The Middle East & Africa industrial explosives market was valued at US$ 1,519.61 million in 2023 and is expected to reach US$ 2,262.04 million by 2031; it is estimated to register a CAGR of 5.1% from 2023 to 2031.

Growth of Mining Industry Bolsters Middle East & Africa Industrial Explosives Market

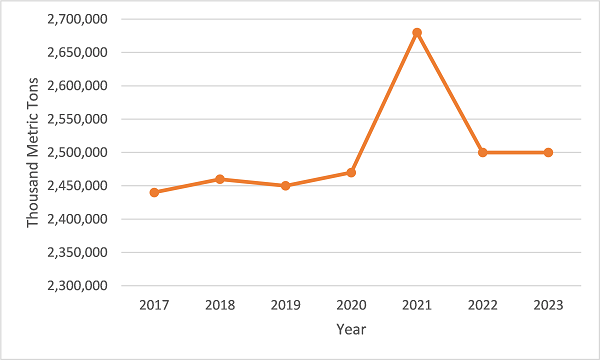

Manufacturing high-end products require a steady supply of raw materials such as metals and minerals. The higher demand for metals necessitates increased mining activity to extract and produce the required raw materials, ultimately leading to extensive use of mining explosives to access ore deposits, remove overburden, and fragment rocks. In addition, with the growing demand for metals, mining companies increasingly focus on improving safety measures and operational efficiency. This includes advancing mining explosive technologies and formulations that can optimize blasting operations. Industrial explosives with better fragmentation capabilities, reduced vibrations, and improved safety features can help increase productivity and minimize environmental impacts. As per the Ministry of Industry and Mineral Resources of Saudi Arabia, in 2022, ~2,272 valid mining licenses were registered, including 1,383 licenses for building materials quarry; 635 licenses for exploration; 178 licenses for mining and small mine exploitation; 43 licenses for reconnaissance; and 33 licenses for surplus mineral ores. As per U.S. Geological Survey, Mineral Commodity Summaries published in January 2024, the global iron ore production increased from 2.45 billion metric ton in 2019 to 2.5 billion metric ton in 2022.

Global Iron Ore Production (2017 - 2023)

Source: U.S. Geological Survey, Mineral Commodity Summaries, January 2024

Several developing countries perform significant mining activities and large-scale mining operations. These operations often require substantial quantities of explosives for various applications such as rock fragmentation, overburden removal, and access to mineral deposits. According to the Mineral Council of South Africa, mineral production in South Africa accounted for US$ 72.1 billion in 2022, up from US$ 67.2 billion in 2021. The successful exploration results and identifying economically viable rare earth metal deposits can lead to expansion operations, which fuels the need for industrial explosives. Therefore, the growth of the mining industry drives the Middle East & Africa industrial explosives market.

Middle East & Africa Industrial Explosives Market Overview

A report published by the Mineral Council of South Africa in 2022 revealed that the value of mining production in South Africa grew from US$ 57.0 billion in 2021 to US$ 61.0 billion in 2022. As per the National Industrial Information Center (Saudi Arabia), the Ministry of Industry and Mineral Resources issued 71 mining licenses, including licenses for 45 exploration projects, 21 building materials quarry, and 5 small mine projects, in July 2023. The report revealed 2,348 active mining licenses in the sector by the end of July 2023. Mining of metals and nonmetals requires several industrial explosives for various mining processes.

The Saudi government's Vision 2030 plan has placed a strong emphasis on infrastructure development, which has led to significant growth in the steel sector. As per the International Trade Administration, the construction sector's value in the UAE is expected to grow by 4.7% per annum in the next five years. According to the World Steel Association, in Saudi Arabia and the UAE, the total production of crude steel stood at 9.94 million metric tons and 3.77 million metric tons, respectively, in 2023. The production growth is attributed to the increasing construction initiatives. Thus, the rise in mining production rates for minerals & metals and construction industries in the Middle East & Africa drives the demand for industrial explosives.

Middle East & Africa Industrial Explosives Market Revenue and Forecast to 2031 (US$ Million)

Middle East & Africa Industrial Explosives Market Segmentation

The Middle East & Africa industrial explosives market is categorized into type, application, and country.

Based on type, the Middle East & Africa industrial explosives market is segmented into high explosives, blasting agents, and low explosives. the blasting agents segment held the largest market share in 2023. The high explosives system segment is further sub segmented into dynamites, gelatins, and RDX. The blasting agents system segment is further sub segmented into slurries and emulsions, ANFO, and blends.

In terms of application, the Middle East & Africa industrial explosives market is segmented into mining, construction, and others. The mining segment held the largest market share in 2023.

By country, the Middle East & Africa industrial explosives market is segmented into South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa. The Rest of Middle East & Africa dominated the Middle East & Africa industrial explosives market share in 2023.

Orica Ltd; AECI Ltd; Austin Powder Company; Dyno Nobel Ltd; Enaex SA; MaxamCorp Holding, S.L.; and EPC Groupe are some of the leading companies operating in the Middle East & Africa industrial explosives market.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 1,519.61 Million |

| Market Size by 2031 | US$ 2,262.04 Million |

| CAGR (2023 - 2031) | 5.1% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

Middle East and Africa

|

| Market leaders and key company profiles |

|

The Middle East & Africa Industrial Explosives Market is valued at US$ 1,519.61 Million in 2023, it is projected to reach US$ 2,262.04 Million by 2031.

As per our report Middle East & Africa Industrial Explosives Market, the market size is valued at US$ 1,519.61 Million in 2023, projecting it to reach US$ 2,262.04 Million by 2031. This translates to a CAGR of approximately 5.1% during the forecast period.

The Middle East & Africa Industrial Explosives Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Industrial Explosives Market report:

The Middle East & Africa Industrial Explosives Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Industrial Explosives Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Industrial Explosives Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)