Surging Number of Surgical Procedures Drives Growth of Surgical Robots Market in South America

There is a rise in the number of surgeries performed across the South America. In the last 25 years, the incidence of cardiovascular diseases has increased South America. The rise in diabetic cases and lifestyle changes are leading to an increase the number of cardiovascular surgeries and general surgeries. For instance, colorectal cancer is one of the most commonly found and lethal cancers developed in individuals due to the combined influence of genetic and environmental factors. It is the third most common type of cancer in men and the second most common cancer in women. The lifetime risk of developing colorectal cancer is about 1 in 23 for men and 1 in 25 for women. Further, ~95,55,027 cancer deaths were recorded in 2018, of which 8,80,792 were related to colorectal cancer. Therefore, colorectal cancer was identified as the third most common cancer and the second highest death-causing cancer. Therefore, the increasing number of colorectal cancer incidences has resulted in the surging demand for surgical Robots. The growing number of surgical procedures creates a need for Robotic surgery instruments. For instance, according to the 2021 National Health Statistics Reports from the Centers for Disease Control, the incidence of obesity has reached 41.9% among adults and 19.7% among children and adolescents aged 2-19 years old. Therefore, the relationship between obesity and the development of various well-known comorbidities, including cardiovascular diseases, diabetes, liver disease, chronic kidney disease, osteoarthritis, and cancer, makes obesity one of the top preventable causes of mortality. Moreover, intense lifestyle modification and pharmacotherapy usually fail to achieve long-term sustained weight loss and remission of obesity-related comorbidities (10% weight loss at one year and 5.3% at 8 years). However, CDC states that bariatric surgery has been demonstrated to be effective at achieving long-term weight–loss up to 77% of excess weight loss (~77% of excess weight at one year and over ~50% at 10-20 years), remission of obesity-related comorbidities, and reducing the incidence of major cardiovascular conditions. Thus, Surgical Robots have been designed to exceed the limitations of conventional laparoscopy. The laparoscopic procedure involves a two-dimensional view displayed on a monitor, whereas Robotic surgery offers a close three-dimensional vision portrayed in the commodity of a console, which gives the surgeon a feeling of operating from inside the cavity. For instance, Robotic systems such as Da Vinci Xi, manufactured by Intuitive Surgical, provide an active camera, multi-quadrant access, improved precision of motion, filtered tremor, and instruments with endo wrist movements and seven degrees of freedom, powerfully enhancing the dexterity of the surgeon. Therefore, the utilization of Robotic platforms for primary and bariatric surgery is expected to rise over the forecast period. Moreover, the rise in the prevalence of chronic conditions and the rising number of surgical procedures generate the demand for surgical Robots. The number of road accidents is increasing in several countries. The surging number of road accidents eventually leads to the rise in the number of orthopedic procedures and treatments, which, in turn, is fueling the growth of the Surgical Robots market.

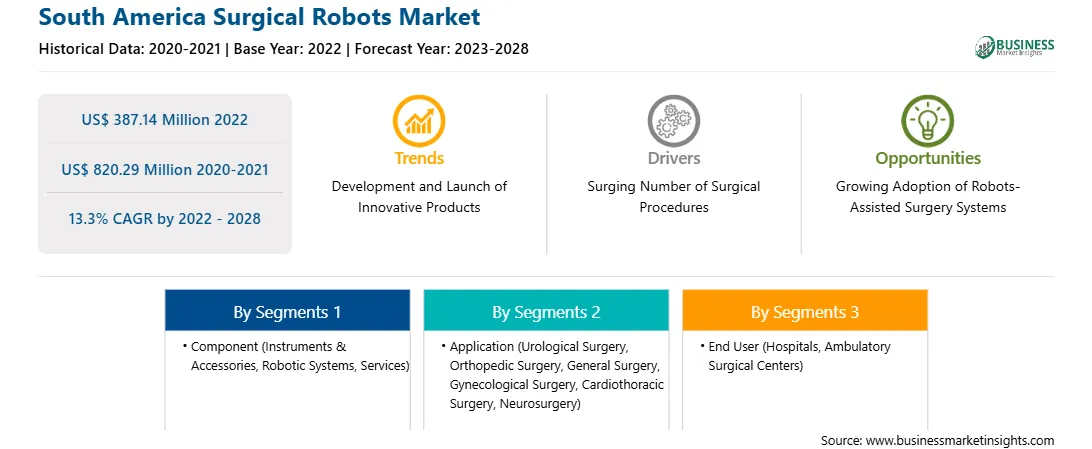

Market Overview

The surgical robots market in South America is segmented into Brazil, Argentina, and the rest of South America. The number of robotic procedures varies a lot in the region, highlighting Brazil with more than 21,000 surgeries since the acquisition of the first robots. The number of surgeries performed on average by using robots is between 525 and 625 procedures per system in Brazil, Chile, and Argentina. This market in the region is expected to grow in the coming years due to the rising prevalence of chronic disorders such as cancer, diabetes, and cardiovascular diseases in South America countries. The market in Brazil is expected to grow during the forecast period due to the increasing adoption of technologically-advanced minimally invasive surgeries and the rising trend of reconstructive plastic surgeries and aesthetic procedures.

Strategic insights for the South America Surgical Robots provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the South America Surgical Robots refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.South America Surgical Robots Strategic Insights

South America Surgical Robots Report Scope

Report Attribute

Details

Market size in 2022

US$ 387.14 Million

Market Size by 2028

US$ 820.29 Million

CAGR (2022 - 2028) 13.3%

Historical Data

2020-2021

Forecast period

2023-2028

Segments Covered

By Component

By Application

By End User

Regions and Countries Covered

South and Central America

Market leaders and key company profiles

South America Surgical Robots Regional Insights

South America Surgical Robots Market Segmentation

The South America surgical robots market is segmented on the basis of component, application, end user, and country. Based on component, the South America surgical robots market is segmented into instruments & accessories, robotic systems, and services. The instruments & accessories segment held the largest market share in 2022.

Based on application, the South America surgical robots market is segmented into urological surgery, orthopedic surgery, general surgery, gynecological surgery, cardiothoracic surgery, neurosurgery, and others. The urological surgery segment held the largest market share in 2022. Based on end user, the South America surgical robots market is categorized into hospitals, ambulatory surgical centers, and others. The hospitals segment held the largest market share in 2022. Based on country, the South America surgical robots market is segmented into the Brazil, Argentina, and Rest of South America. Brazil dominated the market share in 2022. Intuitive Surgical; Smith+Nephew; Johnson & Johnson Services, Inc.; Stryker; Zimmer Biomet; Medtronic; Siemens Healthineers AG; Asensus Surgical, Inc.; and Renishaw plc are among the leading companies operating in the South America surgical robots market.

The South America Surgical Robots Market is valued at US$ 387.14 Million in 2022, it is projected to reach US$ 820.29 Million by 2028.

As per our report South America Surgical Robots Market, the market size is valued at US$ 387.14 Million in 2022, projecting it to reach US$ 820.29 Million by 2028. This translates to a CAGR of approximately 13.3% during the forecast period.

The South America Surgical Robots Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South America Surgical Robots Market report:

The South America Surgical Robots Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South America Surgical Robots Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South America Surgical Robots Market value chain can benefit from the information contained in a comprehensive market report.