Asia Pacific Piling Machines Market Report (2021-2031) by Scope, Segmentation, Dynamics, and Competitive Analysis

No. of Pages: 200 | Report Code: BMIRE00028216 | Category: Manufacturing and Construction

No. of Pages: 200 | Report Code: BMIRE00028216 | Category: Manufacturing and Construction

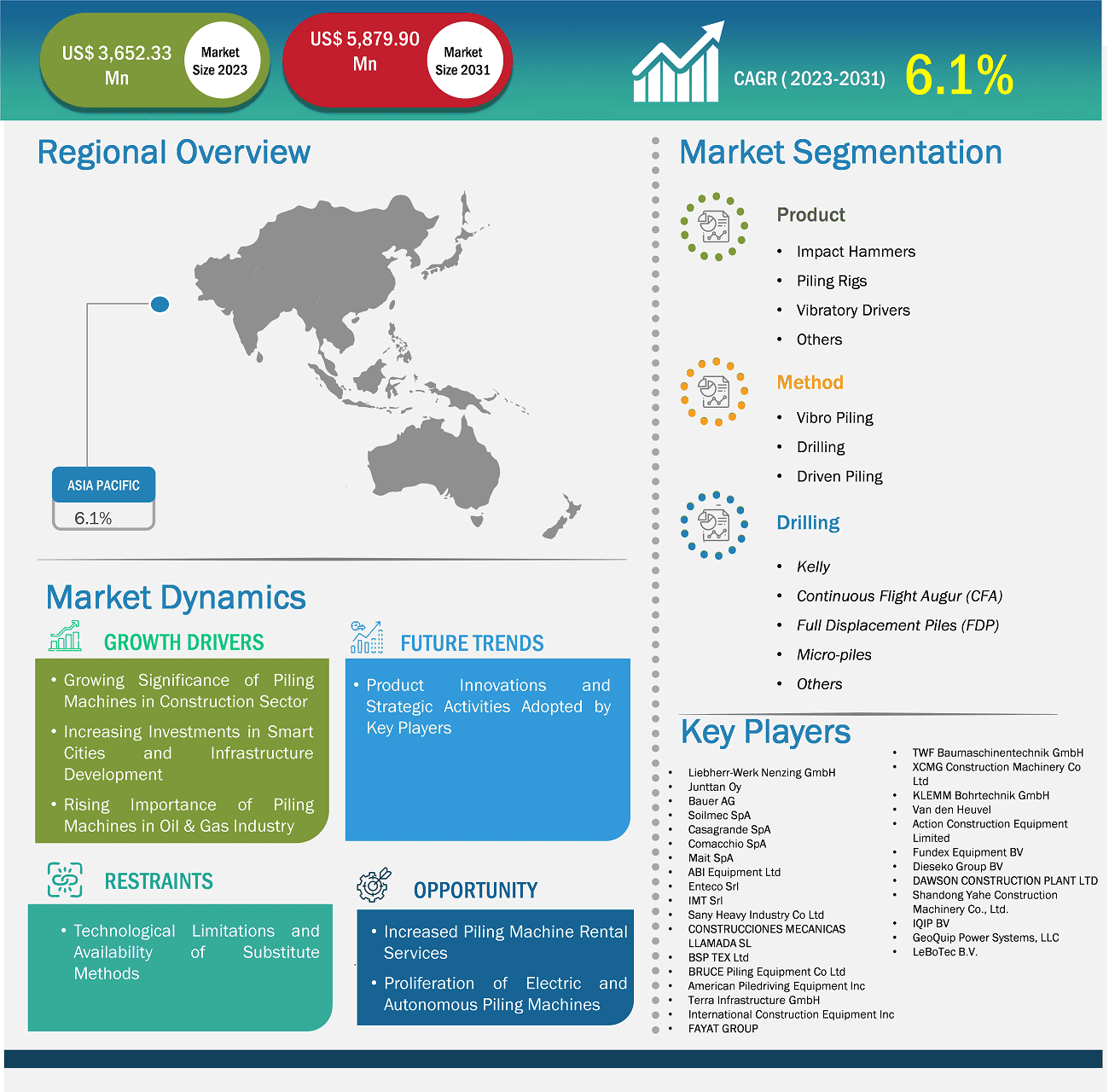

The Asia Pacific piling machines market size is expected to reach US$ 5,879.90 million by 2031 from US$ 3,652.33 million in 2023. The market is estimated to record a CAGR of 6.1% from 2023 to 2031.

Asia Pacific's construction and infrastructure sector is experiencing robust expansion and development initiatives, boosted by the region's surging economic growth and increasing population. Key infrastructure developments include a growing number of railway stations, commercial spaces, buildings, residential housings, airports, and water treatment facilities. High-speed rail projects are at the foreground of transportation infrastructure. Japan's Chuo Shinkansen, China's high-speed rail network expansion, and Australia's Sydney to Melbourne link are a few of the major construction projects positively impacting the piling machines market.

The Government of New Zealand is emphasizing on developing infrastructure networks such as water and wastewater systems, road and rail networks, electricity transmission, and telecommunication infrastructure. Growing population and increasing urbanization are boosting the need to expand and upgrade important infrastructure facilities in the country. In 2023, The government offered ~US$ 47 billion for infrastructure development over the coming five years. The growing focus on infrastructure development is anticipated to propel the growth of construction activities and the application of piling machines across the country in the coming years.

Asia Pacific Piling Machines Market Strategic Insights

Asia Pacific Piling Machines Market Segmentation Analysis

Key segments that contributed to the derivation of the Asia Pacific piling machines market analysis are product and method.

Companies operating in the piling machines market focus on offering upgraded and new products to meet the evolving needs of customers. In December 2023, Roger Bullivant Limited (RBL) announced the simultaneous launch of three groundbreaking 3500 Series Driven Piling Rigs: 3501, 3502, and 3503. These rigs are built on a strong JCB 220X excavator basis and have a larger undercarriage for great stability, ensuring optimal performance on a variety of tasks. In May 2023, National Pile Croppers (NPC) redesigned its hydraulic Contig 600 pile cropper to reduce its width while maintaining its structural strength. As the earlier Contig 600 unit was larger than the new one, it faced issues in addressing 600 mm and 150 mm pile spacing. In June 2023, Bauer launched its new compact cutter systems for confined construction sites. In 2023, Junttan launched its free-hanging vibratory hammer series: the VH and VH VM models.

Apart from the new product development activities, the strategic activities implemented by the key players are another factor that is expected to create notable trends in the near future. In January 2024, Casagrande, a notable player in Italy, expanded its business in Australia. Casagrande delivered its B240 XP-2 piling rig to Australia, marking a strategic market expansion and innovation in foundation equipment. The rig, equipped with a powerful engine and advanced hydraulic system, can tackle challenging soil conditions and accommodate an extensive range of drilling techniques. Its intelligent control systems and advanced safety features enhance operational efficiency and prioritize operator well-being. The rig is set to showcase its capabilities in Australia, a market witnessing unprecedented growth in construction and infrastructure development. Thus, product development and strategic activities are expected to bring new trends in the global piling machines market in the coming years.

Based on country, the Asia Pacific piling machines market comprises Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific. China held the largest share in 2023.

China's construction and infrastructure industry has observed transformative developments driven by rapid economic growth and the nation's ascent as a global economic powerhouse. China is one of the largest construction markets worldwide. The government included an expenditure of US$ 4 trillion (CNY 28.6 trillion) in 2024, which is an increase of ~3.8% than the 2023 Budget.

In March 2024, the government of China announced its target to fund US$ 173 billion (CNY 1.2 trillion) in transport infrastructure projects by the end of 2024. Furthermore, in March 2024, the Yangtze River Delta region government announced an investment of US$ 19.6 billion (CNY 140 billion) to build 32 railway infrastructure projects in the region. In February 2024, the Shanghai government announced its target to initiate work on 24 projects with a combined investment of US$ 5.8 billion (CNY 42.1 billion) in 2024.

The increase in infrastructure development and restoration projects is positively impacting the piling machines market in the country.

China, Mongolia, and Russia are working on the expansion of the Power of Siberia 2 pipeline. The pipeline is anticipated to supply Europe-bound gas from western Siberian fields to China, and it is projected to be operational by 2030. Thus, the development of oil and gas projects contributes to the demand for piling machines across China.

Asia Pacific Piling Machines Market Report Highlights

Report Attribute

Details

Market size in 2023

US$ 3,652.33 Million

Market Size by 2031

US$ 5,879.90 Million

CAGR (2023 - 2031) 6.1%

Historical Data

2021-2022

Forecast period

2024-2031

Segments Covered

By Product

By Method

Regions and Countries Covered

Asia Pacific

Market leaders and key company profiles

Asia Pacific Piling Machines Market Company Profiles

Some of the key players operating in the market include Liebherr-Werk Nenzing GmbH; Junttan Oy; Bauer AG; Soilmec SpA; Casagrande SpA; Comacchio SpA; Mait SpA; ABI Equipment Ltd; Enteco Srl; IMT Srl; Sany Heavy Industry Co Ltd; CONSTRUCCIONES MECANICAS LLAMADA SL; BSP TEX Ltd; BRUCE Piling Equipment Co Ltd; American Piledriving Equipment Inc; Terra Infrastructure GmbH; International Construction Equipment Inc; FAYAT GROUP; TWF Baumaschinentechnik GmbH; XCMG Construction Machinery Co Ltd; KLEMM Bohrtechnik GmbH; Van den Heuvel; Action Construction Equipment Limited; Fundex Equipment BV; Dieseko Group BV; DAWSON CONSTRUCTION PLANT LTD; Shandong Yahe Construction Machinery Co., Ltd.; IQIP BV; GeoQuip Power Systems, LLC; and LeBoTec B.V.among others. These players are adopting various strategies such as expansion, product innovation, and mergers and acquisitions to provide innovative products to their consumers and increase their market share.

The following methodology has been followed for the collection and analysis of data presented in this report:

The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

Note: All financial data included in the Company Profiles section has been standardized to USD. For companies reporting in other currencies, figures have been converted to USD using the relevant exchange rates for the corresponding year.

The Insight Partners conducts a significant number of primary interviews each year with industry stakeholders and experts to validate its data analysis and gain valuable insights. These research interviews are designed to:

Primary research is conducted via email interactions and telephone interviews, encompassing various markets, categories, segments, and sub-segments across different regions. Participants typically include:

The Asia Pacific Piling Machines Market is valued at US$ 3,652.33 Million in 2023, it is projected to reach US$ 5,879.90 Million by 2031.

As per our report Asia Pacific Piling Machines Market, the market size is valued at US$ 3,652.33 Million in 2023, projecting it to reach US$ 5,879.90 Million by 2031. This translates to a CAGR of approximately 6.1% during the forecast period.

The Asia Pacific Piling Machines Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Piling Machines Market report:

The Asia Pacific Piling Machines Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Piling Machines Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Piling Machines Market value chain can benefit from the information contained in a comprehensive market report.