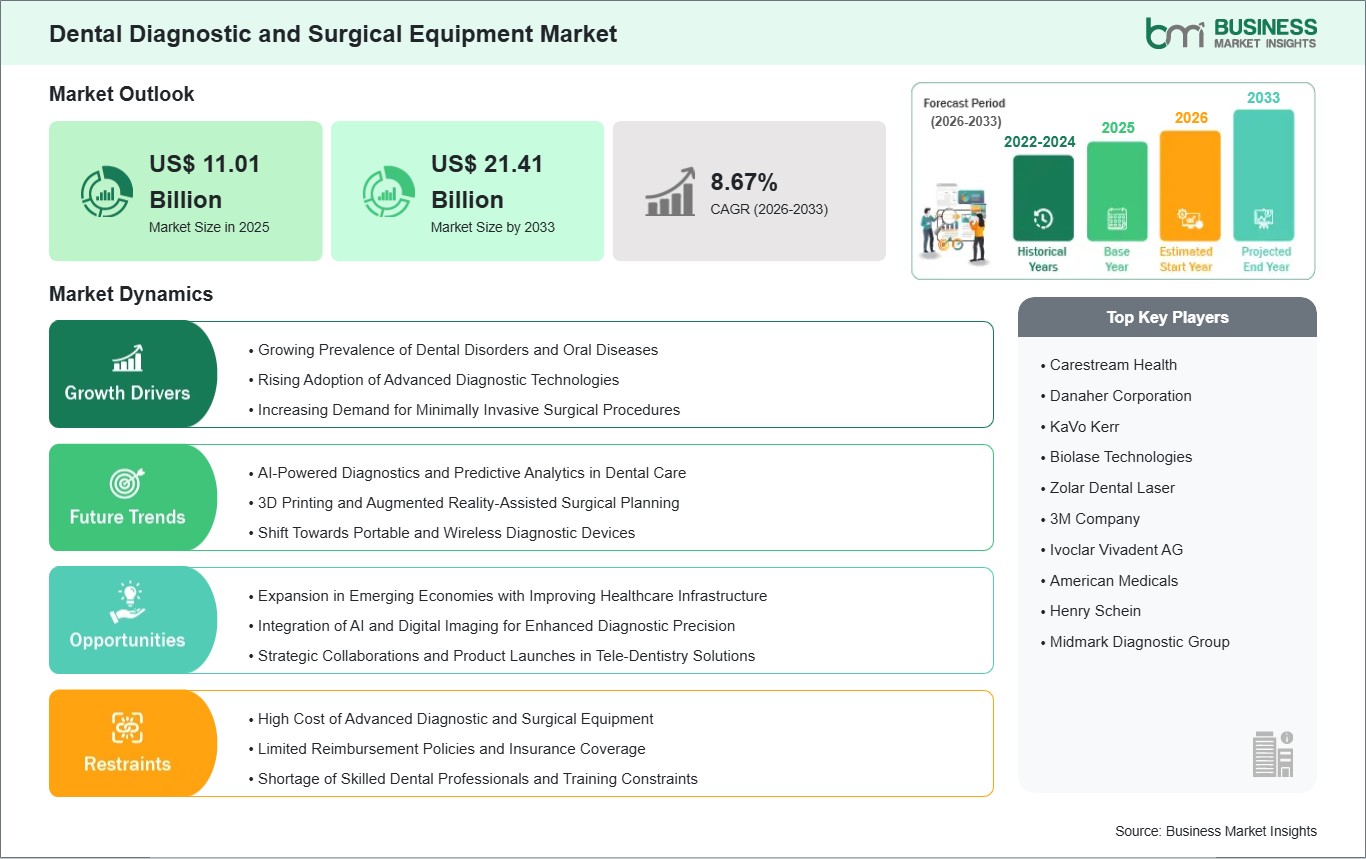

The Dental Diagnostic and Surgical Equipment Market size is expected to reach US$ 21.41 billion by 2033 from US$ 11.01 billion in 2025. The market is estimated to record a CAGR of 8.67% from 2026 to 2033.

Dental diagnostic and surgical equipment refers to a diverse selection of professional instruments and gadgets that dental health professionals rely upon to inspect, determine, plan, and even carry out operations in oral health care. Among these are imaging systems akin to direct digital X-rays, cone-beam computed tomography (CBCT), intraoral scanners, and, among the surgical tools, such as handpieces, lasers, and computer-guided surgical devices. These technologies help improve accuracy, enhance patient comfort, and optimize clinical outcomes across general dentistry, oral surgery, implantology, and cosmetic procedures.

The global dental diagnostic and surgical equipment market is experiencing steady growth as a result of various factors like the increasing rate of dental problems, the aging of the elderly population, the spreading of oral health awareness, and the quick adoption of digital and minimally invasive technologies. Presently, North America is at the forefront of the market mainly because of the modern healthcare infrastructure and the very high dental services spending, while the Asia-Pacific region is becoming a major factor for growth thanks to its expanding access to dental care and the rise of the middle class. Besides, technological advances such as AI-assisted diagnostics, 3D imaging systems, and laser-assisted surgical tools are leading the change of clinical workflows by allowing earlier diagnosis and quicker treatments. The high costs of the equipment and the differing reimbursement systems are some of the difficulties encountered; however, the development of portable diagnostic devices and the creation of better digital platforms for preventive and personalized dental care remain potential areas of opportunity.

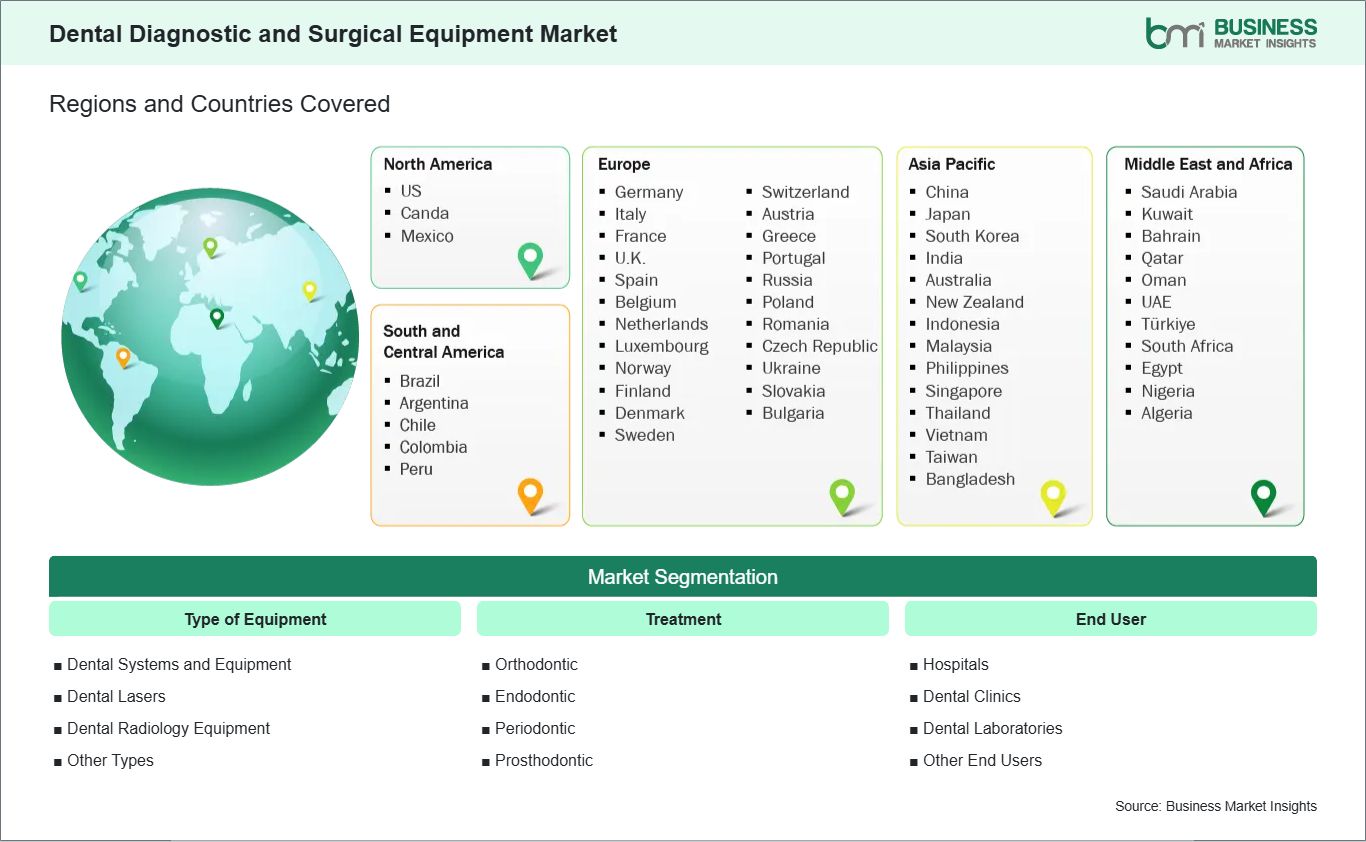

Key segments that contributed to the derivation of the dental diagnostic and surgical equipment market analysis are type of equipment, treatment, and end user.

A high-impact factor in the dental diagnostic and surgical equipment market is the progressively increasing global occurrence of dental diseases, which urges both the patients and the providers to focus on early detection and preventive care. As per world health statistics, 3.7 billion people are suffering from oral diseases, with one of the major problems being untreated dental caries, which is the reason for the demand for upper-class diagnostic imaging and treatment technologies. The trend is not only creating the digital radiography systems, intraoral scanners, and therapeutic equipment that can precisely identify and manage caries, periodontal disease, and other oral health issues but also pushing their acceptance further. Technology in dental clinics and hospitals is moving towards choosing those that promote minimally invasive treatments, better patient comfort, and more clinical outcomes. Thus, the need for radiology, surgical tools, and integrated digital systems reinforces this driver, as providers are looking for tools that not only support preventive strategies but also comprehensive treatment planning through the increasing patient awareness of oral health.

One of the most significant opportunities in the dental diagnostic and surgical equipment market lies in the integration of artificial intelligence (AI) and smart technologies, which are transforming clinical workflows and diagnostic accuracy. AI-supported imaging and diagnosing software have been very helpful in the early identification of dental problems like the formation of cavities and the loss of bone, so some clinical trials have even reported diagnostic accuracies that are higher than the traditional methods. The fast uptake of AI and smart systems offers the chance to create different products and to have luxurious solutions in dental clinics that are focused on precision care. Moreover, the developers are applying AI to intraoral scanners, CBCT imaging solutions, and workflow platforms, which have features like decision support, lesser chair time, and the ability to do predictive analytics. These innovations are attracting dentists who want to have quick work done, fewer manual errors, and better patient outcomes. As the demand for digital dentistry is on the rise and the clinics are getting the intelligent equipment that are connected, the manufacturers and the service providers can easily tap into the new, unexploited market segments and gradually move to tele-dentistry, cloud-based solutions, and technologies for the personalized care of the patients.

By type of equipment, the dental diagnostic and surgical equipment market is categorized into dental systems and equipment, dental lasers, dental radiology equipment, other types. The dental radiology equipment segment held the largest share of the market in 2025. Dental radiology equipment leads due to its fundamental role in diagnosis across virtually all dental procedures. Imaging devices like digital X-rays, CBCT and intraoral systems are indispensable for treatment planning, early disease detection, and precision care, resulting in higher adoption and spend relative to lasers or general systems. Radiology's ability to support multiple specialties and improve clinical outcomes sustains its market dominance.

By treatment, the market is segmented into orthodontic, endodontic, periodontic, prosthodontic. The prosthodontic segment held the largest share of the market in 2025. Prosthodontics involves high-value restorative procedures—such as crowns, bridges, dentures and implants—which require diverse diagnostic, surgical and CAD/CAM devices. The prevalence of edentulism in ageing populations and increased demand for aesthetic rehabilitation drive strong equipment utilization and market share.

By end user, the dental diagnostic and surgical equipment market is segmented into hospitals, dental clinics, dental laboratories, other end users. The dental clinics segment dominated the market in 2025. Dental clinics dominate the market as they perform the bulk of routine and specialized dental services worldwide. Clinics have proliferated in urban and emerging markets, adopt new technologies rapidly, and represent the first point of patient care, leading to higher recurring purchases of equipment versus laboratories or smaller practices.

| Report Attribute | Details |

|---|---|

| Market size in 2025 | US$ 11.01 Billion |

| Market Size by 2033 | US$ 21.41 Billion |

| Global CAGR (2026 - 2033) | 8.67% |

| Historical Data | 2022-2024 |

| Forecast period | 2026-2033 |

| Segments Covered | By Type of Equipment

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

|

The " Dental Diagnostic and Surgical Equipment Market Size and Forecast (2022-2033)" report provides a detailed analysis of the market covering below areas:

The geographical scope of the dental diagnostic and surgical equipment market report is divided into five regions: North America, Asia Pacific, Europe, Middle East and Africa, and South and Central America. The dental diagnostic and surgical equipment market in Asia Pacific is expected to grow significantly during the forecast period.

The Asia-Pacific dental diagnostic and surgical equipment market is segmented into China, Japan, South Korea, India, Australia, New Zealand, Indonesia, Malaysia, the Philippines, Singapore, Thailand, Vietnam, Taiwan, Bangladesh, and the Rest of Asia. The Asia-Pacific dental diagnostic and surgical equipment market is experiencing robust growth, due to healthcare system, economic, and demographic factors. The large and old population of the entire region is one of the main reasons for the growing demand for more advanced diagnostic and surgical equipment. The main contributors to this demand are the increase in these dental conditions in older people and the aging population in countries like Japan, China, and South Korea, where such conditions are very common. Consumers with larger disposable incomes and middle-class populations that are growing in countries like India, China, Indonesia, and Vietnam are spending more on dental care that includes not only basic dental care but also elective and cosmetic procedures for which modern equipment is required. The trend of urbanization, along with the increasing awareness regarding oral hygiene, has led to more patients going to the dentist sooner rather than later, which in turn has resulted in higher use of imaging systems and minimally invasive surgical tools. Governments in the area are upgrading medical facilities and giving subsidies for medical treatments that are not covered by health insurance, which in turn is making dental services more accessible and encouraging clinics and hospitals to get new machines.

Besides, the Asia-Pacific region has turned into a hotspot for dental tourism, with countries such as Thailand, India, and Malaysia pulling in patients from abroad seeking cheaper but still high-quality dental care procedures, thus increasing the utilization of equipment in the dental sector. The rapid adoption of digital dentistry technologies by private clinics and dental chains is also accelerating market growth.

The dental diagnostic and surgical equipment market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the key developments in the dental diagnostic and surgical equipment market are:

The Dental Diagnostic and Surgical Equipment Market is valued at US$ 11.01 Billion in 2025, it is projected to reach US$ 21.41 Billion by 2033.

As per our report Dental Diagnostic and Surgical Equipment Market, the market size is valued at US$ 11.01 Billion in 2025, projecting it to reach US$ 21.41 Billion by 2033. This translates to a CAGR of approximately 8.67% during the forecast period.

The Dental Diagnostic and Surgical Equipment Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Dental Diagnostic and Surgical Equipment Market report:

The Dental Diagnostic and Surgical Equipment Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Dental Diagnostic and Surgical Equipment Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Dental Diagnostic and Surgical Equipment Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)