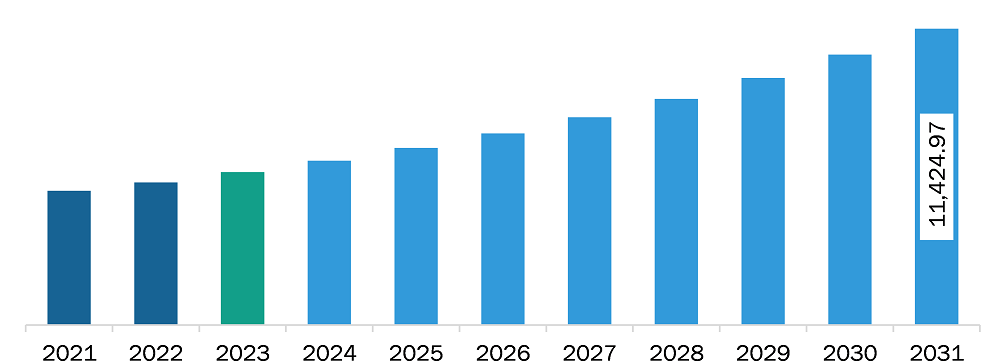

The Asia Pacific wireless testing market was valued at US$ 5,892.63 million in 2023 and is expected to reach US$ 11,424.97 million by 2031; it is estimated to register a CAGR of 8.6% from 2023 to 2031.

The adoption of Wi-Fi 6 and Wi-Fi 6E is creating new opportunities for the wireless testing market as these new standards introduce more complex technologies that require advanced testing solutions. Wi-Fi 6 (802.11ax) and Wi-Fi 6E extend capabilities with higher speeds, lower latency, and support for simultaneous multi-device connections. These features necessitate the testing of key parameters, such as data throughput, coverage, latency, and power efficiency, under various scenarios. Devices, such as smartphones and laptops, undergo multi-band and multi-user performance testing to ensure they can handle traffic from multiple access points and operate efficiently without signal interference. Also, Wi-Fi 6E benefits organizations seeking highly secure networks. The Wi-Fi Alliance has made Wi-Fi Protected Access 3 (WPA3) mandatory for all Wi-Fi 6E devices without backward compatibility for WPA2 security. These measures can increase user confidence in moving to the 6-GHz frequency band for their most trusted connections. This creates a significant opportunity for wireless testing services, as they need to validate backward compatibility and smooth interoperability across different technologies. In addition, the enhanced capacity of Wi-Fi 6/6E makes it suitable for demanding applications, such as smart factories, telemedicine, and AR/VR. However, these use cases require comprehensive testing to ensure devices can maintain stable connections under high bandwidth demands and low latency.

6G, the sixth-generation wireless communication technology standard, has higher frequencies, more data capacity, and noticeably lower latency than 5G networks. Therefore, it is perceived as a catalyst for India's digital transformation in the future. The convergence of digital and physical realities will become essential as wireless networks approach 6G. The Government of India intends to establish the country as a global leader in 6G technology and manufacturing by 2030 by encouraging domestic 6G research and innovation. With this, the country intends to contribute significantly to the world economy and go beyond its earlier target of attaining self-sufficiency (set under the Aatmanirbhar Bharat initiative). China also has the upper hand in 6G technology research due to its outstanding 5G infrastructure. According to the Ministry of Industry and Information Technology, China has managed more than 94,000 5G applications in sectors including manufacturing, mining, power, ports, and healthcare. Thus, the development of connectivity technologies and acceptance of upgraded technologies are likely to fuel the wireless testing market expansion in Asia Pacific the coming years.

The Asia Pacific wireless testing market is categorized into offering, technology, application, and country.

By offering, the Asia Pacific wireless testing market is bifurcated into equipment and services. Further, equipment is sub segmented into wireless device testing and wireless network testing. The equipment segment held a larger share of the Asia Pacific wireless testing market share in 2023.

In terms of technology, the Asia Pacific wireless testing market is segmented into Bluetooth, Wi-Fi, GPS, 2G/3G, 4G/LTE, and 5G. The Bluetooth segment held the largest share of the Asia Pacific wireless testing market share in 2023.

By application, the Asia Pacific wireless testing market is segmented into consumer electronics, automotive, IT and telecommunication, energy and power, medical devices, aerospace, and defense, industrial, and others. The IT and telecommunication segment held the largest share of the Asia Pacific wireless testing market share in 2023.

Based on country, the Asia Pacific wireless testing market is segmented into China, Japan, South Korea, India, Australia, and the Rest of Asia Pacific. China held the largest share of Asia Pacific wireless testing market in 2023.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 5,892.63 Million |

| Market Size by 2031 | US$ 11,424.97 Million |

| CAGR (2023 - 2031) | 8.6% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Offering

|

| Regions and Countries Covered |

Asia Pacific

|

| Market leaders and key company profiles |

|

Anritsu Corp; Bureau Veritas SA; DEKRA SE; EXFO Inc.; Intertek Group Plc; Rohde and Schwarz GmbH and Co KG; SGS SA; ThinkPalm Technologies Pvt. Ltd.; TUV Rheinland AG; and Viavi Solutions Inc are some of the leading companies operating in the wireless testing market.

The Asia Pacific Wireless Testing Market is valued at US$ 5,892.63 Million in 2023, it is projected to reach US$ 11,424.97 Million by 2031.

As per our report Asia Pacific Wireless Testing Market, the market size is valued at US$ 5,892.63 Million in 2023, projecting it to reach US$ 11,424.97 Million by 2031. This translates to a CAGR of approximately 8.6% during the forecast period.

The Asia Pacific Wireless Testing Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Wireless Testing Market report:

The Asia Pacific Wireless Testing Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Wireless Testing Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Wireless Testing Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)