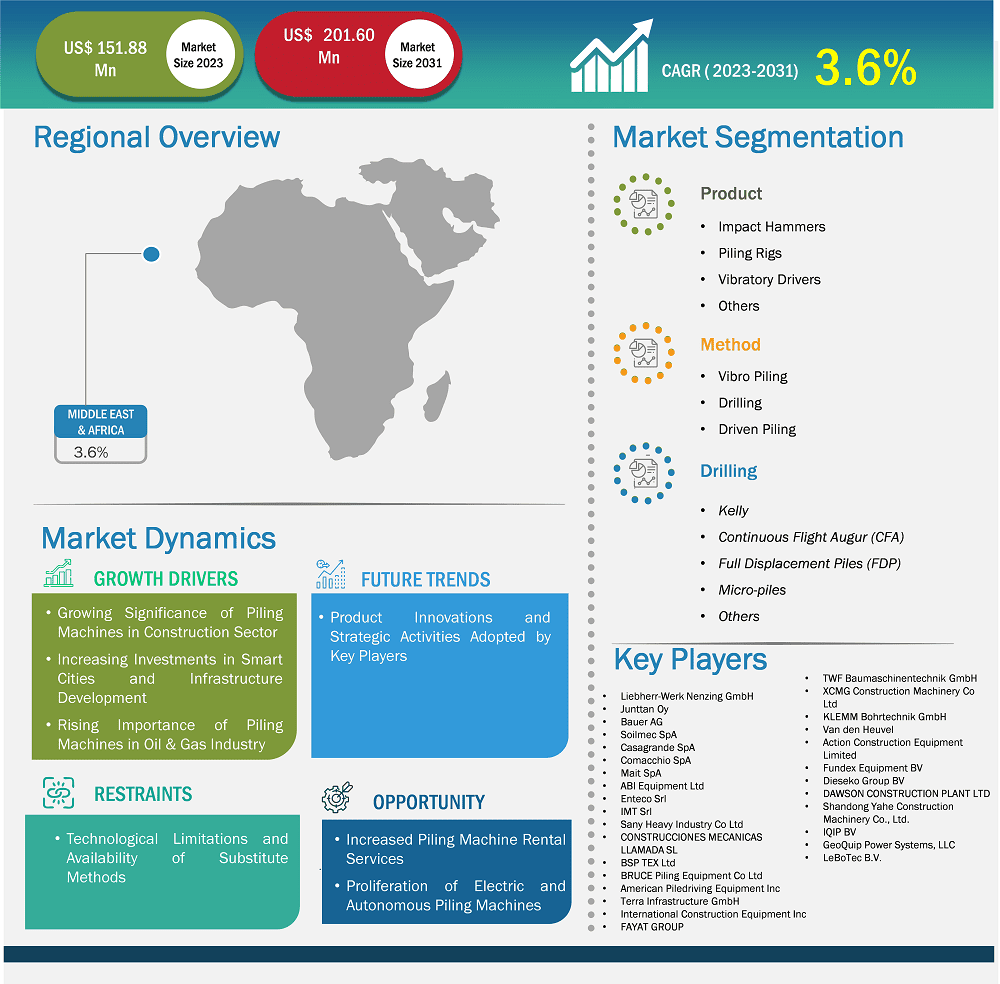

The Middle East & Africa piling machines market size is expected to reach US$ 201.60 million by 2031 from US$ 151.88 million in 2023. The market is estimated to record a CAGR of 3.6% from 2023 to 2031.

The upward growth of the construction industry and increasing government investments are key factors propelling the demand for piling machines in the Middle East & Africa. In addition, the expanding focus on infrastructure development and continuing privatization in the construction sector positively impacts the piling machines market in the region. The Middle East & Africa are witnessing substantial infrastructure developments fueled by economic growth. Major airports such as Dubai International, Hamad International, and King Fahd International are leading the region's modernization efforts, incorporating extensive expansion projects. For example, Jeddah Airport Company aims to expand King Abdulaziz International Airport with an investment of US$ 31 billion. The airport is expected to handle 114 million passengers per year and is expected to be completed by 2031. Beyond major hubs, regional airports in countries such as Ethiopia and Morocco contribute to improved connectivity and economic development. The expansion project at Cape Town International Airport comprises a new runway, new international and domestic departure lounges, a terminal, and other facilities. Thus, a rise in investment and government initiatives toward the development of construction and infrastructure is anticipated to fuel the growth of the piling machines market in the Middle East & Africa. The UAE's allegiance to hosting major international events and its reputation for luxury travel contribute to sustained infrastructure growth in the coming years. Future trends suggest continued investments in infrastructure, strengthening the UAE's status as a premier destination in the global landscape. This, in turn, is expected to boost the growth of the piling machines market in the country during the forecast period.

Middle East & Africa Piling Machines Market Segmentation Analysis:

Key segments that contributed to the derivation of the Middle East & Africa piling machines market analysis are product and method.

The growing inclination toward renting construction equipment, including piling machines, is expected to offer an opportunity for rental companies to expand their services. Renting services allow construction companies to access high-end machines and equipment without the financial obligation of ownership. At present, piling machines are not restricted to conventional construction projects; they are gradually being utilized in various sectors, including renewable energy; for instance, wind turbine foundations and marine construction that involves docks and piers. This expansion opens new possibilities for growth and lets manufacturers choose different kinds of piling machines according to their requirements. The growing proliferation of rental services offers construction companies the liberty to rent various kinds of piling machines as per specific requirements.

Rental services offer companies the elasticity to scale their operations to match the project needs. Construction projects vary in duration and scope, allowing companies to access a rental fleet for suitable equipment for each operation without being tied to a single machine. Furthermore, when renting piling machines, the liability for maintenance normally falls on the rental company. This understanding allows construction companies to emphasize their fundamental activities without being concerned about the maintenance of heavy machinery.

For new piling rigs, prices, in general, range from US$ 50,000 to US$ 55,000 for standard models, such as those with specific capabilities and dimensions. This price can vary based on additional attributes and technology. Renting is a viable option for some customers due to high cost. This option is often more cost-effective for short-term projects. In addition, the increase of online platforms for equipment rental has streamlined the process of obtaining piling machines. Companies such as Piling Broker offer easy online ordering, making it more convenient for contractors to get the equipment without massive logistical challenges.

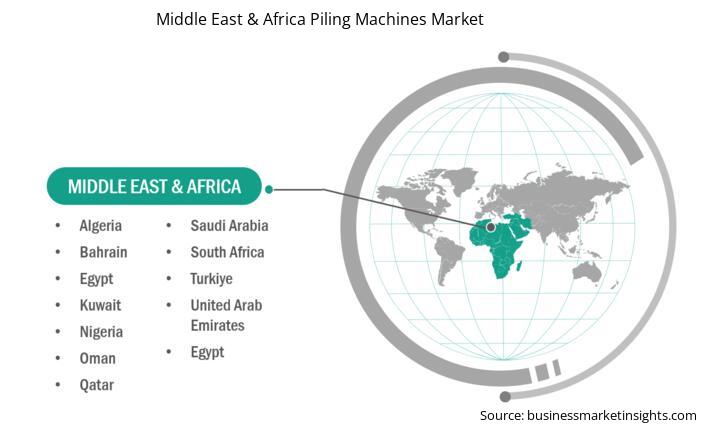

Based on country, the Middle East & Africa piling machines market comprises South Africa, Saudi Arabia, UAE, and the Rest of Middle East & Africa. Saudi Arabia held the largest share in 2023.

In 2024, The King Abdullah University of Science and Technology accomplished its innovative mobile plant project for wastewater treatment in Saudi Arabia. In 2023, the Government of Saudi Arabia started several water projects for transmission, desalinization, strategic reservoirs, and wastewater treatment and an investment of US$ 14.58 billion in ongoing and planned projects. The rising focus on developing modern utilities and infrastructure facilities of smart cities is fueling the piling machines market growth in Saudi Arabia.

One of the leading projects under Vision 2030, NEOM, is a US$ 500 billion mega-city being developed in the northwestern region of Saudi Arabia. The project intends to construct smart, sustainable urban surroundings that incorporate eco-friendly practices and advanced technologies. As of 2024, substantial progress is being made in the construction of transportation networks, residential areas, and renewable energy facilities, putting NEOM as a global hub for modernization. Additionally, the transformation project of the Red Sea coastline into a premier destination for tourists is also one of the major construction projects. Further, the development of King Salman Park is also one of the major examples of infrastructure development in the country, which is driving the demand for piling machines in Saudi Arabia.

Middle East & Africa Piling Machines Market Company Profiles

Some of the key players operating in the market include Liebherr-Werk Nenzing GmbH; Junttan Oy; Bauer AG; Soilmec SpA; Casagrande SpA; Comacchio SpA; Mait SpA; ABI Equipment Ltd; Enteco Srl; IMT Srl; Sany Heavy Industry Co Ltd; CONSTRUCCIONES MECANICAS LLAMADA SL; BSP TEX Ltd; BRUCE Piling Equipment Co Ltd; American Piledriving Equipment Inc; Terra Infrastructure GmbH; International Construction Equipment Inc; FAYAT GROUP; TWF Baumaschinentechnik GmbH; XCMG Construction Machinery Co Ltd; KLEMM Bohrtechnik GmbH; Van den Heuvel; Action Construction Equipment Limited; Fundex Equipment BV; Dieseko Group BV; DAWSON CONSTRUCTION PLANT LTD; Shandong Yahe Construction Machinery Co., Ltd.; IQIP BV; GeoQuip Power Systems, LLC; and LeBoTec B.V., among others. These players are adopting various strategies such as expansion, product innovation, and mergers and acquisitions to provide innovative products to their consumers and increase their market share.

The following methodology has been followed for the collection and analysis of data presented in this report:

The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

Note: All financial data included in the Company Profiles section has been standardized to USD. For companies reporting in other currencies, figures have been converted to USD using the relevant exchange rates for the corresponding year.

The Insight Partners conducts a significant number of primary interviews each year with industry stakeholders and experts to validate its data analysis and gain valuable insights. These research interviews are designed to:

Primary research is conducted via email interactions and telephone interviews, encompassing various markets, categories, segments, and sub-segments across different regions. Participants typically include:

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 151.88 Million |

| Market Size by 2031 | US$ 201.60 Million |

| CAGR (2023 - 2031) | 3.6% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered |

Middle East and Africa

|

| Market leaders and key company profiles |

|

The Middle East & Africa Piling Machines Market is valued at US$ 151.88 Million in 2023, it is projected to reach US$ 201.60 Million by 2031.

As per our report Middle East & Africa Piling Machines Market, the market size is valued at US$ 151.88 Million in 2023, projecting it to reach US$ 201.60 Million by 2031. This translates to a CAGR of approximately 3.6% during the forecast period.

The Middle East & Africa Piling Machines Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Piling Machines Market report:

The Middle East & Africa Piling Machines Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Piling Machines Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Piling Machines Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)