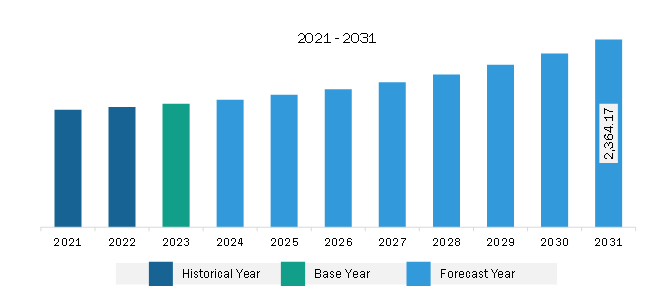

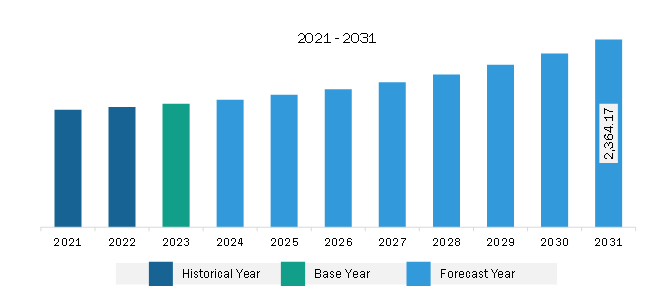

The Europe oil & gas sensors market was valued at US$ 1,555.46 million in 2023 and is expected to reach US$ 2,364.17 million by 2031; it is estimated to register a CAGR of 5.4% from 2023 to 2031.

Growing Demand for Ultrasonic Sensors in Oil & Gas Applications Drives Europe Oil & Gas Sensors Market

The oil & gas business is becoming increasingly important as countries seek alternative decarbonized renewable energy sources. However, the growing demand for oil & gas has led to high production output from existing infrastructure that must be more dependable and efficient. To meet these demands, oil & gas sensor companies, such as Fuji Electric Co Ltd, Honeywell International Inc, Siemens AG, and Murata Manufacturing Co Ltd, are offering ultrasonic sensors that measure liquids in severe and complex process conditions. These sensors are widely used for remote monitoring, condition monitoring & maintenance, analysis & simulation, and flow control in various oil & gas applications. An ultrasonic flow sensor is used in upstream, midstream, and downstream applications to compute the mass flow or volume flow of fluids in pipelines, tanks, and other processing equipment. The sensor also monitors equipment such as monitor pumps, flowlines, valves, and any other component that requires a precise flow rate to maintain the flow of oil. Moreover, the growing demand for nonintrusive measurement in midstream and downstream oil & gas applications is increasing the requirement for ultrasonic sensors for monitoring liquid volumes during various chemical reactions at the refining and purification processes. These sensors accurately monitor the flow of liquids without interrupting ongoing operations.

Many companies are adopting smart ultrasonic sensors in a variety of oil & gas applications. For instance, in May 2023, Polysense Technologies Inc. launched iEdge 4.0-based smart ultrasonic sensors to offer a wide range of monitoring capabilities in upstream, midstream, and downstream applications. iEdge 4.0-based smart ultrasonic sensors are highly capable of measuring waste overflow, equipment distance, and oil consumption and provide accurate data to users. This data further helps oil & gas operators to improve their operational efficiency and reduce additional costs. Thus, the growing demand for ultrasonic sensors in oil & gas applications drives the oil and sensors market.

Europe Oil & Gas Sensors Market Overview

Germany, the UK, France, Italy, Spain, Russia, and other European countries are experiencing a rise in the adoption of technologically advanced devices and equipment. IoT-based wireless sensors help prevent overheating and equipment malfunctions in critical environments of research laboratories, oil plants, and gas pipelines. Sensor companies in European countries are engaging in strategic developments to grow their businesses in the region. In January 2023, Italcoppie Sensori Srl signed an agreement to acquire Reckmann GmbH to expand its presence in Germany. The acquisition allows both companies to develop and upgrade their existing portfolio of temperature sensors. Temperature sensors are being used as early warning systems to prevent fire accidents.

Europe Oil & Gas Sensors Market Revenue and Forecast to 2031 (US$ Million)

Europe Oil & Gas Sensors Market Segmentation

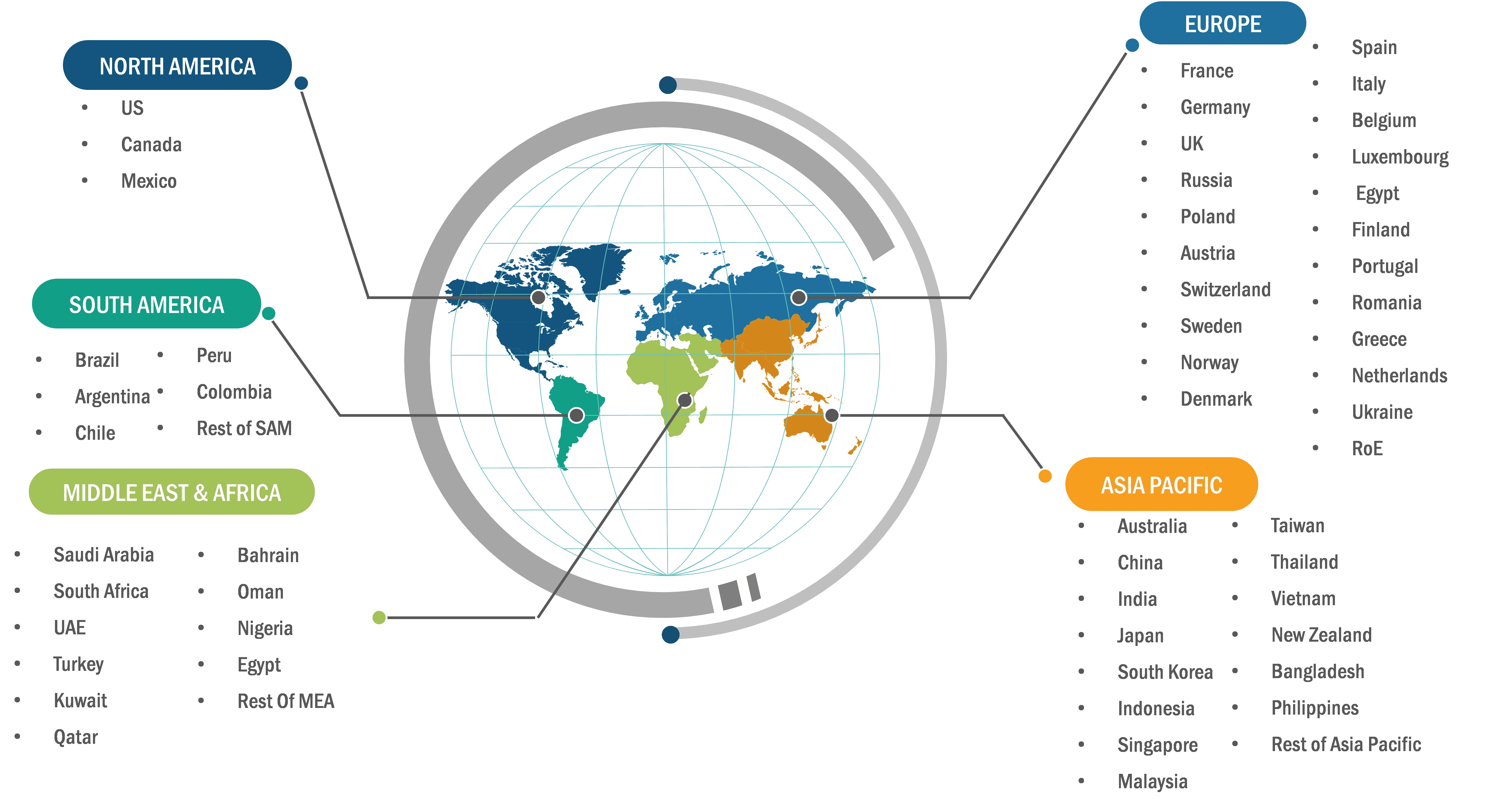

The Europe oil & gas sensors market is categorized into type, connectivity, function, application, and country.

Based on type, the Europe oil & gas sensors market is segmented pressure sensor, temperature sensor, flow sensor, and level sensor. The pressure sensor segment held the largest market share in 2023.

In terms of connectivity, the Europe oil & gas sensors market is bifurcated into wired and wireless. The wired segment held a larger market share in 2023.

By function, the Europe oil & gas sensors market is segmented into remote monitoring, condition monitoring and maintenance, analysis and simulation, and others. The remote monitoring segment held the largest market share in 2023.

By application, the Europe oil & gas sensors market is segmented into upstream, midstream, and downstream. The upstream segment held the largest market share in 2023.

By country, the Europe oil & gas sensors market is segmented into the UK, Germany, France, Italy, Russia, and the Rest of Europe. Germany dominated the Europe oil & gas sensors market share in 2023.

Honeywell International Inc, TE Connectivity Ltd, Robert Bosch GmbH, ABB Ltd, Siemens AG, Rockwell Automation Inc, Analog Devices Inc, Emerson Electric Co, SKF AB, and GE Vernova are some of the leading companies operating in the Europe oil & gas sensors market.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 1,555.46 Million |

| Market Size by 2031 | US$ 2,364.17 Million |

| CAGR (2023 - 2031) | 5.4% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

Europe

|

| Market leaders and key company profiles |

|

The Europe Oil & Gas Sensors Market is valued at US$ 1,555.46 Million in 2023, it is projected to reach US$ 2,364.17 Million by 2031.

As per our report Europe Oil & Gas Sensors Market, the market size is valued at US$ 1,555.46 Million in 2023, projecting it to reach US$ 2,364.17 Million by 2031. This translates to a CAGR of approximately 5.4% during the forecast period.

The Europe Oil & Gas Sensors Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Oil & Gas Sensors Market report:

The Europe Oil & Gas Sensors Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Oil & Gas Sensors Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Oil & Gas Sensors Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)