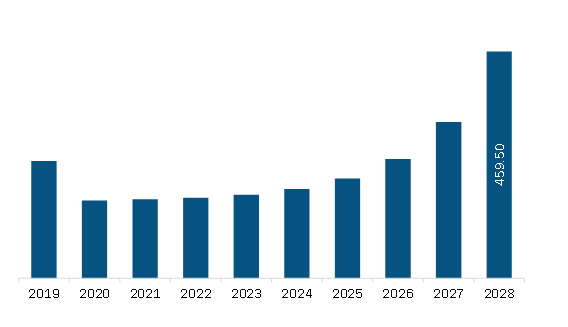

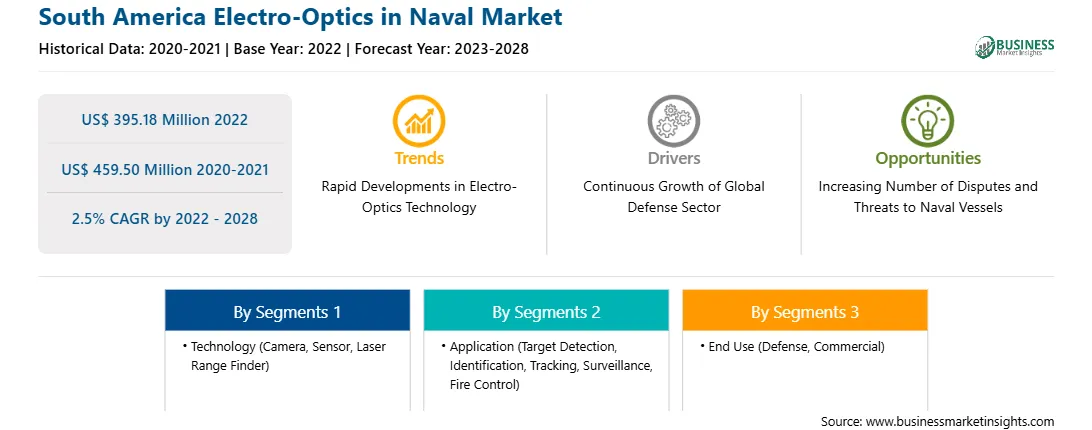

The South America electro-optics in naval market is expected to grow from US$ 395.18 million in 2022 to US$ 459.50 million by 2028. It is estimated to grow at a CAGR of 2.5% from 2022 to 2028.

Continuous Growth of Regional Defense Sector Fuels South America Electro-Optics in Naval Market

The change in the modern warfare system has been urging governments across the region to allocate high funds toward respective military forces. The military budget allocation enables military forces to procure advanced technologies and equipment from domestic or international manufacturers. Solider and military vehicle modernization practices are also on the rise across numerous countries. To strengthen military forces with advanced technologies, armaments, artilleries, combat aircraft, naval vessels, and armored vehicles, defense forces across the region are investing substantial amounts in the aforementioned products. The continuous urge for new technologies for combat and noncombat operations by the defense forces is boosting defense spending across the region. Asymmetric warfare or modern battlefields demand an enormous amount of information regarding an enemy to carry out the operations successfully. To gather such information, defense forces in developed and developing nations are utilizing modern technologies. Moreover, the rising defense expenditure contributes to the growth of modernization programs of an older naval fleet of vessels across different military forces worldwide, which is fueling the electro-optics in naval market growth. The rising military expenditure is boosting the investments in technological developments of naval vessels across different naval forces. Moreover, the procurement of naval vessels continues to generate demand for electro-optic systems, thereby driving the South America electro-optic in naval market growth.

South America Electro-Optics in Naval Market Overview

The South America (SAM) electro-optics in naval market is categorized into Brazil, Argentina, and the Rest of SAM. Countries in SAM are emphasizing on modernizing their naval forces with the procurement of newer fleets or retrofitting the existing fleet with advanced technologies. They are spending notable amounts toward their defense forces, with Brazil leading the way, followed by Colombia and Chile The naval forces of each of the countries play a major role in securing their borders. The naval forces are procuring newer/advanced technologies to strengthen themselves. For instance, in 2021, the Brazilian navy ordered Safran to supply Paseo XLR (eXtra Long Range) optronic (electro-optical) sight for Tamandaré class frigates. Safran’s Paseo XLR (eXtra Long Range) optronic (electro-optical) sights will be mounted on four frigates, which are expected to be delivered by 2026.

South America Electro-Optics in Naval Market Revenue and Forecast to 2028 (US$ Million)

Strategic insights for the South America Electro-Optics in Naval provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the South America Electro-Optics in Naval refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

South America Electro-Optics in Naval Strategic Insights

South America Electro-Optics in Naval Report Scope

Report Attribute

Details

Market size in 2022

US$ 395.18 Million

Market Size by 2028

US$ 459.50 Million

CAGR (2022 - 2028) 2.5%

Historical Data

2020-2021

Forecast period

2023-2028

Segments Covered

By Technology

By Application

By End Use

Regions and Countries Covered

South and Central America

Market leaders and key company profiles

South America Electro-Optics in Naval Regional Insights

South America Electro-Optics in Naval Market Segmentation

The South America electro-optics in naval market is segmented into technology, application, end use, and country.

Based on technology, the South America electro-optics in naval market is segmented into camera, sensor and laser range finder. The camera segment held the largest share of the South America electro-optics in naval market in 2022.

Based on application, the South America electro-optics in naval market is segmented into target detection, identification, and tracking; surveillance; fire control; and others. The surveillance segment held the largest share of the South America electro-optics in naval market in 2022.

Based on end use, the South America electro-optics in naval market is segmented into defense and commercial. The defense segment held a larger share of the South America electro-optics in naval market in 2022.

Based on country, the South America electro-optics in naval market is segmented into Brazil, Argentina, and the Rest of South America. Brazil dominated the share of the South America electro-optics in naval market in 2022.

Elbit Systems Ltd; Israel Aerospace Industries Ltd; L3Harris Technologies Inc; Naval Group SA; Saab AB; and Safran SA are the leading companies operating in the South America electro-optics in naval market.

The South America Electro-Optics in Naval Market is valued at US$ 395.18 Million in 2022, it is projected to reach US$ 459.50 Million by 2028.

As per our report South America Electro-Optics in Naval Market, the market size is valued at US$ 395.18 Million in 2022, projecting it to reach US$ 459.50 Million by 2028. This translates to a CAGR of approximately 2.5% during the forecast period.

The South America Electro-Optics in Naval Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South America Electro-Optics in Naval Market report:

The South America Electro-Optics in Naval Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South America Electro-Optics in Naval Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South America Electro-Optics in Naval Market value chain can benefit from the information contained in a comprehensive market report.