From decades, the telecommunication industry is widely using copper for their communication purpose. Copper is the metal that has been utilized for communication wires and cables. As copper is a ductile material, having tensile strength, and a satisfactory conductor, it is widely used for communication purpose. Moreover, with evolving telecommunication industry, advanced material is used. Despite the roll out of optical fiber systems, copper is still used highly in infrastructure and interface devices. Such copper-based applications in telecommunication will endure to fuel the growth of copper in the future. Moreover, aluminum is gaining popularity in the telecommunication industry for applications such as base station, 5G equipment, and wired & wireless telecom equipment. As wire and cable in telecommunication is highly used, the demand for aluminum and copper wire rods is also high. This factor will, in turn, fuel the demand for wire rods. The adoption of 5G infrastructure is continuously increasing due to the growing smart cities, smart cars, and smart factories. Growing 5G deployment is accelerating the growth of various industries, sectors, and governments by quickly and efficiently connecting organizations to every aspect of their business. In addition, ultra-fast 5G mmWave is creating new use cases for technologies such as AI through distributed computing and connected intelligent edge for immersive XR. Thus, the 5G technology is fueling digital transformations across the world by connecting people to their homes and cars and different businesses to their supply chains. Also, the growing of 5G network helps in increasing the adoption of robotics for various industrial purposes, which will subsequently increase the demand for wire rods to construct 5G infrastructure for uninterrupted communication and data transfer. Therefore, the growing demand for 5G is expected to create lucrative opportunities for the South America wire rod market during the forecast period.

The South America wire rod market is segmented into Brazil, Argentina, and the Rest of South America. Brazil is estimated to be the most significant contributor to the revenue of the SAM wire rod market during the forecast period. Wire rods are used for continuous power supply in electric and hybrid vehicles. They are also used to provide robust connectivity, which is raising their demand for electric vehicles. The automotive industry in SAM is currently going through a transitional shift toward electric vehicle mobility. Most of the global automotive companies, including BMW, BYD, Ford, General Motors, Honda, Hyundai, Kia, Land Rover, and Mercedes-Benz, have manufacturing operations in the country. The automotive industry accounts for approximately 15% of Brazil’s industrial GDP. According to Atradius Collections, in the 1st half of 2021, there was a 33% increase in the registration of new passenger cars in Brazil. Similarly, Colombia has also experienced tremendous growth in the automotive industry. According to United Nations Industrial Development Organization, the country’s automotive industry represents 6.2% of its industrial GDP. Also, as per the National Traffic Registry (RUNT) of Colombia, in June 2022, 23,306 new vehicles were registered, which represented an increase of 14.1% compared to June 2021. Thus, the growing automotive industry in these countries is propelling the growth of the South America wire rod market.

Strategic insights for the South America Wire Rod provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the South America Wire Rod refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.South America Wire Rod Strategic Insights

South America Wire Rod Report Scope

Report Attribute

Details

Market size in 2022

US$ 126.08 Million

Market Size by 2028

US$ 147.42 Million

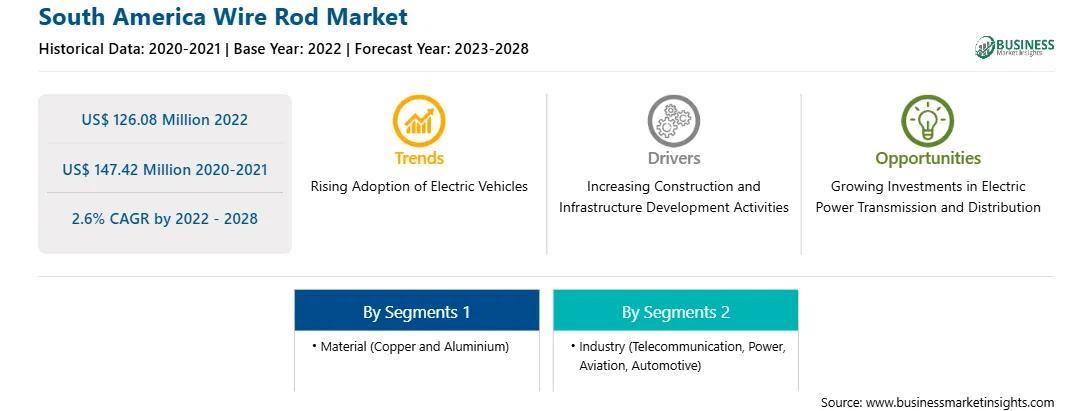

CAGR (2022 - 2028) 2.6%

Historical Data

2020-2021

Forecast period

2023-2028

Segments Covered

By Material

By Industry

Regions and Countries Covered

South and Central America

Market leaders and key company profiles

South America Wire Rod Regional Insights

The South America wire rod market is segmented into material, industry, and country.

Based on material, the South America wire rod market is bifurcated into copper and aluminium. The copper segment held a larger share of the South America wire rod market in 2022.

Based on industry, the South America wire rod market is segmented into telecommunication, power, aviation, automotive, and others. The telecommunication segment held the largest share of the South America wire rod market in 2022.

Based on country, the South America wire rod market has been categorized into Brazil, Argentina, Peru, Chile, and the rest of South America. Our regional analysis states that Chile dominated the South America wire rod market in 2022.

Alcoa Corp, APAR Industries Ltd, Elcowire Group AB, Hindalco Industries Ltd, Mitsubishi Materials Trading Corp, Norsk Hydro ASA, Sumitomo Electric Industries Ltd, United Co RUSAL Plc, and Vimetco NV are the leading companies operating in the South America wire rod market.

The South America Wire Rod Market is valued at US$ 126.08 Million in 2022, it is projected to reach US$ 147.42 Million by 2028.

As per our report South America Wire Rod Market, the market size is valued at US$ 126.08 Million in 2022, projecting it to reach US$ 147.42 Million by 2028. This translates to a CAGR of approximately 2.6% during the forecast period.

The South America Wire Rod Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South America Wire Rod Market report:

The South America Wire Rod Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South America Wire Rod Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South America Wire Rod Market value chain can benefit from the information contained in a comprehensive market report.