North America Data Center Cooling Market Report (2021–2031) by Scope, Segmentation, Dynamics, and Competitive Analysis.

No. of Pages: 229 | Report Code: TIPRE00007020 | Category: Electronics and Semiconductor

No. of Pages: 229 | Report Code: TIPRE00007020 | Category: Electronics and Semiconductor

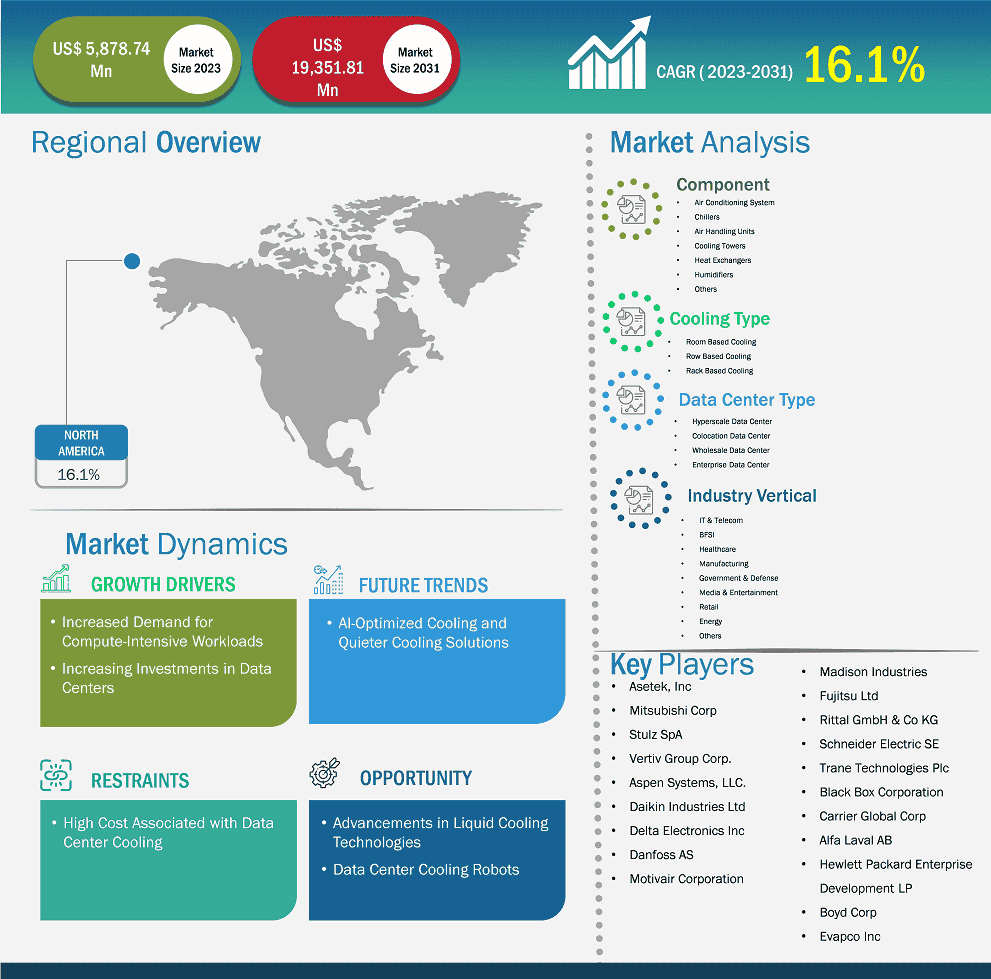

The North America data center cooling market size is expected to reach US$ 19,351.81 million by 2031 from US$ 5,878.74 million in 2023. The market is estimated to record a CAGR of 16.1% from 2023 to 2031.

In North America, the data center cooling market has seen substantial developments and innovations, driven by the rising adoption of cost-effective, energy-efficient, and environment-friendly cooling solutions in line with various stringent conservational safety rules offered by governmental bodies. Moreover, companies are launching products to contribute to the growth of the North America data center cooling market. For instance, in November 2023, Vertiv, a global provider of critical digital infrastructure and continuity solutions, introduced the Vertiv SmartMod Max CW, a prefabricated modular data center built to address the increasing demand for rapid deployment of computing in North America. This configurable and scalable solution supports up to 200kW of total IT load in a single system and utilizes chilled water cooling for low environmental impact and high energy efficiency in data center operations. The introduction of this solution aligns with the increasing need for efficient and rapid deployment of computing resources in the region. This development reflects the significant growth and innovation in the data center cooling market in North America, driven by the rising demand for energy-efficient and environmentally friendly cooling solutions.

In April 2024, Vertiv unveiled end-to-end AI power and cooling solutions to simplify data center infrastructure selection and deployment in North America. As Artificial Intelligence (AI) and High-Performance Compute (HPC) continue to disrupt the data center landscape, the company announced a new portfolio of high-density data center infrastructure solutions to support the higher cooling and power requirements of the accelerated computing IT stack. The new Vertiv 360AI solutions are designed to accelerate AI adoption through pre-engineered infrastructure solutions, digitized management, and end-to-end service, resulting in up to 2x faster deployment compared to typical infrastructure installation. The availability of data center cooling solutions in North America emphasizes the region's importance in driving advancements in data center infrastructure and cooling technologies.

North America Data Center Cooling Market Strategic Insights

North America Data Center Cooling Market Segmentation Analysis

Key segments that contributed to the derivation of the North America data center cooling market analysis are component, cooling type, data center type, and industry vertical.

Pressure to decarbonize data centers, climate change, unpredictable weather events, and the use of powerful computers are a few factors encouraging organizations to invest in cooling and energy-efficient technologies for data centers. The escalating demand for data center cooling solutions is fueled by the need for effective cooling technologies to maintain optimal operating conditions as these centers expand to accommodate increasing workloads and storage demands. The demand for data centers is increasing, prompting investments in companies that operate them. A few of such investments are listed below:

All these investments in data centers worldwide reflect the increasing demand for data center campuses, which drives the need for advanced data center cooling solutions to maintain optimal operating conditions. Thus, rising investments in data centers fuel the data center cooling market growth.

Based on country, the North America data center cooling market comprises the US, Canada, and Mexico. The US held the largest share in 2023.

Data centers in the US rely on a variety of cooling solutions to manage the substantial heat generated by the operation of millions of servers. The industry has traditionally used air cooling methods, but there is a growing emphasis on more efficient and sustainable cooling technologies such as brazed plate heat exchangers, precision cooling units, direct air cooling, and liquid cooling technologies. Companies such as Alfa Laval, Schneider Electric, Munters, USystems, and STULZ are at the forefront of providing advanced cooling solutions for data centers. As the demand for effective data center cooling solutions continues to rise, the industry is exploring innovative technologies such as smart cooling systems using AI and machine learning (ML), geothermal cooling methods, and evaporative cooling to enhance sustainability and energy efficiency. For instance, GIGABYTE Technology, Giga Computing, a subsidiary of GIGABYTE, an industry leader in AI and HPC servers and an integrator for direct liquid cooling (DLC) and Immersion cooling technology, announced a range of advanced cooling products, some of which was showcased at the SC23 event.

North America Data Center Cooling Market Report Highlights

Report Attribute

Details

Market size in 2023

US$ 5,878.74 Million

Market Size by 2031

US$ 19,351.81 Million

CAGR (2023 - 2031) 16.1%

Historical Data

2021-2022

Forecast period

2024-2031

Segments Covered

By Component

By Cooling Type

By Data Center Type

By Industry Vertical

By Component

Regions and Countries Covered

North America

Market leaders and key company profiles

North America Data Center Cooling Market Company Profiles

Some of the key players operating in the market Asetek, Inc; Mitsubishi Corp; Stulz SpA; Vertiv Group Corp.; Aspen Systems, LLC.; Daikin Industries Ltd; Delta Electronics Inc; Danfoss AS; Motivair Corporation; Madison Industries; Fujitsu Ltd; Rittal GmbH & Co KG; Schneider Electric SE; Trane Technologies Plc; Black Box Corporation; Carrier Global Corp; Alfa Laval AB; Hewlett Packard Enterprise Development LP; Boyd Corp; and Evapco Inc among others. These players are adopting various strategies such as expansion, product innovation, and mergers and acquisitions to provide innovative products to their consumers and increase their market share.

The following methodology has been followed for the collection and analysis of data presented in this report:

The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

Note: All financial data included in the Company Profiles section has been standardized to USD. For companies reporting in other currencies, figures have been converted to USD using the relevant exchange rates for the corresponding year.

The Insight Partners conducts a significant number of primary interviews each year with industry stakeholders and experts to validate its data analysis and gain valuable insights. These research interviews are designed to:

Primary research is conducted via email interactions and telephone interviews, encompassing various markets, categories, segments, and sub-segments across different regions. Participants typically include:

The North America Data Center Cooling Market is valued at US$ 5,878.74 Million in 2023, it is projected to reach US$ 19,351.81 Million by 2031.

As per our report North America Data Center Cooling Market, the market size is valued at US$ 5,878.74 Million in 2023, projecting it to reach US$ 19,351.81 Million by 2031. This translates to a CAGR of approximately 16.1% during the forecast period.

The North America Data Center Cooling Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Data Center Cooling Market report:

The North America Data Center Cooling Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Data Center Cooling Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Data Center Cooling Market value chain can benefit from the information contained in a comprehensive market report.