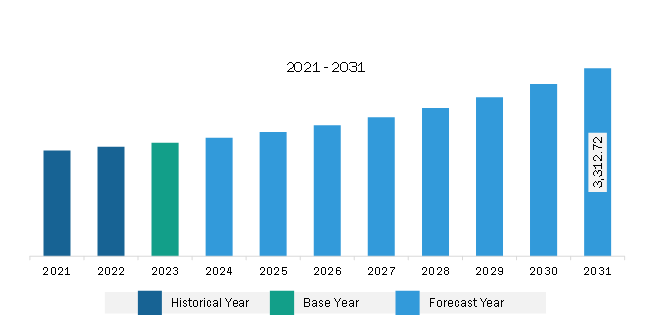

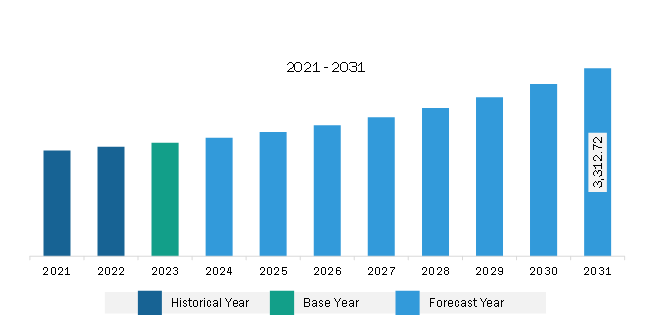

The Asia Pacific oil & gas sensors market was valued at US$ 2,001.22 million in 2023 and is expected to reach US$ 3,312.72 million by 2031; it is estimated to register a CAGR of 6.5% from 2023 to 2031.

Increasing Adoption of Wireless Sensors and Miniaturized Sensors Boosts Asia Pacific Oil & Gas Sensors Market

The oil & gas industry is constantly seeking ways to improve efficiency, increase safety, and optimize operations. This has led to a greater focus on technological innovation, particularly in the field of sensor technology; for example, the development of wireless sensors. These sensors eliminate the need for complex and expensive wiring systems, enabling easy installation and flexibility in monitoring various parameters in the oil & gas infrastructure. Wireless sensors offer real-time data collection, reducing downtime and enhancing decision-making capabilities. They also provide remote monitoring and control capabilities to operators by improving overall operational efficiency. The growing demand for automated monitoring sensors encourages market players to develop new innovative sensors used in the oil & gas industry. For instance, in November 2023, SKF AB expanded its portfolio by launching a new wireless sensor that supports the oil & gas industry to automate machine monitoring in hazardous areas.

Miniaturized sensors, another technological advancement in sensor technology, are smaller in size yet retain high-performance capabilities. These sensors are designed to withstand harsh operating conditions, including high temperatures and extreme pressures, making them ideal for use in oil & gas exploration and production activities. The compact size of miniaturized sensors allows for easy integration into existing infrastructure, reducing installation costs and minimizing disruption to operations. For instance, WIKA Alexander Wiegand SE & Co. KG provides a miniature pressure sensor that offers high measurement performance in extreme pressure spikes. Thus, the increasing adoption of wireless sensors and miniaturized sensors is expected to create lucrative opportunities for the oil & gas sensors market growth during the forecast period.

Asia Pacific Oil & Gas Sensors Market Overview

The APAC temperature sensors market is anticipated to expand at a notable pace during the forecast period owing to the growing consumption of crude oil, biofuels, and other petroleum liquids. According to data by the US Energy Information Administration, in 2022, China and India recorded an oil consumption of 15.15 and 5.05 million barrels per day, respectively, accounting for 15% and 5% of the world’s total oil consumption. Companies in China and India are highly demanding crude oil converting electricity and other renewables, which encourages oil & gas market players to increase their production capacity. Moreover, the growing need for oil & gas plant capacity expansion is likely to propel the adoption of temperature sensors, pressure sensors, flow sensors, and oil sensors in the coming years. Sensors are placed strategically throughout a production plant to ensure real-time data monitoring and alarms.

Asia Pacific Oil & Gas Sensors Market Revenue and Forecast to 2031 (US$ Million)

Asia Pacific Oil & Gas Sensors Market Segmentation

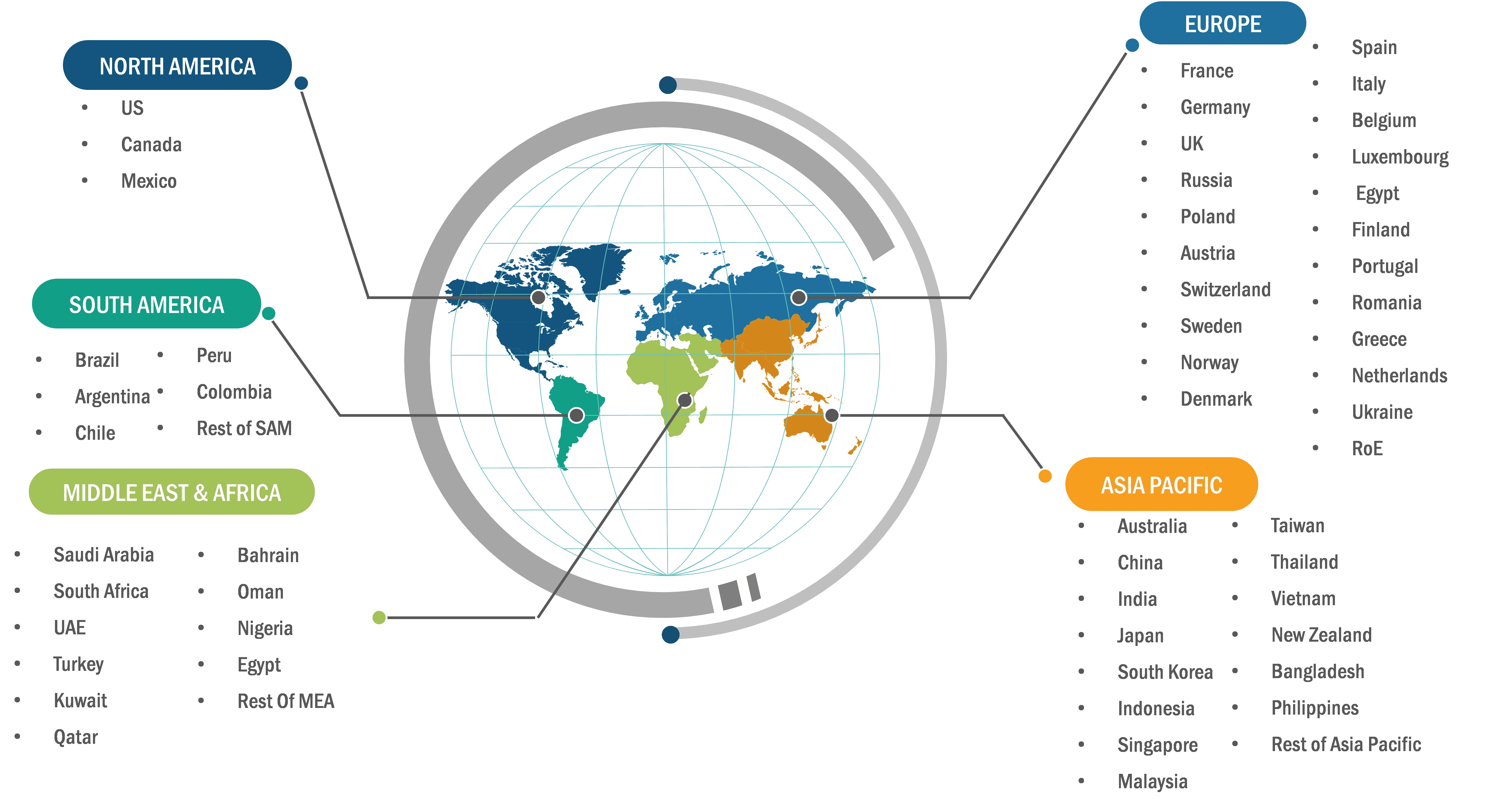

The Asia Pacific oil & gas sensors market is categorized into type, connectivity, function, application, and country.

Based on type, the Asia Pacific oil & gas sensors market is segmented pressure sensor, temperature sensor, flow sensor, and level sensor. The pressure sensor segment held the largest market share in 2023.

In terms of connectivity, the Asia Pacific oil & gas sensors market is bifurcated into wired and wireless. The wired segment held a larger market share in 2023.

By function, the Asia Pacific oil & gas sensors market is segmented into remote monitoring, condition monitoring and maintenance, analysis and simulation, and others. The remote monitoring segment held the largest market share in 2023.

By application, the Asia Pacific oil & gas sensors market is segmented into upstream, midstream, and downstream. The upstream segment held the largest market share in 2023.

By country, the Asia Pacific oil & gas sensors market is segmented into India, China, Japan, South Korea, Australia, and the Rest of Asia Pacific. China dominated the Asia Pacific oil & gas sensors market share in 2023.

Honeywell International Inc, TE Connectivity Ltd, Robert Bosch GmbH, ABB Ltd, Siemens AG, Rockwell Automation Inc, Analog Devices Inc, Emerson Electric Co, SKF AB, and GE Vernova are some of the leading companies operating in the Asia Pacific oil & gas sensors market.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 2,001.22 Million |

| Market Size by 2031 | US$ 3,312.72 Million |

| CAGR (2023 - 2031) | 6.5% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

Asia-Pacific

|

| Market leaders and key company profiles |

|

The Asia Pacific Oil & Gas Sensors Market is valued at US$ 2,001.22 Million in 2023, it is projected to reach US$ 3,312.72 Million by 2031.

As per our report Asia Pacific Oil & Gas Sensors Market, the market size is valued at US$ 2,001.22 Million in 2023, projecting it to reach US$ 3,312.72 Million by 2031. This translates to a CAGR of approximately 6.5% during the forecast period.

The Asia Pacific Oil & Gas Sensors Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Oil & Gas Sensors Market report:

The Asia Pacific Oil & Gas Sensors Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Oil & Gas Sensors Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Oil & Gas Sensors Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)