Telemedicine requires a network supporting high-quality videos during real-time remote patient monitoring. Using 4G or older networks for transferring larger files between departments can be time-consuming, forcing physicians to spend their valuable time waiting for the file transfer process to complete. Upgrading to 5G can eliminate these blocks and provide healthcare providers with a more effective network that can continue to adapt to new technology. 5G is the next generation of wireless technology that benefits all devices operating in a network by providing higher bandwidths, faster speeds, and greater capacity to connect devices. 5G technology offers 100-2,000 times faster speed than typical hospital wireless networks, as it allows for quick data transfer even for large data sets (i.e., low latency), which can help the medical device connectivity to work faster. Using connected medical devices paired with smart data applications and artificial intelligence (AI), doctors can remotely track the patient's vitals and efficiently proceed with the diagnosis, prescription, and treatment plans. 5G technology has the ability to transform the healthcare sector with its high speed, low latency, and improved data accuracy. Thus, combining 5G technology and AI can greatly improve the healthcare sector. The importance of telehealth solutions was widely witnessed during the COVID-19 pandemic, when maintaining social distancing was imperative. Also, remote patient monitoring aided in the proactive management of chronic diseases and the delivery of healthcare services. Moreover, 5G is a key enabling technology for digital health and the Internet of Things (IoT) and is quickly being incorporated into various medical devices. Wireless technology enables connectivity among devices in the hospital, home, etc. 5G-enabled wearable devices can transmit large data packets throughout the day, driving improved patient outcomes through continuous remote monitoring. Thus, with increasing medical device connectivity usage, the need for a better network and technology also arises, and 5G is one such technology that is likely to offer growth opportunities to the market during the forecast period.

The Middle East & Africa medical device connectivity market is segmented into the UAE, Saudi Arabia, South Africa, and the Rest of Middle East & Africa. Saudi Arabia is expected to account for the largest market share and is expected to develop moderately in the Middle East & Africa. Countries such as the UAE and South Arabia are expected to be the largest contributor to the medical device connectivity market due to the large geriatric population and a surge in the prevalence of various diseases, which require telehealth and remote online consultation. Technology has become mainstream in healthcare, with more than 50% of hospitals in the UAE using various IoT-based solutions; approximately 90% of doctors use smartphones and medical apps to provide healthcare. The population of the Middle East also makes it easier to implement telehealth; ~85% are under the age of 45, and ~90% of this population uses mobile technology, laptops, and tablets. The UAE government supports establishing a telematics infrastructure and advancing telemedicine applications with the aim of country-wide provision of healthcare services in the long term through various initiatives. The UAE has several companies offering teleconsultations, from independent telemedicine companies to health insurers. In March 2020, the UAE Ministry of Health and Prevention (MOHAP) collaborated with Du, a telecom company, to establish the first virtual hospital in the Middle East to provide remote care to patients. In July 2020, UAE-based Mulk Healthcare launched the first "e-hospital" in the form of an app for providing medical services.

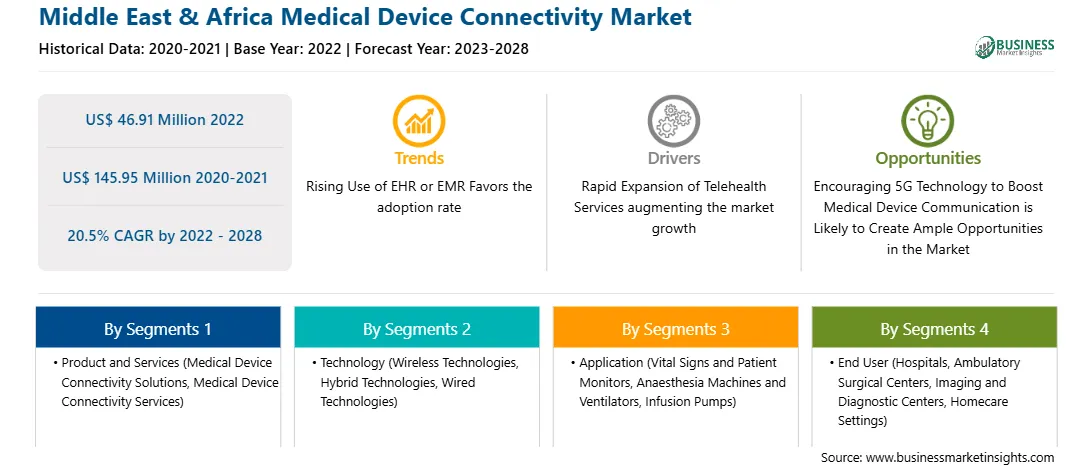

Strategic insights for the Middle East & Africa Medical Device Connectivity provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Middle East & Africa Medical Device Connectivity refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.Middle East & Africa Medical Device Connectivity Strategic Insights

Middle East & Africa Medical Device Connectivity Report Scope

Report Attribute

Details

Market size in 2022

US$ 46.91 Million

Market Size by 2028

US$ 145.95 Million

CAGR (2022 - 2028) 20.5%

Historical Data

2020-2021

Forecast period

2023-2028

Segments Covered

By Product and Services

By Technology

By Application

By End User

Regions and Countries Covered

Middle East and Africa

Market leaders and key company profiles

Middle East & Africa Medical Device Connectivity Regional Insights

Middle East & Africa Medical Device Connectivity Market Segmentation

The Middle East & Africa medical device connectivity market is segmented into product and services, technology, application, end user, and country. Based on product and services, the Middle East & Africa medical device connectivity market is segmented into medical device connectivity solutions and medical device connectivity services. The medical device connectivity solutions segment registered the largest market share in 2022.

Based on technology, the Middle East & Africa medical device connectivity market is segmented into wireless technologies, hybrid technologies, and wired technologies. The wireless technologies segment registered the largest market share in 2022.

Based on application, the Middle East & Africa medical device connectivity market is segmented into vital signs and patient monitors, anesthesia machines and ventilators, infusion pumps, and others. The vital signs and patient monitors segment registered the largest market share in 2022.

Based on end user, the Middle East & Africa medical device connectivity market is segmented into hospitals, ambulatory surgical centres, imaging and diagnostic centres, and homecare settings. The hospitals segment registered the largest market share in 2022.

Based on country, the Middle East & Africa medical device connectivity market is segmented into Saudi Arabia, South Africa, the UAE, and the Rest of Middle East & Africa. Saudi Arabia dominated the market share in 2022.

Cisco Systems Inc, Digi International Inc., GE HealthCare Technologies Inc, iHealth Labs Inc, Infosys Ltd, Koninklijke Philips NV, Lantronix Inc., Medtronic Plc, and Oracle Corp are the leading companies operating in the Middle East & Africa medical device connectivity market.

1. Cisco Systems Inc

2. Digi International Inc.

3. GE HealthCare Technologies Inc

4. iHealth Labs Inc

5. Infosys Ltd

6. Koninklijke Philips NV

7. Lantronix Inc.

8. Medtronic Plc

9. Oracle Corp

The Middle East & Africa Medical Device Connectivity Market is valued at US$ 46.91 Million in 2022, it is projected to reach US$ 145.95 Million by 2028.

As per our report Middle East & Africa Medical Device Connectivity Market, the market size is valued at US$ 46.91 Million in 2022, projecting it to reach US$ 145.95 Million by 2028. This translates to a CAGR of approximately 20.5% during the forecast period.

The Middle East & Africa Medical Device Connectivity Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Medical Device Connectivity Market report:

The Middle East & Africa Medical Device Connectivity Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Medical Device Connectivity Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Medical Device Connectivity Market value chain can benefit from the information contained in a comprehensive market report.