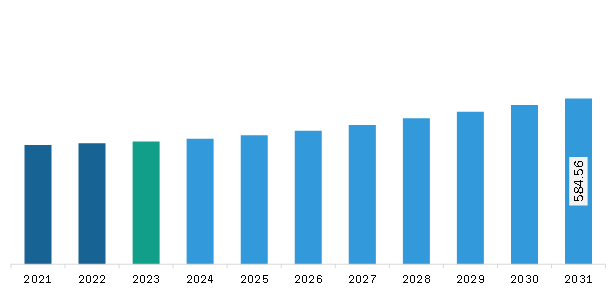

The South & Central America industrial explosives market was valued at US$ 432.79 million in 2023 and is expected to reach US$ 584.56 million by 2031; it is estimated to register a CAGR of 3.8% from 2023 to 2031.

The growing environmental awareness, stringent regulations, and the need for sustainable practices in various applications such as mining, construction, and avalanche control are fostering the research on several environment-friendly explosives. Environment-friendly explosives or green explosives are developed to minimize their environmental impact while maintaining or improving performance and safety. Water-based explosives such as water gels and emulsions are gaining traction as they tend to be safe and produce few harmful byproducts. In the construction industry, the use of environment-friendly explosives can mitigate the impact of urban blasting operations. The reduced emissions by green explosives contribute to better air quality. Green explosives are an important subfamily of explosives due to the ban of explosives on the basis of heavy metals such as lead azide and lead styphnate, according to the REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) list. The introduction of environment-friendly explosives is expected to become a significant trend in the South & Central America industrial explosives market over the coming years.

South & Central America is a leading mineral producer and presents exploration potential in the mining sector. Brazil is one of the top five largest lithium-producing countries, according to the World Mining Data 2022 report by the Federal Ministry Republic of Austria. According to a report published by the International Energy Agency in 2023, Latin America's share of global copper exploration expenditure increased from 35% to 45% during 2012–2022, which indicates potential for mining production growth. As of 2023, countries in Latin America supply 35% of the global lithium, including Chile (26%) and Argentina (6%).

In 2022, Vale SA commenced production of sustainable sand Viga mine in Congonhas (Brazil), obtained from its iron ore tailing, to reduce the disposal of materials in dams or piles. South & Central America marks the presence of various major geological departments such as SERNAGEOMIN (Chile) and the Division of Special Projects and Strategic Minerals (Brazil). Government organizations and departments build mining project strategies focusing on lithium, rare earth elements, graphite, copper, and cobalt. Thus, the developing mining industry of South & Central America fuels the demand for industrial explosives across the region.

The South & Central America industrial explosives market is categorized into type, application, and country.

Based on type, the South & Central America industrial explosives market is segmented into high explosives, blasting agents, and low explosives. the blasting agents segment held the largest market share in 2023. The high explosives system segment is further sub segmented into dynamites, gelatins, and RDX. The blasting agents system segment is further sub segmented into slurries and emulsions, ANFO, and blends.

In terms of application, the South & Central America industrial explosives market is segmented into mining, construction, and others. The mining segment held the largest market share in 2023.

By country, the South & Central America industrial explosives market is segmented into Brazil, Argentina, and the Rest of South & Central America. Brazil dominated the South & Central America industrial explosives market share in 2023.

Orica Ltd; AECI Ltd; Austin Powder Company; Dyno Nobel Ltd; Enaex SA; MaxamCorp Holding, S.L.; and EPC Groupe are some of the leading companies operating in the South & Central America industrial explosives market.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 432.79 Million |

| Market Size by 2031 | US$ 584.56 Million |

| CAGR (2023 - 2031) | 3.8% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

South and Central America

|

| Market leaders and key company profiles |

|

The South & Central America Industrial Explosives Market is valued at US$ 432.79 Million in 2023, it is projected to reach US$ 584.56 Million by 2031.

As per our report South & Central America Industrial Explosives Market, the market size is valued at US$ 432.79 Million in 2023, projecting it to reach US$ 584.56 Million by 2031. This translates to a CAGR of approximately 3.8% during the forecast period.

The South & Central America Industrial Explosives Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South & Central America Industrial Explosives Market report:

The South & Central America Industrial Explosives Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South & Central America Industrial Explosives Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South & Central America Industrial Explosives Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)