The change in the modern warfare system has been urging governments across the region to allocate high funds toward respective military forces. The military budget allocation enables military forces to procure advanced technologies and equipment from domestic or international manufacturers. Solider and military vehicle modernization practices are also on the rise across numerous countries. To strengthen military forces with advanced technologies, armaments, artilleries, combat aircraft, naval vessels, and armoured vehicles, defense forces across the region are investing substantial amounts in the aforementioned products. The continuous urge for new technologies for combat and noncombat operations by the defense forces is boosting defense spending across the region. Asymmetric warfare or modern battlefields demand an enormous amount of information regarding an enemy to carry out the operations successfully. To gather such information, defense forces in developed and developing nations are utilizing modern technologies.

The rising military expenditure is boosting the investments in technological developments of naval vessels across different naval forces. Many countries such as the US already have several naval vessel projects in the pipeline for expanding their respective naval fleet in the defense forces. Moreover, the procurement of naval vessels continues to generate demand for electro-optic systems, thereby driving the North America electro-optics in naval market growth.

Based on country, the North America electro-optics in naval market is segmented into the US, Canada, and Mexico. Over the years, countries in North America have experienced a rise in their military expenditure for enhancing their land, sea, and air troop capabilities. This rise in military expenditure by these countries is leading to an increase in the adoption of advanced technologies among the military forces. This is further leading to the rise in the procurement of advanced camera and sensor technologies in naval ships for applications such as target detection, tracking, surveillance, and fire control. Some of the major investments by the naval forces to acquire new electro-optics are; In February 2022, the US Navy awarded a contract to Teledyne FLIR, a subsidiary of Teledyne Technologies, to maintain and supply BRITE Star II multi-sensory imaging systems for the US Navy’s H-1 program.

Strategic insights for the North America Electro-Optics in Naval provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

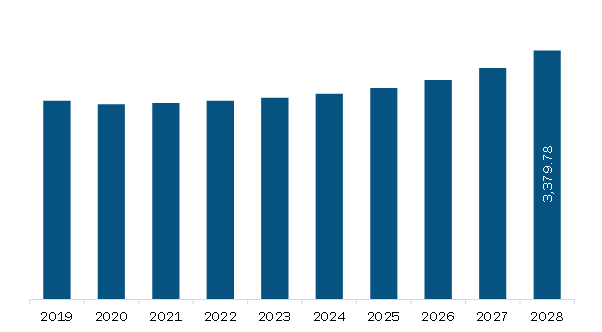

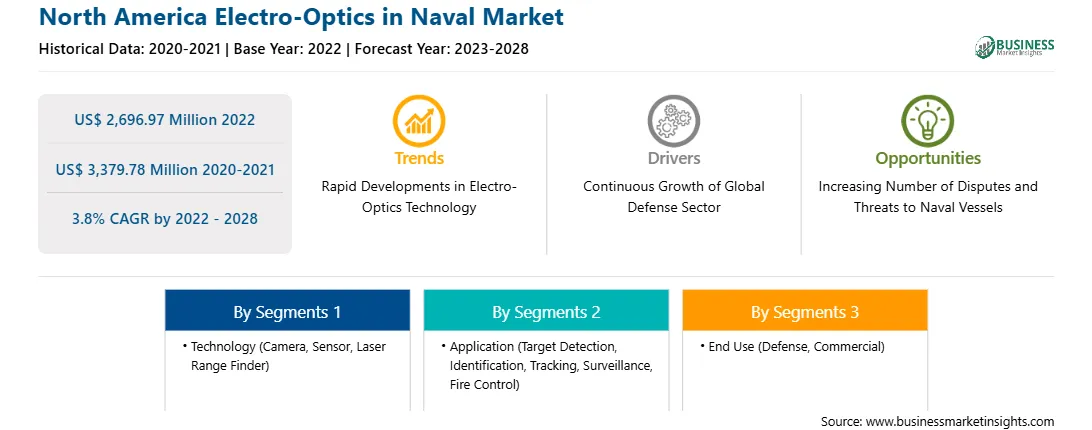

| Market size in 2022 | US$ 2,696.97 Million |

| Market Size by 2028 | US$ 3,379.78 Million |

| CAGR (2022 - 2028) | 3.8% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Technology

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

|

The geographic scope of the North America Electro-Optics in Naval refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The North America electro-optics in naval market is segmented into technology, application, end use, and country.

Based on technology, the North America electro-optics in naval market is segmented into camera, sensor and laser range finder. The camera segment held the largest share of the North America electro-optics in naval market in 2022.

Based on application, the North America electro-optics in naval market is segmented into target detection, identification, and tracking; surveillance; fire control; and others. The surveillance segment held the largest share of the North America electro-optics in naval market in 2022.

Based on end use, the North America electro-optics in naval market is segmented into defense and commercial. The defense segment held a larger share of the North America electro-optics in naval market in 2022.

Based on country, the North America electro-optics in naval market is segmented into the US, Canada, and Mexico. The US dominated the share of the North America electro-optics in naval market in 2022.

Elbit Systems Ltd; Israel Aerospace Industries Ltd; L3Harris Technologies Inc; Naval Group SA; Saab AB; Safran SA; and Ultra Electronics Holdings Ltd are the leading companies operating in the North America electro-optics in naval market.

The North America Electro-Optics in Naval Market is valued at US$ 2,696.97 Million in 2022, it is projected to reach US$ 3,379.78 Million by 2028.

As per our report North America Electro-Optics in Naval Market, the market size is valued at US$ 2,696.97 Million in 2022, projecting it to reach US$ 3,379.78 Million by 2028. This translates to a CAGR of approximately 3.8% during the forecast period.

The North America Electro-Optics in Naval Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Electro-Optics in Naval Market report:

The North America Electro-Optics in Naval Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Electro-Optics in Naval Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Electro-Optics in Naval Market value chain can benefit from the information contained in a comprehensive market report.