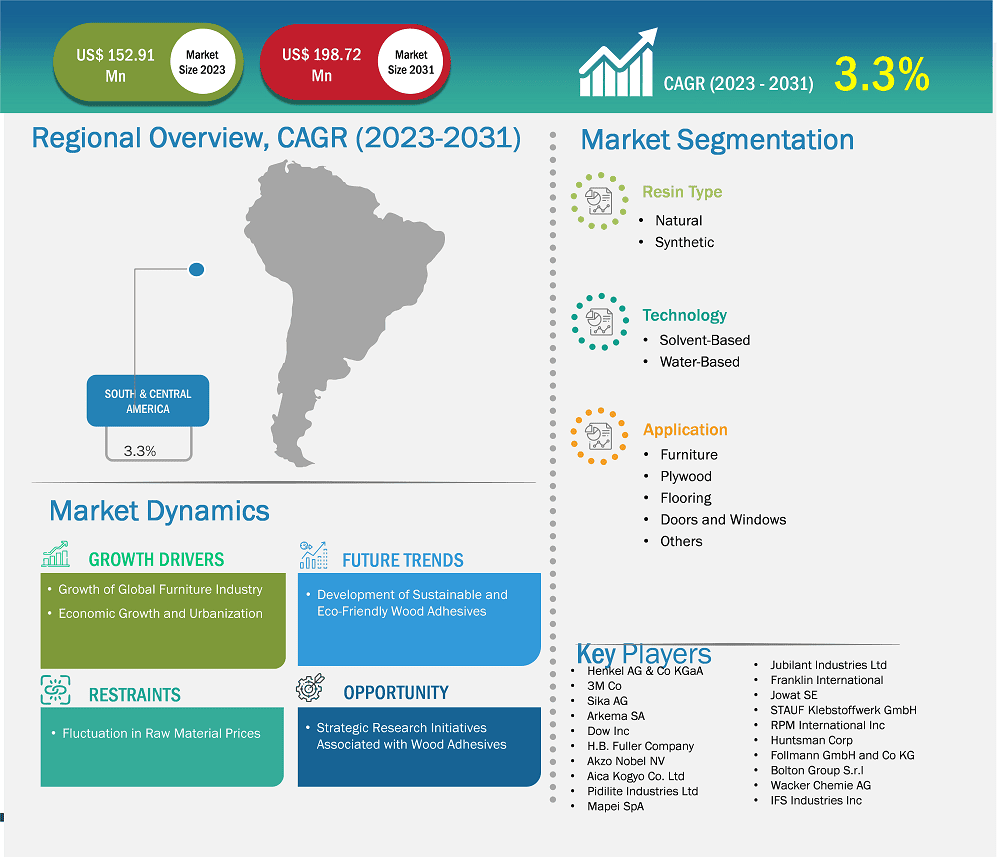

The South & Central America wood adhesives market size is expected to reach US$ 198.72 million by 2031 from US$ 152.91 million in 2023. The market is estimated to record a CAGR of 3.3% from 2023 to 2031.

In South & Central America, countries are experiencing significant urbanization and infrastructure development growth. New housing projects, commercial buildings, and public infrastructure are being built to accommodate the growing population. Wood adhesives are essential in producing engineered wood products such as plywood and particleboard, which are extensively used in construction projects. As construction activities surge, the demand for wood adhesive increases. Moreover, rising consumer preferences for aesthetics and increasing investments in construction fuel the wood adhesives market growth in South & Central America. Wooden floorings are gaining immense traction in Latin American countries. Construction of resorts and luxury hotels involves large-scale use of wooden floors to offer aesthetic appeal. Also, wooden floors are resistant to stains and require little maintenance. The expanding tourism sector in Latin American countries will amplify the construction of hotels and resorts, subsequently stimulating market growth. For instance, Chile's tourism sector is expanding strongly, especially in remote areas, presenting lucrative opportunities for the wood adhesives market in the country.

South & Central America Wood Adhesives Market Segmentation Analysis:

Key segments that contributed to the derivation of the South & Central America wood adhesives market analysis are resin type, technology, and application.

Sustainable and eco-friendly materials are the subject of extensive research in various fields, fueled by the driving utilization in commercial applications. The easy availability of natural raw materials for the production of eco-friendly polymers is an added factor boosting its supply and demand. Further, due to rising concerns and awareness about the social and environmental impacts of synthesized chemicals, customers are shifting toward the utilization of renewable wood adhesives. Stringent government regulations pertaining to the utilization of toxic chemicals across the globe have encouraged many market players to develop nontoxic alternatives and green products, aiding global sustainability goals. The global transition toward sustainability and circular economy leads to a rise in research and development activities associated with novel sustainable wood adhesives.

The rising demand for sustainable materials has prompted manufacturers to develop eco-friendly wood adhesives for various applications. In 2023, Henkel AG & Co KGaA announced the launch of two new wood adhesives that are developed with bio-based materials; the new Loctite engineered wood adhesives, HB S ECO and CR 821 ECO, reduce CO2 equivalent emissions by more than 60% compared to fossil-based alternatives. In May 2024, Garnica launched Naturbind, a high-performance bio-based adhesive. The developed product is derived from a tannin-based source that does not contain formaldehyde. It is FSC plywood and CE2+ certified, as well as offers high indoor air quality standards. Thus, the replacement of petroleum-derived polymers with eco-friendly materials, otherwise sourced from natural sources, is expected to become a significant trend in the wood adhesives market during the forecast period.

Based on country, the South & Central America wood adhesives market comprises Brazil, Argentina, and the Rest of South & Central America. Brazil held the largest share in 2023.

The flourishing residential and commercial sectors in Brazil are the prime contributors to the wood adhesives market in the country. Brazil is one of the frontrunners in furniture production in South & Central America, and the cost of production of these products is considerably low in the country. In addition, the proliferating construction industry is expected to fuel the furniture market in the coming years, bolstering the demand for wood adhesives. According to the International Trade Administration report, in 2023, the Ministry of Finance and the banking system issued credit lines for the construction of over 530,000 new residential units. Burgeoning construction activities and investments by international furniture manufacturers boost the demand for wood adhesives.

South & Central America Wood Adhesives Market Company Profiles

Some of the key players operating in the market Henkel AG & Co KGaA; 3M Co; Sika AG; Arkema SA; Dow Inc; H.B. Fuller Company; Akzo Nobel NV; Aica Kogyo Co. Ltd; Pidilite Industries Ltd; Mapei SpA; Jubilant Industries Ltd; Franklin International; Jowat SE; STAUF Klebstoffwerk GmbH; RPM International Inc; Huntsman Corp; Follmann GmbH and Co KG; Bolton Group S.r.l; Wacker Chemie AG; and the IFS Industries Inc, among others. These players are adopting various strategies such as expansion, product innovation, and mergers and acquisitions to provide innovative products to their consumers and increase their market share.

The following methodology has been followed for the collection and analysis of data presented in this report:

The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

Note: All financial data included in the Company Profiles section has been standardized to USD. For companies reporting in other currencies, figures have been converted to USD using the relevant exchange rates for the corresponding year.

The Insight Partners conducts a significant number of primary interviews each year with industry stakeholders and experts to validate its data analysis, and gain valuable insights. These research interviews are designed to:

Primary research is conducted via email interactions and telephone interviews, encompassing various markets, categories, segments, and sub-segments across different regions. Participants typically include:

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 152.91 Million |

| Market Size by 2031 | US$ 198.72 Million |

| CAGR (2023 - 2031) | 3.3% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Resin Type

|

| Regions and Countries Covered |

South and Central America

|

| Market leaders and key company profiles |

|

The South & Central America Wood Adhesives Market is valued at US$ 152.91 Million in 2023, it is projected to reach US$ 198.72 Million by 2031.

As per our report South & Central America Wood Adhesives Market, the market size is valued at US$ 152.91 Million in 2023, projecting it to reach US$ 198.72 Million by 2031. This translates to a CAGR of approximately 3.3% during the forecast period.

The South & Central America Wood Adhesives Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South & Central America Wood Adhesives Market report:

The South & Central America Wood Adhesives Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South & Central America Wood Adhesives Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South & Central America Wood Adhesives Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)