North America Battery Metals Market Forecast to 2028 - COVID-19 Impact and Regional Analysis By Type (Lithium, Nickel, Cobalt, and Others), Application (Electric Vehicles, Consumer Electronics, Energy Storage Systems, and Others).

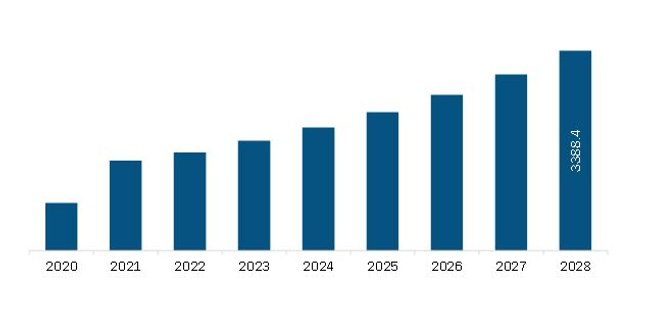

North America battery metals market in North America is expected to grow from US$ 1526.0 million in 2021 to US$ 3388.4 million by 2028; it is estimated to grow at a CAGR of 12.1% from 2021 to 2028.

The electric vehicle has proven to be an essential technology in terms of reducing air pollution in densely populated areas and a promising option for contribution in energy diversification and the reduction in greenhouse gas emission objectives. Various benefits of electric vehicles include zero tailpipe emissions, the potential for greenhouse gas emissions reductions, better efficiency than internal combustion engine vehicles, etc. Electric vehicles are expanding significantly as technological progress in the electrification of two/three-wheelers, buses, and trucks advances and their market grows. The continued electrification of transport requires vast volumes of lithium-ion batteries. This in turn is creating demand for battery metals. Growing adoption of electric vehicles in various countries across the region has increased the demand for rechargeable batteries and their input commodities, including lithium, cobalt, nickel, manganese, and copper. Thus, due to all these factors, demand for electric vehicles/hybrid electric vehicles/plug-in hybrid vehicles is increasing. This, in turn, is driving the battery metals market substantiallyNorth America is one of the worst affected economies due to the COVID-19 pandemic. The unprecedented rise in the number of COVID-19 cases across the US and Canada and the subsequent lockdown of numerous manufacturing facilities in the countries have negatively influenced the growth of the various markets. The market for battery metals has been impacted in the region due to distortion in the supply chain with limited operational efficiencies. The pandemic has also impacted the automotive and consumer electronics industry in the region. However, the market is reviving on account of significant measures taken by the government such as vaccination drives. In the US, according to the car registration data from Experian, about 378,466 electric vehicles were registered from January to October 2021, which was 94% more than in 2020. In 2021, sales of electric vehicles in the US were record-breaking despite supply chain issues. This is expected to provide the impetus for market growth.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the North America battery metals market. The North America battery metals market is expected to grow at a good CAGR during the forecast period.

North America Battery Metals Market Revenue and Forecast to 2028(US$ Million)

Get more information on this report :

North America Battery Metals Market Segmentation

By Type

- North America Battery Metals Market, by Type

- Lithium

- Nickel

- Cobalt

By End User

- Electric Vehicles

- Consumer Electronics

- Energy Storage System

- Others

By Country

- North America

- US

- Mexico

- Canada

Companies Mentioned -

- Albemarle Corporation

- Bolt Metals Corp.

- Ganfeng Lithium Co.,Ltd.

- Umicore

- LG Chem

- Vale

- BASF SE

- Metso Outotec

1. Introduction

1.1 The Insight Partners Research Report Guidance

1.2 Market Segmentation

1.2.1 North America Battery Metals Market, by Type

1.2.2 North America Battery Metals Market, by Application

1.2.3 North America Battery Metals Market, by Country

2. Key Takeaways

3. Research Methodology

3.1 Scope of the Study

3.1.1 North America Battery Metals Market, by Type and Application

3.2 Research Methodology

3.2.1 Data Collection:

3.2.2 Primary Interviews:

3.2.3 Hypothesis formulation:

3.2.4 Macro-economic factor analysis:

3.2.5 Developing base number:

3.2.6 Data Triangulation:

3.2.7 Country level data:

4. North America Battery Metals Market Landscape

4.1 Market Overview

4.2 Porter's Five Forces Analysis

4.2.1 Bargaining Power of Suppliers:

4.2.2 Bargaining Power of Buyers:

4.2.3 Threat of New Entrants:

4.2.4 Competitive Rivalry:

4.2.5 Threat of Substitutes:

4.3 Ecosystem Analysis

4.4 Expert Opinion

5. North America Battery Metals Market – Key Market Dynamics

5.1 Market Drivers

5.1.1 Increase in Demand for Electrical Vehicles/Hybrid Electric Vehicles/Plug-in Hybrid Vehicles

5.1.2 Growing Demand for Battery Metals from Consumer Electronics Industry

5.2 Market Restraints

5.2.1 Volatility in the Raw Material Prices of Battery Metals

5.3 Market Opportunities

5.3.1 Rapid Growth in Renewable Energy Sector

5.4 Future Trends

5.4.1 Growing Focus on Battery Recycling

5.5 Impact Analysis

6. North America Battery Metals – Country Market Analysis

6.1 North America Battery Metals Market Overview

6.2 North America Battery Metals Market –Revenue and Forecast to 2028 (US$ Mn)

7. North America Battery Metals Market Analysis – By Type

7.1 Overview

7.2 North America Battery Metals Market, By Type(2020 and 2028)

7.3 Lithium

7.3.1 Overview

7.3.2 Lithium: North America Battery Metals Market – Revenue and Forecast to 2028 (US$ Mn)

7.4 Nickel

7.4.1 Overview

7.4.2 Nickel: North America Battery Metals Market – Revenue and Forecast to 2028 (US$ Mn)

7.5 Cobalt:

7.5.1 Overview

7.5.2 Cobalt: North America Battery Metals Market – Revenue and Forecast to 2028 (US$ Mn)

7.6 Others:

7.6.1 Overview

7.6.2 Others: North America Battery Metals Market – Revenue and Forecast to 2028 (US$ Mn)

8. North America Battery Metals Market Analysis – By Application

8.1 Overview

8.2 North America Battery Metals Market, By Application (2020 and 2028)

8.3 Electric Vehicles

8.3.1 Overview

8.3.2 Electric Vehicles: North America Battery Metals Market – Revenue and Forecast to 2028 (US$ Mn)

8.4 Consumer Electronics

8.4.1 Overview

8.4.2 Consumer Electronics: North America Battery Metals Market – Revenue and Forecast to 2028 (US$ Mn)

8.5 Energy Storage System

8.5.1 Overview

8.5.2 Energy Storage Systems: North America Battery Metals Market – Revenue and Forecast to 2028 (US$ Mn)

8.6 Other

8.6.1 Overview

8.6.2 Others: North America Battery Metals Market – Revenue and Forecast to 2028 (US$ Mn)

9. North America Battery Metals Market – Country Analysis

9.1 Overview

9.2 North America

9.2.1 Overview

9.2.2 North America: North America Battery Metals Market –Revenue and Forecast to 2028 (US$ Million)

9.2.2.1 US: North America Battery Metals Market – Revenue and Forecast to 2028 (US$ Million)

9.2.2.1.1 US: North America Battery Metals Market, By Type

9.2.2.1.2 US: North America Battery Metals Market, by Application

9.2.2.2 Canada: North America Battery Metals Market – Revenue and Forecast to 2028 (US$ Million)

9.2.2.2.1 Canada: North America Battery Metals Market, By Type

9.2.2.2.2 Canada: North America Battery Metals Market, by Application

9.2.2.3 Mexico: North America Battery Metals Market – Revenue and Forecast to 2028 (US$ Million)

9.2.2.3.1 Mexico: North America Battery Metals Market, By Type

9.2.2.3.2 Mexico: North America Battery Metals Market, by Application

10. Impact of COVID-19

10.1 North America: Impact Assessment of COVID-19 Pandemic

11. Industry Landscape

11.1 Overview

11.2 Market Initiative

11.3 New Product Development

11.4 Merger and Acquisition

12. Company Profiles

12.1 Albemarle Corporation

12.1.1 Key Facts

12.1.2 Business Description

12.1.3 Products and Services

12.1.4 Financial Overview

12.1.5 SWOT Analysis

12.1.6 Key Developments

12.2 Bolt Metals Corp.

12.2.1 Key Facts

12.2.2 Business Description

12.2.3 Products and Services

12.2.4 Financial Overview

12.2.5 SWOT Analysis

12.2.6 Key Developments

12.3 Ganfeng Lithium Co.,Ltd.

12.3.1 Key Facts

12.3.2 Business Description

12.3.3 Products and Services

12.3.4 Financial Overview

12.3.5 SWOT Analysis

12.3.6 Key Developments

12.4 Umicore

12.4.1 Key Facts

12.4.2 Business Description

12.4.3 Products and Services

12.4.4 Financial Overview

12.4.5 SWOT Analysis

12.4.6 Key Developments

12.5 LG Chem

12.5.1 Key Facts

12.5.2 Business Description

12.5.3 Products and Services

12.5.4 Financial Overview

12.5.5 SWOT Analysis

12.5.6 Key Developments

12.6 Vale

12.6.1 Key Facts

12.6.2 Business Description

12.6.3 Products and Services

12.6.4 Financial Overview

12.6.5 SWOT Analysis

12.6.6 Key Developments

12.7 BASF SE

12.7.1 Key Facts

12.7.2 Business Description

12.7.3 Products and Services

12.7.4 Financial Overview

12.7.5 SWOT Analysis

12.7.6 Key Developments

12.8 Metso Outotec

12.8.1 Key Facts

12.8.2 Business Description

12.8.3 Products and Services

12.8.4 Financial Overview

12.8.5 SWOT Analysis

12.8.6 Key Developments

13. Appendix

13.1 About The Insight Partners

13.2 Glossary of Terms

LIST OF TABLES

Table 1. North America Battery Metals Market, by Type– Revenue and Forecast to 2028 (US$ Million)

Table 2. North America Battery Metals Market, by Application – Revenue and Forecast to 2028 (US$ Million)

Table 3. North America Battery Metals Market –Revenue and Forecast to 2028 (US$ Mn)

Table 4. US North America Battery Metals Market, By Type – Revenue and Forecast to 2028 (USD Million)

Table 5. US North America Battery Metals Market, by Application – Revenue and Forecast to 2028 (USD Million)

Table 6. Canada North America Battery Metals Market, By Type – Revenue and Forecast to 2028 (USD Million)

Table 7. Canada North America Battery Metals Market, by Application – Revenue and Forecast to 2028 (USD Million)

Table 8. Mexico North America Battery Metals Market, By Type – Revenue and Forecast to 2028 (USD Million)

Table 9. Mexico North America Battery Metals Market, by Application – Revenue and Forecast to 2028 (USD Million)

Table 10. Glossary of Terms, North America Battery Metals Market

LIST OF FIGURES

Figure 1. North America Battery Metals Market Segmentation

Figure 2. North America Battery Metals Market Overview

Figure 3. North America Battery Metals Market, By Application

Figure 4. North America Battery Metals Market, by Country

Figure 5. Porter's Five Forces Analysis

Figure 6. North America Battery Metals Market - Ecosystem

Figure 7. Expert Opinion

Figure 8. North America Battery Metals Market Impact Analysis of Drivers and Restraints

Figure 9. Geographic Overview of North America Battery Metals Market

Figure 10. North America Battery Metals Market – Revenue and Forecast to 2028 (US$ Mn)

Figure 11. North America Battery Metals Market Revenue Share, By Type (2020 and 2028)

Figure 12. Lithium: North America Battery Metals Market – Revenue and Forecast To 2028 (US$ Mn)

Figure 13. Nickel: North America Battery Metals Market – Revenue and Forecast To 2028 (US$ Mn)

Figure 14. Cobalt: North America Battery Metals Market – Revenue and Forecast To 2028 (US$ Mn)

Figure 15. Others: North America Battery Metals Market – Revenue and Forecast To 2028 (US$ Mn)

Figure 16. North America Battery Metals Market Revenue Share, By Application(2020 and 2028)

Figure 17. Electric Vehicles: North America Battery Metals Market – Revenue and Forecast To 2028 (US$ Mn)

Figure 18. Consumer Electronics: North America Battery Metals Market – Revenue and Forecast To 2028 (US$ Mn)

Figure 19. Energy Storage Systems: North America Battery Metals Market – Revenue and Forecast To 2028 (US$ Mn)

Figure 20. Others: North America Battery Metals Market – Revenue and Forecast To 2028 (US$ Mn)

Figure 21. North America Battery Metals Market Revenue Share, By Region (2021 and 2028)

Figure 22. North America: North America Battery Metals Market – Revenue and Forecast to 2028 (US$ Million)

Figure 23. US: North America Battery Metals Market – Revenue and Forecast to 2028 (US$ Million)

Figure 24. Canada: North America Battery Metals Market – Revenue and Forecast to 2028 (US$ Million)

Figure 25. Mexico: North America Battery Metals Market – Revenue and Forecast to 2028 (US$ Million)

Figure 26. Impact of COVID-19 Pandemic on North America Battery Metals Market in North America

- Albemarle Corporation

- Bolt Metals Corp.

- Ganfeng Lithium Co.,Ltd.

- Umicore

- LG Chem

- Vale

- BASF SE

- Metso Outotec

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the North America battery metals market.

- Highlights key business priorities in order to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in North America battery metals market, thereby allowing players across the value chain to develop effective long-term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth global market trends and outlook coupled with the factors driving the market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin security interest with respect to client products, segmentation, pricing and distribution.