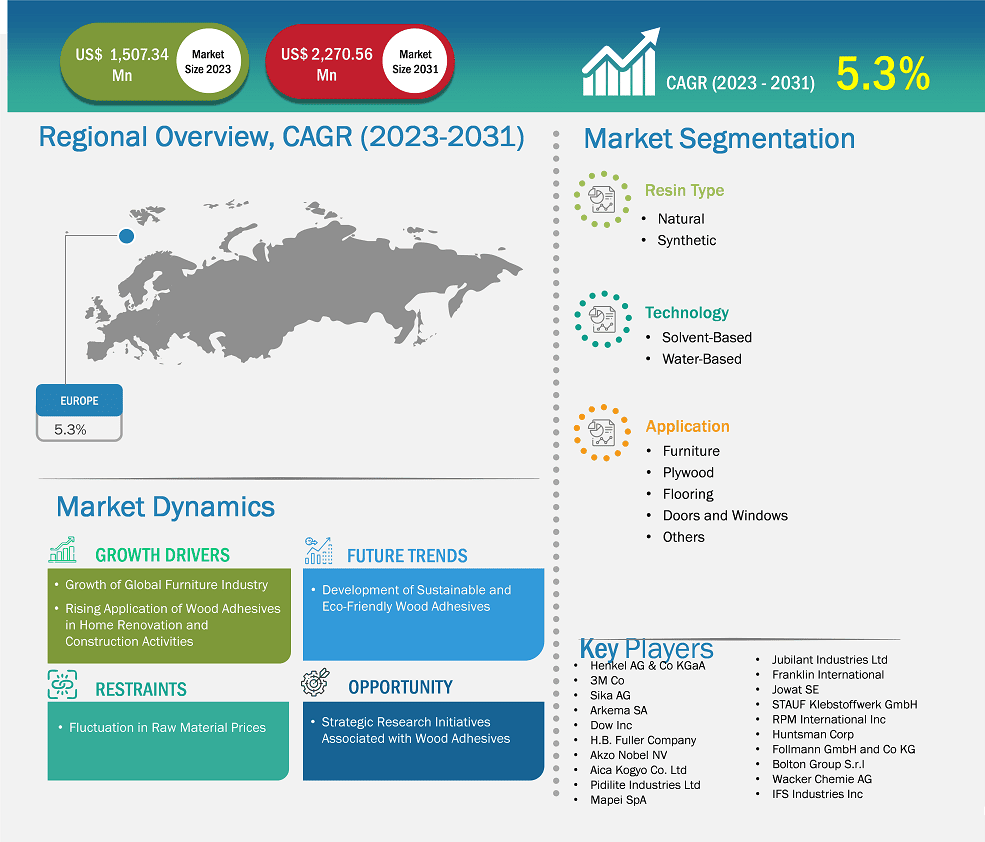

The Europe wood adhesives market size is expected to reach US$ 2,270.56 million by 2031 from US$ 1,507.34 million in 2023. The market is estimated to record a CAGR of 5.3% from 2023 to 2031.

In Europe, the demand for wood adhesives is increasing primarily due to the resurgence of the construction and real estate sectors. As urbanization continues and the need for residential, commercial, and infrastructure projects grows, there is a heightened demand for wood products. Wood adhesives are essential in producing engineered wood products such as plywood, particleboard, and laminated veneer lumber, which are extensively used in modern construction for their strength and versatility. Further, Europe's strong push toward sustainability and environmental consciousness has propelled the market growth. European regulations and consumer preferences are increasingly favoring sustainable and eco-friendly materials. Wood adhesives formulated to be environmentally friendly, such as those based on renewable resources, are in high demand. Manufacturers are responding to these trends by developing and making adhesives that meet stringent environmental standards, thus propelling market growth. For instance, in January 2024, Durante Adesivi, a leading company in producing hot melt adhesives for wood, assembly, textile, and paper industries, signed an agreement with the Belgian group Soudal to sell a majority stake.

The presence of key market players, including Henkel, Arkema Group, H.B. Fuller Company, and others, contributes to the wood adhesives market growth. Key regional players are adopting strategic initiatives, such as mergers, acquisitions, collaborations, partnerships, and product launches, to fulfil the growing demand for wood adhesives and expand their geographical presence. For instance, in February 2024, Henkel and Covestro collaborated to increase the sustainability of engineered wood adhesives.

Key segments that contributed to the derivation of the Europe wood adhesives market analysis are resin type, technology, and application.

Formaldehyde, phenol-formaldehyde, melamine-formaldehyde, and polymeric methylene diisocyanate are used for the production of wood-based panels, such as particleboard, medium/high-density fiberboard, oriented strand board, and plywood. Polyurethane, phenol-formaldehyde, phenol-resorcinol-formaldehyde, emulsion polymer isocyanate, polyvinyl acetate, and other formulation chemistries are used for solid wood lamination and construction beams and coating of boards with veneers or finish foils, among other applications. Key manufacturers operating in the wood adhesives market invest significantly in strategic development initiatives such as product innovation and research and development to enhance their market position and attract a wide customer base. In May 2023, Arkema SA’s Bostik launched Supergrip SG6518 and SG6520 adhesives for the woodworking industry. The launched product is a hot melt polyurethane reactive (HMPUR) adhesive solution produced for edge banding applications.

In June 2024, Huntsman Corp announced the launch of a new innovation center in Tienen, Belgium, to strengthen its research and development capabilities and reinforce its commitment to its customers in the market in Europe. Thus, strategic expansion and research initiatives associated with wood adhesives are expected to create lucrative opportunities in the wood adhesives market over the forecasted period.

Based on country, the Europe wood adhesives market comprises Germany, France, Italy, the UK, Russia, and the Rest of Europe. The Rest of Europe held the largest share in 2023.

The Rest of Europe consists of countries such as Russia, Poland, the Netherlands, Greece, Belgium, and others. The demand for wood adhesives in the region is attributed to the booming furniture industry and growing demand for eco-friendly and sustainable home décor products. Exports of windows and doors from Poland increased by 32% to reach US$ 4.68 billion in 2022 from US$ 3.40 billion in 2021. The construction sector is a crucial component of Poland's GDP; it held ~10% of GDP in 2022. According to the European Construction Industry Federation (FICE), in 2022, the construction output of Hungary was US$ 20.76 billion, ~6.3% higher than in 2021. The demand for building and construction materials is likely to propel as the country invests in infrastructure development and construction projects. Therefore, the expanding end-use industries propel the demand for wood adhesives in the Rest of Europe.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 1,507.34 Million |

| Market Size by 2031 | US$ 2,270.56 Million |

| CAGR (2023 - 2031) | 5.3% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Resin Type

|

| Regions and Countries Covered |

Europe

|

| Market leaders and key company profiles |

|

Some of the key players operating in the market include Henkel AG & Co KGaA; 3M Co; Sika AG; Arkema SA; Dow Inc; H.B. Fuller Company; Akzo Nobel NV; Aica Kogyo Co. Ltd; Pidilite Industries Ltd; Mapei SpA; Jubilant Industries Ltd; Franklin International; Jowat SE; STAUF Klebstoffwerk GmbH; RPM International Inc; Huntsman Corp; Follmann GmbH and Co KG; Bolton Group S.r.l; Wacker Chemie AG; and the IFS Industries Inc among others. These players are adopting various strategies such as expansion, product innovation, and mergers and acquisitions to provide innovative products to their consumers and increase their market share.

The following methodology has been followed for the collection and analysis of data presented in this report:

The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

Note: All financial data included in the Company Profiles section has been standardized to USD. For companies reporting in other currencies, figures have been converted to USD using the relevant exchange rates for the corresponding year.

The Insight Partners conducts a significant number of primary interviews each year with industry stakeholders and experts to validate its data analysis, and gain valuable insights. These research interviews are designed to:

Primary research is conducted via email interactions and telephone interviews, encompassing various markets, categories, segments, and sub-segments across different regions. Participants typically include:

The Europe Wood Adhesives Market is valued at US$ 1,507.34 Million in 2023, it is projected to reach US$ 2,270.56 Million by 2031.

As per our report Europe Wood Adhesives Market, the market size is valued at US$ 1,507.34 Million in 2023, projecting it to reach US$ 2,270.56 Million by 2031. This translates to a CAGR of approximately 5.3% during the forecast period.

The Europe Wood Adhesives Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Wood Adhesives Market report:

The Europe Wood Adhesives Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Wood Adhesives Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Wood Adhesives Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)