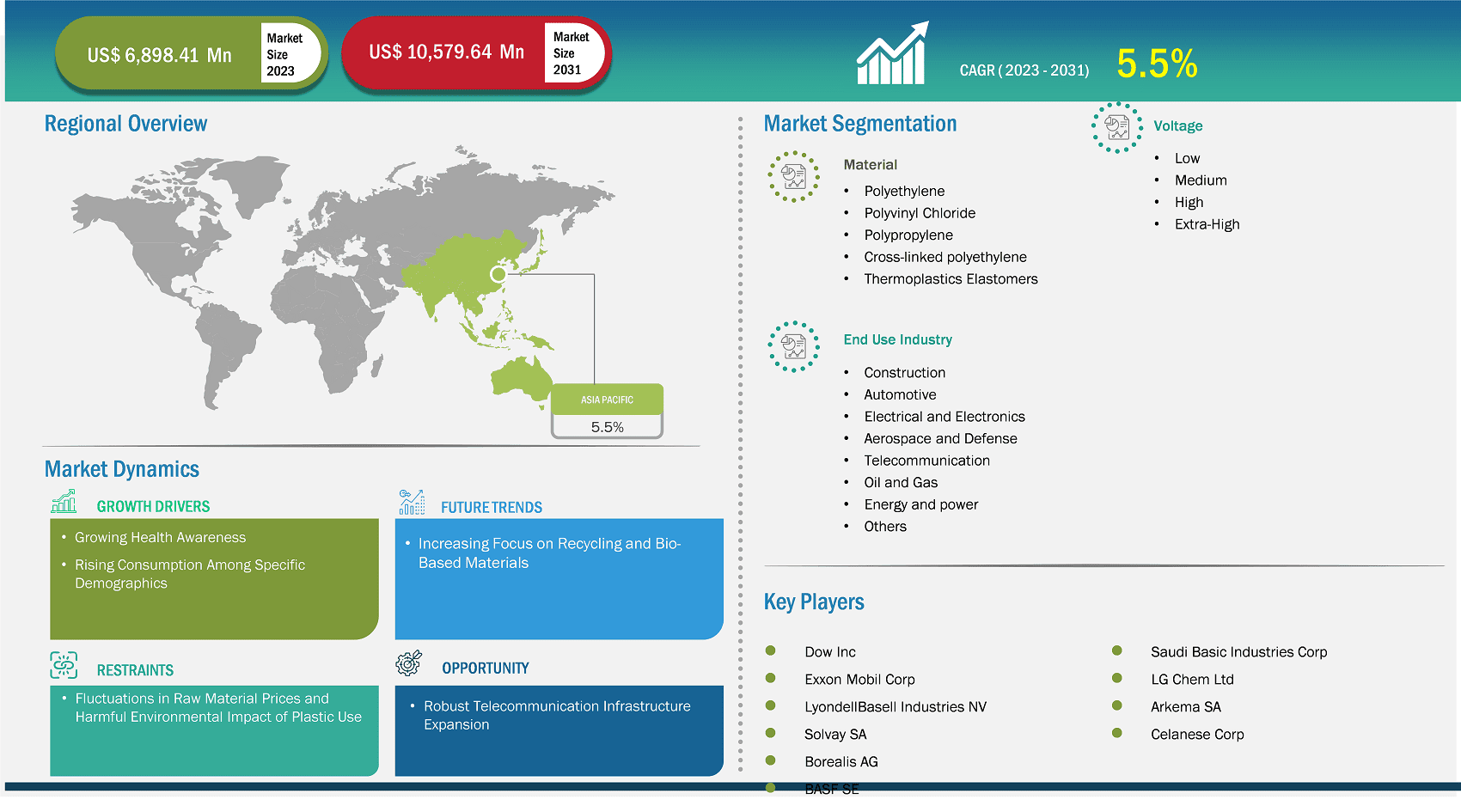

The Asia Pacific Wire and Cable Plastics Market size is expected to reach US$ 10,579.64 million by 2031 from US$ 6,898.41 million in 2023. The market is estimated to record a CAGR of 5.5% from 2023 to 2031.

Executive Summary and Asia Pacific Wire and Cable Plastics Market Analysis:

Asia Pacific is one of the prominent markets for utilizing wire and cable plastics, owing to the growing automotive, electronics, construction, and energy and power industries. Asia Pacific is a global leader in consumer electronics, with major companies such as Samsung, Sony, and Xiaomi at the forefront of innovation. Asia Pacific is a global hub for consumer electronics production, with countries such as China, South Korea, Japan, and India hosting major manufacturing facilities for smartphones, laptops, wearable devices, and home appliances. Investments in electronics production facilities across Asia, especially in China and South Korea, have accelerated the adoption of wire and cable plastics to meet the technical demands of high-performance consumer electronic devices. For instance, in March 2024, Neways expanded global operations with a new high-tech manufacturing facility in Malaysia. This thriving industry requires extensive use of insulated wires and cables for power supply, signal transmission, and connectivity within electronic devices, fueling the demand for high-performance plastic materials.

Key segments that contributed to the derivation of the wire and cable plastics market analysis are material, voltage, and end-use industry.

Asia Pacific Wire and Cable Plastics Market Outlook

The global telecommunications industry is expanding, which is driven by technological advancements and increasing internet penetration, leading to an increased need for robust and reliable cabling infrastructure. This demand directly impacts the consumption of plastics used in manufacturing telecommunication cables, including optical fiber cables, coaxial cables, and ethernet cables—which rely on materials such as PE, PVC, and PP for insulation, jacketing, and durability. With 5G technology requiring high-capacity fiber optics cables for seamless data transmission, the telecommunication industry demands superior quality that offers enhanced protection against environmental factors such as moisture, heat, and UV radiation.

According to the GSM Association, 5G networks are likely to cover one-third (1.2 billion) of the world's population by 2025. In addition, there is a widespread rollout of 5G networks across the globe, which has led to an increased demand for smartphones and other consumer electronics. For instance, in October 2021, AIS and Samsung jointly launched a voice-over 5G radio service enabling voice calls on AIS's 5G standalone (SA) network in Thailand. Samsung Electronics and Viettel announced the launch of 5G commercial trials in Da Nang (Vietnam) in December 2021. In addition, according to Viavi Solutions Inc.'s report, in April 2023, over 92 countries across the globe launched 5G networks. Further, 23 countries have pre-commercial 5G network trials underway, and 32 nations have announced their 5G rollout plans. The widespread rollout of 5G networks has led to an increased demand for smartphones and other consumer electronics products. Plastics ensure the longevity and reliability of cables in outdoor and underground installations, boosting their adoption. Additionally, the increasing deployment of fiber-to-the-home (FTTH) and fiber-to-the-premises (FTTP) networks further boosts the need for plastic-coated wires and cables. Further, data transmission has become crucial in modern communication networks, particularly with the rollout of 5G and the increasing use of fiber-optic cables. These cables demand durable plastic coatings to ensure signal integrity, minimize data loss, and protect against environmental factors such as moisture, heat, and mechanical stress.

Asia Pacific Wire and Cable Plastics Market Country Insights

Based on country, the Asia Pacific wire and cable plastics market comprises China, Japan, India, Australia, South Korea, and the Rest of Asia Pacific. China held the largest share in 2023.

Rapid urbanization is one of the primary factors fueling the growth of the construction industry in China. Demographic factors such as the continuous growth of the elderly population and improvements in the standards of living of the masses owing to urbanization also bolster this industry. The country has the world's largest construction market, which is highly supported by government initiatives. Under the 14th Five-Year Plan, China aims to boost its urbanization rate to 65% during 2021–2025. Thus, government support for urbanization has the potential to bring further developments in the construction and infrastructure sectors, thereby driving the demand for wire and cable plastics. China is the global leader in the production of passenger cars, commercial vehicles, and electronic product assembly. The government of China has introduced the "Made in China 2025" initiative, which further drives the manufacturing sector. As the world's largest producer of electronic devices, including smartphones, tablets, computers, and home appliances, China relies heavily on high-performance wire and cable plastics to enhance the performance, safety, and longevity of these products. Furthermore, China's automotive industry, especially the EV sector, plays a significant role in boosting the demand for wire and cable plastics. EV manufacturers are increasingly turning to advanced plastics, such as PVC, PE, and thermoplastic elastomers, for the insulation of power cables, connectors, and harnesses in vehicles. These materials ensure that the cables are lightweight, durable, and resistant to environmental factors, contributing to the efficient functioning of EVs.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 6,898.41 Million |

| Market Size by 2031 | US$ 10,579.64 Million |

| CAGR (2023 - 2031) | 5.5% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Material

|

| Regions and Countries Covered |

Asia Pacific

|

| Market leaders and key company profiles |

|

Some of the key players operating in the market include Dow Inc, Exxon Mobil Corp, LyondellBasell Industries NV, Solvay SA, Borealis AG, BASF SE, Saudi Basic Industries Corp, LG Chem Ltd, Arkema SA, and Celanese Corp among others. These players are adopting various strategies such as expansion, product innovation, and mergers and acquisitions to provide innovative products to their consumers and increase their market share.

Asia Pacific Wire and Cable Plastics Market Research Methodology :

The following methodology has been followed for the collection and analysis of data presented in this report:

The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

Note: All financial data included in the Company Profiles section has been standardized to USD. For companies reporting in other currencies, figures have been converted to USD using the relevant exchange rates for the corresponding year.

Business Market Insight’ conducts a significant number of primary interviews each year with industry stakeholders and experts to validate its data analysis, and gain valuable insights. These research interviews are designed to:

Primary research is conducted via email interactions and telephone interviews, encompassing various markets, categories, segments, and sub-segments across different regions. Participants typically include:

The Asia Pacific Wire and Cable Plastics Market is valued at US$ 6,898.41 Million in 2023, it is projected to reach US$ 10,579.64 Million by 2031.

As per our report Asia Pacific Wire and Cable Plastics Market, the market size is valued at US$ 6,898.41 Million in 2023, projecting it to reach US$ 10,579.64 Million by 2031. This translates to a CAGR of approximately 5.5% during the forecast period.

The Asia Pacific Wire and Cable Plastics Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Wire and Cable Plastics Market report:

The Asia Pacific Wire and Cable Plastics Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Wire and Cable Plastics Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Wire and Cable Plastics Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)