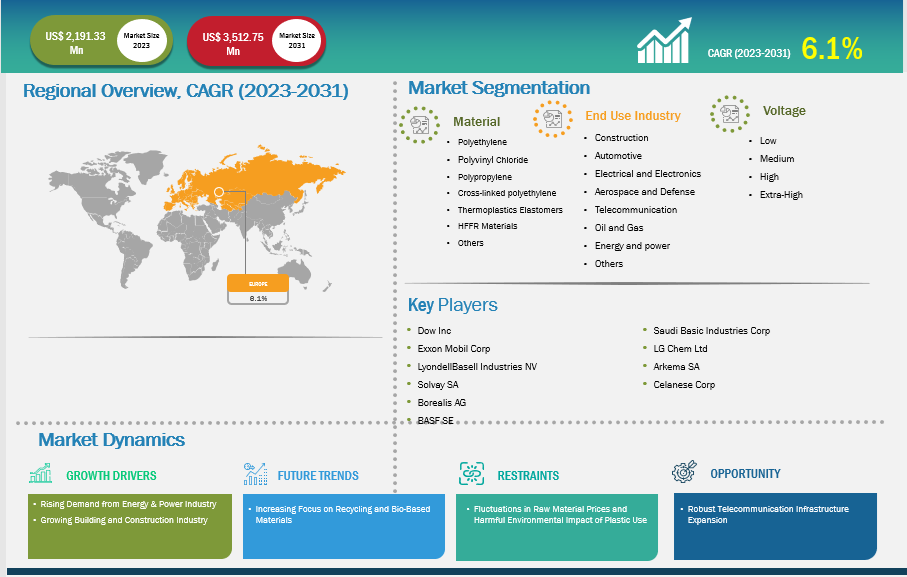

The Europe Wire and Cable Plastics Market size is expected to reach US$ 3,512.75 million by 2031 from US$ 2,191.33 million in 2023. The market is estimated to record a CAGR of 6.1% from 2023 to 2031.

Executive Summary and Europe Wire and Cable Plastics Market Analysis:

Various countries in Europe are experiencing increasing advancements and expansions in the automotive, electronics, and aerospace industries. 5G infrastructure development is fueling the demand for wire and cable plastics, as 5G technology requires robust electronic components to support high-speed data transmission. High-speed communication cables, including fiber optics, require advanced plastic coatings that enhance data transmission efficiency and protect against electromagnetic interference. Additionally, the growing adoption of smart devices and Internet of Things (IoT) technologies further increases the need for robust cabling systems, driving the demand for innovative plastic materials. In October 2024, the European Commission adopted the second Work Programme for the digital part of the Connecting Europe Facility (CEF) Digital, which defines the scope and objectives of European Union (EU)-funded actions to improve the region's digital connectivity infrastructures. These actions will receive ~US$ 935 million (EUR 865 million) of funding from 2024 to 2027. Improving Europe's connectivity infrastructure is fundamental for achieving Europe's 2030 Digital Decade objectives to connect all citizens and businesses with 5G and gigabit connectivity. By fostering public and private investments, CEF Digital contributes to connectivity projects of common EU interest and the deployment of safe, secure, and sustainable high-performance infrastructure across the EU, such as Gigabit and 5G networks. As a result, the demand for high-performance wire and cable plastics has grown across the region.

According to the European Commission, the construction industry is one of the major industries in Europe, contributing ~9% to the region's GDP. In June 2023, the EU invested ~US$ 6 billion in the construction of sustainable, safe, and efficient transport structures, including 107 transport infrastructure projects. The demand for wire and cable plastics in the building and construction industry is fueled by infrastructure development and the push for energy-efficient solutions. The demand for high-performance electrical wiring has surged with ongoing investments in residential, commercial, and industrial projects. Plastics, such as PVC, polyethylene, and cross-linked polyethylene (XLPE), are crucial for insulating and protecting these wires and cables, ensuring durability, flexibility, and safety in diverse environments. The automotive industry in Europe is playing an increasingly important role in driving the demand for wire and cable plastics, particularly as the region undergoes a shift toward advanced manufacturing techniques and electric vehicle (EV) production.

According to the European Commission, Europe is one of the largest manufacturers of motor vehicles worldwide. The automobile industry directly and indirectly employs 13.8 million people, resulting in 6.1% of overall employment in the European Union (EU). According to the Organisation Internationale des Constructeurs d'Automobiles (OICA), the EU automotive production increased to 4.2 million units in 2023 from 3.7 million units in 2022, registering a growth of 19%. The region has several prominent automotive players, including Volkswagen AG, Stellantis NV, Mercedes-Benz Group AG, Bayerische Motoren Werke AG, and Renault SA. Automobile manufacturers in the region are investing heavily in EV production. For instance, in February 2024, Stellantis and Mercedes-Benz announced the plan to invest US$ 7.6 billion to set up three new EV gigafactories across the EU. These factories will be set up in Kaiserslautern (Germany), Termoli (Italy), and another undisclosed location in France.

Europe has set ambitious climate goals, aiming for a significant reduction in greenhouse gas emissions, which has spurred growth in EV and battery production. With stringent European Union (EU) regulations and consumer preference for environmentally friendly transportation, the adoption of EVs is accelerating. Electric vehicles require extensive wiring systems for battery management, power distribution, and onboard electronics. Lightweight and thermally stable plastics are essential for insulating and protecting these cables, enabling efficient performance while meeting safety standards. As EV production scales up across Europe, the demand for wire and cable plastics is expected to grow exponentially in the coming years. Urbanization and smart city initiatives in Europe are a few other factors contributing to the market growth. These projects involve the installation of sophisticated power distribution and communication systems, relying heavily on high-performance cables. Moreover, the increasing focus on replacing aging infrastructure with modern, sustainable solutions has led to greater use of advanced wire and cable plastics. As countries across Europe transition toward sustainable energy systems, the deployment of wind, solar, and other renewable energy sources requires extensive cabling infrastructure. Plastics used in wire and cable applications are essential for insulation, durability, and resistance to harsh environmental conditions. In addition, the need for flexible, durable, and chemical-resistant cable insulation materials is rising to meet the demands of factory automation systems. Europe is also witnessing a growing interest in eco-friendly and bio-based plastic solutions for wire and cable applications, reflecting the region's commitment to a circular economy.

Key segments that contributed to the derivation of the wire and cable plastics market analysis are material, voltage, and end-use industry.

Europe Wire and Cable Plastics Market Outlook

The building and construction industry’s growth is fueled by several factors, including the increasing need for infrastructure development, the rise in residential and commercial construction, and advancements in modern electrical systems. As the global population grows and urbanization accelerates, there is a surging demand for electricity and communication networks, both of which are reliant on the efficient use of wires and cables. Electrical wiring is essential for powering homes, offices, schools, hospitals, and other critical infrastructures. Further, the integration of smart technologies in modern buildings, including smart lighting, HVAC systems, and security solutions, fueled the need for advanced cables capable of supporting higher power loads and data transmission.

In Europe, the growing population of countries such as the UK, Austria, Italy, and France, as well as urbanization, is leading to an urgent need for more housing. In response, both private developers and governments of these countries have initiated extensive housing projects to alleviate the housing shortage. For instance, under the Affordable Homes Programme 2021–2026, the UK government has planned to deliver up to 180,000 new homes. The variety of residential developments, from high-rise apartments and suburban houses to luxury estates and affordable housing, requires a wide range of wires and cables. These products offer a solution for homeowners seeking modern, high-performance wires and cables that can withstand the varying climates of countries in Europe.

Europe Wire and Cable Plastics Market Country Insights

Based on country, the Europe wire and cable plastics market comprises Germany, France, Italy, Russia, the UK, and the Rest of Europe. The Rest of Europe held the largest share in 2023.

Spain, Austria, Poland, Portugal, the Netherlands, and Belgium are among the major countries in the wire and cable plastics market in the Rest of Europe. The thriving electronics industry, driven by technological advancements and increased consumer demand, is a major factor boosting the demand for wire and cable plastics in these countries. In addition, as these nations invest notably in modernizing and expanding their urban areas, there is a surging requirement for wire and cable plastics. As per the data obtained from the Main Statistical Office of Poland (GUS), the comparable prices of construction and assembly production rose by 6.6% year-on-year and by 10.6% month-on-month in February 2023, attributed to growth in civil construction in Poland. Modern buildings require complex wiring systems for power distribution, HVAC, and smart technologies, all of which utilize plastic-insulated cables for safety and reliability.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 2,191.33 Million |

| Market Size by 2031 | US$ 3,512.75 Million |

| CAGR (2023 - 2031) | 6.1% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Material

|

| Regions and Countries Covered |

Europe

|

| Market leaders and key company profiles |

|

Some of the key players operating in the market include Dow Inc, Exxon Mobil Corp, LyondellBasell Industries NV, Solvay SA, Borealis AG, BASF SE, Saudi Basic Industries Corp, LG Chem Ltd, Arkema SA, and Celanese Corp among others. These players are adopting various strategies such as expansion, product innovation, and mergers and acquisitions to provide innovative products to their consumers and increase their market share.

Europe Wire and Cable Plastics Market Research Methodology:

The following methodology has been followed for the collection and analysis of data presented in this report:

The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

Note: All financial data included in the Company Profiles section has been standardized to USD. For companies reporting in other currencies, figures have been converted to USD using the relevant exchange rates for the corresponding year.

Business Market Insight’ conducts a significant number of primary interviews each year with industry stakeholders and experts to validate its data analysis, and gain valuable insights. These research interviews are designed to:

Primary research is conducted via email interactions and telephone interviews, encompassing various markets, categories, segments, and sub-segments across different regions. Participants typically include:

The Europe Wire and Cable Plastics Market is valued at US$ 2,191.33 Million in 2023, it is projected to reach US$ 3,512.75 Million by 2031.

As per our report Europe Wire and Cable Plastics Market, the market size is valued at US$ 2,191.33 Million in 2023, projecting it to reach US$ 3,512.75 Million by 2031. This translates to a CAGR of approximately 6.1% during the forecast period.

The Europe Wire and Cable Plastics Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Wire and Cable Plastics Market report:

The Europe Wire and Cable Plastics Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Wire and Cable Plastics Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Wire and Cable Plastics Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)