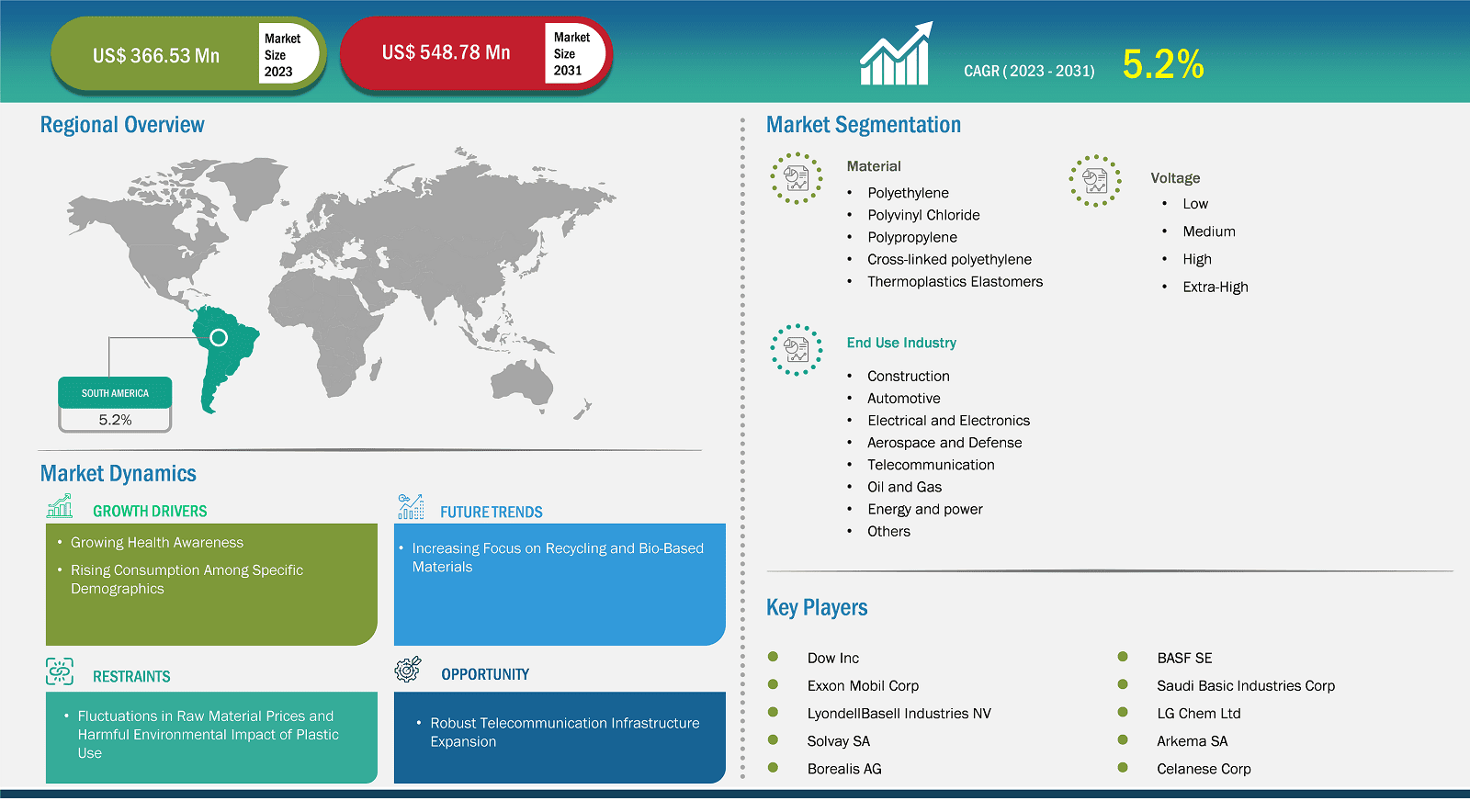

The South & Central America Wire and Cable Plastics Market size is expected to reach US$ 548.78 million by 2031 from US$ 366.53 million in 2023. The market is estimated to record a CAGR of 5.2% from 2023 to 2031.

Executive Summary and South & Central America Wire and Cable Plastics Market Analysis:

South & Central America has experienced significant industrial growth in sectors such as automotive, aerospace, and electronics. Brazil is one of the strongest markets for aircraft manufacturing across the globe. Brazil-based Embraer is the fourth largest aircraft manufacturer in the world, after Airbus, Boeing, and Bombardier Aerospace. The rising number of air passengers in the region supports the aircraft manufacturing industry. Regional manufacturers are investing in strategic initiatives such as product development, mergers, and acquisitions to gain a competitive position in the market. For instance, in September 2022, South American rotorcraft operator Ecocopter collaborated with Airbus on possible plans to launch urban air mobility (UAM) services with eVTOL aircraft in markets such as Chile, Ecuador, and Peru. In April 2024, Embraer and ENAER (National Aeronautical Company of Chile) announced two industrial and services cooperation agreements involving the A-29 Super Tucano and the C-390 Millennium defense aircraft and commercial aircraft. The cooperation will expand Embraer's network of suppliers and services in Chile and contribute to integrating the aerospace industries in Brazil and Chile.

The growth of the automotive industry is driving the demand for wire and cable plastics in the region. According to the OICA, the total number of vehicles produced in South and Central America grew from ~2.96 million in 2022 to ~2.97 million in 2023, registering an increase of 9%. Moreover, major market players in the automotive industry have strategized the expansion of their operational capacities in South and Central America. For instance, in 2022, Audi AG invested US$ 19.2 million to restart production at its plant in Parana, Brazil, registering a capacity of 4,000 vehicles per year. Countries such as Brazil and Argentina expand their automotive manufacturing sectors, which promotes integrating advanced electronics and EV technologies into vehicles. With more electronics embedded in vehicles for functions such as infotainment systems, advanced driver-assistance systems (ADAS), and engine control units (ECUs), high-performance wire and cable plastics have become crucial to ensure the reliability and performance of these components. This has led to a rising demand for wire and cable plastics that offer superior lightweight properties, excellent electrical insulation, and high thermal resistance.

South & Central America Wire and Cable Plastics Market Segmentation Analysis:

Key segments that contributed to the derivation of the wire and cable plastics market analysis are material, voltage, and end-use industry.

South & Central America Wire and Cable Plastics Market Outlook

The global telecommunications industry is expanding, which is driven by technological advancements and increasing internet penetration, leading to an increased need for robust and reliable cabling infrastructure. This demand directly impacts the consumption of plastics used in manufacturing telecommunication cables, including optical fiber cables, coaxial cables, and ethernet cables—which rely on materials such as PE, PVC, and PP for insulation, jacketing, and durability. With 5G technology requiring high-capacity fiber optics cables for seamless data transmission, the telecommunication industry demands superior quality that offers enhanced protection against environmental factors such as moisture, heat, and UV radiation. According to the GSM Association, 5G networks are likely to cover one-third (1.2 billion) of the world's population by 2025. In addition, there is a widespread rollout of 5G networks across the globe, which has led to an increased demand for smartphones and other consumer electronics. For instance, in October 2021, AIS and Samsung jointly launched a voice-over 5G radio service enabling voice calls on AIS's 5G standalone (SA) network in Thailand. Samsung Electronics and Viettel announced the launch of 5G commercial trials in Da Nang (Vietnam) in December 2021. In addition, according to Viavi Solutions Inc.'s report, in April 2023, over 92 countries across the globe launched 5G networks. Further, 23 countries have pre-commercial 5G network trials underway, and 32 nations have announced their 5G rollout plans. The widespread rollout of 5G networks has led to an increased demand for smartphones and other consumer electronics products. Plastics ensure the longevity and reliability of cables in outdoor and underground installations, boosting their adoption. Additionally, the increasing deployment of fiber-to-the-home (FTTH) and fiber-to-the-premises (FTTP) networks further boosts the need for plastic-coated wires and cables. Further, data transmission has become crucial in modern communication networks, particularly with the rollout of 5G and the increasing use of fiber-optic cables. These cables demand durable plastic coatings to ensure signal integrity, minimize data loss, and protect against environmental factors such as moisture, heat, and mechanical stress.

South & Central America Wire and Cable Plastics Market Country Insights

Based on country, the South & Central America wire and cable plastics market comprises Brazil, Argentina, and the Rest of South & Central America. Brazil held the largest share in 2023.

In Brazil, the demand for wire and cable plastics is growing significantly owing to their essential role in various industries, mainly energy and power, construction, automotive, technology, and manufacturing. The wire and cable plastics market in Brazil is emerging as a promising sector driven by the availability of abundant natural resources, a growing industrial base, and increased demand for high-performance insulation materials in the country. The rising residential and commercial sectors in Brazil are the prime contributors to the wire and cable plastics market. In April 2024, the Brazilian government announced a fund of ~US$ 2.28 billion (R$ 11.6 billion) for the construction of 112,500 homes under the My Home My Life (MCMV) program in rural areas and municipalities. Burgeoning construction activities and investments empower the demand for wire and cable plastics. The booming aerospace industry is one of the major drivers of the demand for electronic thermal management materials in the country. According to the Aerospace Industries Association of Brazil (AIAB), Brazil has the largest aerospace industry in the Southern Hemisphere, with Embraer being the largest representative company. The firm produces commercial, military, and executive aircraft and is currently the third major aerospace manufacturer in the world. Wire and cable plastics have found crucial applications in the automotive industry in Brazil. According to the OICA, Brazil was the largest manufacturer and exporter of light and commercial vehicles in South and Central America in 2023. The country reported production of 2.3 million vehicles in 2022, recording a surge of 5% compared to 2021. Thus, the expanding automotive production industry and increasing vehicle ownership in Brazil are expected to propel the demand for automotive electronics, thereby bolstering the growth of the wire and cable plastics market in Brazil.

South & Central America Wire and Cable Plastics Market Company Profiles

Some of the key players operating in the market include Dow Inc, Exxon Mobil Corp, LyondellBasell Industries NV, Solvay SA, Borealis AG, BASF SE, Saudi Basic Industries Corp, LG Chem Ltd, Arkema SA, and Celanese Corp among others. These players are adopting various strategies such as expansion, product innovation, and mergers and acquisitions to provide innovative products to their consumers and increase their market share.

South & Central America Wire and Cable Plastics Market Research Methodology :

The following methodology has been followed for the collection and analysis of data presented in this report:

The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

Note: All financial data included in the Company Profiles section has been standardized to USD. For companies reporting in other currencies, figures have been converted to USD using the relevant exchange rates for the corresponding year.

Business Market Insight’ conducts a significant number of primary interviews each year with industry stakeholders and experts to validate its data analysis, and gain valuable insights. These research interviews are designed to:

Primary research is conducted via email interactions and telephone interviews, encompassing various markets, categories, segments, and sub-segments across different regions. Participants typically include:

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 366.53 Million |

| Market Size by 2031 | US$ 548.78 Million |

| CAGR (2023 - 2031) | 5.2% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Material

|

| Regions and Countries Covered |

South and Central America

|

| Market leaders and key company profiles |

|

The South & Central America Wire and Cable Plastics Market is valued at US$ 366.53 Million in 2023, it is projected to reach US$ 548.78 Million by 2031.

As per our report South & Central America Wire and Cable Plastics Market, the market size is valued at US$ 366.53 Million in 2023, projecting it to reach US$ 548.78 Million by 2031. This translates to a CAGR of approximately 5.2% during the forecast period.

The South & Central America Wire and Cable Plastics Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South & Central America Wire and Cable Plastics Market report:

The South & Central America Wire and Cable Plastics Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South & Central America Wire and Cable Plastics Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South & Central America Wire and Cable Plastics Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)