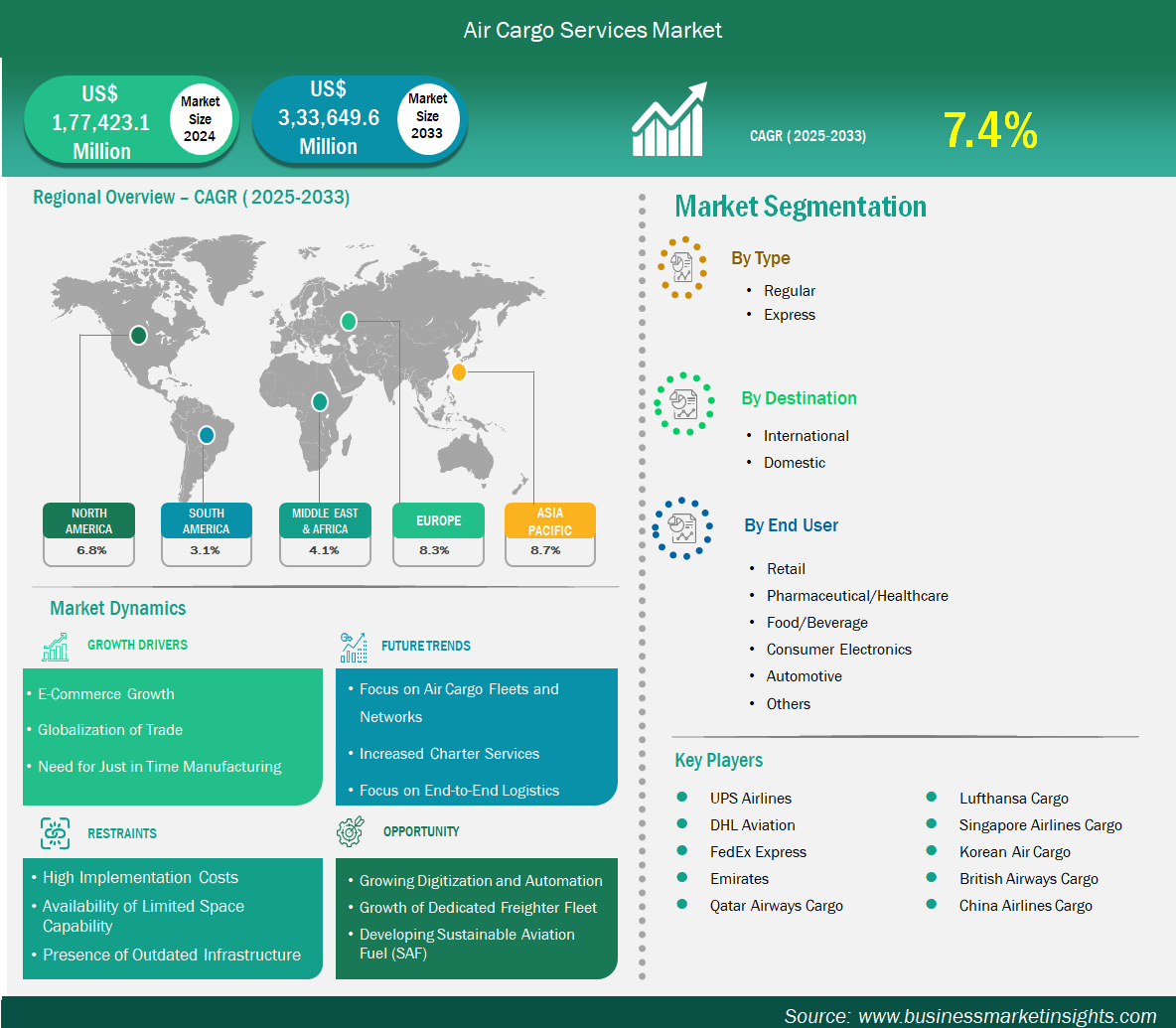

The Air Cargo Services market size is expected to reach US$ 3,33,649.6 million by 2033 from US$ 1,77,423.1 million in 2024. The market is estimated to record a CAGR of 7.4% from 2025 to 2033.

Air Cargo Services play a critical role in the transportation of goods globally, offering fast and reliable delivery over long distances. They are essential for industries such as pharmaceuticals, electronics, automotive, perishables, and e-commerce. Air cargo has several advantages, including rapid transit times, reduced risk of damage, and the ability to connect remote or landlocked areas to global markets. Increasing global trade volumes, the rise of cross-border e-commerce, and the growing demand for just-in-time inventory systems are fueling the market. Additionally, innovations in cargo tracking, automation, and cold chain logistics are enhancing service efficiency and reliability.

However, several challenges can restrain market growth, such as high fuel costs, limited cargo space on passenger flights, and regulatory complexities across international borders. The industry is also sensitive to economic fluctuations and disruptions such as geopolitical tensions or pandemics. Despite these hurdles, the market holds significant opportunities driven by rising demand for temperature-sensitive goods, expansion of trade networks in developing countries, and increased adoption of digital freight management solutions. Investment in green logistics and sustainable aviation fuels is also expected to open new avenues for market expansion.

Key segments that contributed to the derivation of the Air Cargo Services market analysis are type, destination, and end user.

The rapid growth of global eCommerce has emerged as a pivotal factor positively driving the air cargo services market. With the digitalization of commerce and the increasing preference for online shopping, consumers now expect faster delivery times and real-time tracking, making air cargo a critical component of the supply chain.

For instance, according to the International Trade Administration (ITA)'s 2024 eCommerce Sales & Size Forecast data, the global B2B (business-to-business) ecommerce market is expected to reach USD $36 trillion by 2026, and B2C (business-to-consumer) ecommerce revenue is expected to grow to USD $5.5 trillion by 2027. The growth is associated with the increasing demand and sales of consumer electronics, fashion, furniture, toys and hobbies, biohealth pharmaceuticals, media and entertainment, beverages, and food. This robust eCommerce expansion directly supports the growth of the air cargo services market, as the need for fast, efficient global shipping solutions continues to increase to meet consumer expectations and supply chain demands worldwide.

Major eCommerce giants such as Amazon, Alibaba, and Shopify have not only expanded their reach globally but have also significantly influenced logistics models by demanding high-speed delivery capabilities. Air cargo services, known for their speed and reliability over long distances, are uniquely positioned to meet these evolving consumer demands. Unlike sea or land freight, air transportation enables the quick movement of high-value, time-sensitive goods, which is essential for the eCommerce sector that thrives on rapid fulfillment.

The ongoing globalization of trade has become a powerful driver of growth in the air cargo services market. As international trade agreements expand and global supply chains become increasingly interconnected, businesses are more reliant than ever on fast, efficient, and reliable logistics solutions to move goods across borders. Air cargo services, with their ability to transport goods quickly over long distances, have emerged as a crucial enabler of this global exchange.

In recent years, trade liberalization policies, reduced tariffs, and the establishment of free trade zones have opened new markets, encouraging cross-border commerce and the flow of goods between developed and emerging economies. High-value, time-sensitive products such as electronics, pharmaceuticals, automotive parts, and fashion apparel are often transported by air due to the speed and security the mode offers. These goods are frequently sourced, manufactured, and consumed in different regions, underscoring the need for a dependable global air freight network.

Moreover, multinational companies continue to diversify their sourcing and manufacturing strategies to remain resilient in the face of geopolitical and economic shifts. This shift often involves the need for air cargo solutions that can support complex, time-critical supply chains spanning multiple continents. As companies adapt to demand-driven production models and just-in-time inventory practices, the demand for rapid delivery via air freight is expected to grow steadily.

By type, the air cargo services market is bifurcated into regular and express. The regular segment dominated the market in 2024. Regular air cargo services are typically used for shipments that are less time-sensitive and can be transported on scheduled routes at lower costs. This type of service is widely utilized across various industries due to its affordability and capacity for large-volume shipments.

By destination, the market is bifurcated into international and domestic. The international segment held the largest share of the market in 2024. International air cargo involves the movement of goods across country borders and plays a vital role in supporting global trade and supply chains. This segment benefits from increasing globalization, trade agreements, and the rising demand for cross-border e-commerce fulfillment.

By end user, the market is segmented into retail, pharmaceutical/healthcare, food/beverage, consumer electronics, automotive, and others. The pharmaceutical/healthcare segment held the largest share of the market in 2024. Pharmaceutical and healthcare industries utilize air freight for transporting temperature-sensitive products such as vaccines, medical devices, and biologics, requiring strict handling and timely delivery.

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 1,77,423.1 Million |

| Market Size by 2033 | US$ 3,33,649.6 Million |

| Global CAGR (2025 - 2033) | 7.4% |

| Historical Data | 2022-2023 |

| Forecast period | 2025-2033 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

The "Air Cargo Services Market Size and Forecast (2022–2033)" report provides a detailed analysis of the market covering below areas:

The geographical scope of the Air Cargo Services market report is divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America. The Air Cargo Services market in Asia Pacific is expected to grow significantly during the forecast period.

The Asia-Pacific Air Cargo Services market is segmented into China, Japan, South Korea, India, Australia, New Zealand, Indonesia, Malaysia, the Philippines, Singapore, Thailand, Vietnam, Taiwan, Bangladesh, and the Rest of Asia. The Asia-Pacific air cargo market is experiencing robust growth, driven by the rapid expansion of cross-border e-commerce, growing international trade volumes, and the rising demand for time-sensitive delivery services. Major economies like China and India are leading the way, fueled by increasing industrial output, strategic logistics investments, and the development of free trade zones.

The region is also witnessing increased adoption of advanced logistics technologies, including AI-based shipment tracking, digital freight booking, and temperature-controlled cargo systems—particularly relevant for sectors like pharmaceuticals and perishables. Air cargo capacity expansion, alongside fleet modernization efforts by regional airlines and integrators, is enhancing operational efficiency and reducing transit times. Additionally, the surge in manufacturing activity and exports, coupled with the growth of express delivery networks, is positioning Asia-Pacific as a key hub in the global air freight ecosystem. The rise of regional trade agreements (such as RCEP) and strong infrastructure development across major logistics corridors further solidifies the region’s dominant market position

The Air Cargo Services market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the key developments in the air cargo services market are:

The Air Cargo Services Market is valued at US$ 1,77,423.1 Million in 2024, it is projected to reach US$ 3,33,649.6 Million by 2033.

As per our report Air Cargo Services Market, the market size is valued at US$ 1,77,423.1 Million in 2024, projecting it to reach US$ 3,33,649.6 Million by 2033. This translates to a CAGR of approximately 7.4% during the forecast period.

The Air Cargo Services Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Air Cargo Services Market report:

The Air Cargo Services Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Air Cargo Services Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Air Cargo Services Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)