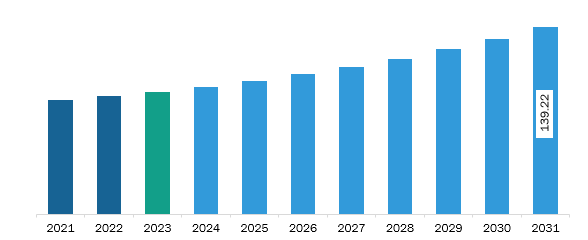

The Middle East & Africa electronic thermal management materials market was valued at US$ 100.28 million in 2023 and is expected to reach US$ 139.22 million by 2031; it is estimated to register a CAGR of 4.2% from 2023 to 2031.

The rollout of 5G technology is expected to bring significant trends in the electronic thermal management materials market. 5G-enabled devices, including smartphones, base stations, and network infrastructure, handle larger data volumes and higher processing speeds, leading to substantially more heat generation than previous generations. To maintain optimal performance and prevent overheating, advanced thermal management materials are essential in dissipating heat effectively. This focus on 5G is spurring the demand for high-performance TIMs, heat spreaders, and phase-change materials that can manage elevated thermal loads. The telecommunication industry is evolving rapidly, particularly with the deployment of 5G technology. According to the GSM Association, 5G networks are likely to cover one-third (1.2 billion) of the world's population by 2025. In addition, there is a widespread rollout of 5G networks across the globe, which has led to an increased demand for smartphones and other consumer electronics. In addition, according to Viavi Solutions Inc.'s report, in April 2023, over 92 countries across the world had active 5G networks. Further, 23 countries have pre-commercial 5G network trials underway, and 32 nations have announced their 5G rollout plans. The widespread rollout of 5G networks has led to an increased demand for smartphones and other consumer electronics products. This revolution is driving the development of high-frequency, high-performance devices and systems. 5G base stations, for instance, generate much more heat due to the increased power and data processing required for faster connectivity and low latency. They often operate continuously, particularly in urban areas, requiring robust thermal solutions to ensure uninterrupted performance and avoid component failure. High-performance materials such as synthetic graphite and advanced TIMs are in demand to meet these requirements, as they provide both high thermal conductivity and reliability in extreme conditions. With the global expansion of 5G networks, especially in regions such as North America, Asia Pacific, and Europe, a need for efficient thermal management solutions is expected to grow rapidly. Moreover, 5G smartphones and devices, which integrate complex antennas and high-frequency processors, require compact yet efficient thermal solutions. To address these needs, innovations in thermal materials, such as flexible graphite sheets and nanocomposites, are emerging. These materials can dissipate heat without adding bulk, enabling manufacturers to maintain sleek device designs while ensuring heat management. With the rising adoption of 5G, the electronic thermal management materials market is likely to benefit from increased demand for innovative, efficient solutions that support next-generation telecommunications technology's performance and reliability requirements.

The Middle East and Africa market is evolving due to the increasing passenger vehicle production. The demand for vehicles made in the region is growing consistently. Moreover, rising middle-class income and growing population are driving the market. The growing automotive sales in South Africa and Saudi Arabia create a significant demand for electronic thermal management materials. In September 2022, Renault Group Morocco announced that its two factories in Tangier and Casablanca, Morocco, produced 350,000 vehicles in 2022, a 15.3% increase over the production numbers in 2021. Moreover, the region is increasingly recognizing the importance of electric vehicles (EVs) in reducing greenhouse gas emissions, enhancing energy security, and promoting sustainable transportation solutions. As a result, there has been a surge in investment in EV infrastructure and manufacturing across the region, driving significant demand for electronic thermal management materials. In 2023, Saudi Arabia's Public Investment Fund (PIF) partnered with the Saudi Electricity Company (SEC) to develop an electric vehicle infrastructure company. The company aims to establish its presence in more than 1,000 locations and install 5,000 chargers across the country by 2030. Countries in the Middle East and Africa, especially in the Gulf Cooperation Council (GCC), are investing heavily in diversifying their economies, with automotive manufacturing identified as a promising industry for economic growth. As automotive production expands, particularly with an emphasis on advanced and electric vehicles, the demand for electronic components and, consequently, electronic thermal management materials is rising. These materials are critical for maintaining optimal performance and safety in modern vehicles, where electronics play a central role in everything, from engine management to in-car entertainment and safety systems.

The Middle East & Africa electronic thermal management materials market is categorized into product type, end-use industry, and country.

By product type, the Middle East & Africa electronic thermal management materials market is segmented into conductive adhesives, thermal management films, gap fillers, thermal gels, phase change materials, thermal greases, and others. The thermal greases segment held the largest share of the Middle East & Africa electronic thermal management materials market share in 2023.

In terms of end-use industry, the Middle East & Africa electronic thermal management materials market is segmented into consumer electronics, automotive, aerospace, telecommunication, and others. The automotive segment held the largest share of the Middle East & Africa electronic thermal management materials market share in 2023.

Based on country, the Middle East & Africa electronic thermal management materials market is segmented into South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa. Saudi Arabia segment held the largest share of the Middle East & Africa electronic thermal management materials market in 2023.

3M Co, DuPont de Nemours Inc, Electrolube Ltd, European Thermodynamics Ltd, Graco Inc, Henkel AG & Co KGaA, Honeywell International Inc, Marian Inc, Master Bond Inc, Momentive Performance Materials Inc, Parker Hannifin Corp, Robnor ResinLab Ltd, Sur-Seal Corp, Tecman Speciality Materials Ltd, and Wacker Chemie AG are some of the leading companies operating in the electronic thermal management materials market.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 100.28 Million |

| Market Size by 2031 | US$ 139.22 Million |

| CAGR (2023 - 2031) | 4.2% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered |

Middle East and Africa

|

| Market leaders and key company profiles |

|

The Middle East & Africa Electronic Thermal Management Materials Market is valued at US$ 100.28 Million in 2023, it is projected to reach US$ 139.22 Million by 2031.

As per our report Middle East & Africa Electronic Thermal Management Materials Market, the market size is valued at US$ 100.28 Million in 2023, projecting it to reach US$ 139.22 Million by 2031. This translates to a CAGR of approximately 4.2% during the forecast period.

The Middle East & Africa Electronic Thermal Management Materials Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Electronic Thermal Management Materials Market report:

The Middle East & Africa Electronic Thermal Management Materials Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Electronic Thermal Management Materials Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Electronic Thermal Management Materials Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)