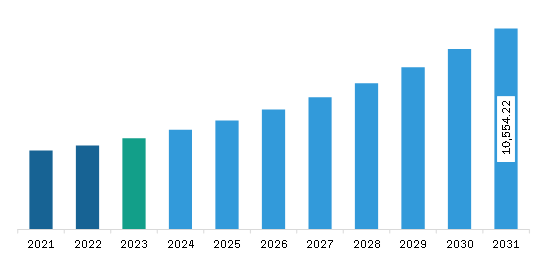

The North America wireless testing market was valued at US$ 4,785.73 million in 2023 and is expected to reach US$ 10,554.22 million by 2031; it is estimated to register a CAGR of 10.4% from 2023 to 2031.

The deployment of 5G is accelerating worldwide primarily due to significant investments from governments and private companies. According to the report of the GSM Association, within four years after the arrival of technology, the number of 5G connections worldwide surpassed 1.5 billion by the end of 2023, making it the fastest-growing mobile broadband technology to date. As of 2023, around 300 commercial 5G networks have been launched globally, covering approximately 40% of the world's population outside of Mainland China. By 2029, this is expected to increase to 80%, highlighting the aggressive pace of rollouts. Also, according to the same report, by the end of 2023, 123 operators in 62 markets worldwide had launched 5G fixed wireless access (FWA) services, i.e., more than 40% of commercial 5G networks included a 5G FWA offering. 5G represents a leap in wireless communication with its ultra-fast speeds, low latency, massive device connectivity, and support for new technologies, such as IoT, autonomous systems, and smart cities.

Furthermore, 5G networks are designed to connect billions of IoT devices with higher density and efficiency than previous generations. As IoT devices operate in diverse environments, they are required to be thoroughly tested for different frequencies, data rates, and battery performance. Additionally, 5G networks must be resilient against cyberattacks, especially with the growing number of connected devices and mission-critical applications. Wireless testing ensures that a vast array of IoT sensors, traffic management systems, environmental monitoring devices, and other connected infrastructure communicate seamlessly with low power consumption and minimal interference. Security testing validates encryption, authentication protocols, and the overall security architecture of 5G networks. Thus, the demand for wireless testing is gaining immense traction owing to the increase in 5G deployment.

The demand for wireless testing is on the rise in the consumer electronics industry in North America, owing to an uptick in the number of connected devices and the complexity of wireless technologies. The complex nature of consumer electronics indicates the need to test these products for conformity, safety, and performance. EXFO, Intertek Group Plc, ThinkPalm, and SGS SA are a few of the companies offering testing products and services in North America. Healthcare infrastructure in North American countries is growing with the expanding presence of hospitals and laboratories. Moreover, a rising focus on the advancement of healthcare facilities with the integration of modern technologies and the Internet of Things (IoT) is expected to boost the need for wireless testing in this sector. UL, a leading global safety science company, increased the size of its facility in Fremont, California, in 2018 to meet the rising demand for testing and certification services from a variety of industry sectors. This multi-million-dollar expansion included the addition of a cutting-edge 39,000-square-foot building and one of the largest laboratories for electromagnetic compatibility (EMC) and wireless testing.

The North America wireless testing market is categorized into offering, technology, application, and country.

By offering, the North America wireless testing market is bifurcated into equipment and services. Further, equipment is sub segmented into wireless device testing and wireless network testing. The equipment segment held a larger share of the North America wireless testing market share in 2023.

In terms of technology, the North America wireless testing market is segmented into Bluetooth, Wi-Fi, GPS, 2G/3G, 4G/LTE, and 5G. The Bluetooth segment held the largest share of the North America wireless testing market share in 2023.

By application, the North America wireless testing market is segmented into consumer electronics, automotive, IT and telecommunication, energy and power, medical devices, aerospace, and defense, industrial, and others. The IT and telecommunication segment held the largest share of the North America wireless testing market share in 2023.

Based on country, the North America wireless testing market is segmented into the US, Canada, and Mexico. The US segment held the largest share of North America wireless testing market in 2023.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 4,785.73 Million |

| Market Size by 2031 | US$ 10,554.22 Million |

| CAGR (2023 - 2031) | 10.4% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Offering

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Anritsu Corp; Bureau Veritas SA; DEKRA SE; EXFO Inc.; Intertek Group Plc; Rohde and Schwarz GmbH and Co KG; SGS SA; ThinkPalm Technologies Pvt. Ltd.; TUV Rheinland AG; and Viavi Solutions Inc are some of the leading companies operating in the wireless testing market.

The North America Wireless Testing Market is valued at US$ 4,785.73 Million in 2023, it is projected to reach US$ 10,554.22 Million by 2031.

As per our report North America Wireless Testing Market, the market size is valued at US$ 4,785.73 Million in 2023, projecting it to reach US$ 10,554.22 Million by 2031. This translates to a CAGR of approximately 10.4% during the forecast period.

The North America Wireless Testing Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Wireless Testing Market report:

The North America Wireless Testing Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Wireless Testing Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Wireless Testing Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)