Rising Awareness of Simulation Education Fueling North America Patient Simulators Market Growth

Different organizations perform various patient simulation awareness activities. Considering the importance of patient safety, many universities are also opening patient simulation centers. Healthcare simulation centers are constantly being unveiled. For instance, in 2019, the University of Illinois, Chicago, opened three healthcare simulation centers. These will be run individually by the university’s College of Medicine, College of Pharmacy, and College of Nursing. The simulation centers have specialized trained doctors, advanced and computerized manikins of all ages, and simulated conditions to help students and healthcare professionals practice clinical skills. These training centers will also help with communication and decision-making skills and provide hands-on medical diagnosis, treatment, and care training. It is estimated that it will provide more than 50,000 hours of hands-on learning for nearly 20,000 learners working or pursuing careers in the health sciences. In 2022, Gaumard Scientific’s HAL S5301, the world's most advanced interdisciplinary patient simulator, was installed at the Emory University Nell Hodgson Woodruff School of Nursing's new state-of-the-art simulation and learning center. This was the first commercial installation of HAL S5301. Moreover, companies are coming together to enhance healthcare education. For instance, in 2021, CAE Healthcare and the Rush Center for Clinical Skills and Simulation (RCCSS) entered a simulation research partnership to improve patient safety and enhance healthcare education, including support for RCCSS simulation research initiatives. Rush students and industry partners can access some of the most advanced medical simulation technology through this innovative partnership. The rising awareness of simulation education is anticipated to provide an opportunity for the North America patient simulators market.

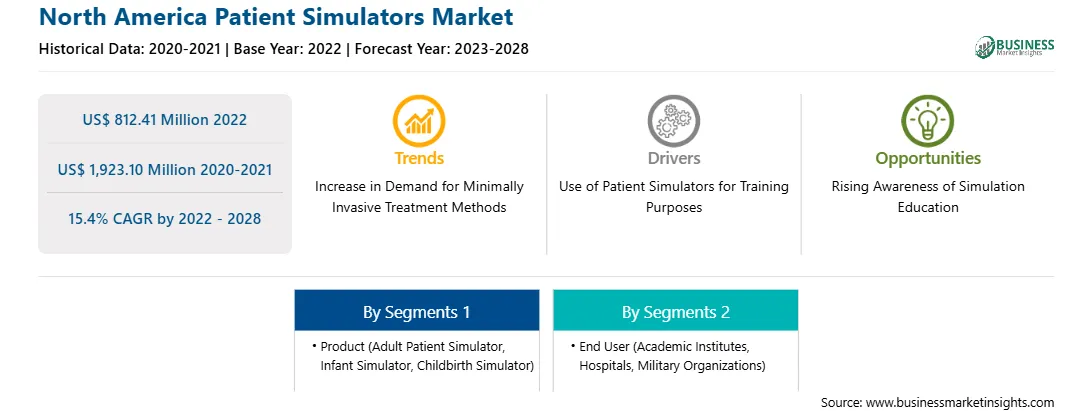

North America Patient Simulators Market Overview

The North America patient simulators market is segmented into the US, Canada, and Mexico. The US dominated the North America patient simulators market in 2022. There has been rapid development in healthcare standards in the United States in recent years. However, there has also been an increase in deaths due to medical errors. A study published in 2020 by the National Library of Medicine concluded that medical errors lead to just over 22,000 deaths a year in the US. The publication has analyzed eight studies published between 2007 and 2019 from Europe and Canada. Each study started by examining hospital deaths to determine their cause and whether they were preventable. Most hospital errors involve diagnostic errors, poor management of medical conditions, and surgery-related errors. In addition, research has shown that the total number of adverse events in U.S. hospitals is falling, as the annual falls in such events of 3–7% between 2010 and 2019. The rise in the above-stated cases can be primarily attributed to the increasing number of errors during medical training programs. Hence, to decrease such incidents, the focus on providing medical education by using patient simulators has significantly increased in the United States.

Strategic insights for the North America Patient Simulators provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 812.41 Million |

| Market Size by 2028 | US$ 1,923.10 Million |

| CAGR (2022 - 2028) | 15.4% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

|

The geographic scope of the North America Patient Simulators refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

North America Patient Simulators Market Segmentation

The North America patient simulators market is segmented based on product, end user, and country.

Based on product, the North America patient simulators market is segmented into adult patient simulator, infant simulator, and childbirth simulator. The adult patient simulator segment held the largest North America patient simulators market share in 2022.

Based on end user, the North America patient simulators market is segmented into academic institutes, hospitals, and military organizations. The academic institutes segment held the largest North America patient simulators market share in 2022.

Based on country, the North America patient simulators market has been categorized into the US, Canada, and Mexico. The US dominated the North America patient simulators market in 2022.

CAE Inc, Gaumard Scientific Co Inc, Kyoto Kagaku Co Ltd, Laerdal Medical AS, Limbs & Things Ltd, Mentice AB, Simulab Corp, Surgical Science Sweden AB, and VirtaMed AG are among the leading companies operating in the North America patient simulators market.

The North America Patient Simulators Market is valued at US$ 812.41 Million in 2022, it is projected to reach US$ 1,923.10 Million by 2028.

As per our report North America Patient Simulators Market, the market size is valued at US$ 812.41 Million in 2022, projecting it to reach US$ 1,923.10 Million by 2028. This translates to a CAGR of approximately 15.4% during the forecast period.

The North America Patient Simulators Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Patient Simulators Market report:

The North America Patient Simulators Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Patient Simulators Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Patient Simulators Market value chain can benefit from the information contained in a comprehensive market report.