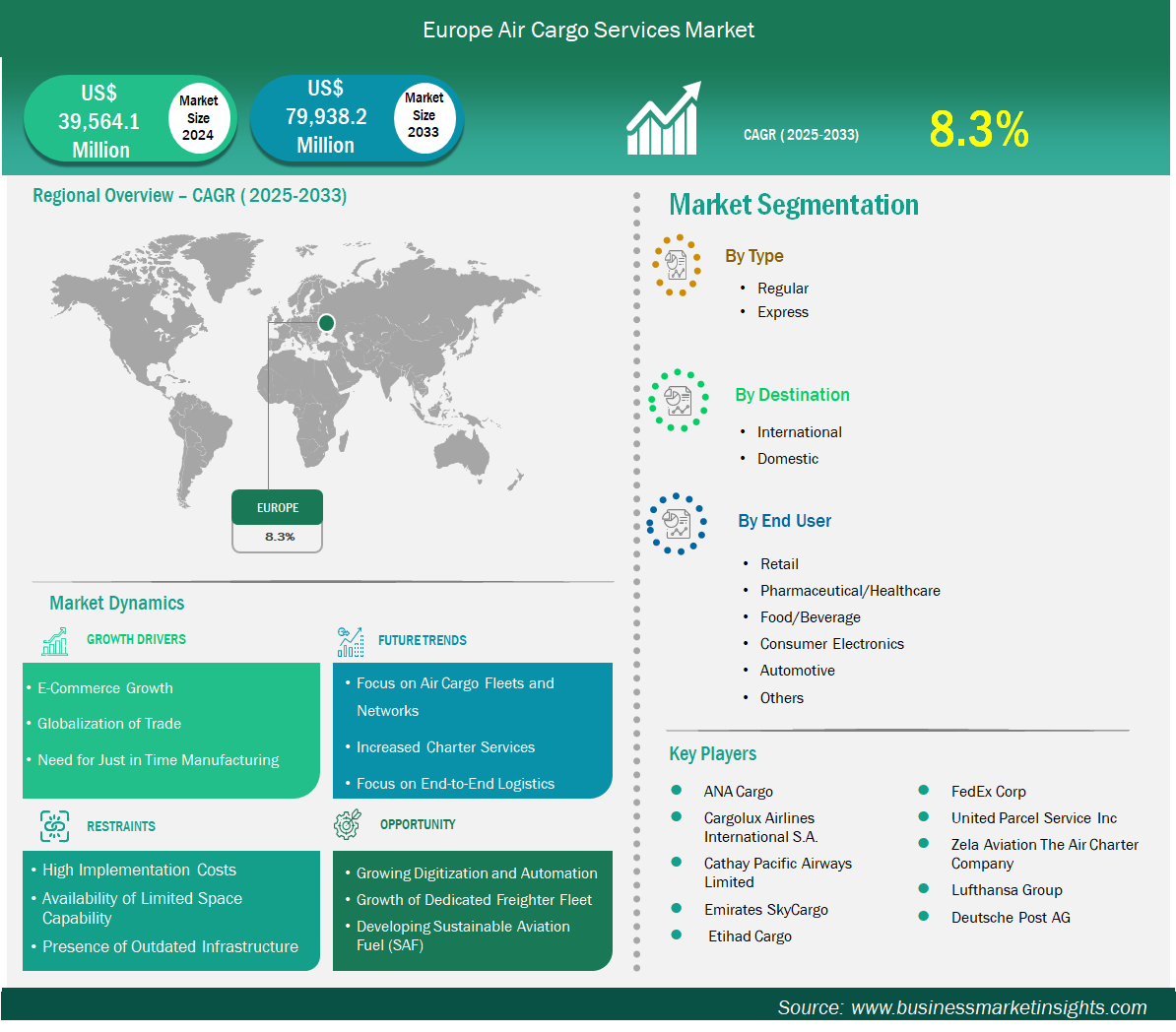

The Europe air cargo services market size is expected to reach US$ 79,938.2 million by 2033 from US$ 39,564.1 million in 2024. The market is estimated to record a CAGR of 8.3% from 2025 to 2033.

The Europe air cargo services market presents a highly developed and integrated logistics network, supported by strong trade infrastructure, regional connectivity, and sustained e-commerce growth. Covering key economies such as Belgium, Netherlands, Luxembourg, Germany, France, Italy, Russian Federation, Spain, Switzerland, Poland, Sweden, Austria, United Kingdom, Denmark, Ukraine, Romania, Greece, Portugal, Norway, and Finland, the region offers a well-coordinated and technologically advanced air freight ecosystem. Each country contributes specific strengths, fostering efficiency and agility in pan-European and global cargo movements.

Belgium plays a pivotal role in pharmaceutical and express cargo, supported by Brussels Airport’s specialization in temperature-sensitive freight. The Netherlands, with Schiphol Airport, is a major hub for international air cargo, known for its digital freight solutions and efficient customs processes.

Luxembourg leverages its central location and Cargolux operations to serve as a strategic node for European and intercontinental freight. Germany leads with strong industrial exports and a dense airport network; Frankfurt Airport remains one of Europe’s largest cargo gateways.

France supports air cargo growth via Paris-CDG and regional airports, benefiting from diversified exports and freight digitization initiatives. Italy is strengthening its air freight sector through investments in southern airports and increasing exports of high-value goods.

The Russian Federation, despite recent disruptions, continues to serve as a key transit and domestic air cargo corridor, especially across Eurasia. Spain is emerging as a logistics hub for Latin America-Europe trade, driven by Madrid and Barcelona airports’ expanded cargo handling.

Switzerland provides specialized handling for medical, financial, and high-value goods through its well-regulated and reliable cargo infrastructure. Poland is a rising market, supported by manufacturing exports and ongoing investments in airport modernization.

Sweden leads in green logistics, emphasizing sustainable air freight solutions and advanced cargo tracking technologies. Austria enhances regional distribution with efficient connections to Central and Eastern Europe, driven by Vienna Airport’s logistics role.

The United Kingdom, post-Brexit, is adapting its trade routes while maintaining strong air cargo throughput through major hubs like Heathrow and East Midlands. Denmark serves Northern Europe through Copenhagen Airport, focusing on pharmaceutical and express delivery services.

Ukraine, despite current instability, remains strategically important for future regional logistics and cross-border connectivity. Romania is growing in relevance, driven by EU-backed infrastructure upgrades and expanding manufacturing exports.

Greece leverages its maritime-air freight connectivity to serve Southeastern Europe and Mediterranean trade corridors. Portugal supports transatlantic cargo flows with a growing emphasis on perishables and e-commerce logistics. Norway specializes in time-sensitive and perishable goods, especially seafood, with advanced cold chain infrastructure.

Finland connects Europe with Asia through Helsinki, serving as a gateway for East-West air cargo routes and digital logistics innovation. Europe’s air cargo services market is expected to continue evolving through investments in automation, sustainability, and cross-border digitalization, reinforcing the region’s position as a global air logistics leader.

Europe Air Cargo Services Market Strategic Insights

Key segments that contributed to the derivation of the air cargo services market analysis are type, destination and end user.

The Europe air cargo services market is among the most mature and strategically positioned globally, supported by its robust multimodal logistics infrastructure, well-integrated airport networks, and dense trade corridors. The region benefits from strong participation in international trade, advanced supply chain technologies, and increasing demand for e-commerce, pharmaceutical, and time-sensitive goods. Key markets such as Germany, the Netherlands, France, and Belgium serve as vital gateways for both intra-European and global air freight flows.

A major factor driving market growth is the region’s emphasis on automation, digital freight management, and sustainability. Airlines and logistics providers are investing in AI-enabled cargo tracking systems, low-emission aircraft, and smart warehousing to enhance visibility, reduce turnaround times, and meet climate goals. Additionally, EU-wide initiatives supporting cross-border logistics integration, green transportation corridors, and customs modernization are reinforcing Europe’s position as a global air cargo leader. As consumer expectations and trade volumes grow, the Europe air cargo services market is poised for further expansion and innovation.

Based on country, the Europe air cargo services market is witnessing significant developments across key economies, including Germany, Italy, France, the U.K., Spain, Belgium, the Netherlands, Luxembourg, Norway, Finland, Denmark, Sweden, Austria, Switzerland, Russia, Romania, Greece, the Czech Republic, Portugal, Ukraine, Poland, Slovakia, and Bulgaria. These countries are playing vital roles in shaping the region’s air cargo network through investments in airport infrastructure, digital logistics solutions, and sustainable freight innovations.

Belgium serves as a major hub for pharmaceutical and temperature-sensitive cargo, led by Brussels Airport’s advanced cold chain facilities and express logistics handling. The Netherlands, anchored by Amsterdam Schiphol Airport, offers one of Europe’s most digitally advanced cargo ecosystems, enabling rapid customs clearance and efficient international throughput.

Luxembourg is home to Cargolux, one of Europe’s leading cargo airlines, positioning the country as a strategic transshipment hub for global freight flows. Germany remains a logistics powerhouse, driven by Frankfurt Airport and an extensive industrial export base. The country is prioritizing smart cargo handling and automation to optimize freight efficiency.

France supports strong air freight volumes through Paris-CDG and regional airports, underpinned by investments in sustainable cargo infrastructure and digital innovation. Italy is enhancing its air cargo capacity with growing exports of fashion, pharmaceuticals, and food products, supported by modernization of key southern and central airports.

The Russian Federation, despite recent geopolitical disruptions, continues to operate regional cargo corridors and is investing in domestic logistics resilience. Spain is becoming an important gateway for Latin American and North African trade, with Madrid and Barcelona airports expanding cargo capabilities.

Switzerland specializes in high-value, secure, and medical cargo, with Zurich and Geneva airports supporting regulated and efficient logistics handling. Poland is gaining momentum as a regional cargo hub due to increasing manufacturing exports and EU-backed airport modernization projects.

Sweden is investing in green logistics and air cargo digitization, aligning with national goals on emissions reduction and sustainability. Austria, through Vienna Airport, acts as a key cargo bridge between Western and Eastern Europe, with growing intermodal logistics connectivity.

The United Kingdom, post-Brexit, is adapting its cargo strategies to maintain competitiveness, with major airports like Heathrow and East Midlands driving throughput. Denmark focuses on time-critical and pharmaceutical air cargo, leveraging Copenhagen Airport’s specialized handling capabilities and digital infrastructure.

Ukraine, while affected by conflict, remains important for future regional logistics planning, especially in connecting Central and Eastern Europe. Romania is emerging as a key player in Southeastern Europe, supported by EU funding for airport development and increased trade flows.

Greece utilizes its strategic location to link Europe with Middle Eastern and North African markets, combining air and sea logistics capabilities. Portugal is growing its role in transatlantic and e-commerce air freight, backed by airport capacity upgrades in Lisbon and Porto.

Norway remains a leader in perishable air freight, particularly seafood exports, supported by efficient cold chain operations. Finland connects Europe with Asia via Helsinki Airport, acting as a gateway for high-tech and time-sensitive cargo, strengthened by digital logistics solutions.

The Europe air cargo services market is expected to continue evolving rapidly as nations increase investments in digital transformation, green freight solutions, and infrastructure upgrades. These country-specific efforts are collectively reinforcing Europe’s role as a global logistics leader.

Europe Air Cargo Services Market Report Highlights| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 39,564.1 Million |

| Market Size by 2033 | US$ 79,938.2 Million |

| CAGR (2025 - 2033) | 8.3% |

| Historical Data | 2022-2023 |

| Forecast period | 2025-2033 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

Europe

|

| Market leaders and key company profiles |

|

ANA Cargo, Cargolux Airlines International S.A., Cathay Pacific Airways Limited, Emirates SkyCargo, Etihad Cargo, FedEx Corp, United Parcel Service Inc, Zela Aviation The Air Charter Company, Lufthansa Group, and Deutsche Post AG are among the key players operating in the market. These players adopt strategies such as expansion, product innovation, and mergers and acquisitions to stay competitive in the market and offer innovative products to their consumers.

The following methodology has been followed for the collection and analysis of data presented in this report:

The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

Note: All financial data included in the Company Profiles section has been standardized to US$. For companies reporting in other currencies, figures have been converted to US$ using the relevant exchange rates for the corresponding year.

Business Market Insights conducts a significant number of primary interviews each year with industry stakeholders and experts to validate and analyze the data and gain valuable insights. These research interviews are designed to:

Primary research is conducted via email interactions and telephone interviews with industry experts across various markets, categories, segments, and sub-segments in different regions. Participants typically include:

The Europe Air Cargo Services Market is valued at US$ 39,564.1 Million in 2024, it is projected to reach US$ 79,938.2 Million by 2033.

As per our report Europe Air Cargo Services Market, the market size is valued at US$ 39,564.1 Million in 2024, projecting it to reach US$ 79,938.2 Million by 2033. This translates to a CAGR of approximately 8.3% during the forecast period.

The Europe Air Cargo Services Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Air Cargo Services Market report:

The Europe Air Cargo Services Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Air Cargo Services Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Air Cargo Services Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)