Joint Reconstruction Devices Market Outlook (2022-2033)

No. of Pages: 200 | Report Code: BMIPUB00031715 | Category: Life Sciences

No. of Pages: 200 | Report Code: BMIPUB00031715 | Category: Life Sciences

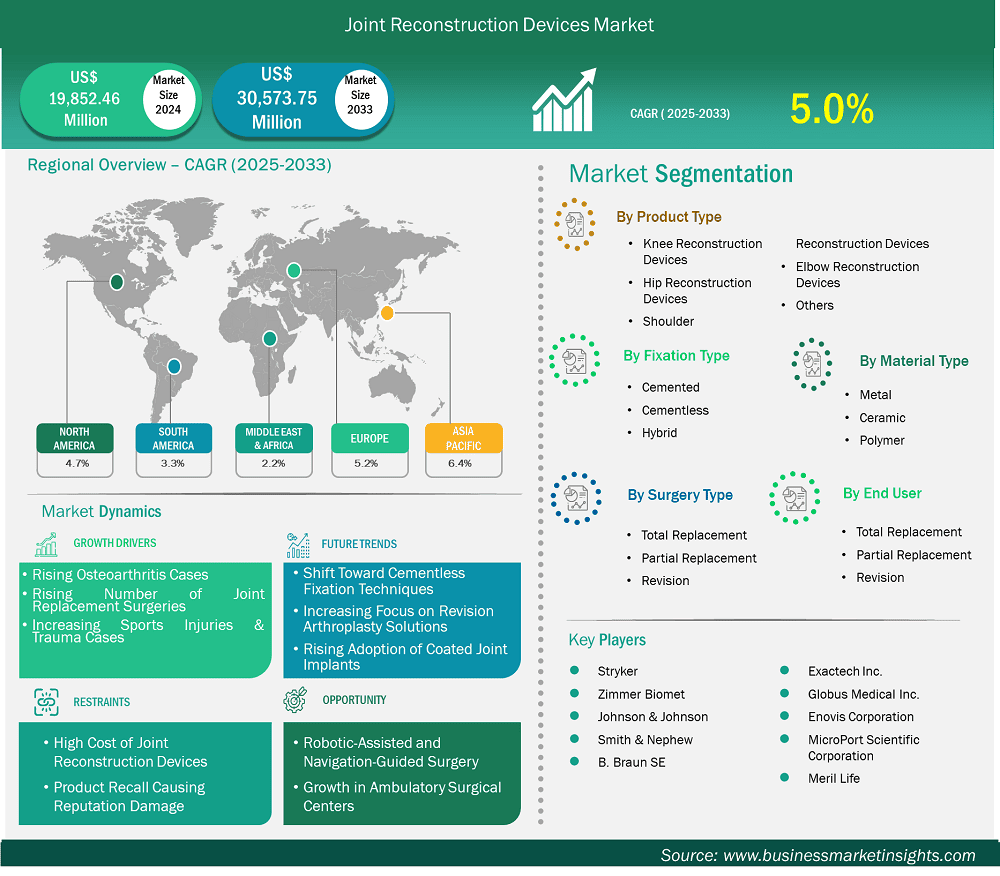

The joint reconstruction devices market size is expected to reach US$ 30,573.75 million by 2033 from US$ 19,852.46 million in 2024. The market is estimated to record a CAGR of 5.0% from 2025 to 2033.

Joint replacement devices are intended for the restoration or substitution of damaged joints including knees, hips, shoulders, ankles, and elbows. The medical devices are used to treat joint disease such as osteoarthritis, rheumatoid arthritis, traumatic injuries, and congenital joint deformities relies heavily on these medical devices. The market is driven by rising prevalence of joint diseases, advancement in surgical techniques, advancement in implant materials and others. Patient inclination towards less invasive treatments combined with the expanding deployment of robotic and image-assisted surgical techniques drives adoption rates.

In line with the adoption rate, the global joint reconstruction devices market stood at US$ 19,852.46 million in 2024 and is expected to reach US$ 30,573.75 million by 2033. The financial burden of implants and medical procedures combined with strict regulatory hurdles and potential complications or implant failures present major obstacles. The availability of quality healthcare services remains restricted in economically disadvantaged areas. The potential for future development encompasses expansion within emerging markets alongside the increased adoption of 3D-printed personalized implants and smart sensor technologies which aim to improve post-operative results and long-term implant functionality.

Key segments that contributed to the derivation of the joint reconstruction devices market analysis are product type, fixation type, material type, surgery type and end user.

Rising Osteoarthritis Cases

Healthcare systems face mounting pressures due to a global increase in life expectancy which results in more age-related health conditions. Musculoskeletal disorders emerge as a common disease which severely affects both mobility and quality of life. The frequency of degenerative joint diseases has increased among aging populations particularly in developed and fast-developing countries.

Among older adults, osteoarthritis stands as the predominant arthritis type that leads to joint deterioration and disability. The knee, hip, and shoulder joints represent the primary regions affected which commonly undergo treatment with joint reconstruction devices. The number of osteoarthritis cases continues to rise, leading an increasing number of patients to choose joint replacement surgeries as a means to regain functionality and alleviate persistent pain.

For instance, according to an article published in September 2023 in The Lancet Rheumatology, an open-access medical journal, globally around 595 million people were suffering from osteoarthritis in 2020, which was equal to 7.6% of the global population. In addition, according to the same source, compared with 2020, cases of osteoarthritis are projected to increase 74.9% for knee, 48.6% for hand, 78.6% for hip, and 95.1% for other types of osteoarthritis by 2050. This has increased demand for technologically advanced, durable, and minimally invasive joint reconstruction solutions.

Rising Number of Joint Replacement Surgeries

The rising number of joint replacement surgeries drives demand for joint replacements surgeries for joint such as knee and hips. These are the most common orthopedic procedures performed globally. Surgical technique improvements combined with superior implant materials and expanded insurance coverage have increased both the effectiveness and accessibility of these surgeries.

For instance, according to the report published in September 2024 by American Association of Hip and Knee Surgeons (AAHKS), the total number of hip replacement procedures in U.S. were 763,691 in 2022 which increased to 793,082 in 2023, marking a 3.8% growth. Similarly, knee surgeries experienced an even stronger upward trend, with the total number increasing from 1,293,438 in 2022 to 1,359,110 in 2023, a 5.1% jump.

The increasing number of surgical operations generates high demand for joint reconstruction devices needed in both initial surgeries and subsequent procedures. The joint reconstruction devices market experiences substantial growth due to the rising frequency of joint replacement surgeries.

By product type, the joint reconstruction devices market is segmented into knee reconstruction devices, hip reconstruction devices, shoulder reconstruction devices, elbow reconstruction devices, others. The knee reconstruction devices segment dominated the market in 2024. Knee reconstruction devices lead owing to the high global prevalence of osteoarthritis and sports injuries, increasing demand for knee replacements, and ongoing advancements in implant technology that improve outcomes and patient mobility.

By Fixation Type, the joint reconstruction devices market is segmented into cemented, cementless, and hybrid. The cemented segment dominated the market in 2024. Cemented fixation dominates due to its proven long-term success, especially in elderly patients with poor bone quality. It ensures immediate stability, faster post-operative recovery, and lower revision rates compared to uncemented methods.

By Material Type, the market is segmented into metal, ceramic and polymer. The metal segment held the largest share of the market in 2024. Metal leads as the preferred material due to its superior strength, biocompatibility, durability, and load-bearing capacity, which are essential for long-term performance in joint implants, particularly in weight-bearing joints like the hip and knee.

By Surgery Type, the market is segmented into total replacement, partial replacement, and revision. The total replacement segment held the largest share of the market in 2024. Total replacement is dominant due to its effectiveness in managing severe joint degeneration, offering substantial pain relief, improved joint function, and longer-lasting results, especially among aging populations with advanced osteoarthritis.

By end user, the market is segmented into hospitals, ambulatory surgical centers, and orthopedic clinics. The hospitals segment held the largest share of the market in 2024. Hospitals dominate due to advanced surgical infrastructure, availability of skilled orthopedic surgeons, and higher patient footfall for complex joint procedures, enabling efficient handling of large volumes of joint reconstruction surgeries.

Joint Reconstruction Devices Market Report Highlights

Report Attribute

Details

Market size in 2024

US$ 19,852.46 Million

Market Size by 2033

US$ 30,573.75 Million

Global CAGR (2025 - 2033) 5.0%

Historical Data

2022-2023

Forecast period

2025-2033

Segments Covered

By Product Type

By Fixation Type

By Material Type

By Surgery Type

Regions and Countries Covered

North America

Europe

Asia-Pacific

South and Central America

Middle East and Africa

Market leaders and key company profiles

The "Joint Reconstruction Devices Market Size and Forecast (2022–2033)" report provides a detailed analysis of the market covering below areas:

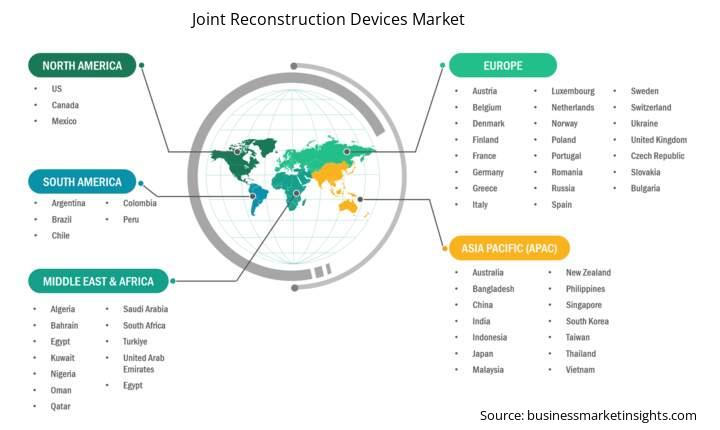

The geographical scope of the joint reconstruction devices market report is divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America. The joint reconstruction devices market in Asia Pacific is expected to grow significantly during the forecast period.

The Asia Pacific joint reconstruction devices market is segmented into China, Japan, South Korea, India, Australia, New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, Taiwan, Bangladesh and Rest of Asia. The Asia Pacific is the fastest growing region within the global market. The market in Asia Pacific region is driven by a rising aging population, increasing prevalence of osteoarthritis, and growing awareness of advanced surgical options. Countries like China, India, and Japan are leading due to expanding healthcare infrastructure and rising medical tourism. Growing government initiative in this region such as improving access to orthopedic care and rising adoption of minimally invasive techniques is further supporting market expansion. Moving forward, rising middle class population, rising disposable income also supports market growth. Increasing investments by global players and local manufacturing also contribute to the region's strengthening position in the global market.

The joint reconstruction devices market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the key developments in the joint reconstruction devices market are:

The Joint Reconstruction Devices Market is valued at US$ 19,852.46 Million in 2024, it is projected to reach US$ 30,573.75 Million by 2033.

As per our report Joint Reconstruction Devices Market, the market size is valued at US$ 19,852.46 Million in 2024, projecting it to reach US$ 30,573.75 Million by 2033. This translates to a CAGR of approximately 5.0% during the forecast period.

The Joint Reconstruction Devices Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Joint Reconstruction Devices Market report:

The Joint Reconstruction Devices Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Joint Reconstruction Devices Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Joint Reconstruction Devices Market value chain can benefit from the information contained in a comprehensive market report.