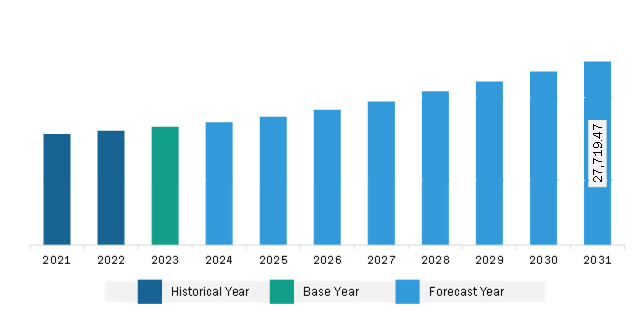

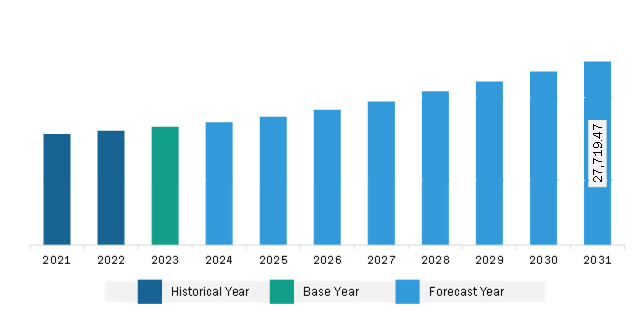

The Asia Pacific industrial explosives market was valued at US$ 17,874.11 million in 2023 and is expected to reach US$ 27,719.47 million by 2031; it is estimated to register a CAGR of 5.6% from 2023 to 2031.

Surge in Government Support for Infrastructure Development Boosts Asia Pacific Industrial Explosives Market

Industrial explosives play a major role in infrastructure development, providing an efficient and cost-effective means for large-scale excavation and demolition. Their applications span from the construction of roads, dams, tunnels, and other civil engineering projects. The utilization of industrial explosives allows for the rapid breaking of rock and other hard materials, which is essential for creating foundations and facilitating the extraction of resources. In mountainous regions, tunnels are constructed to ensure the passage of roads and railways. Blasting allows engineers to efficiently carve through rocks, resulting in the formation of stable tunnels. The development of dams and reservoirs also relies heavily on industrial explosives. Controlled blasting techniques are used for the removal of substantial amounts of rock.

The government-supported infrastructure projects generally include roads, dams, bridges, tunnels, ports, airport pavements, and highways. In May 2023, South Korea and Saudi Arabia signed two memorandums of understanding with an aim to enhance business opportunities in the transport and logistics industries, including public transport, air transport, roads, ports, railways, and logistics. The construction business in India is expected to grow significantly, attributed to the expansion of the National Infrastructure Pipeline of US$ 1.35 trillion by 2025. Thus, the surge in government support for infrastructure development fuels the Asia Pacific industrial explosives market growth.

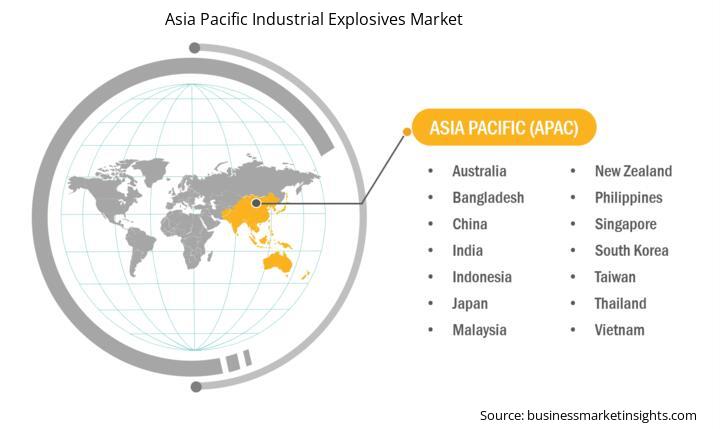

Asia Pacific Industrial Explosives Market Overview

Asia Pacific marks the presence of major mining companies such as Mitsubishi Materials Corporation, Jiangxi Copper Co Ltd, Aluminum Corporation of China Ltd, Coal India Limited, China Molybdenum Co Ltd, BHP, etc. Asia Pacific has 10 major surface mining projects—Green mine (China), Sangatta mine (Indonesia), Heidaigou mine (China), Oyu Tolgoi Copper-Gold mine (Mongolia), Gevra OC mine (India), Letpadaung Copper mine (Myanmar), Li mine (Thailand), FTB Project (Thailand), and Pasir mine (Indonesia). According to the report published by the US Geological Survey in 2022, China is the producer of 16 critical minerals out of 25 listed minerals. According to research conducted by the Norwegian Institute of International Affairs in 2022, Central Asia recorded a presence of 38.6% of global manganese ore reserves, 30.07% of chromium, 20% of lead, 12.6% of zinc, 8.7% of titanium, 5.8% of aluminum, and 5.3% of copper. China's well-established mining infrastructure and expertise in rare earth metal extraction enable efficient extraction of scandium-containing ores, ensuring a steady supply to meet domestic and global demand. China, Tajikistan, Australia, Vietnam, and other countries account for major antimony mine production and reserves worldwide. As per the International Energy Agency, Chinese companies doubled their investments in critical mineral exploration, especially in lithium projects.

In June 2024, Seksiui, an Osaka-based developer, was notified by the municipal government of Japan to cancel the project and demolish the 10-storey, 18-unit building in Kunitachi. In July 2024, Koh Samui municipality (Thailand) suspended a Chinese-owned luxury resort project on Koh Samui due to permit issues, resulting in possible demolition. According to the National Investment Promotion & Facilitation Agency, India allocated an investment budget of US$ 1.4 trillion in infrastructure under the National Infrastructure Pipeline by 2025, of which 18% accounted for roads and highways, 17% accounted for urban infrastructure, and 12% for railways. The demand for industrial explosives is directly proportional to the region's mining operations, mineral exploration, and demolition activities. Therefore, growth in mining and demolition operations bolsters the demand for industrial explosives in Asia Pacific.

Asia Pacific Industrial Explosives Market Revenue and Forecast to 2031 (US$ Million)

Asia Pacific Industrial Explosives Market Segmentation

The Asia Pacific industrial explosives market is categorized into type, application, and country.

Based on type, the Asia Pacific industrial explosives market is segmented into high explosives, blasting agents, and low explosives. the blasting agents segment held the largest market share in 2023. The high explosives system segment is further sub segmented into dynamites, gelatins, and RDX. The blasting agents system segment is further sub segmented into slurries and emulsions, ANFO, and blends.

In terms of application, the Asia Pacific industrial explosives market is segmented into mining, construction, and others. The mining segment held the largest market share in 2023.

By country, the Asia Pacific industrial explosives market is segmented into Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific. China dominated the Asia Pacific industrial explosives market share in 2023.

Orica Ltd; AECI Ltd; Austin Powder Company; Dyno Nobel Ltd; Enaex SA; MaxamCorp Holding, S.L.; Solar Industries India Ltd; EPC Groupe; Keltech Energies Ltd; and Hanwha Corp are some of the leading companies operating in the Asia Pacific industrial explosives market.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 17,874.11 Million |

| Market Size by 2031 | US$ 27,719.47 Million |

| CAGR (2023 - 2031) | 5.6% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

Asia Pacific

|

| Market leaders and key company profiles |

|

The Asia Pacific Industrial Explosives Market is valued at US$ 17,874.11 Million in 2023, it is projected to reach US$ 27,719.47 Million by 2031.

As per our report Asia Pacific Industrial Explosives Market, the market size is valued at US$ 17,874.11 Million in 2023, projecting it to reach US$ 27,719.47 Million by 2031. This translates to a CAGR of approximately 5.6% during the forecast period.

The Asia Pacific Industrial Explosives Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Industrial Explosives Market report:

The Asia Pacific Industrial Explosives Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Industrial Explosives Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Industrial Explosives Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)