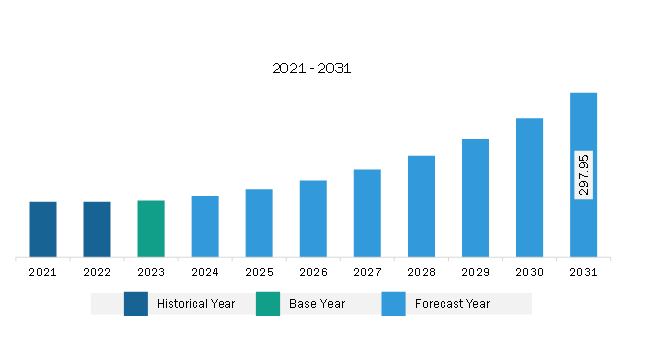

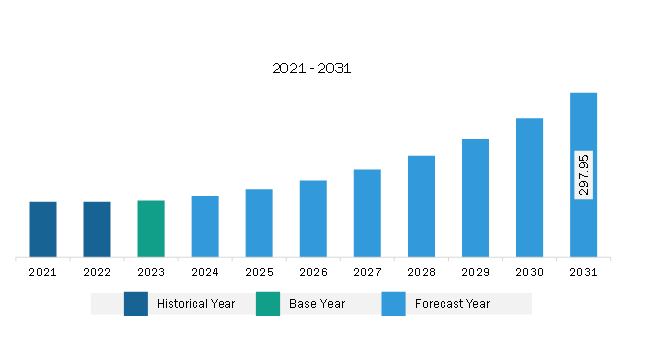

The South & Central America oil & gas sensors market was valued at US$ 260.03 million in 2023 and is expected to reach US$ 297.95 million by 2031; it is estimated to register a CAGR of 1.7% from 2023 to 2031.

Development of Internet of Things (IoT)-based Sensors Fuels South & Central America Oil & Gas Sensors Market

The evolution of IoT technology in the oil & gas industry is transforming operations by increasing operational efficiency and workers' safety. These developments make it possible for oil & gas companies to monitor equipment and pipelines in real-time, perform predictive maintenance, and control operations remotely by decreasing downtime and risk. In oil & gas-based applications, IoT-based sensors collect, and track asset operation, pressure, speed, temperature, or other factors based on predetermined conditions. IoT-based sensors help transfer the data in real time to an external storage location, which might be on the cloud. This further enables plant operators to analyze the data collected by the sensors to determine whether the asset is properly working, broken, or close to failure. Moreover, IoT-based sensors ensure the safety of critical systems by providing real-time monitoring.

IoT-based sensors are used in various applications in the oil & gas industry to ensure the reliability, safety, and longevity of machines operating in a harsh environment. The growing demand for IoT-based sensors has encouraged manufacturers to develop new innovative sensors or upgrade existing sensors with additional features. For instance, in April 2024, TE Connectivity Ltd expanded its IoT wireless pressure sensor by launching a 69xxN wireless pressure sensor. These sensors provide support to oil & gas companies in advancing data collection processes and precisely monitoring the plant’s condition. The sensor engineered with low power wide area networking (LoRaWAN) technology provides long-range coverage. This compact sensor fits effortlessly into various environments, offers a wide pressure sensing range, simplifies system integration, reduces the need for multiple sensors, and shows high durability and resistance to corrosion. The scalability, extended battery life, and low power consumption support users to enhance system reliability and lower maintenance frequency in a hazardous environment. Thus, the development of Internet of Things (IoT)-based sensors contributes to the oil & gas sensors market growth.

South & Central America Oil & Gas Sensors Market Overview

According to the Global Energy Association data published in May 2023, oil production in South America increased by 370,000 barrels per day (bpd) in 2023. Brazil is a key growth driver of oil production in the region, with an increasing output of 240,000 bpd. A surge in production can be ascribed to the establishment of new floating production storage and offloading (FPSO) units at pre-salt fields on the Atlantic shelf—the Anna Nery FPSO unit and Almirante Barroso FPSO units having production capacities of 70,000 bpd and 150,000 bpd oil, respectively. Growing oil production and plant capacity expansion are among the activities triggering the demand for oil & gas sensors for accurate and reliable monitoring of pressure, temperature, and flow rates in production plants. Moreover, significant benefits provided by oil & gas sensors include reduction in downtime, optimization of operations, and betterment of asset and employee safety, which also contribute to the oil & gas sensor market growth in South & Central America.

South & Central America Oil & Gas Sensors Market Revenue and Forecast to 2031 (US$ Million)

South & Central America Oil & Gas Sensors Market Segmentation

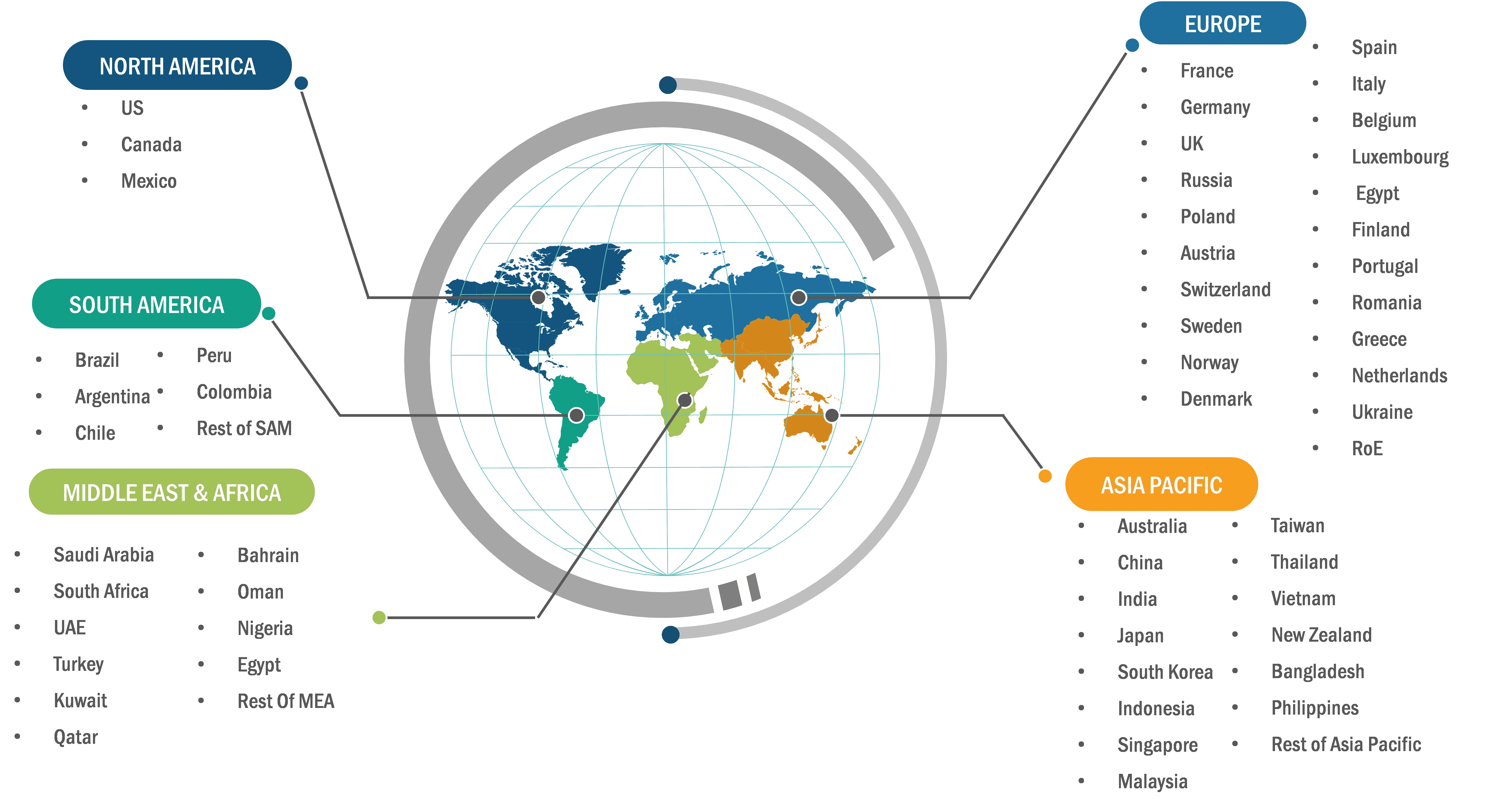

The South & Central America oil & gas sensors market is categorized into type, connectivity, function, application, and country.

Based on type, the South & Central America oil & gas sensors market is segmented pressure sensor, temperature sensor, flow sensor, and level sensor. The pressure sensor segment held the largest market share in 2023.

In terms of connectivity, the South & Central America oil & gas sensors market is bifurcated into wired and wireless. The wired segment held a larger market share in 2023.

By function, the South & Central America oil & gas sensors market is segmented into remote monitoring, condition monitoring and maintenance, analysis and simulation, and others. The remote monitoring segment held the largest market share in 2023.

By application, the South & Central America oil & gas sensors market is segmented into upstream, midstream, and downstream. The upstream segment held the largest market share in 2023.

By country, the South & Central America oil & gas sensors market is segmented into Brazil, Argentina, and the Rest of South & Central America. Brazil dominated the South & Central America oil & gas sensors market share in 2023.

Honeywell International Inc, TE Connectivity Ltd, Robert Bosch GmbH, ABB Ltd, Siemens AG, Rockwell Automation Inc, Analog Devices Inc, Emerson Electric Co, SKF AB, and GE Vernova are some of the leading companies operating in the South & Central America oil & gas sensors market.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 260.03 Million |

| Market Size by 2031 | US$ 297.95 Million |

| CAGR (2023 - 2031) | 1.7% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

South and Central America

|

| Market leaders and key company profiles |

|

The South & Central America Oil & Gas Sensors Market is valued at US$ 260.03 Million in 2023, it is projected to reach US$ 297.95 Million by 2031.

As per our report South & Central America Oil & Gas Sensors Market, the market size is valued at US$ 260.03 Million in 2023, projecting it to reach US$ 297.95 Million by 2031. This translates to a CAGR of approximately 1.7% during the forecast period.

The South & Central America Oil & Gas Sensors Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South & Central America Oil & Gas Sensors Market report:

The South & Central America Oil & Gas Sensors Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South & Central America Oil & Gas Sensors Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South & Central America Oil & Gas Sensors Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)