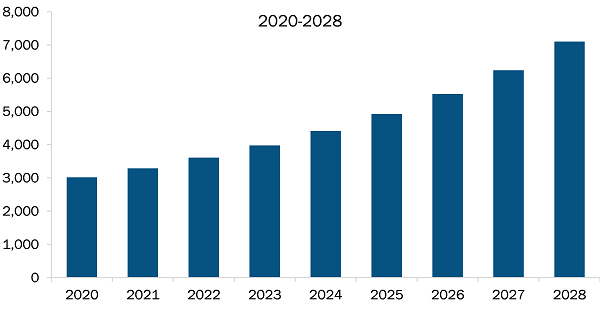

The India commercial fixed wing aircraft landing gear MRO market is expected to grow from US$ 86.71 million in 2022 to US$ 134.75 million by 2028; it is estimated to grow at a CAGR of 7.6% from 2022 to 2028.

Market Introduction

Landing gears are among the main components of aircraft landing operations that require several checks, repair, periodic maintenance, and regular overhauling. It is mandatory to replace landing gears about every 8–12 years or after 18,000 cycles. The existing fleet of commercial aircraft is one of the major factors generating new opportunities for market vendors across India. According to the Boeing and Airbus forecasts, there will be more than 40,000 commercial aircraft deliveries by the end of 2041 across the world, which will subsequently boost aircraft deployments across India as more than 1,000 aircraft orders will be received from major OEMs such as Boeing and Airbus. This is further likely to boost the India commercial fixed wing aircraft landing gear MRO market size during the forecast period as the current operational fleet will be requiring landing gear maintenance, repair, and overhaul services for their respective airline operations.

Market Overview and Dynamics

The India commercial fixed wing aircraft landing gear is mainly driven by the existing fleet of aircraft across the country, i.e., ~713 commercial aircraft, as per the Center for Asia Pacific Aviation (CAPA). India does not have many vendors that can cater to the landing gear MRO for the country’s commercial fixed wing aircraft fleet. Hence, most of the domestic demand for Indian MRO services is mainly fulfilled by foreign MRO companies, which is one of the major restraining factor for the growth of the India commercial fixed wing aircraft landing gear size.

The demand for non-destructive testing in the India commercial fixed wing aircraft landing gear MRO market is growing as the rising aircraft fleet requires regular and periodic maintenance checks, repairs, and overhauls (if required). Further, as aircraft operations have already resumed after the COVID-19 pandemic, almost every grounded aircraft needs several maintenance checks and other MRO operations in order to ensure the overall operational efficiency and proper functioning of the aircraft components for continuing the flight operations. In addition, the landing gear is one of the critical components of an aircraft that handles the overall landing operations of an aircraft during the flight. Therefore, regularly maintaining the aircraft landing efficiency through related component checks is necessary. This has driven the India commercial fixed wing aircraft landing gear MRO market during the FY 2021–2022.

Moreover, the new government policies and projects, such as the “Make in India” initiative, are supporting the interest of FDI companies to invest in the country’s MRO sector, which is another major factor likely to generate new competitive opportunity for market vendors during the forecast period. Similarly, the government’s aim to make the country an Aviation MRO Hub by the end of 2040 is another major factor likely to drive the India commercial fixed wing aircraft landing gear MRO market growth during the forecast period.

Key Market Segments

India commercial fixed wing aircraft landing gear MRO market, by activity, is segmented into single overhaul and non-destructive testing. The non-destructive testing segment dominated the market in 2021. The NDT involves all types of MRO activities such as periodic maintenances, regular checks, inspection, analysis, and repairing of landing gear components across the narrow body and wide body fleet of aircraft. The NDT activities included in the scope of the study include corrosion prevention, acoustic testing, and liquid penetration inspection. The landing gear bears a lot of loads during its takeoff and landing operations, which is why it requires many checks of every component before its takeoff and landing operations. Moreover, the need for several types of checks such as cracks, leakages, hydraulic functioning, retracting mechanism such as the motors and wiring is another major factor generating the demand for non-destructive testing operations of the aircraft landing gear across Indian commercial aircraft fleet.

Further, several other checks are conducted during the aircraft landing gear operations such as residual strength testing that allows to check the mechanical load that a damaged landing gear can still carry without failing. The rising commercial aviation operations across Indian aviation sector due to rising passenger traffic is boosting the aircraft operations across the region. This in turn is generating new market opportunities for landing gear MRO market vendors across the country. Moreover, the rising aircraft fleet across India and increasing number of long run international flights is leading to requirements of several NDT testing of landing gear components before the takeoff operations of any commercial flight. Such factors are catalyzing the India commercial fixed wing aircraft landing gear MRO market growth for non-destructive testing (NDT) segment.

Major Sources and Companies Listed

Tentacle Aerologistix Pvt Ltd, AI Engineering services Ltd, AAR Indamer Technics Pvt Ltd, InterGlobe Aviation Ltd, Haveus Aerotech India Pvt Ltd, Air Works India (Engineering) Pvt Ltd, Horizon Aerospace Pvt Ltd, and Aerotek Sika Aviation Engineering Pvt Ltd are some of the key India commercial fixed wing aircraft landing gear MRO market players. Various other companies are also introducing new technologies and offerings, helping the India commercial fixed wing aircraft landing gear MRO market players expand their business in terms of revenue.

Reasons to Buy Report

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 86.71 million |

| Market Size by 2028 | US$ 134.75 million |

| CAGR (2022 - 2028) | 7.6% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Gear Type

|

| Regions and Countries Covered |

India

|

| Market leaders and key company profiles |

|

The India Commercial Fixed Wing Aircraft Landing Gear MRO Market is valued at US$ 86.71 million in 2022, it is projected to reach US$ 134.75 million by 2028.

As per our report India Commercial Fixed Wing Aircraft Landing Gear MRO Market, the market size is valued at US$ 86.71 million in 2022, projecting it to reach US$ 134.75 million by 2028. This translates to a CAGR of approximately 7.6% during the forecast period.

The India Commercial Fixed Wing Aircraft Landing Gear MRO Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the India Commercial Fixed Wing Aircraft Landing Gear MRO Market report:

The India Commercial Fixed Wing Aircraft Landing Gear MRO Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The India Commercial Fixed Wing Aircraft Landing Gear MRO Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the India Commercial Fixed Wing Aircraft Landing Gear MRO Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)