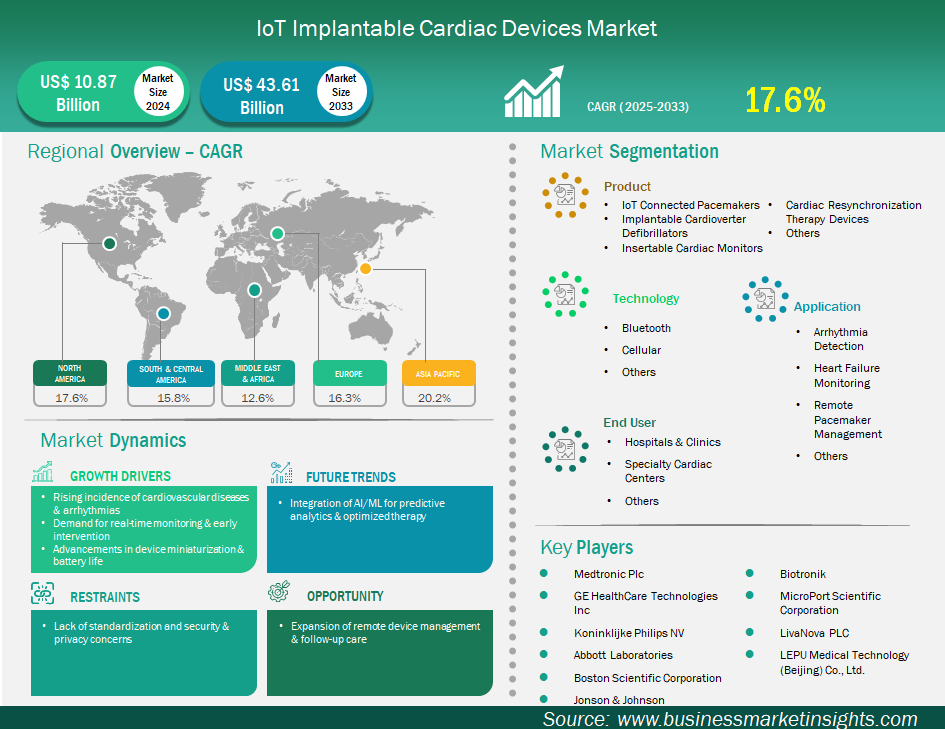

The IoT implantable cardiac devices market size is expected to reach US$ 43,609.7 million by 2033 from US$ 10,874.7 million in 2024. The market is estimated to record a CAGR of 17.6% from 2025 to 2033.

The global IoT implantable cardiac devices market is experiencing significant growth driven by rising incidence of cardiovascular diseases & arrhythmias, demand for real-time monitoring & early intervention, advancements in device miniaturization & battery life. However, the lack of standardization and associated security and privacy concerns are slowing market evolution. Geographically, the North America market dominates due to the high prevalence of cardiovascular disease, its reimbursement systems, advanced digital health markets, and digital health solutions adoption. Many major manufacturers, such as Medtronic, Boston Scientific, Abbott Laboratories, and GE HealthCare have a presence in North America, which may also be offering cloud-based remote monitoring solutions. The APAC market is the most rapidly growing market as a result of an aging population, increasing cases of heart disease, investments in healthcare, and the emergence of more advanced cardiac care solutions in countries (e.g. China, India, and the Japan). The key players are focusing on minimization, battery capacity, and artificial intelligence as well as use of data to improve diagnosis and personalize cardiac care.

Key segments that contributed to the derivation of the IoT Implantable Cardiac Devices market analysis are product, technology, application, and end user.

Increasing incidence of cardiovascular diseases (CVDs) and arrhythmias. CVDs are the overall leading cause of death globally and the prevalence of diseases such as heart failure, coronary artery disease, and several arrhythmias are rising, especially in the growing older population. Because of this rising burden, there will be an increased demand for advanced, life-sustaining devices such as pacemakers, implantable cardioverter-defibrillators (ICDs), and cardiac resynchronization therapy (CRT) devices. IoT-enabled devices will allow continuous, real-time monitoring of cardiac rhythm and function, allowing clinicians to act earlier on any potentially life-threatening events, optimize therapy, and result in an eventual improvement in patient outcomes and quality of life. In addition, many cardiac conditions typically require regular monitoring for long periods of time, which is impractical to achieve through traditional in-clinic visits alone. IoT-enabled implantable devices can wirelessly send important information to the healthcare provider, so the healthcare provider can conduct follow-up remotely, avoid hospital visits, and act when data are off. This option has tremendous value in managing complex arrhythmias, monitoring the effectiveness of the device, and preventing sudden cardiac death, which means, the smart implants will be the practice and provide value in affecting treatment in the clinical care pathways.

As remote device management and follow-up care advances into the IoT implantable cardiac devices market, it represents a substantial and transformative opportunity. Although patients with pacemakers, ICDs, and any other implanted cardiac device have required numerous face-to-face visits to the clinic for device interrogation, downloading data, and monitoring their health, this approach was both cumbersome to the patient, (especially for those in rural areas or with mobility challenges), and a strain on the clinic resources and staff. Advances in IoT technology facilitate continuous and automated data transfer from the implanted device to a secure cloud-based platform for access by the clinician, which completely changes this model. The clinician can monitor the device function, its battery-level, and the patient's cardiac rhythm at any point without the patient ever stepping into the clinic. Should problems arise, the clinician can detect issues, including arrhythmia, and will then proactively reach out to the patient, without ever waiting for the patient to schedule an appointment to alert the clinic. With the new model of remote monitoring come multiple advantages worth noting, which provide a compelling opportunity for market growth. For the patient, there are fewer inconvenient and costly visits to the clinic. Moreover, it enhances the patient's quality of life and sense of comfort to know, for example, that their device is being monitored constantly, and should problems arise, they will do so without a clinical procedure for the patient. For the healthcare provider, it permits better allocation of resources; reduces the clinical and charging workload; and gives the healthcare provider an earlier opportunity to intervene clinically, should something significant occur with the patient or their device.

The IoT implantable cardiac devices market is classified according to products into IoT connected pacemakers, implantable cardioverter defibrillators, insertable cardiac monitors, cardiac resynchronization therapy devices, others. The implantable cardioverter defibrillators segment led the market in 2024 and beyond. Implantable Cardioverter-Defibrillators (ICDs) dominate the product segment with the ever-increasing need for life-saving intervention from sudden cardiac arrest (SCA) as the pre-existing severe cardiovascular conditions also define, associated with these devices. As a unit, they also come with higher complexity and costs relative to the other implantable cardiac devices. In this way, ICDs provides a duality in helping to protect patients from serious ventricular arrhythmias (very fast and irregular heartbeats) which can be fatal if not managed, as well as insurance from SCA. The demand for these devices is being driven by the increased prevalence of serious cardiovascular diseases and conditions leading to SCA, along with continuously eradicating technology space (improved battery, smaller size, and improved remote monitoring space). Beyond this, many state-of-the-art products use dual capacities, providing both defibrillation and pacing functions (usually not identified as combination devices - CRT-D's), this in turn implies a large range of ability to help patients with a range of cardiac rhythm disorders to facilitate comprehensive care.

By technology, the market is segmented into Bluetooth, cellular, and others. The Bluetooth segment held the largest share of the market in 2024. Bluetooth Low Energy (BLE) is the leading technology segment for IoT implantable cardiac devices because its fundamental design meets the basic ideal requirements of these long-term implanted devices. First and foremost is the fact that it provides ultra-low energy consumption, which is critical in extending the life of the device battery, thus decreasing the need for surgical battery replacements. BLE uses intermittent, small data packets, which is exactly the right fit for transmitting important cardiac rhythm data, device diagnostics, and alerts from the implant to external home monitors, or smartphones. Its pervasive existence in the consumer electronics space (smartphones, tablets) is nearly ideal when considering patient and clinician use; that is, BLE allows for easy transmission of patient data and remote management of device diagnostics, without additional external hardware, which is a great way to improve patient engagement and compliance.

In terms of applications, the market is segmented into arrhythmia detection, heart failure monitoring, remote pacemaker management, and others. The arrhythmia detection segment had the largest market share in 2024. Arrhythmia detection is the largest market segment as this is the basic function and main clinical utility of most IoT implantable cardiac devices. The functional pacemaker and ICD, for example, are developed to help monitor the heart's electrical impulse in real time, available 24 hours a day, with the explicit purpose of identifying any occurrences of irregular - or life-threatening - rhythms. With the presence of its IoT capability, arrhythmia detection can improve significantly; it provides a continuous connection in real-time monitoring of these arrhythmias and immediate communication of alerts and stored data to their respective healthcare providers. Furthermore, they allow continuous monitoring and enable a more immediate identification of the arrhythmia, enable an expeditious diagnosis, evaluation of therapy success, and timely patient intervention in regard to a critical event that may otherwise go undetected until the next patient visit or intermittent physical visit - reducing serious cardiac events and enhancing patient outcomes.

By end user, the market is segmented into hospitals & clinics, specialty cardiac centers, and others. The hospitals & clinics segment held the largest share of the market in 2024. Hospitals and clinics are the largest end-user segment for IoT implantable cardiac devices because they are the ongoing reason and primary locations for initial diagnosis, procedure and immediate post-op for patients requiring the continued supervision of these devices. These locations are embedded with additional complex healthcare facilities, i.e., hospitals have the complex infrastructure, medical specialists (e.g. electrophysiologists, cardiac surgeons, intensivists) to maintain these complex embodiments and complex surgical suites to perform many of the more complex medical procedures. Hospitals are also located in central referral areas with a system that allows patients to be referred to their practicing physician and have it covered by their government health care coverage.

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 10,874.7 Million |

| Market Size by 2033 | US$ 43,609.7 Million |

| Global CAGR (2025 - 2033) | 17.6% |

| Historical Data | 2022-2023 |

| Forecast period | 2025-2033 |

| Segments Covered |

By Product

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

The "IoT Implantable Cardiac Devices Market Size and Forecast (2022–2033)" report provides a detailed analysis of the market covering below areas:

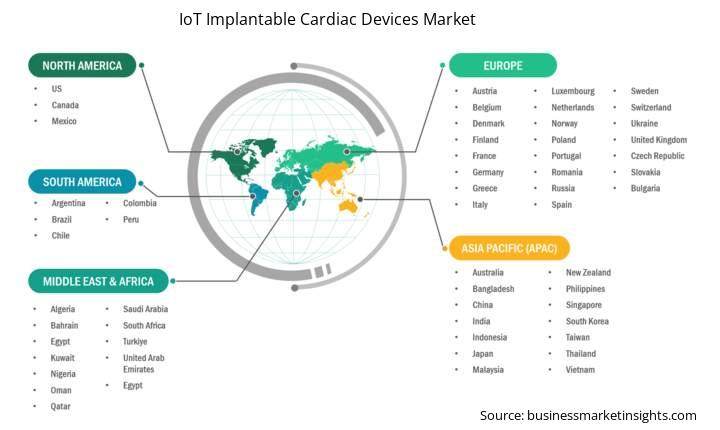

The geographical scope of the IoT implantable cardiac devices market report is divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America. The IoT Implantable Cardiac Devices market in Asia Pacific is expected to grow significantly during the forecast period.

Asia Pacific IoT implantable cardiac devices market includes China, Japan, India, South Korea, Australia, Bangladesh, New Zealand, Philippines, Singapore, Indonesia, Taiwan, Malaysia, Vietnam, and the rest of Asia Pacific. The Asia Pacific region is witnessing the highest growth in the IoT implantable cardiac devices market due to a unique combination of demographic shifts, a growing burden of disease, and considerable improvements in healthcare technology infrastructure and technology adoption.

Within a rapidly transformative region, specific countries are driving market growth. The first is China, with rising disposable incomes, massive government investment in improving healthcare infrastructure and access to digital health, growing population, and increasing burden of cardiovascular diseases resulting in demand and increased growth for implantable cardiac devices. India is also experiencing considerable market growth, with a large and growing population, a rising and more aware middle class interested in cardiac health measures, and less capital invested in healthcare leading to better access at the healthcare system level (government makes enhancing domestic manufacturing (Make in India) a priority, Bhartiya Arogya Yojana program to enhance access for the poor to healthcare). Japan is a mature healthcare market but remains a growth opportunity given the country has the oldest population, with the highest proportion of elderly anywhere in the world. This aging population demands closer attention to age-related cardiac conditions rendering timeless growth.

The IoT implantable cardiac devices market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the key developments in the IoT Implantable Cardiac Devices market are:

The IoT Implantable Cardiac Devices Market is valued at US$ 10,874.7 Million in 2024, it is projected to reach US$ 43,609.7 Million by 2033.

As per our report IoT Implantable Cardiac Devices Market, the market size is valued at US$ 10,874.7 Million in 2024, projecting it to reach US$ 43,609.7 Million by 2033. This translates to a CAGR of approximately 17.6% during the forecast period.

The IoT Implantable Cardiac Devices Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the IoT Implantable Cardiac Devices Market report:

The IoT Implantable Cardiac Devices Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The IoT Implantable Cardiac Devices Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the IoT Implantable Cardiac Devices Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)