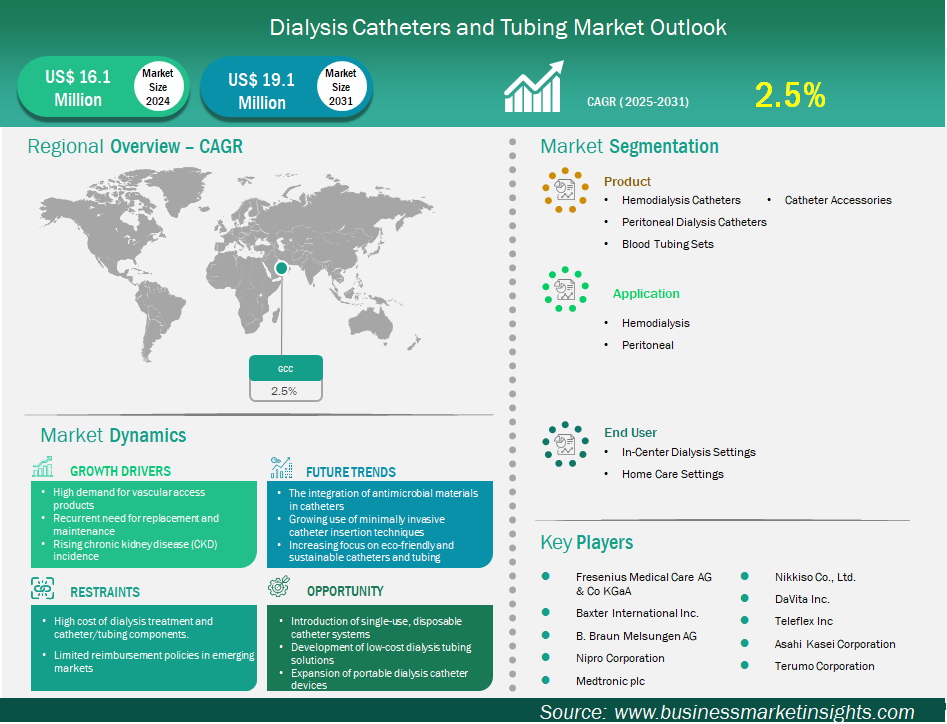

The GCC dialysis catheters and tubing market size is expected to reach US$ 19.1 million by 2031 from US$ 16.1 million in 2024. The market is estimated to record a CAGR of 2.5% from 2025 to 2031.

The dialysis catheters and tubing market in GCC is experiencing significant growth driven by high demand for vascular access products, recurrent need for replacement and maintenance, and rising chronic kidney disease (CKD) incidence. The dialysis catheters and tubing market in the GCC (Gulf Cooperation Council) region is experiencing high growth driven by increasing healthcare expenditure and a significant burden of non-communicable diseases. The data indicate a significant preference for premium, technology-driven products, most likely attributable to high per capita income and focus on patient comfort and quality of care in the healthcare system. There is a high demand for catheters with advanced features, including antimicrobial coatings, to mitigate the risk of infections, which is highly pertinent given the regional demographic and the high prevalence of diabetes-related renal failure. The competitive landscape of the dialysis business is occupied by only a few significant, well-known multinationals with solid ties to public and private hospitals and a well-established supply chain network. The dynamics of the GCC dialysis market are also dependent on the requirements for long-term vascular access, which are most applicable to patients who require consistent renal healthcare needs over a longer time.

Key segments that contributed to the derivation of the dialysis catheters and tubing market analysis are product, application, and end user.

The GCC dialysis catheters and tubing market is segmented into the United Arab Emirates, Bahrain, Saudi Arabia, Oman, Qatar, and Kuwait. The outlook for the GCC dialysis catheters and tubing market is extremely positive, with growth likely to accelerate further. A primary driver of this growth is an increase in sustainable development of local capabilities for medical device manufacturing and supply chains. Governments in the GCC are investing heavily in local production capabilities to reduce reliance on imports and create supply security, which will present opportunities for local and international companies. The market will also benefit from the growth of privatized specialized dialysis centers, which are being constructed in response to escalating demands for care. These centers typically contain state-of-the-art technology, which will increase demand for catheters and tubing. In addition, there is a gradual shift towards telemedicine and remote patient monitoring, even in home-based care plans, to improve patient convenience and reduce hospital visits. However, if telemedicine does become the accepted standard of care, there will be a demand for more user-friendly and digitally-enabled dialysis consumables.

Based on country, the GCC dialysis catheters and tubing market is segmented into the United Arab Emirates, Bahrain, Saudi Arabia, Oman, Qatar, and Kuwait. Saudi Arabia held the largest share in 2024.

The GCC market is one economic market with different market characteristics. The two primary players in the market are Saudi Arabia and the United Arab Emirates (UAE). These two markets represent a considerable share of the total revenue due to their large populations, substantial healthcare budgets, and government commitment to delivering health initiatives. Both countries have healthcare systems capable of supporting advanced medical technologies. The smaller markets of Qatar and Kuwait represent smaller market sizes. Still, they are considered high-value markets since they both spend high amounts per capita on healthcare and focus on premium high-quality medical services, providing a market opportunity to implement high-technology dialysis products. Regulatory frameworks of the GCC countries are becoming increasingly harmonized, which helps to ease the use of regional operating models for companies. However, technology companies must understand each country's specific procurement processes, clinical requirements, and rule-making conduct to establish a sufficient market-entry strategy and grow across the GCC region.

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 16.1 Million |

| Market Size by 2031 | US$ 19.1 Million |

| CAGR (2025 - 2031) | 2.5% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered |

GCC

|

| Market leaders and key company profiles |

|

Fresenius Medical Care AG & Co KGaA; Baxter International Inc.; B. Braun SE; Nipro Corp; Medtronic Plc, Nikkiso Co Ltd, Teleflex Inc, Asahi Kasei Medical Co., Ltd., Terumo Corp, and DaVita Inc., are among the key players operating in the market. These players adopt strategies such as expansion, product innovation, and mergers and acquisitions to stay competitive in the market and offer innovative products to their consumers.

The following methodology has been followed for the collection and analysis of data presented in this report:

The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

Note: All financial data included in the Company Profiles section has been standardized to US$. For companies reporting in other currencies, figures have been converted to US$ using the relevant exchange rates for the corresponding year.

Business Market Insights conducts a significant number of primary interviews each year with industry stakeholders and experts to validate and analyze the data and gain valuable insights. These research interviews are designed to:

Primary research is conducted via email interactions and telephone interviews with industry experts across various markets, categories, segments, and sub-segments in different regions. Participants typically include:

The GCC Dialysis Catheters and Tubing Market is valued at US$ 16.1 Million in 2024, it is projected to reach US$ 19.1 Million by 2031.

As per our report GCC Dialysis Catheters and Tubing Market, the market size is valued at US$ 16.1 Million in 2024, projecting it to reach US$ 19.1 Million by 2031. This translates to a CAGR of approximately 2.5% during the forecast period.

The GCC Dialysis Catheters and Tubing Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the GCC Dialysis Catheters and Tubing Market report:

The GCC Dialysis Catheters and Tubing Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The GCC Dialysis Catheters and Tubing Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the GCC Dialysis Catheters and Tubing Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)