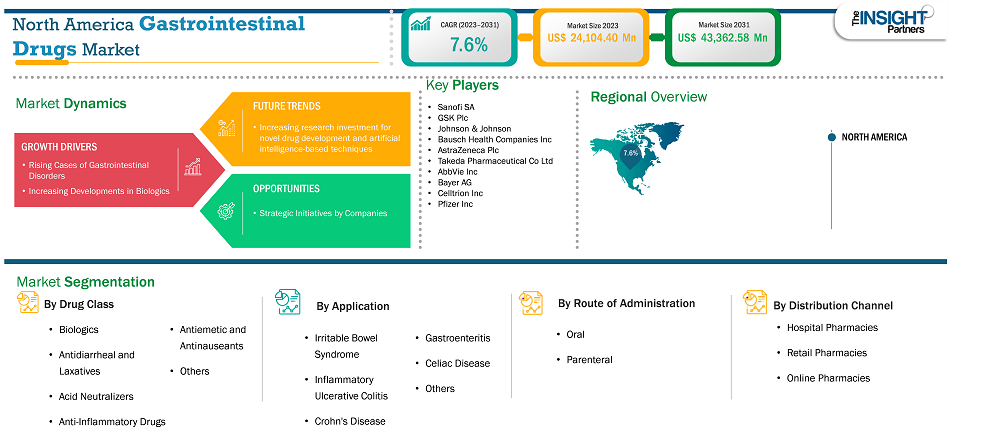

The North America gastrointestinal drugs market size is expected to reach US$ 43,362.58 million by 2031 from US$ 24,104.40 million in 2023. The market is estimated to record a CAGR of 7.6% from 2023 to 2031.

Executive Summary and North America Gastrointestinal Drugs Market Analysis:

The North America gastrointestinal drugs market is segmented into the US, Canada, and Mexico. Increasing incidence of gastrointestinal diseases due to change in lifestyle, government support for prevention and treatment of gastrointestinal diseases, presence of well-developed healthcare infrastructure, growing pharmaceutical industry, reimbursement coverage and industry giants are some of the prominent factors propelling the market growth in North America.

Key segments that contributed to the derivation of the gastrointestinal drugs market analysis are drug class, application, route of administration, and distribution channel .

North America Gastrointestinal Drugs Market Outlook

In the past few years, there has been a rise in the development of advanced new treatments such as biologics, which are utilized for the treatment of inflammatory diseases. In addition, biologics have transformed the IBD treatment, and their success in the treatment of these conditions is supporting the use of biologics in other gastrointestinal conditions. Biologics are also effective in treating eosinophilic esophagitis, celiac disease, autoimmune hepatitis, and other gastrointestinal diseases because they target the disease-causing elements in the immune system. Many ulcerative colitis medications have wide-ranging effects on the immune system. To block such effects of the inflammatory process, biologics are widely used. One such group of biologic drugs for ulcerative colitis is known as anti-TNF drugs that block a protein called tumor necrosis factor-alpha (TNF alpha). This protein promotes inflammation in the intestines and specific other organs. Anti-TNF agents were the first class of biologics to be authorized for IBD treatment, and since then, they have tremendously changed IBD management. A few types of anti-TNF drugs include Humira, Simponi, and Remicade. A variety of biological drugs can reduce IBD symptoms in adults and help achieve remission. Biologic medications can be an effective substitute to help control the symptoms of ulcerative colitis. The FDA has approved many biologic drugs such as Humira (adalimumab), Cimzia, Simponi (golimumab), Tysabri, Remicade (infliximab), Entyvio (Vedolizumab), and Stelara (ustekinumab) for the treatment of Crohn’s disease and ulcerative colitis. Vedolizumab has become the first choice among second-line biologics for the treatment of moderate to severe Crohn's disease and ulcerative colitis patients who have experienced failure with conventional medications or anti-TNF agents. Apart from this, in February 2024, Celltrion Healthcare’s Remsima SC obtained approval from Health Canada for its use as maintenance therapy for IBD. As cases of gastrointestinal disease are on the rise in developing countries, the introduction of new biologics in these markets fuels the growth of the market. Thus, the increasing development of biologics for the treatment of gastrointestinal diseases drives the gastrointestinal drugs market.

North America Gastrointestinal Drugs Market Country Insights

Based on Geography, the North America gastrointestinal drugs market comprises the US, Canada, and Mexico. The US held the largest share in 2023.

In North America, the US is the largest market for gastrointestinal drugs. In the US, the increasing prevalence of gastrointestinal diseases contributes directly to the demand for gastrointestinal drugs. Crohn's disease and ulcerative colitis are two of the most common types of inflammatory bowel diseases (IBD). As per the Crohn’s & Colitis Foundation of America (CCFA) report, “Facts about IBD,” approximately 70,000 new cases of IBD are diagnosed yearly in the US. The overall prevalence of IBD increased significantly from 2011 to 2020. The study estimates that nearly 1 in 100 Americans have IBD, and ~2.4 million Americans have some form of IBD. Additionally, the rising funding for research and development related to gastrointestinal diseases is expected to increase focus on developing novel treatment medications. Per a study titled “Endometriosis Is Undervalued,” published in 2022, Crohn's disease research received US$ 90 million in funding, or US$ 130.07 per patient.

The US Food and Drug Administration (FDA) approvals are likely to support the growth of the market. For instance, in May 2020, the US FDA approved Qinlock (ripretinib) tablets as a fourth-line treatment for advanced gastrointestinal stromal tumors (GIST). In May 2024, Strides Pharma received approval for the generic version of Sucralfate Oral Suspension, 1gm/10 mL, from the US FDA for the treatment of gastrointestinal diseases as well as stomach ulcers, gastroesophageal reflux disease (GERD), and stomach inflammation and prevent stress ulcers.

Therefore, the growth of this market is driven by the growing prevalence of gastrointestinal diseases, developments by the market players, and the presence of major market players in the US.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 24,104.40 Million |

| Market Size by 2031 | US$ 43,362.58 Million |

| CAGR (2023 - 2031) | 7.6% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Drug Class

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Some of the key players operating in the market include Sanofi SA, GSK Plc, Johnson & Johnson, Bausch Health Companies Inc, AstraZeneca Plc, Takeda Pharmaceutical Co Ltd, AbbVie Inc, Bayer AG, Celltrion Inc, and Pfizer Inc among others. These players are adopting various strategies such as expansion, product innovation, and mergers and acquisitions to provide innovative products to their consumers and increase their market share.

North America Gastrointestinal Drugs Market Research Methodology :

The following methodology has been followed for the collection and analysis of data presented in this report:

The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

Note: All financial data included in the Company Profiles section has been standardized to USD. For companies reporting in other currencies, figures have been converted to USD using the relevant exchange rates for the corresponding year.

The Insight Partners’ conducts a significant number of primary interviews each year with industry stakeholders and experts to validate its data analysis, and gain valuable insights. These research interviews are designed to:

Primary research is conducted via email interactions and telephone interviews, encompassing various markets, categories, segments, and sub-segments across different regions. Participants typically include:

The North America Gastrointestinal Drugs Market is valued at US$ 24,104.40 Million in 2023, it is projected to reach US$ 43,362.58 Million by 2031.

As per our report North America Gastrointestinal Drugs Market, the market size is valued at US$ 24,104.40 Million in 2023, projecting it to reach US$ 43,362.58 Million by 2031. This translates to a CAGR of approximately 7.6% during the forecast period.

The North America Gastrointestinal Drugs Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Gastrointestinal Drugs Market report:

The North America Gastrointestinal Drugs Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Gastrointestinal Drugs Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Gastrointestinal Drugs Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)