North America Piling Machines Market Report (2021-2031) by Scope, Segmentation, Dynamics, and Competitive Analysis

No. of Pages: 187 | Report Code: BMIRE00028223 | Category: Manufacturing and Construction

No. of Pages: 187 | Report Code: BMIRE00028223 | Category: Manufacturing and Construction

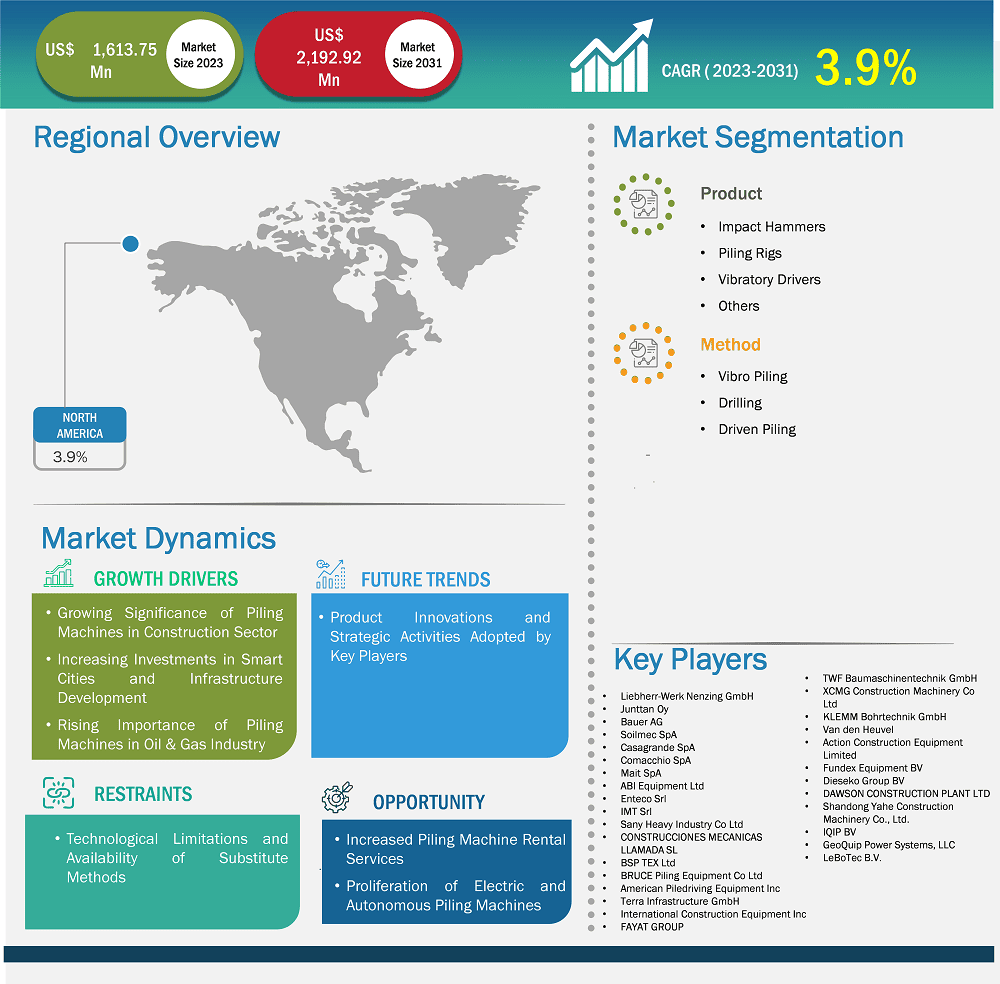

The North America piling machines market size is expected to reach US$ 2,192.92 million by 2031 from US$ 1,613.75 million in 2023. The market is estimated to record a CAGR of 3.9% from 2023 to 2031.

The North America piling machines market is segmented into the US, Canada, and Mexico. Factors such as the rise in demand for infrastructure development, an increase in the need for renovation and repair work, and rapid urbanization influence the piling machines market. The development in the construction sector is one of the prime reasons for the growth of the piling machines market in North America.

In October 2023, the governments of Canada and British Columbia financed more than US$ 10 million for three new water and wastewater facilities in Canada to provide purified and more consistent municipal services. The rising investment in the municipalities of Fraser Lake, Burns Lake, and the District of Mackenzie in Canada is anticipated to drive the growth of the construction sector, propelling the piling machines market growth.

North America is one of the prime markets in terms of investments in the oil & gas industry. The US is a key natural gas and crude oil producer globally. In 2022, the country showcased the highest natural gas production capacity, followed by Canada and Mexico. Ixachi, Coulomb Phase 2, Quesqui, Nejo (IEPC), Leo, May, Koban, and Powerball are a few of the natural gas-producing fields in North America. The Ixachi plant is located in Veracruz, Mexico, and it produced 618.09 mmcfd (i.e., million cubic feet per day) of natural gas in 2022. The Coulomb Phase 2 field, owned by Shell, is located in the Central Planning Area, US. There were 436 oil and gas rigs in the US in 2020, which increased to 580 in 2021 and 721 in 2022. Canada had 91 oil and gas rigs in 2020, which increased to 149 in 2021 and 176 in 2022. Mexico had 41 oil and gas rigs in 2020, which increased to 45 in 2021 and 47 in 2022. Increasing gas exploration and oil production activities and the mounting number of oil & gas rigs across different countries of North America drive the demand for piling machines.

Key segments that contributed to the derivation of the North America piling machines market analysis are product and method.

The demand for energy is skyrocketing across the world with population growth. India is the third largest energy-consuming country worldwide after China and the US, and its energy consumption has doubled since 2000. As per the US Energy Information Administration (EIA), US energy consumption is anticipated to grow by 2050 owing to economic and population development. Natural gas has a potential application in electricity generation, in addition to several other industries. Moreover, due to the increasing energy uncertainties in Europe owing to the Russia–Ukraine war, governments are encouraging the utilization of natural gas.

Countries such as the US, China, India, Vietnam, and South Korea are showcasing a massive demand for crude oil owing to continuous developments in their manufacturing sectors, supported by favorable financial landscape and government policies and a surge in investments in the oil & gas sector. As per the US Energy Information Administration (EIA), seven giant shale basins in the US are estimated to ramp up their natural gas production capacities in 2024. With such advancements, the share of shale production is anticipated to increase from ~23% of total gas production in 2010 to ~49% by 2035 in the country.

Thus, the growing number of oil & gas projects and plants is fueling the growth of the piling machines market across the globe.

Based on country, the North America piling machines market comprises the US, Canada, and Mexico. The US held the largest share in 2023.

The US holds a prominent share in the piling machines market in North America. Rising demand for infrastructure development, increasing requirements for renovation and repair work, and growing urbanization influence the piling machines market. The growth in the construction sector is a major driving factor influencing the US piling machines market. The key sectors in the US construction market are industrial construction, energy and utilities construction, commercial construction, infrastructure construction, and residential and institutional construction. Gordie Howe International Bridge, Madison Square Garden Sphere, Sound Transit 3 (ST3) Construction Project, Hudson Yards – New York, Second Avenue Subway, Chicago airport expansion, Hudson Tunnel Project, and JFK Airport Expansion are among the major construction projects in the US, which is anticipated to drive the piling machines market in the country.

New York City – East Side Access Project, California High-Speed Rail, The Hudson Yards project in New York City, and several developments across cities such as Denver and Seattle being constructed with energy-efficient standards are a few major construction projects in the US, which are positively impacting the piling machines market.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 1,613.75 Million |

| Market Size by 2031 | US$ 2,192.92 Million |

| CAGR (2023 - 2031) | 3.9% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

|

Some of the key players operating in the market include Liebherr-Werk Nenzing GmbH; Junttan Oy; Bauer AG; Soilmec SpA; Casagrande SpA; Comacchio SpA; Mait SpA; ABI Equipment Ltd; Enteco Srl; IMT Srl; Sany Heavy Industry Co Ltd; CONSTRUCCIONES MECANICAS LLAMADA SL; BSP TEX Ltd; BRUCE Piling Equipment Co Ltd; American Piledriving Equipment Inc; Terra Infrastructure GmbH; International Construction Equipment Inc; FAYAT GROUP; TWF Baumaschinentechnik GmbH; XCMG Construction Machinery Co Ltd; KLEMM Bohrtechnik GmbH; Van den Heuvel; Action Construction Equipment Limited; Fundex Equipment BV; Dieseko Group BV; DAWSON CONSTRUCTION PLANT LTD; Shandong Yahe Construction Machinery Co., Ltd.; IQIP BV; GeoQuip Power Systems, LLC; and LeBoTec B.V., among others. These players are adopting various strategies such as expansion, product innovation, and mergers and acquisitions to provide innovative products to their consumers and increase their market share.

The following methodology has been followed for the collection and analysis of data presented in this report:

The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

Note: All financial data included in the Company Profiles section has been standardized to USD. For companies reporting in other currencies, figures have been converted to USD using the relevant exchange rates for the corresponding year.

The Insight Partners conducts a significant number of primary interviews each year with industry stakeholders and experts to validate its data analysis and gain valuable insights. These research interviews are designed to:

Primary research is conducted via email interactions and telephone interviews, encompassing various markets, categories, segments, and sub-segments across different regions. Participants typically include:

The North America Piling Machines Market is valued at US$ 1,613.75 Million in 2023, it is projected to reach US$ 2,192.92 Million by 2031.

As per our report North America Piling Machines Market, the market size is valued at US$ 1,613.75 Million in 2023, projecting it to reach US$ 2,192.92 Million by 2031. This translates to a CAGR of approximately 3.9% during the forecast period.

The North America Piling Machines Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Piling Machines Market report:

The North America Piling Machines Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Piling Machines Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Piling Machines Market value chain can benefit from the information contained in a comprehensive market report.