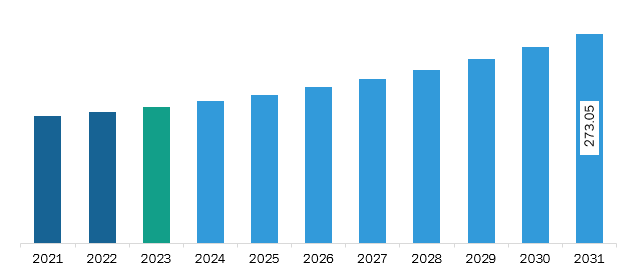

The South & Central America electronic thermal management materials market was valued at US$ 184.84 million in 2023 and is expected to reach US$ 273.05 million by 2031; it is estimated to register a CAGR of 5.0% from 2023 to 2031.

Advancements in electronic thermal management materials are poised to create significant growth opportunities by addressing the increasing thermal challenges in modern electronics. As devices become more powerful and compact, new materials with enhanced thermal conductivity, flexibility, and durability are essential to manage the higher heat loads effectively. For instance, innovations in graphene and carbon-based materials offer ultra-high thermal conductivity and lightweight solutions, making them ideal for applications in high-performance electronics and EVs. These advancements enable manufacturers to design more efficient and compact thermal solutions, allowing for better device performance and longevity. Developments in phase-change materials and nanotechnology are also contributing to growth in this market.

Strategic collaborations and new product launches in the market are driving product innovations and unlocking growth opportunities. For instance, in September 2024, Asahi Kasei announced the presentation of its range of material solutions at FAKUMA 2024, including polymer solutions for thermal management applications in EVs, a thermoplastic elastomer, and a cellulose nanofiber composite. In addition, in October 2024, Dow and Carbic, a pioneer in carbon nanotube (CNT) technology, announced a strategic, first-of-its-kind partnership to provide a multi-generational thermal interface material (TIM) product offering for high-performing electronics in the mobility, industrial, consumer, and semiconductor industries. Through these collaborations, manufacturers accelerate the research and development process and enhance their market reach by entering new application areas or integrating with innovative electronic systems.

Phase change materials, which absorb and release heat during phase transitions, are enhanced for faster thermal response and greater stability, making them more effective for peak heat management in applications such as data centers and EV batteries. Nanotechnology advancements are further improving the performance of TIMs, enabling thinner layers with superior heat dissipation. These innovations open up opportunities across sectors, including consumer electronics, automotive, and telecommunications, where thermal management is increasingly critical. Together, these advancements in material performance, efficiency, and sustainability will drive the demand, opening up new avenues for market expansion as industries increasingly seek effective, advanced thermal management solutions to support next-generation technologies.

South and Central America have experienced significant industrial growth in sectors such as automotive, aerospace, and electronics. Brazil is one of the strongest markets for aircraft manufacturing across the globe. Brazil-based Embraer is the fourth largest aircraft manufacturer in the world, after Airbus, Boeing, and Bombardier Aerospace. The rising number of air passengers in the region supports the aircraft manufacturing industry. Regional manufacturers are investing in strategic initiatives such as product development, mergers, and acquisitions to gain a competitive position in the market. For instance, in September 2022, South American rotorcraft operator Ecocopter collaborated with Airbus on possible plans to launch urban air mobility (UAM) services with eVTOL aircraft in markets such as Chile, Ecuador, and Peru. In April 2024, Embraer and ENAER (National Aeronautical Company of Chile) announced two industrial and services cooperation agreements involving the A-29 Super Tucano and the C-390 Millennium defense aircraft and commercial aircraft. The cooperation will expand Embraer's network of suppliers and services in Chile and contribute to integrating the aerospace industries in Brazil and Chile.

The South & Central America electronic thermal management materials market is categorized into product type, end-use industry, and country.

By product type, the South & Central America electronic thermal management materials market is segmented into conductive adhesives, thermal management films, gap fillers, thermal gels, phase change materials, thermal greases, and others. The thermal greases segment held the largest share of the South & Central America electronic thermal management materials market share in 2023.

In terms of end-use industry, the South & Central America electronic thermal management materials market is segmented into consumer electronics, automotive, aerospace, telecommunication, and others. The automotive segment held the largest share of the South & Central America electronic thermal management materials market share in 2023.

Based on country, the South & Central America electronic thermal management materials market is segmented into Brazil, Argentina, and the Rest of South & Central America. Brazil held the largest share of the South & Central America electronic thermal management materials market in 2023.

3M Co, DuPont de Nemours Inc, Electrolube Ltd, European Thermodynamics Ltd, Graco Inc, Henkel AG & Co KGaA, Honeywell International Inc, Marian Inc, Master Bond Inc, Momentive Performance Materials Inc, Parker Hannifin Corp, Robnor ResinLab Ltd, Sur-Seal Corp, Tecman Speciality Materials Ltd, and Wacker Chemie AG are some of the leading companies operating in the electronic thermal management materials market.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 184.84 Million |

| Market Size by 2031 | US$ 273.05 Million |

| CAGR (2023 - 2031) | 5.0% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered |

South and Central America

|

| Market leaders and key company profiles |

|

The South & Central America Electronic Thermal Management Materials Market is valued at US$ 184.84 Million in 2023, it is projected to reach US$ 273.05 Million by 2031.

As per our report South & Central America Electronic Thermal Management Materials Market, the market size is valued at US$ 184.84 Million in 2023, projecting it to reach US$ 273.05 Million by 2031. This translates to a CAGR of approximately 5.0% during the forecast period.

The South & Central America Electronic Thermal Management Materials Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South & Central America Electronic Thermal Management Materials Market report:

The South & Central America Electronic Thermal Management Materials Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South & Central America Electronic Thermal Management Materials Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South & Central America Electronic Thermal Management Materials Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)