway; Nizhnekamsk-Naberezhnye Chelny Bypass; Banja Luka-Prijedor-Novi Grad Motorway; and Llogara Tunnel. Thus, the rise in infrastructure projects in European countries is further bolstering the demand for piling machines in the region.

In addition, the increasing investment by governments of countries in Europe in infrastructure and industrial development is contributing to the market's growth. For instance, according to the European Commission, in June 2022 the European Union has planned to invest US$ 5.76 billion in sustainable, safe, and efficient transport infrastructure. Also, according to the European Construction Industry Federation, the European Union's total investment for new construction reached US$ 1,753.01 billion in 2023. Increasing investment in new construction in Europe has created a massive demand for piling machine products. Moreover, the key players operating in the piling machines market, such as Liebherr-International Deutschland GmbH, Junttan Oy, and Soilmec S.p.A., are focused on new and improved product offerings to meet the demand for automation in piling machines. For instance, in October 2022, Liebherr-International Deutschland GmbH announced the launch of a new range of electric piling machines. These machines offer zero-emission and are quiet in operation. Such initiatives by key regional manufacturers are boosting the growth of the piling machines market in the region.

Europe Piling Machines Market Strategic Insights

Europe Piling Machines Market Segmentation Analysis

Key segments that contributed to the derivation of the Europe piling machines market analysis are product and method.

The construction industry is continuously growing due to an increase in low-to-medium-priced residential housing projects, commercial infrastructure, and government-backed infrastructure initiatives, including roads, bridges, and highways. As the construction industry develops and evolves, the requirement for construction equipment and machines becomes essential. There is an increase in various types of construction projects, such as residential buildings, commercial complexes, and industrial facilities. Each project needs various kinds of machines for construction, repair, maintenance, and renovation. Rapid urbanization and population outbursts drive the necessity for new housing, commercial spaces, and infrastructure.

As of mid-2025, Europe is experiencing significant advancements in residential, commercial, and infrastructure development. In the UK, the £3.9 billion Ebbsfleet Garden City project is currently underway, with plans to deliver 15,000 homes, 50 parks, and extensive amenities by 2035. Spain is ramping up its industrialized social housing construction through a €1.3 billion EU-backed initiative aimed at building 15,000 homes annually. In Sweden, the Stockholm Wood City project is making progress, set to become the world's largest timber-built city, offering 2,000 homes by 2027.

Such an increase in the population directly propels the need for commercial and residential construction. The mounting d real estate progress, including commercial, residential, and mixed-use projects, drives the demand for piling machines, including impact hammers, piling rigs, and vibratory drivers, during construction and maintenance activities. Thus, the growth of the construction industry steers the demand for piling machines, as these are among the fundamental tools that ensure operational efficiency across a wide range of projects.

Based on country, the Europe piling machines market comprises Germany, France, Italy, the UK, Russia, Sweden, Norway, Denmark, Belgium, the Netherlands, Finland, and the Rest of Europe. Germany held the largest share in 2023.

Residential construction dominates the construction sector in Germany, accounting for 61% of total construction investments. Germany's investment in the construction sector in 2023 reached US$ 506.22 billion in 2023. This is increasing with the surge in investment for infrastructure developments across the country. Germany's residential real estate investment reached US$ 5.52 billion in the first three quarters of 2024. In Germany, the building construction permits increased to 15,050 Units in October 2024 compared to 11616 Units in September 2024. Major players in the market are developing piling rigs and sheet piles for construction site developments. For instance, in January 2021, RTG Rammtechnik GmbH introduced a sheet pile wall construction system with advanced features. The system was used for multiple applications. For example, in the new construction of an underground garage, RG 19T with integrated sheet pile assistant was used. Further, in December 2023, Roger Bullivant Limited launched this 3500 Series of Driven Piling Rigs, the 3501, 3502, and 3503. This ground-breaking triple launch has advanced design and functionality.

The rising demand for piling machines from several end-use industries, such as commercial and residential construction, along with the growing road construction activities, are fueling the growth of the piling machines market in Germany.

Europe Piling Machines Market Report Highlights

Report Attribute

Details

Market size in 2023

US$ 1,737.87 Million

Market Size by 2031

US$ 2,519.96 Million

CAGR (2023 - 2031) 4.8%

Historical Data

2021-2022

Forecast period

2024-2031

Segments Covered

By Product

By Method

Regions and Countries Covered

Europe

Market leaders and key company profiles

Europe Piling Machines Market Company Profiles

Some of the key players operating in the market include Liebherr-Werk Nenzing GmbH; Junttan Oy; Bauer AG; Soilmec SpA; Casagrande SpA; Comacchio SpA; Mait SpA; ABI Equipment Ltd; Enteco Srl; IMT Srl; Sany Heavy Industry Co Ltd; CONSTRUCCIONES MECANICAS LLAMADA SL; BSP TEX Ltd; BRUCE Piling Equipment Co Ltd; American Piledriving Equipment Inc; Terra Infrastructure GmbH; International Construction Equipment Inc; FAYAT GROUP; TWF Baumaschinentechnik GmbH; XCMG Construction Machinery Co Ltd; KLEMM Bohrtechnik GmbH; Van den Heuvel; Action Construction Equipment Limited; Fundex Equipment BV; Dieseko Group BV; DAWSON CONSTRUCTION PLANT LTD; Shandong Yahe Construction Machinery Co., Ltd.; IQIP BV; GeoQuip Power Systems, LLC; and LeBoTec B.V., among others. These players are adopting various strategies such as expansion, product innovation, and mergers and acquisitions to provide innovative products to their consumers and increase their market share.

The following methodology has been followed for the collection and analysis of data presented in this report:

The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

Note: All financial data included in the Company Profiles section has been standardized to USD. For companies reporting in other currencies, figures have been converted to USD using the relevant exchange rates for the corresponding year.

The Insight Partners conducts a significant number of primary interviews each year with industry stakeholders and experts to validate its data analysis and gain valuable insights. These research interviews are designed to:

Primary research is conducted via email interactions and telephone interviews, encompassing various markets, categories, segments, and sub-segments across different regions. Participants typically include:

The Europe Piling Machines Market is valued at US$ 1,737.87 Million in 2023, it is projected to reach US$ 2,519.96 Million by 2031.

As per our report Europe Piling Machines Market, the market size is valued at US$ 1,737.87 Million in 2023, projecting it to reach US$ 2,519.96 Million by 2031. This translates to a CAGR of approximately 4.8% during the forecast period.

The Europe Piling Machines Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Piling Machines Market report:

The Europe Piling Machines Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Piling Machines Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Piling Machines Market value chain can benefit from the information contained in a comprehensive market report.