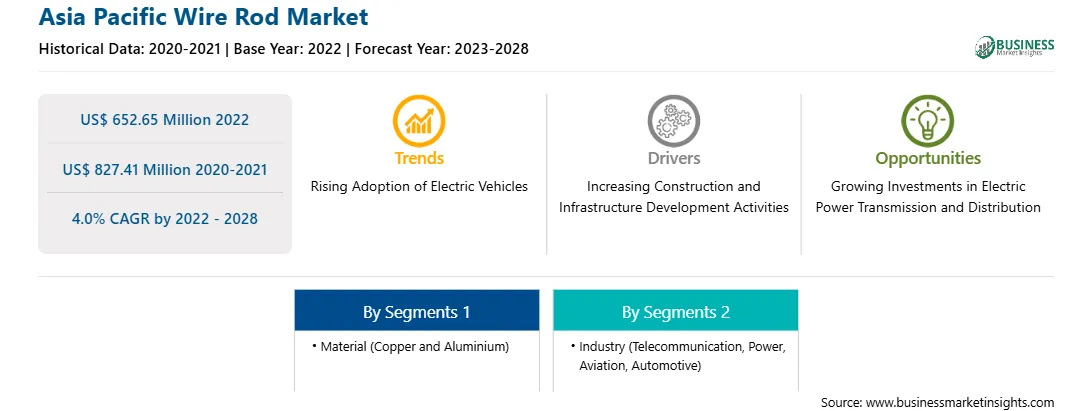

The Asia Pacific wire rod market is expected to grow from US$ 652.65 million in 2022 to US$ 827.41 million by 2028. It is estimated to grow at a CAGR of 4.0% from 2022 to 2028.

Strong Inclination Toward Aluminum is Fuelling Asia Pacific Wire Rod Market

With constant developments, the automotive industry is witnessing an upward trend. The industry is getting inclined toward using aluminum because of its intrinsic properties. Both passenger and commercial vehicle manufacturers are utilizing aluminum. As aluminum is a lightweight material known for improving performance, the demand for the same is rising. Also, owing to its versatile, durable, and corrosion resistance characteristic, the demand for aluminum is expanding. At present, aluminum is a second used metal in vehicles and predicted to be the fastest growing. Growth in aluminum depicts metal prominence in the automobile manufacturing. Pertaining to changing consumer consciousness toward tightening of emission norms and sustainability, an upward trend is witnessed in aluminum usage among the vehicles including hybrids, internal combustion engine (ICE) vehicles, and battery electric vehicles (BEVs). As major proportion (more than 60%) of aluminum production is used for producing wire rods, the inclination toward manufacturing aluminum wire rods will rise. Also, coupled with rising demand for cars, aluminum wire rods are projected to grow at a faster CAGR during the forecast period. For applications such as electrical wiring, the demand for aluminum-based products (wires) is rising. Therefore, with growing demand of wires in automotive, production of aluminum wire rods will also penetrate.

Asia Pacific Wire Rod Market Overview

A wire rod is used as a communication cable in the telecommunication industry. The growing adoption of 5G communication in Asia Pacific is increasing the demand for wire rods. According to GSMA, mobile operators in Asia Pacific plan to invest US$ 227 billion in 5G deployments between 2022 and 2025. In addition, in April 2022, SoftBank, a Japanese operator, announced its plan to raise approximately US$ 283 million (JPY 35 billion) for the construction of 5G base stations. Through this investment, the company can provide ultra-high speeds, reliability, low latency, and massive device connectivity in the country. Similarly, according to the 2022 World 5G Convention, telecom operators in China have invested ~US$ 59.4 billion (401.6 billion yuan) in 5G. Thus, such investment in 5G technology is expected to boost the demand for wire rods, which is likely to fuel the market growth during the forecast period. Further, wire rods are used for high-voltage overhead transmission lines. They also help to connect power grids with various end users, including industrial, residential, and commercial buildings. In APAC, investment in the power & energy sector is increasing due to the rising demand for electricity. For instance, in February 2023, the Government of India approved the investment of US$ 3.9 billion (Rs. 319 billion) for the 2,880-megawatt Dibang project, a hydropower project in Arunachal Pradesh, India. Similarly, in September 2022, the New South Wales government approved EnergyConnect, the country’s biggest transmission project. This project is expected to provide cheaper renewable energy to the power grid. Hence, the growing investment in the power sector is likely to boost the growth of the wire rod market in APAC during the forecast period.

Asia Pacific Wire Rod Market Revenue and Forecast to 2028 (US$ Million)

Strategic insights for the Asia Pacific Wire Rod provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Asia Pacific Wire Rod refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.Asia Pacific Wire Rod Strategic Insights

Asia Pacific Wire Rod Report Scope

Report Attribute

Details

Market size in 2022

US$ 652.65 Million

Market Size by 2028

US$ 827.41 Million

CAGR (2022 - 2028) 4.0%

Historical Data

2020-2021

Forecast period

2023-2028

Segments Covered

By Material

By Industry

Regions and Countries Covered

Asia-Pacific

Market leaders and key company profiles

Asia Pacific Wire Rod Regional Insights

Asia Pacific Wire Rod Market Segmentation

The Asia Pacific wire rod market is segmented into material, industry, and country.

Based on material, the Asia Pacific wire rod market is bifurcated into copper and aluminium. The copper segment held a larger share of the Asia Pacific wire rod market in 2022.

Based on industry, the Asia Pacific wire rod market is segmented into telecommunication, power, aviation, automotive, and others. The telecommunication segment held the largest share of the Asia Pacific wire rod market in 2022.

Based on country, the Asia Pacific wire rod market has been categorized into China, India, Japan, South Korea, Australia, and the rest of Asia Pacific. Our regional analysis states that China dominated the Asia Pacific wire rod market in 2022.

Alcoa Corp, APAR Industries Ltd, Elcowire Group AB, Hindalco Industries Ltd, Mitsubishi Materials Trading Corp, Norsk Hydro ASA, Sumitomo Electric Industries Ltd, United Co RUSAL Plc, Vedanta Aluminium and Power Ltd, and Vimetco NV are the leading companies operating in the Asia Pacific wire rod market.

The Asia Pacific Wire Rod Market is valued at US$ 652.65 Million in 2022, it is projected to reach US$ 827.41 Million by 2028.

As per our report Asia Pacific Wire Rod Market, the market size is valued at US$ 652.65 Million in 2022, projecting it to reach US$ 827.41 Million by 2028. This translates to a CAGR of approximately 4.0% during the forecast period.

The Asia Pacific Wire Rod Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Wire Rod Market report:

The Asia Pacific Wire Rod Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Wire Rod Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Wire Rod Market value chain can benefit from the information contained in a comprehensive market report.