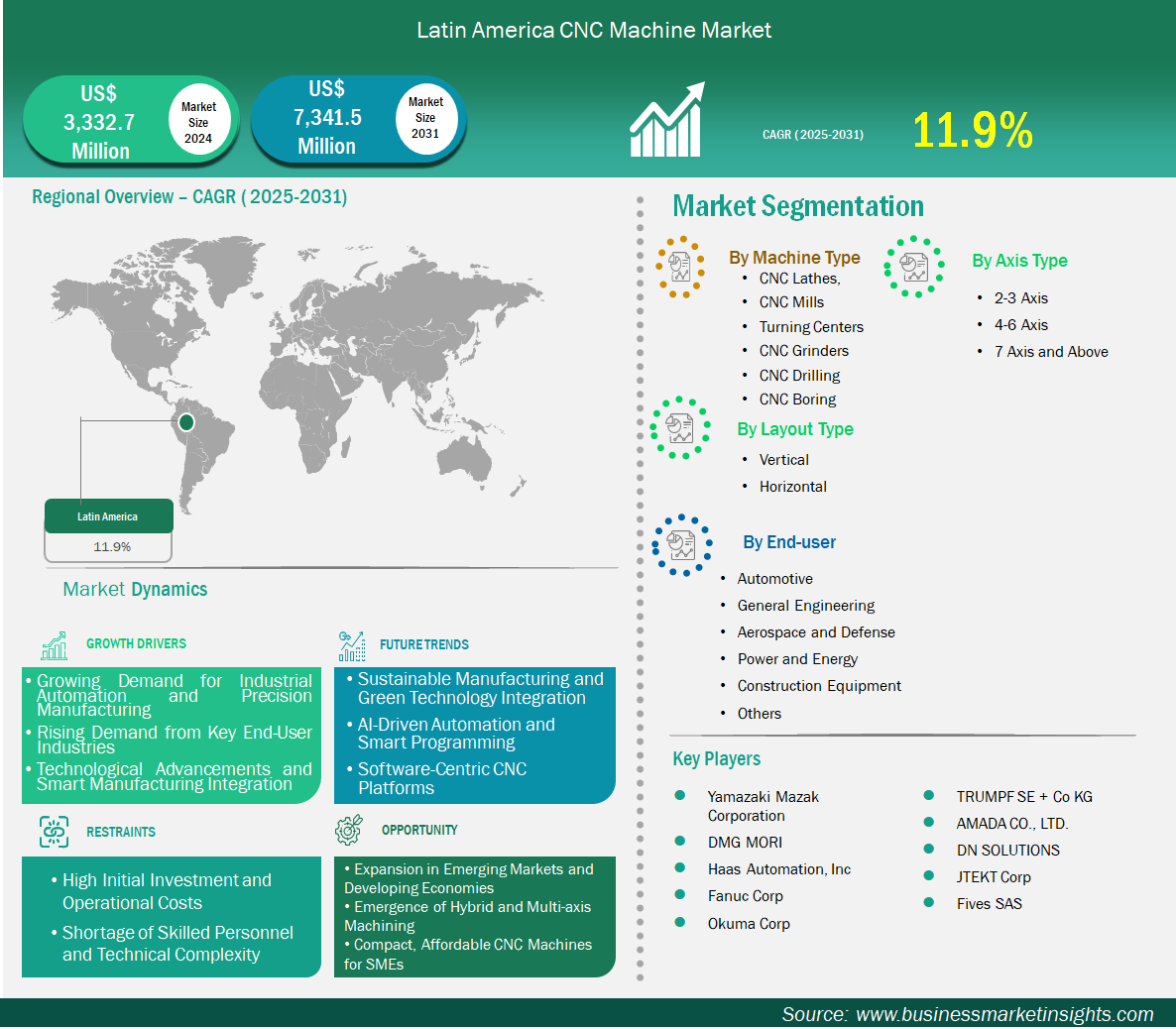

The Latin America CNC machine market size is expected to reach US$ 7,341.5 million by 2031 from US$ 3,332.7 million in 2024. The market is estimated to record a CAGR of 11.9% from 2025 to 2031.

The Latin America CNC machine market demonstrates a high degree of technological sophistication, driven by convergence of industrial, economic, and technological advancement. Covering the Brazil, Mexico, Argentina, Peru, Chile, Colombia, each country contributes distinct competitive advantages, collectively propelling technological progress and elevating manufacturing excellence across the region.

The Latin America CNC machine market driven by the region's growing manufacturing sector, particularly in automotive, aerospace, and metalworking industries, which demand high-precision machining and greater automation to meet international quality standards and remain competitive. Countries like Mexico and Brazil, which are key players in global supply chains, are witnessing increased investments in modern production technologies, including CNC systems, to enhance productivity and reduce reliance on manual labor. Additionally, government initiatives aimed at promoting industrial modernization and foreign direct investment (FDI) are catalyzing the shift toward advanced manufacturing technologies. Trade agreements such as the United States-Mexico-Canada Agreement (USMCA) also incentivize local manufacturers to upgrade their facilities to meet export requirements.

Technological advancements and the decreasing cost of CNC machines have made them more accessible to small and medium-sized enterprises (SMEs), which make up a large portion of Latin America's manufacturing base. Furthermore, the integration of CNC systems with Industry 4.0 technologies—such as IoT, AI, and cloud computing—is enhancing machine efficiency and enabling predictive maintenance, making the investment more appealing. The rising demand for customized and complex components, especially in industries like medical devices and electronics, is further propelling the adoption of CNC machining.

Additionally, the availability of technical training programs and skilled labor is improving, particularly through partnerships between governments, technical institutions, and private industry, which is crucial for supporting CNC operations. Despite challenges such as inconsistent infrastructure and economic volatility, the overall trend indicates a positive trajectory, with increasing awareness of CNC benefits—precision, repeatability, and cost-efficiency—acting as strong motivators for adoption across Latin America.

Key segments that contributed to the derivation of the CNC machine market analysis are machine type, layout type, end-user, and axis type.

The Latin America CNC machine market is among the most developed globally, with the Brazil leading in both production and consumption. The region benefits from a compelling mix of technological, economic, and policy-related factors. The expansion of the manufacturing sector—particularly in automotive, aerospace, energy, and medical devices—has heightened demand for precision and efficiency, making CNC systems essential.

Technological advancements, including the integration of AI, IoT, robotics, and other Industry 4.0 solutions, are transforming production by enabling real-time data analytics, predictive maintenance, and automation, all boosting CNC uptake. Government programs like “New Industry Brazil” aim to digitize up to 90% of industrial firms and promote neo‑industrialization, further supporting infrastructure upgrades and CNC adoption. Meanwhile, regulatory frameworks that emphasize sustainability and quality standards incentivize firms to invest in modern, eco-friendly CNC technologies. Hence, Brazil’s trajectory suggests that continued government support, workforce training initiatives, and cost‑effective solutions will play key roles in driving broader CNC adoption and enhancing global competitiveness.

Based on country, the Latin America CNC machine market is primarily segmented into the Brazil, Mexico, Argentina, Peru, Chile, and Colombia. Among these, the Brazil dominates the market due to expansion of the manufacturing sector, integration of AI, IoT, robotics, and other Industry 4.0 solutions, and businesses demand for real-time data analytics, predictive maintenance, and automation.

Mexico benefits from a robust industrial base—especially in manufacturing, energy, aerospace, and automotive—supported by strong trade ties (USMCA) and geographical proximity to the U.S. The country’s industrial output increased significantly (e.g., manufacturing valued at US$360.7 billion in 2023), while foreign direct investment, particularly into high‑tech manufacturing, has surged, driving demand for CNC machines. Additionally, digital transformation initiatives and the growing adoption of IoT and automation are catalyzing modern CNC adoption. Mexico’s skilled engineering workforce and longstanding electronics sector further create favorable conditions for CNC integration.

Argentina maintains a sophisticated manufacturing base, with machinery, vehicles, and equipment representing a sizeable share of its industrial output (19% of GDP in 2023). The country’s strong agricultural-equipment sector, supported by clusters of SMEs and multinationals, underscores its CNC-readiness. Industrial parks and electronics assembly industries create further demand for precision machining. Government initiatives like the “mini RIGI” and broader incentives for large-scale investment in machinery, hybrid vehicles, and advanced manufacturing offer promising fiscal support.

Peru’s industrial focus centers on mining and resource extraction—an area that requires specialized, precision-engineered components, rendering CNC machinery highly valuable. Its abundant natural resources, open trade environment, and export growth highlight the country’s potential to industrialize and upgrade manufacturing processes. Though specific data on CNC adoption in Peru is limited, the broader Latin American trend toward automation, IoT integration, and smart manufacturing suggests possible growth opportunities.

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 3,332.7 Million |

| Market Size by 2031 | US$ 7,341.5 Million |

| CAGR (2025 - 2031) | 11.9% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Machine Type

|

| Regions and Countries Covered |

Latin America

|

| Market leaders and key company profiles |

|

Yamazaki Mazak Corporation, DMG MORI, Haas Automation, Inc , Fanuc Corp, Okuma Corp, TRUMPF SE + Co KG, AMADA CO., LTD., DN SOLUTIONS, Hurco Companies Inc, and Hyundai Wia Corp are among the key players operating in the market. These players adopt strategies such as expansion, product innovation, and mergers and acquisitions to stay competitive in the market and offer innovative products to their consumers.

The following methodology has been followed for the collection and analysis of data presented in this report:

The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

Note: All financial data included in the Company Profiles section has been standardized to US$. For companies reporting in other currencies, figures have been converted to US$ using the relevant exchange rates for the corresponding year.

The Insight Partners conducts a significant number of primary interviews each year with industry stakeholders and experts to validate and analyze the data and gain valuable insights. These research interviews are designed to:

Primary research is conducted via email interactions and telephone interviews with industry experts across various markets, categories, segments, and sub-segments in different regions. Participants typically include:

The Latin America CNC Machine Market is valued at US$ 3,332.7 Million in 2024, it is projected to reach US$ 7,341.5 Million by 2031.

As per our report Latin America CNC Machine Market, the market size is valued at US$ 3,332.7 Million in 2024, projecting it to reach US$ 7,341.5 Million by 2031. This translates to a CAGR of approximately 11.9% during the forecast period.

The Latin America CNC Machine Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Latin America CNC Machine Market report:

The Latin America CNC Machine Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Latin America CNC Machine Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Latin America CNC Machine Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)