The shift of point of care (PoC) from hospital to home provides good chances for better, consistent, and timely interaction between patient and doctor, making cloud and mobility-driven medical devices a foremost trend. Also, the COVID-19 crisis triggered the importance of AI in healthcare, which led to the growing emphasis on home-based care due to limited hospital bed capacity and a scarcity of skilled healthcare professionals. By monitoring the patient’s vitals remotely, healthcare professionals can avoid hospital admission if cases can be handled virtually, thereby reserving hospital beds only for patients requiring critical care. Home monitoring, often known as remote patient monitoring (RPM), has a subset of applications that have different requirements and frequency of data delivery, including monitoring chronic diseases and tracking patients’ health status.The bolstering numbers of connected medical devices, along with improvements in the systems and software that support capture and transmission of medical grade data, connectivity technologies and services, have given rise to the Internet of Medical Things (IoMT). Through IoMT, the connectivity between sensors and devices is expected to aid in real-time patient care, even remotely, thereby improving communication within and between medical facilities. Owing to the aforementioned factors, the market for medical device connectivity is expected to proliferate during the forecast period.

The South America medical device connectivity market is segmented into Brazil, Argentina, and the Rest of South America. The healthcare facilities and services are better in Brazil and Argentina as compared to the other countries in the region. Latin American startups emerging in the telemedicine/telecare industry have quickly gained traction in providing hospital-level clinical solutions. The Argentinian government announced its plan to create an interoperability HUB where all the stakeholders (public and private) can integrate to provide synergies for better patient outcomes. This plan also considers providing free training, which is required to understand the standards and leverage adoption. These kinds of training and initiatives are usually expensive for health-based IT companies and professionals who want to adopt the defined standards. The COVID-19 pandemic catalyzed the development of digital health strategies in Brazil. Among the key initiatives, it is worth noting the creation of actual governance organizations (such as the National Health Data Network– Rede Nacional de Dados em Saúde) in preparation for the rollout of a massive data-driven healthcare strategy that involves technology. It involves telemedicine, remote monitoring, remote diagnostics, telerehabilitation, etc. The initiatives taken by governments of various countries in South America for creating awareness about the various digital health facilities such as EMR, telehealth, and telemedicine are driving the growth of the medical device connectivity market.

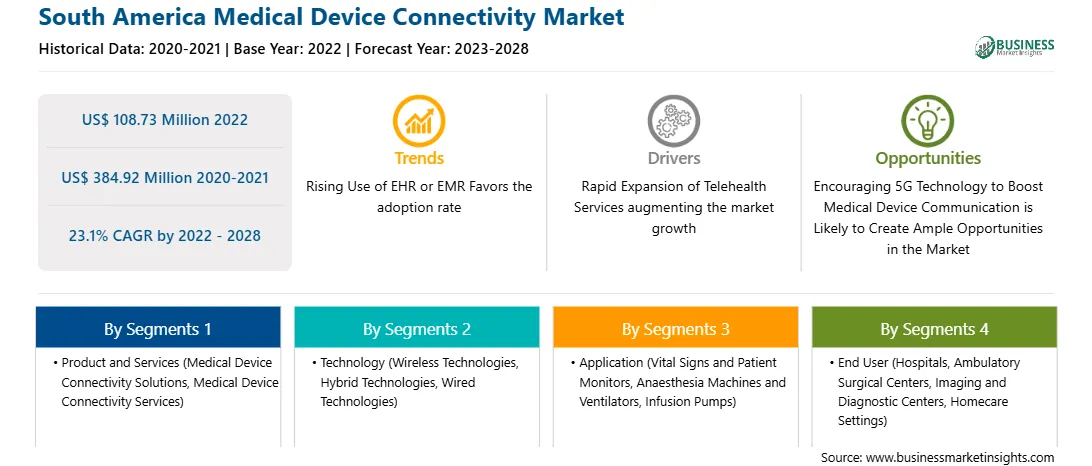

Strategic insights for the South America Medical Device Connectivity provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the South America Medical Device Connectivity refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.South America Medical Device Connectivity Strategic Insights

South America Medical Device Connectivity Report Scope

Report Attribute

Details

Market size in 2022

US$ 108.73 Million

Market Size by 2028

US$ 384.92 Million

CAGR (2022 - 2028) 23.1%

Historical Data

2020-2021

Forecast period

2023-2028

Segments Covered

By Product and Services

By Technology

By Application

By End User

Regions and Countries Covered

South and Central America

Market leaders and key company profiles

South America Medical Device Connectivity Regional Insights

South America Medical Device Connectivity Market Segmentation

The South America medical device connectivity market is segmented into product and services, technology, application, end user, and country. Based on product and services, the South America medical device connectivity market is segmented into medical device connectivity solutions and medical device connectivity services. The medical device connectivity solutions segment registered the largest market share in 2022.

Based on technology, the South America medical device connectivity market is segmented into wireless technologies, hybrid technologies, and wired technologies. The wireless technologies segment registered the largest market share in 2022.

Based on application, the South America medical device connectivity market is segmented into vital signs and patient monitors, anesthesia machines and ventilators, infusion pumps, and others. The vital signs and patient monitors segment registered the largest market share in 2022.

Based on end user, the South America medical device connectivity market is segmented into hospitals, ambulatory surgical centres, imaging and diagnostic centres, and homecare settings. The hospitals segment registered the largest market share in 2022.

Based on country, the South America medical device connectivity market is segmented into Brazil, Argentina, and the Rest of South America. The Rest of South America dominated the market share in 2022.

Cisco Systems Inc, Digi International Inc., GE HealthCare Technologies Inc, iHealth Labs Inc, Infosys Ltd, Koninklijke Philips NV, Lantronix Inc., Medtronic Plc, and Oracle Corp are the leading companies operating in the South America medical device connectivity market.

1. Cisco Systems Inc

2. Digi International Inc.

3. GE HealthCare Technologies Inc

4. iHealth Labs Inc

5. Infosys Ltd

6. Koninklijke Philips NV

7. Lantronix Inc.

8. Medtronic Plc

9. Oracle Corp

The South America Medical Device Connectivity Market is valued at US$ 108.73 Million in 2022, it is projected to reach US$ 384.92 Million by 2028.

As per our report South America Medical Device Connectivity Market, the market size is valued at US$ 108.73 Million in 2022, projecting it to reach US$ 384.92 Million by 2028. This translates to a CAGR of approximately 23.1% during the forecast period.

The South America Medical Device Connectivity Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South America Medical Device Connectivity Market report:

The South America Medical Device Connectivity Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South America Medical Device Connectivity Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South America Medical Device Connectivity Market value chain can benefit from the information contained in a comprehensive market report.