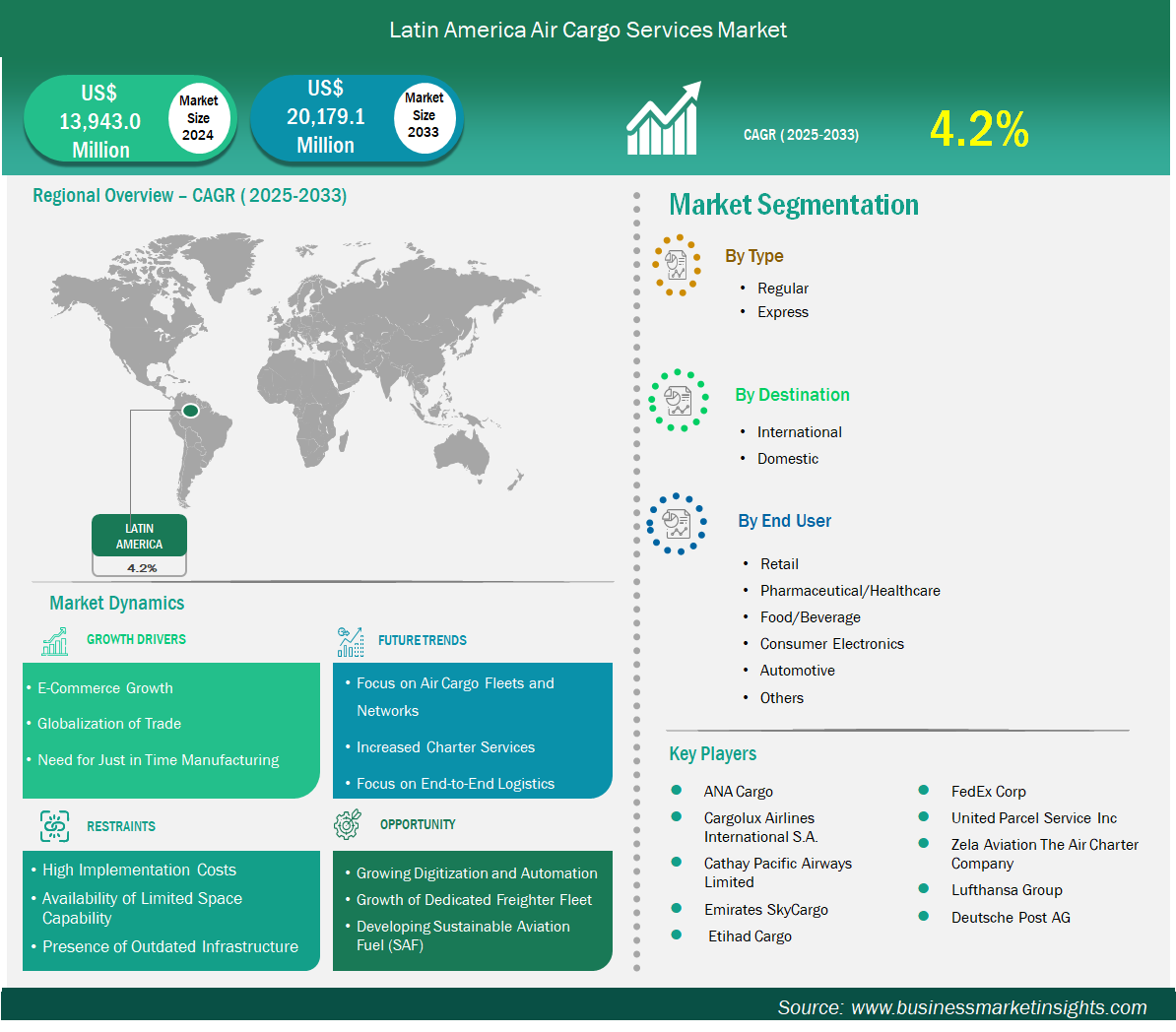

The Latin America air cargo services market size is expected to reach US$ 20,179.1 million by 2033 from US$ 13,943.0 million in 2024. The market is estimated to record a CAGR of 4.2% from 2025 to 2033.

The Latin America air cargo services market is evolving as a strategic component of global logistics, fueled by growing e-commerce demand, increasing regional trade, and modernization of logistics infrastructure. Key countries such as Mexico, Brazil, Argentina, Peru, Chile, and Colombia are investing in airport upgrades, digital freight technologies, and customs simplification to enhance cargo flow across the Americas and with partners in North America, Europe, and Asia.

Mexico is a major player in the region’s cargo sector, anchored by Mexico City International Airport and Guadalajara Airport. The country is modernizing air cargo terminals and adopting bonded logistics zones to improve turnaround times and support electronics and perishable cargo movement.

Brazil remains the region’s largest air cargo hub, with São Paulo–Guarulhos and Viracopos airports leading in international and express cargo operations. Brazil is focusing on automation, bonded warehousing, and cold chain logistics to support growth in pharmaceuticals, food exports, and high-tech goods.

Argentina is scaling up its air cargo capabilities through infrastructure investments in Buenos Aires and regional gateways. Emphasis on private sector participation and modernization of customs is enhancing efficiency in cargo handling and boosting trade flows.

Peru is strengthening its position with Lima’s Jorge Chávez International Airport serving as a strategic hub for both domestic and international freight. The government is investing in digital tracking systems, customs simplification, and airport expansion to boost throughput and trade efficiency.

Chile is enhancing its cargo ecosystem through upgrades at Santiago International Airport and digital freight corridors. The country is focusing on improving cold chain capabilities and supporting agricultural exports and time-sensitive goods.

Colombia is expanding its cargo handling infrastructure at El Dorado International Airport in Bogotá, with a focus on e-commerce fulfillment, smart warehousing, and green logistics initiatives. Public-private partnerships are also driving growth in freight connectivity across Latin America.

Latin America Air Cargo Services Market Strategic Insights

Key segments that contributed to the derivation of the air cargo services market analysis are type, destination and end user.

The Latin America air cargo services market is poised for significant growth, driven by rising demand for faster logistics solutions, growing e-commerce activity, and continued investment in multimodal infrastructure. The region serves as a strategic bridge between North and South America, and benefits from increasing trade links with Europe and Asia. Countries such as Brazil, Mexico, Argentina, Peru, Chile, and Colombia are investing in air cargo modernization through airport upgrades, digital logistics solutions, and streamlined customs processes.

A key market driver is the growing emphasis on automation, sustainability, and digitization. Airlines and logistics providers across the region are adopting AI-powered platforms, electric ground support systems, and green aviation technologies to improve efficiency and reduce emissions. Investments in cold chain capabilities are also expanding to support the region’s rising export of pharmaceuticals, seafood, and perishable agricultural products.

Governments across Latin America are facilitating growth by supporting logistics reforms, developing bonded logistics parks, and strengthening public-private partnerships to improve air cargo connectivity. As global trade continues to evolve, the region is well-positioned to become a dynamic player in the global air freight network, offering competitive transit times and increasing cargo capacity across strategic corridors.

Based on country, the Latin America air cargo services market is witnessing dynamic growth, supported by expanding trade volumes, digital transformation, and infrastructure upgrades across key economies such as Brazil, Mexico, Argentina, Peru, Chile, and Colombia. These countries are enhancing their positions in the global air cargo network by investing in airport modernization, green logistics solutions, and improved customs efficiency.

Brazil leads the region’s air cargo activity, supported by São Paulo–Guarulhos and Viracopos airports, which serve as major cargo gateways. The country is investing heavily in automation, bonded logistics zones, and cold chain facilities to support exports of pharmaceuticals, automotive parts, and agricultural products.

Mexico plays a key role in the region’s air cargo sector, with Mexico City International Airport and Guadalajara Airport serving as major hubs. The country is upgrading its air cargo facilities and implementing bonded logistics zones to enhance turnaround efficiency and facilitate the transportation of electronics and perishable goods.

Argentina is advancing its air cargo capabilities through upgrades at Ezeiza International Airport and regulatory reforms to simplify cargo handling. The country plays a strategic role in temperature-sensitive cargo, including food and wine exports, supported by growing logistics partnerships.

Peru is emerging as a key air freight hub on the Pacific coast, with Lima’s Jorge Chávez International Airport expanding to handle higher volumes of time-critical and high-value shipments. Government initiatives are focused on improving customs clearance processes and boosting regional connectivity.

Chile continues to strengthen its role in perishable cargo logistics, particularly in the export of seafood and fresh produce. Investments in Santiago International Airport and digital air cargo platforms are helping reduce transit times and ensure cold chain integrity.

Colombia is experiencing robust air cargo growth, driven by flower exports, textiles, and e-commerce. Bogotá’s El Dorado International Airport is a critical cargo hub, with increasing capacity, AI-enabled cargo management, and strong linkages to North American and European markets.

The Latin America air cargo services market is expected to continue expanding as countries boost investment in automation, green freight solutions, and air cargo infrastructure. These developments are reinforcing the region’s leadership role in global air cargo logistics.

Latin America Air Cargo Services Market Report Highlights| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 13,943.0 Million |

| Market Size by 2033 | US$ 20,179.1 Million |

| CAGR (2025 - 2033) | 4.2% |

| Historical Data | 2022-2023 |

| Forecast period | 2025-2033 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

Latin America

|

| Market leaders and key company profiles |

|

ANA Cargo, Cargolux Airlines International S.A., Cathay Pacific Airways Limited, Emirates SkyCargo, Etihad Cargo, FedEx Corp, United Parcel Service Inc, Zela Aviation The Air Charter Company, Lufthansa Group, and Deutsche Post AG are among the key players operating in the market. These players adopt strategies such as expansion, product innovation, and mergers and acquisitions to stay competitive in the market and offer innovative products to their consumers.

The following methodology has been followed for the collection and analysis of data presented in this report:

The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

Note: All financial data included in the Company Profiles section has been standardized to US$. For companies reporting in other currencies, figures have been converted to US$ using the relevant exchange rates for the corresponding year.

Business Market Insights conducts a significant number of primary interviews each year with industry stakeholders and experts to validate and analyze the data and gain valuable insights. These research interviews are designed to:

Primary research is conducted via email interactions and telephone interviews with industry experts across various markets, categories, segments, and sub-segments in different regions. Participants typically include:

The Latin America Air Cargo Services Market is valued at US$ 13,943.0 Million in 2024, it is projected to reach US$ 20,179.1 Million by 2033.

As per our report Latin America Air Cargo Services Market, the market size is valued at US$ 13,943.0 Million in 2024, projecting it to reach US$ 20,179.1 Million by 2033. This translates to a CAGR of approximately 4.2% during the forecast period.

The Latin America Air Cargo Services Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Latin America Air Cargo Services Market report:

The Latin America Air Cargo Services Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Latin America Air Cargo Services Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Latin America Air Cargo Services Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)