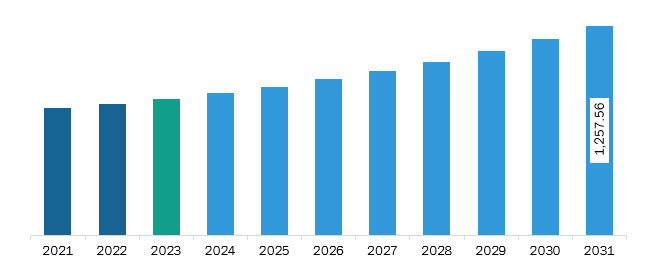

The North America electronic thermal management materials market was valued at US$ 795.66 million in 2023 and is expected to reach US$ 1,257.56 million by 2031; it is estimated to register a CAGR of 5.9% from 2023 to 2031.

The rapid expansion of the electronics and semiconductor industry has been a key driver of demand for electronic thermal management materials. As electronic devices become more powerful and compact, they generate higher heat levels, necessitating advanced thermal management solutions to maintain operational efficiency and extend device lifespan. These materials are essential for managing heat in components such as processors, memory modules, and power electronics in devices such as smartphones, laptops, and automotive electronics. In the semiconductor sector, where miniaturization and performance enhancement are crucial, effective heat dissipation has become vital to prevent overheating and ensure stable operation, fueling the demand for innovative thermal management materials. According to Invest India, the global electronics manufacturing services market is anticipated to reach US$ 1,145 billion by 2026, at a CAGR of 5.4% during 2021–2026. In addition, the Internet of Things (IoT) has gained considerable popularity worldwide recently, with businesses acknowledging the significance of connectivity. IoT has enabled every device to be connected to the Internet. According to the International Data Corporation (IDC), 41.6 billion IoT devices will be capable of generating 79.4 zettabytes (ZB) of data in 2025. The increasing penetration of connected devices such as smartphones and other consumer electronics due to the rising popularity of IoT is resulting in an exponential increase in data traffic over the Internet. Electronic thermal management materials, such as thermal interface materials (TIMs), phase change materials, thermal pads, and conductive adhesives, have become indispensable in addressing the heat dissipation needs of modern devices. TIMs, for instance, improve heat transfer from electronic components to heat sinks, allowing devices to operate at optimal temperatures. As processors become more powerful, TIMs with enhanced thermal conductivity are crucial to transfer heat, minimizing temperature buildup efficiently.

The semiconductor industry, a primary driver of electronic device advancements, is also heavily reliant on thermal management materials. With continuous scaling down of transistor sizes, power densities within chips increase, making efficient heat dissipation more challenging. In high-density semiconductor applications such as data centers, the demand for thermal management materials is particularly high, as these facilities run thousands of servers, generating massive amounts of heat. Effective thermal management is crucial to keep these systems running and to reduce energy costs associated with cooling, thus making thermal management materials a vital component in achieving energy efficiency. As per the Semiconductor Industry Association, global semiconductor sales increased from US$ 45.6 billion in November 2022 to US$ 48.0 billion in November 2023. Thus, the rapid growth of the electronics and semiconductor industry is accelerating the demand for electronic thermal management materials. As these industries continue advancing toward more powerful, compact, and energy-intensive applications, innovative thermal management materials are crucial for ensuring performance, safety, and energy efficiency.

The North America electronic thermal management materials market is anticipated to witness lucrative opportunities during the forecast period, owing to the growth of various industries, including electronics, telecommunication, aerospace, and automotive. With the expansion of high-performance computing, data centers, electric vehicles (EVs), 5G infrastructure, and consumer electronics industries, thermal management has become a critical factor in ensuring device longevity and reliability. The proliferation of 5G networks and the demand for high-speed internet connectivity in North America are further boosting the need for thermal management materials. The expansion of 5G infrastructure has introduced new electronic components, including antennas, base stations, and network equipment, that require efficient cooling to maintain connectivity and performance. According to the GSM Association, by 2030, 5G will account for 90% of connections in the region and contribute US$ 210 billion to the North American economy. As 5G becomes a foundational technology for smart cities and connected devices, maintaining optimal thermal conditions in equipment is critical to prevent signal disruption and manage increased data transmission.

The North America electronic thermal management materials market is categorized into product type, end-use industry, and country.

By product type, the North America electronic thermal management materials market is segmented into conductive adhesives, thermal management films, gap fillers, thermal gels, phase change materials, thermal greases, and others. The thermal greases segment held the largest share of the North America electronic thermal management materials market share in 2023.

In terms of end-use industry, the North America electronic thermal management materials market is segmented into consumer electronics, automotive, aerospace, telecommunication, and others. The automotive segment held the largest share of the North America electronic thermal management materials market share in 2023.

Based on country, the North America electronic thermal management materials market is segmented into the US, Canada, and Mexico. The US held the largest share of the North America electronic thermal management materials market in 2023.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 795.66 Million |

| Market Size by 2031 | US$ 1,257.56 Million |

| CAGR (2023 - 2031) | 5.9% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

3M Co, DuPont de Nemours Inc, Electrolube Ltd, European Thermodynamics Ltd, Graco Inc, Henkel AG & Co KGaA, Honeywell International Inc, Marian Inc, Master Bond Inc, Momentive Performance Materials Inc, Parker Hannifin Corp, Robnor ResinLab Ltd, Sur-Seal Corp, Tecman Speciality Materials Ltd, and Wacker Chemie AG are some of the leading companies operating in the electronic thermal management materials market.

The North America Electronic Thermal Management Materials Market is valued at US$ 795.66 Million in 2023, it is projected to reach US$ 1,257.56 Million by 2031.

As per our report North America Electronic Thermal Management Materials Market, the market size is valued at US$ 795.66 Million in 2023, projecting it to reach US$ 1,257.56 Million by 2031. This translates to a CAGR of approximately 5.9% during the forecast period.

The North America Electronic Thermal Management Materials Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Electronic Thermal Management Materials Market report:

The North America Electronic Thermal Management Materials Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Electronic Thermal Management Materials Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Electronic Thermal Management Materials Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)