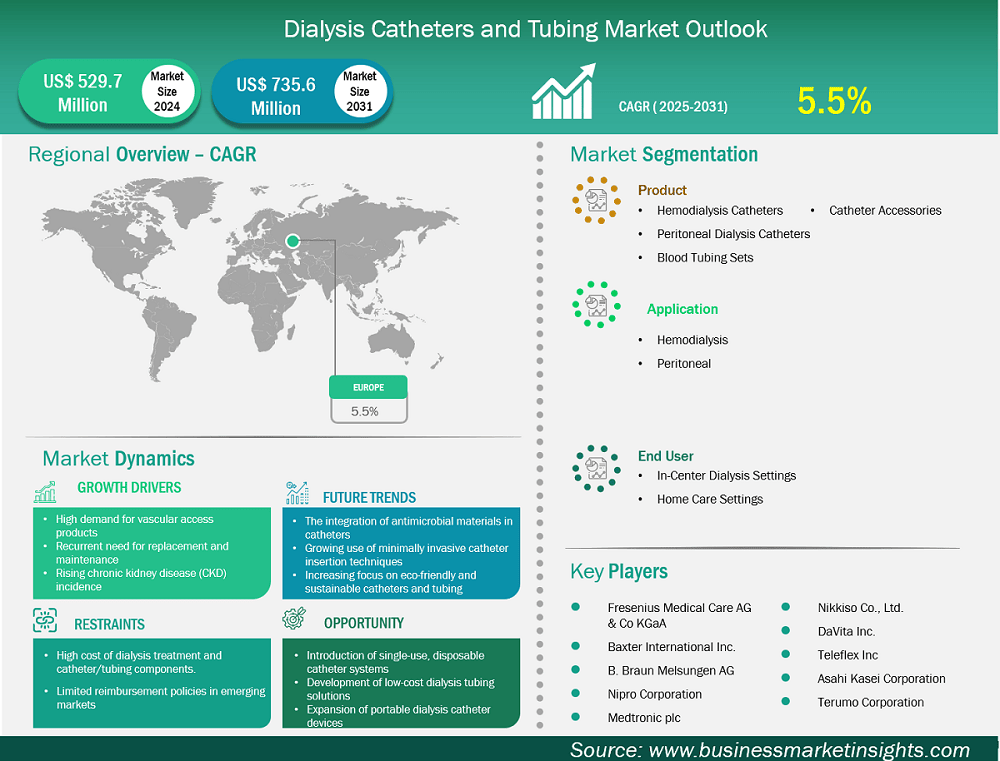

The Europe dialysis catheters and tubing market size is expected to reach US$ 735.6 million by 2031 from US$ 529.7 million in 2024. The market is estimated to record a CAGR of 5.5% from 2025 to 2031.

The dialysis catheters and tubing market in Europe is experiencing significant growth driven by high demand for vascular access products, recurrent need for replacement and maintenance, and rising chronic kidney disease (CKD) incidence. The European marketplace of dialysis catheters and tubing is a mature yet dynamic one because of the increasing incidence of chronic kidney disease (CKD) and an aging population. The executive summary illustrates a market characterized by competition from key players and a focus on innovation to improve patient outcomes. The analysis determined that the hemodialysis catheters remain the largest product group due to the usage of hemodialysis, the predominant form of renal replacement therapy in the European region, compared to peritoneal dialysis, and the shift towards treatments requiring more patient-friendly tubing and catheter designs. The market is also highly determined by its regulation; for example, the European Medical Device Regulation (MDR) creates an additional burden on catheters and tubing beyond quality by maintaining continuous compliance through post-market data, including biocompatibility and sterilization. End users are seeking, and manufacturers are investing in R&D to produce advanced materials and antimicrobial catheter coatings to mitigate the significant risk of catheter-related infection, contributing to market growth. The competitive landscape characterizes a few large suppliers of dialysis devices; however, there is an influx of specialized small companies focusing on niche segments and products.

Key segments that contributed to the derivation of the dialysis catheters and tubing market analysis are product, application, and end user.

The Europe dialysis catheters and tubing market is segmented into Belgium, Austria, Finland, Denmark, Greece, Poland, Romania, Russia, Ukraine, the Czech Republic, Slovakia, Bulgaria, Italy, Luxembourg, Germany, Switzerland, France, the Netherlands, Norway, Portugal, Spain, Sweden, and the United Kingdom. The projection for the European dialysis catheters and tubing market is continued expansion and notable technological progress. The trend of home-based dialysis solutions is growing. National healthcare systems increasingly support this, recognizing the improved quality of life for patients and reduced costs. This has created demand for portable, compact, and easy-to-use dialysis tubing and catheters. The market is trending from in-center dialysis to decentralized care, where manufacturers will develop products that are easier to use and monitor remotely. There is a rapid upswing in the number of catheters and tubing that are "smart," featuring sensors to provide real-time blood flow, pressure, and temperature data. The functionality of these technologically integrated systems will promote personalized and efficient treatment. Sustainability is also a growing concern and is driven by climate change, as demand for sustainable and biodegradable materials is changing the composition of emerging single-use medical devices, and seeking alternatives to single-use plastics. The complexity of reimbursement and the initial investment burden associated with advanced technologies are key market challenges. Still, the market is driven by continued innovation, and above all, by focusing on patient-focused care.

Based on country, the Europe dialysis catheters and tubing market is further segmented into Belgium, Austria, Finland, Denmark, Greece, Poland, Romania, Russia, Ukraine, the Czech Republic, Slovakia, Bulgaria, Italy, Luxembourg, Germany, Switzerland, France, the Netherlands, Norway, Portugal, Spain, Sweden, and the United Kingdom. Germany held the largest share in 2024.

The European landscape has varying markets that pose substantial country-level differences in market maturity, healthcare systems, and treatment protocols. Germany continues to be the leading market due to some of the most advanced healthcare systems, the highest prevalence of CKD, and the most favorable reimbursement systems. Germany has a stronger aversion to home modalities like peritoneal dialysis and a greater preference for in-center hemodialysis. This further increases the demand for a continuous supply of catheters and tubing. On the other hand, the UK and Nordic region are leading the move towards home dialysis therapies. Their market shows more demand for peritoneal dialysis catheters and portable hemodialysis systems. Southern and Eastern European countries (such as Spain and Poland) also show good upward movement, mostly because of progress in improving healthcare systems and overall awareness of renal diseases. Despite growth in the market, these previously mentioned countries will still have some constraints due to limited healthcare funding and slower adoption of advanced technologies. Overall, the market's future trajectory in each country has unique influences based on its respective healthcare policies, population demographics, and investment in modernizing dialysis care.

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 529.7 Million |

| Market Size by 2031 | US$ 735.6 Million |

| CAGR (2025 - 2031) | 5.5% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered |

Europe

|

| Market leaders and key company profiles |

|

Fresenius Medical Care AG & Co KGaA; Baxter International Inc.; B. Braun SE; Nipro Corp; Medtronic Plc, Nikkiso Co Ltd, Teleflex Inc, Asahi Kasei Medical Co., Ltd., Terumo Corp, and DaVita Inc., are among the key players operating in the market. These players adopt strategies such as expansion, product innovation, and mergers and acquisitions to stay competitive in the market and offer innovative products to their consumers.

The following methodology has been followed for the collection and analysis of data presented in this report:

The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

Note: All financial data included in the Company Profiles section has been standardized to US$. For companies reporting in other currencies, figures have been converted to US$ using the relevant exchange rates for the corresponding year.

Business Market Insights conducts a significant number of primary interviews each year with industry stakeholders and experts to validate and analyze the data and gain valuable insights. These research interviews are designed to:

Primary research is conducted via email interactions and telephone interviews with industry experts across various markets, categories, segments, and sub-segments in different regions. Participants typically include:

The Europe Dialysis Catheters and Tubing Market is valued at US$ 529.7 Million in 2024, it is projected to reach US$ 735.6 Million by 2031.

As per our report Europe Dialysis Catheters and Tubing Market, the market size is valued at US$ 529.7 Million in 2024, projecting it to reach US$ 735.6 Million by 2031. This translates to a CAGR of approximately 5.5% during the forecast period.

The Europe Dialysis Catheters and Tubing Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Dialysis Catheters and Tubing Market report:

The Europe Dialysis Catheters and Tubing Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Dialysis Catheters and Tubing Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Dialysis Catheters and Tubing Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)