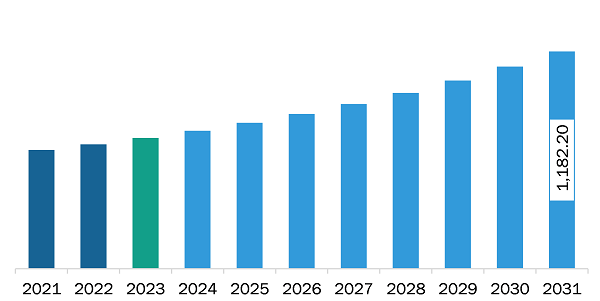

The Middle East & Africa wireless testing market was valued at US$ 711.35 million in 2023 and is expected to reach US$ 1,182.20 million by 2031; it is estimated to register a CAGR of 6.6% from 2023 to 2031.

The aerospace industry is rapidly adopting advanced communication technology platforms, such as 5G, Wi-Fi 6, and satellite communication. Aircraft are heavily equipped with wireless communication systems for in-flight entertainment, passenger connectivity, and operational data transmission. This heightened connectivity necessitates extensive testing to ensure seamless operation. Also, the aerospace sector is governed by stringent safety regulations imposed by bodies such as the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA). Wireless testing is critical to verify that all systems meet these regulatory standards.

The development of advanced testing equipment, such as spectrum analyzers, signal generators, and software-defined radios, further enhances the capability to test wireless systems. As the aerospace industry continues to evolve and embrace wireless technologies, the need for effective wireless testing gets stimulated. Automating the testing processes can help reduce the time and costs associated with manual testing, making it easier for aerospace companies to integrate comprehensive wireless testing into their workflows. Thus, the transition toward automated wireless testing in the aerospace industry is likely to trend in the market during the forecast period.

There is a high demand for broadband across the Middle East and Africa for personal and business purposes, and the investment in the wireless infrastructure supports this with improved broadband capabilities. Many countries in the region are participating in digital transformation initiatives, which coincide with the vision of modernizing their economy and improving service delivery. Initiatives in many of the states in the region primarily underline wireless technologies as the primary enabler to support smart cities, e-governance, and efficient and fast digital services. Governments, together with private sectors, are therefore concentrating on the availability of quality telecommunications infrastructure to improve connectivity. Thus, the wireless testing market in the Middle East and Africa is driven by continued digital transformation efforts and the integration of wireless technologies into the healthcare sector. Moreover, the expanding young, tech-savvy populace, and tremendous investments being made in telecommunications infrastructure for the long-term goal of economic diversification benefit the market.

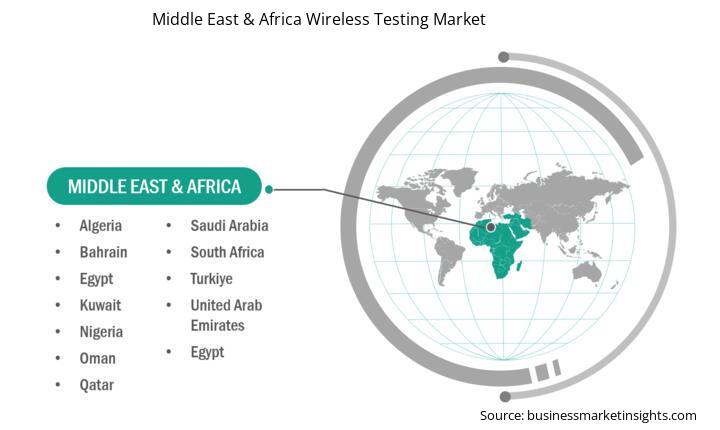

The Middle East & Africa wireless testing market is categorized into offering, technology, application, and country.

By offering, the Middle East & Africa wireless testing market is bifurcated into equipment and services. Further, equipment is sub segmented into wireless device testing and wireless network testing. The equipment segment held a larger share of the Middle East & Africa wireless testing market share in 2023.

In terms of technology, the Middle East & Africa wireless testing market is segmented into Bluetooth, Wi-Fi, GPS, 2G/3G, 4G/LTE, and 5G. The Bluetooth segment held the largest share of the Middle East & Africa wireless testing market share in 2023.

By application, the Middle East & Africa wireless testing market is segmented into consumer electronics, automotive, IT and telecommunication, energy and power, medical devices, aerospace, defense, industrial, and others. The IT and telecommunication segment held the largest share of the Middle East & Africa wireless testing market share in 2023.

Based on country, the Middle East & Africa wireless testing market is segmented into South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa. Saudi Arabia held the largest share of Middle East & Africa wireless testing market in 2023.

Middle East & Africa Wireless Testing Market Company Profiles

Anritsu Corp; Bureau Veritas SA; DEKRA SE; EXFO Inc.; Intertek Group Plc; Rohde and Schwarz GmbH and Co KG; SGS SA; ThinkPalm Technologies Pvt. Ltd.; TUV Rheinland AG; and Viavi Solutions Inc are some of the leading companies operating in the wireless testing market.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 711.35 Million |

| Market Size by 2031 | US$ 1,182.20 Million |

| CAGR (2023 - 2031) | 6.6% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Offering

|

| Regions and Countries Covered |

Middle East and Africa

|

| Market leaders and key company profiles |

|

The Middle East & Africa Wireless Testing Market is valued at US$ 711.35 Million in 2023, it is projected to reach US$ 1,182.20 Million by 2031.

As per our report Middle East & Africa Wireless Testing Market, the market size is valued at US$ 711.35 Million in 2023, projecting it to reach US$ 1,182.20 Million by 2031. This translates to a CAGR of approximately 6.6% during the forecast period.

The Middle East & Africa Wireless Testing Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Wireless Testing Market report:

The Middle East & Africa Wireless Testing Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Wireless Testing Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Wireless Testing Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)