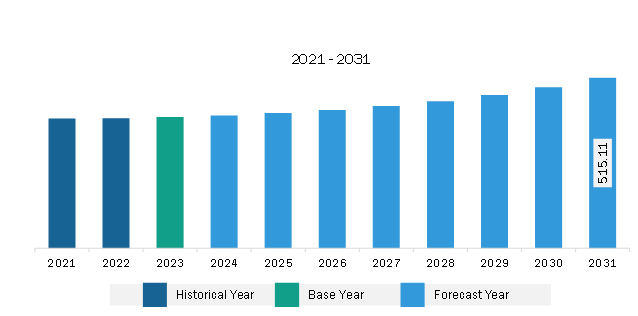

The Middle East & Africa oil & gas sensors market was valued at US$ 396.33 million in 2023 and is expected to reach US$ 515.11 million by 2031; it is estimated to register a CAGR of 3.3% from 2023 to 2031.

Expanding Oil and Gas Industry Bolsters Middle East & Africa Oil & Gas Sensors Market

The oil & gas industry has played a significant role in the economic transformation of various countries. The industry accounted for the largest share of global consumption of energy resources. Natural gas is projected to become the fastest-growing fossil fuel in the coming years. The oil production are increasing and fulfill energy demand. According to the International Energy Agency (IEA), global oil demand is expected to rise by 6% from 2022 to 2028 and reach 105.7 million barrels per day, with a significant requirement from the aviation and petrochemical industries. Rising demand for oil among various industries increases the demand for numerous oil & gas sensors such as pressure sensors, temperature sensors, flow sensors, and level sensors for monitoring and controlling plant operations.

The expansion of the oil & gas industry is also associated with increasing investment in oil & gas exploration activities. For instance, according to the Urwald eV report published in November 2023, between 2021 and 2023, 384 businesses across the globe have reported an average capital expenditure of more than US$ 10 million in oil & gas exploration activities. The top seven companies invested in oil & gas exploration are China National Petroleum Corporation (CNPC) (US$ 5.9 billion), China National Offshore Oil Corporation (CNOOC) (US$ 3.2 billion), Saudi Aramco (US$ 2.8 billion), Pemex (US$ 2.6 billion), Sinopec Group (US$ 2.4 billion), Pioneer Natural Resources (US$ 2.1 billion), and Shell plc (US$ 2.0 billion). These investments support oil & gas companies to adopt technologically advanced oil & gas sensors by expanding their business worldwide. Thus, the expanding oil & gas industry fuels the oil & gas sensors market growth.

Middle East & Africa Oil & Gas Sensors Market Overview

Governments of several countries in the MEA are implementing various policies and regulations to encourage the adoption of advanced technologies such as IoT and AI in different industries. According to the International Trade Administration report of November 2023, the government of UAE aims to become self-sufficient in gas supplies by 2030. The UAE now imports natural gas from Qatar via the Dolphin pipeline to fuel power plants and desalination facilities. Simultaneously, the country has increased its focus on energy transition and is moving forward to adopt its "net-zero" emissions objective. This encourages oil & gas industries to adopt advanced devices that sustainably promote energy transition. In December 2022, Abu Dhabi National Oil Company (ADNOC), a global leader in the oil & gas industry, announced its intentions to focus on renewable energy, carbon capture and storage, and clean hydrogen, along with making efforts to expand its presence in the global gas, liquefied natural gas (LNG), and chemicals sectors. Thus, burgeoning investments to expand the oil & gas industry and government initiatives to promote sustainability throughout the oil production process are expected to create growth opportunities for the oil & gas sensors market in the coming years.

Middle East & Africa Oil & Gas Sensors Market Revenue and Forecast to 2031 (US$ Million)

Middle East & Africa Oil & Gas Sensors Market Segmentation

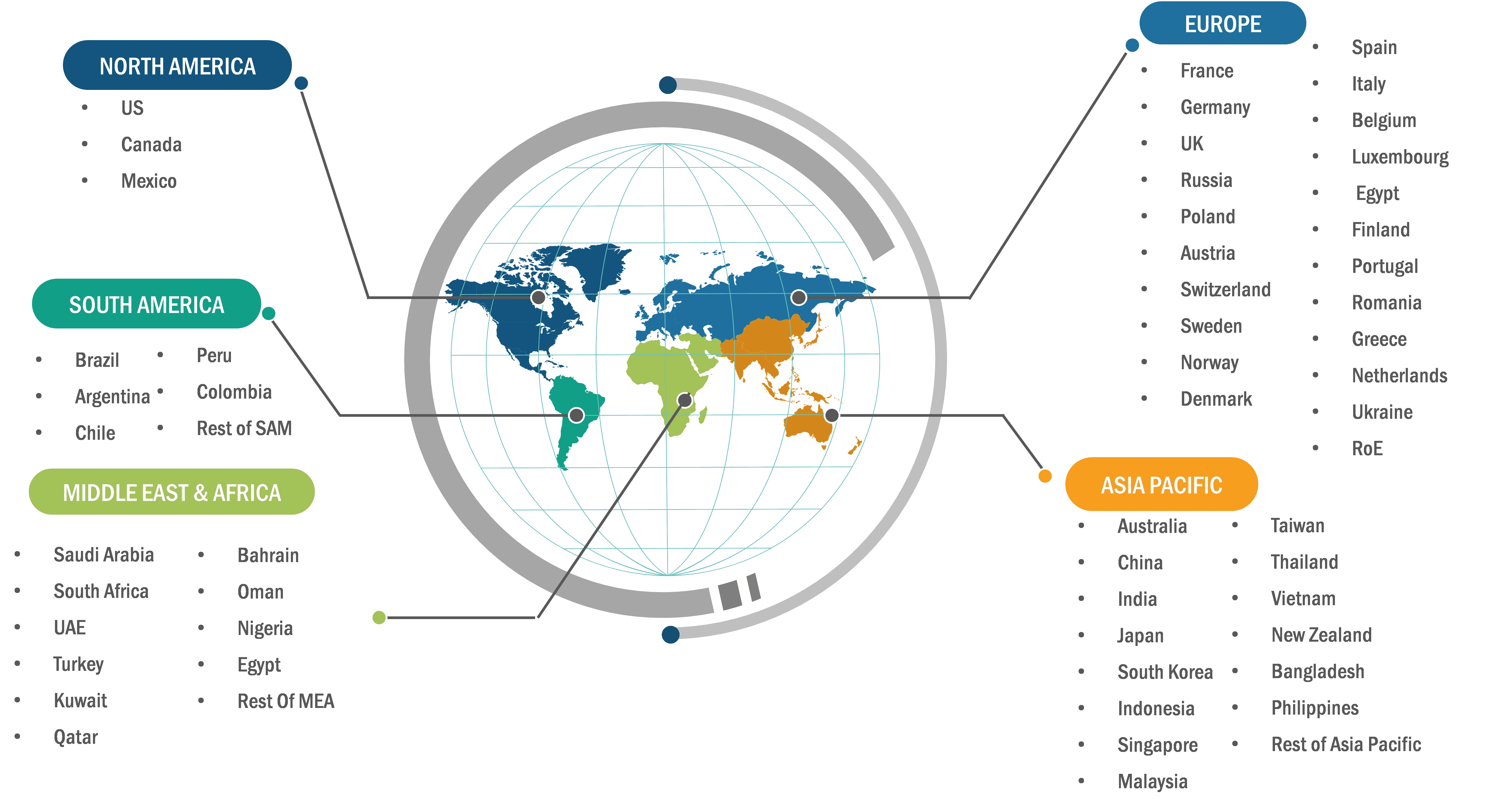

The Middle East & Africa oil & gas sensors market is categorized into type, connectivity, function, application, and country.

Based on type, the Middle East & Africa oil & gas sensors market is segmented pressure sensor, temperature sensor, flow sensor, and level sensor. The pressure sensor segment held the largest market share in 2023.

In terms of connectivity, the Middle East & Africa oil & gas sensors market is bifurcated into wired and wireless. The wired segment held a larger market share in 2023.

By function, the Middle East & Africa oil & gas sensors market is segmented into remote monitoring, condition monitoring and maintenance, analysis and simulation, and others. The remote monitoring segment held the largest market share in 2023.

By application, the Middle East & Africa oil & gas sensors market is segmented into upstream, midstream, and downstream. The upstream segment held the largest market share in 2023.

By country, the Middle East & Africa oil & gas sensors market is segmented into Saudi Arabia, the UAE, South Africa, and the Rest of Middle East & Africa. Saudi Arabia dominated the Middle East & Africa oil & gas sensors market share in 2023.

Honeywell International Inc, TE Connectivity Ltd, Robert Bosch GmbH, ABB Ltd, Siemens AG, Rockwell Automation Inc, Analog Devices Inc, Emerson Electric Co, SKF AB, and GE Vernova are some of the leading companies operating in the Middle East & Africa oil & gas sensors market.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 396.33 Million |

| Market Size by 2031 | US$ 515.11 Million |

| CAGR (2023 - 2031) | 3.3% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

Middle East and Africa

|

| Market leaders and key company profiles |

|

The Middle East & Africa Oil & Gas Sensors Market is valued at US$ 396.33 Million in 2023, it is projected to reach US$ 515.11 Million by 2031.

As per our report Middle East & Africa Oil & Gas Sensors Market, the market size is valued at US$ 396.33 Million in 2023, projecting it to reach US$ 515.11 Million by 2031. This translates to a CAGR of approximately 3.3% during the forecast period.

The Middle East & Africa Oil & Gas Sensors Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Oil & Gas Sensors Market report:

The Middle East & Africa Oil & Gas Sensors Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Oil & Gas Sensors Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Oil & Gas Sensors Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)