Dialysis Catheters and Tubing Market Outlook (2021-2031)

No. of Pages: 200 | Report Code: BMIPUB00031673 | Category: Life Sciences

No. of Pages: 200 | Report Code: BMIPUB00031673 | Category: Life Sciences

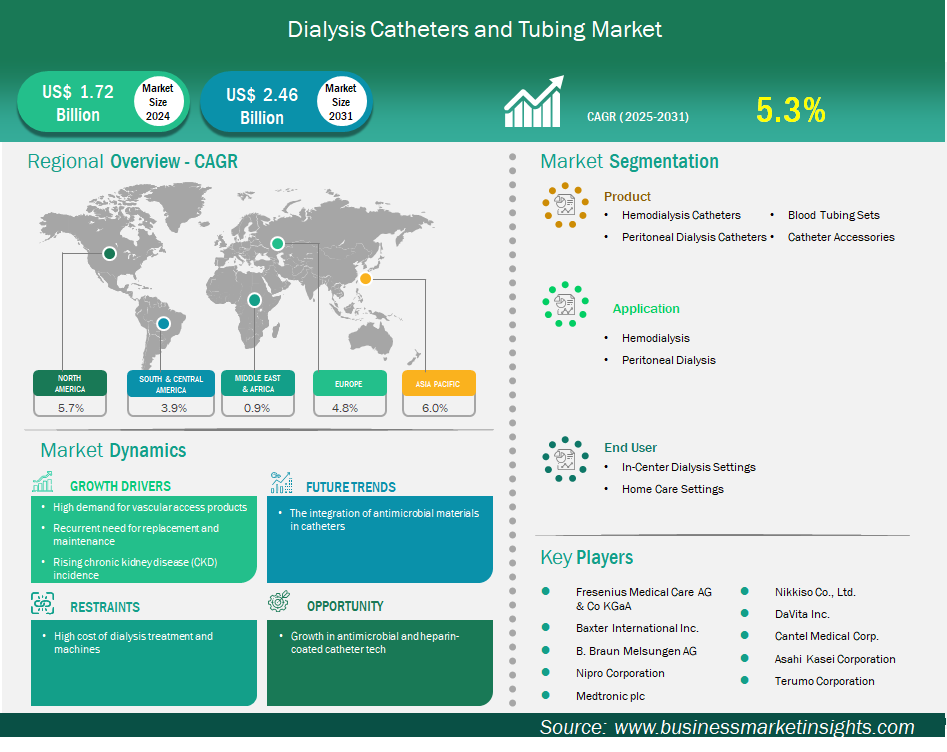

The dialysis catheters and tubing market size is expected to reach US$ 2,462.38 million by 2031 from US$ 1,719.12 million in 2024. The market is estimated to record a CAGR of 5.3% from 2025 to 2031.

Executive Summary and Global Market Analysis:

The global dialysis catheters and tubing market is experiencing significant growth driven by high demand for vascular access products, recurrent need for replacement and maintenance, and rising chronic kidney disease (CKD) incidence. Dialysis catheters and tubing encompasses hemodialysis catheters, peritoneal dialysis catheters, blood tubing sets, and catheter accessories. Catheters and tubing make the safe and efficient transfer of blood and dialysis fluids between a patient and a dialysis machine a reality. Catheters are a vascular access device that allows blood movement between a patient and a dialysis machine, whereas tubing allows the circulation of dialysate solutions.

The catheter and tubing market have many exciting developments in catheter choices as there is an increasing need for both long-term and temporary catheters. The catheter market is responding to a number of trends such as the emergence of soft silicone-based catheters that increase patient comfort and soothe complications associated with rigid catheters. The merging of Al-assisted monitoring systems for dialysis and catheter technologies are also ensuring optimized blood flow and treatment errors are minimized. A recently published study demonstrated the rise in the adoption of tunnelled dialysis catheters over AVF procedures in North America during 2023.

Dialysis Catheters and Tubing Market Strategic Insights

Dialysis Catheters and Tubing Market Segmentation Analysis

Key segments that contributed to the derivation of the dialysis catheters and tubing market analysis are product, application, and end user.

Dialysis Euipment Market Drivers and Opportunities:

The High Demand for Vascular Access Products Driving Dialysis Catheters and Tubing Market

The growing demand for vascular access products serves as a sizeable factor contributing to the dialysis catheters and tubing industry's growth. Vascular access is paramount to administering safe hemodialysis as it allows for mandatory repeated connection of a patient's connected bloodstream to the dialysis machine. The rise in the global prevalence of chronic kidney disease and end-stage renal disease has contributed to the need for reliable, durable, and safe vascular access. Central venous catheters, arteriovenous fistulas, and grafts are common vascular access procedures, while catheters, particularly to support patients using acute and emergency service, continues to be critical in clinical practice.

An increase in the number of dialysis patients continues to drive demand, and the continued need for rapid-initiated treatment, realizing that patients may have significant access challenges, will increase variability of that demand. Some catheters and tubing systems will be specialized, and there has always been a greater degree of demand for the short-term nature of catheters, and increased availability of specialized catheter designs to reduce infection, and improve patient comfort will fuel even further demand for vascular access products within the world of dialysis consumables.

The Advancement of Antimicrobial and Heparin-coated Catheter Technologies

The development of antimicrobial and heparin-coated catheter technologies offers a strong opportunity for the dialysis catheters and tubings market, as traditional catheters are often associated with complications from bloodstream infection or clot formation. These complications can delay treatments, increase costs and potentially lead to poor outcomes. Hence, to address such issues, manufacturers are currently developing antimicrobial catheters to prevent infections, as well as coating catheters with heparin and other anticoagulants to help prevent thrombosis. Not only do these solutions improve patient safety and comfort, but they effectively decrease the overall frequency of catheter replacement, increase catheter longevity and ultimately improve patient clinical outcomes.

More hospitals and other healthcare providers are making infection control a priority today, as well as quality clinical outcomes. As a result, there is a greater demand for improved catheter solutions, especially antimicrobial and heparin-coated products that target prevention rather than treatment. As more advanced, patient-focused catheter technologies enter the market, antimicrobial and heparin-coated catheters represent a high-growth opportunity for the dialysis consumables market overall.

Dialysis Catheters and Tubing Market Size and Share Analysis

The dialysis catheters and tubing market is classified according to products into hemodialysis catheters, peritoneal dialysis catheters, blood tubing sets, and catheter accessories. The hemodialysis catheters segment led the market in 2024 and beyond. Hemodialysis refers to the removal of waste products, excess toxic substances, and excess fluid from the blood when the kidneys can no longer remove them from the blood. Hemodialysis catheters dominate the dialysis catheters and tubing market because they are essential for immediate vascular access, especially in acute and short-term dialysis settings. Their ability to provide rapid blood flow and ease of insertion makes them a critical choice for initiating dialysis, particularly when arteriovenous fistulas or grafts are not yet viable.

In terms of applications, the market is segmented into hemodialysis and peritoneal dialysis. The hemodialysis segment had the largest market share in 2024. Hemodialysis remains the leading application in this market due to its widespread use across both developed and developing regions. It requires a robust vascular access system, including catheters and tubings, to efficiently circulate blood through the dialysis machine. As hemodialysis is performed multiple times a week, the demand for reliable and durable access components remains consistently high.

By end user, the market is segmented into in-center dialysis settings, and home care settings. The in-center dialysis settings segment held the largest share of the market in 2024. In-center dialysis settings hold the largest share in the market because most dialysis patients continue to receive treatment in hospitals and dedicated dialysis clinics. These facilities rely heavily on catheters and tubing systems that meet clinical standards, support high patient turnover, and are managed by trained professionals, ensuring the safety and efficiency of hemodialysis procedures.

Dialysis Catheters and Tubing Market Report Highlights

Report Attribute

Details

Market size in 2024

US$ 1.72 Billion

Market Size by 2031

US$ 2.46 Billion

Global CAGR (2025 - 2031) 5.3%

Historical Data

2021-2023

Forecast period

2025-2031

Segments Covered

By Product

By Application

By End User

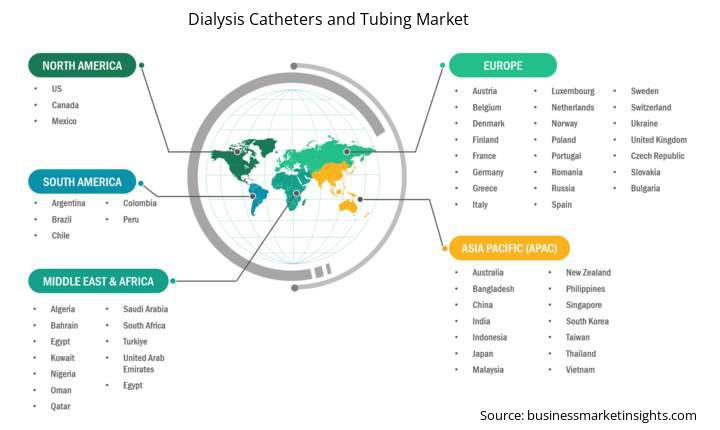

Regions and Countries Covered

North America

Europe

Asia-Pacific

South and Central America

Middle East and Africa

Market leaders and key company profiles

Dialysis Catheters and Tubing Market Report Coverage and Deliverables

The "Dialysis Catheters and Tubing Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

Dialysis Catheters and Tubing Market Country and Regional Insights

The geographical scope of the dialysis catheters and tubing market report is divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America. The dialysis catheters and tubing market in Asia Pacific is expected to grow significantly during the forecast period.

The Asia Pacific dialysis catheters and tubing market consists of China, Japan, India, South Korea, Australia, Bangladesh, New Zealand, Philippines, Singapore, Indonesia, Taiwan, Malaysia, Vietnam, and the Rest of Asia Pacific. The Asia Pacific is rapidly growing the dialysis catheters and tubing market, increased rates of chronic kidney disease (CKD), a healthcare infrastructure expansion, and higher rates of patient awareness are key factors driving this growth. China, India, Japan, and South Korea are leading the charge. The government of China has invested heavily in healthcare infrastructure, leading to hundreds of new dialysis centers and a multitude of hospitals with advanced medical technology. Since healthcare continues to expand, the demand for dialysis catheters and tubing increases. In addition, a large population and increasing prevalence of CKD continues to drive up the need. India's dialysis catheters and tubing is also experiencing an uptick in demand, led by increased CKD prevalence and growth of healthcare facilities. Improved access to healthcare through government initiatives and rising awareness of kidney diseases are significant factors in the rising demand for dialysis treatments, subsequently leading to higher demand for medical devices. Aging populations, a high incidence of CKD, and the availability of dialysis services are increasing demand for dialysis services in Japan. Increased healthcare advancements and medical technologies support Japan's dialysis catheters and tubing market.

Dialysis Catheters and Tubing Market Research Report Guidance

Dialysis Catheters and Tubing Market News and Key Development:

The dialysis catheters and tubing market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the key developments in the dialysis catheters and tubing market are:

Key Sources Referred:

The Dialysis Catheters and Tubing Market is valued at US$ 1.72 Billion in 2024, it is projected to reach US$ 2.46 Billion by 2031.

As per our report Dialysis Catheters and Tubing Market, the market size is valued at US$ 1.72 Billion in 2024, projecting it to reach US$ 2.46 Billion by 2031. This translates to a CAGR of approximately 5.3% during the forecast period.

The Dialysis Catheters and Tubing Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Dialysis Catheters and Tubing Market report:

The Dialysis Catheters and Tubing Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Dialysis Catheters and Tubing Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Dialysis Catheters and Tubing Market value chain can benefit from the information contained in a comprehensive market report.