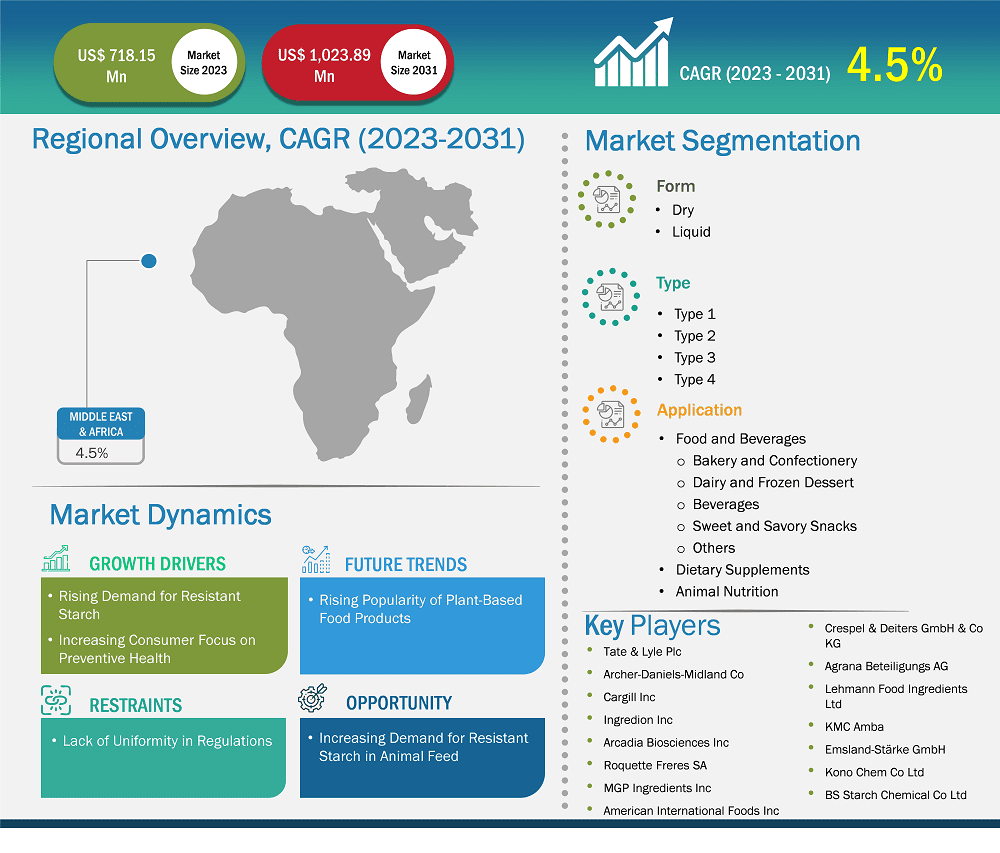

The Middle East & Africa resistant starch market size is expected to reach US$ 1,023.89 million by 2031 from US$ 718.15 million in 2023. The market is estimated to record a CAGR of 4.5% from 2023 to 2031.

In the Middle East & Africa, the rising obesity rates have become a major public health concern, along with the subsequent increase in obesity-related comorbidities. The prevalence of overweight and obesity in the Middle East ranges from 47% in women and 34% in men, according to the WHO Regional Office for the Eastern Mediterranean. Further, malnutrition rates are particularly high in Africa. Various types of dietary risks raise the chances of becoming prone to different diseases. Therefore, nowadays, many people across the region are focusing on following healthy eating patterns, thereby boosting the demand for fiber-rich dietary supplements.

In the MEA, the demand for resistant starch is being propelled by the growing health-conscious middle-class population, particularly in countries such as Saudi Arabia, the UAE, and South Africa. In these countries, people are shifting toward healthier eating patterns due to rising incidences of lifestyle-related diseases, such as diabetes and obesity. The prevalence of diabetes in the region is significant, with 25.8% of adults in the UAE and 29.1% in Saudi Arabia diagnosed as of 2023. This trend has encouraged consumers to seek food products that help regulate blood glucose levels, fueling the demand for resistant starch. Therefore, the food & beverages industry in the region is responding to this demand by incorporating resistant starch into a variety of products, including baked goods, snacks, and dairy alternatives.

Middle East & Africa Resistant Starch Market Segmentation Analysis:

Key segments that contributed to the derivation of the Middle East & Africa resistant starch market analysis are form, type, and application.

The global food industry is growing tremendously owing to rising population, changing lifestyles, increasing per capita income, and surging demand for convenience food. In 2022, the UAE was the second-largest market for US processed food exports in the Middle East, following Saudi Arabia. The UAE imported US$ 468.5 million worth of U.S. processed foods that year, showing an 11% growth. In 2023, US exports of processed foods to the UAE increased by 7%, reaching US$ 499.1 million, making the UAE the top market in the region, surpassing Saudi Arabia. Further, various food and beverage products are made from clean label ingredients such as resistant starch extracted from banana, potato, grains, and cassava starch. Resistant starch is also used in food and beverages as additives to lower glycemic value and calorific value quality in baked food products, confectioneries, dairy products, thick beverages, savory snacks, sweets, sauces, and mayonnaise.

The growing population worldwide is increasing the demand for food and beverages. According to the United Nations, the global population is projected to reach 8.5 billion by 2030. There has been a substantial increase in demand for ready-to-eat or convenience food and beverage products due to increasingly busy lifestyles and a surge in the working population. Further, the manufacturers are also developing products that meet the changing consumer requirements for different food and beverage products, especially clean-label, gluten-free, vegan, non-GMO, and plant-based products. ADM (Archer Daniels Midland Company) is a global leader in nutrition and ingredients, offering a variety of gluten-free, resistant starch products. They provide a range of starches, including resistant starches, that meet various dietary needs, particularly for gluten-free options and functional ingredients used in food formulations. Thus, the rising demand for resistant starch for various food and beverage products drives the market.

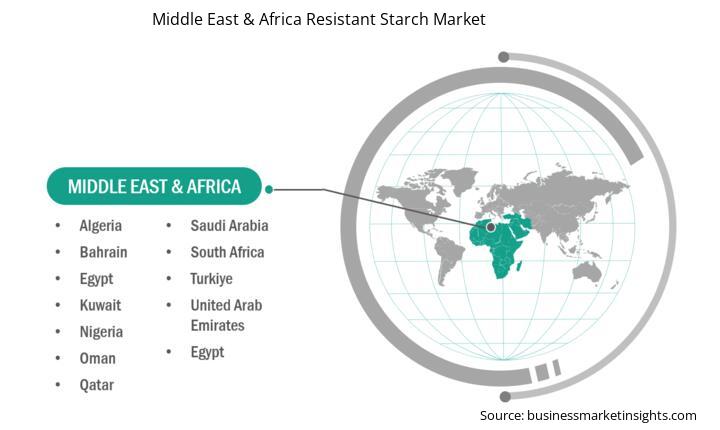

Based on country, the Middle East & Africa resistant starch market comprises South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa. The Rest of Middle East & Africa held the largest share in 2023.

Turkey, Iran, Kuwait, Qatar, Oman, Egypt, and Morocco are among the major countries in the Rest of Middle East & Africa resistant starch market. The region is witnessing a surge in the prevalence of diabetes and obesity among consumers. According to the International Diabetes Federation, the Middle East & Africa are expected to record 136 million diabetic patients by 2045. Due to increasing obesity among the population there is growing demand for prebiotic food such as resistant starch. Moreover, according to the records of the International Federation of Starch Associations (IFSA), the majority of resistant starch produced in Turkey and Qatar is derived from maize and wheat, respectively. Thus, the growing production drives the growth of the resistant starch market.

Middle East & Africa Resistant Starch Market Company Profiles

Some of the key players operating in the market include Tate & Lyle Plc, Archer-Daniels-Midland Co, Cargill Inc, Ingredion Inc, Arcadia Biosciences Inc, Roquette Freres SA, MGP Ingredients Inc, American International Foods Inc, Crespel & Deiters GmbH & Co KG, Agrana Beteiligungs AG, Lehmann Food Ingredients Ltd, KMC Amba, Emsland-Stärke GmbH, Kono Chem Co Ltd, and BS Starch Chemical Co Ltd, among others. These players are adopting various strategies such as expansion, product innovation, and mergers and acquisitions to provide innovative products to their consumers and increase their market share.

The following methodology has been followed for the collection and analysis of data presented in this report:

The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

Note: All financial data included in the Company Profiles section has been standardized to USD. For companies reporting in other currencies, figures have been converted to USD using the relevant exchange rates for the corresponding year.

The Insight Partners conducts a significant number of primary interviews each year with industry stakeholders and experts to validate its data analysis and gain valuable insights. These research interviews are designed to:

Primary research is conducted via email interactions and telephone interviews, encompassing various markets, categories, segments, and sub-segments across different regions. Participants typically include:

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 718.15 Million |

| Market Size by 2031 | US$ 1,023.89 Million |

| CAGR (2023 - 2031) | 4.5% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Form

|

| Regions and Countries Covered |

Middle East and Africa

|

| Market leaders and key company profiles |

|

The Middle East & Africa Resistant Starch Market is valued at US$ 718.15 Million in 2023, it is projected to reach US$ 1,023.89 Million by 2031.

As per our report Middle East & Africa Resistant Starch Market, the market size is valued at US$ 718.15 Million in 2023, projecting it to reach US$ 1,023.89 Million by 2031. This translates to a CAGR of approximately 4.5% during the forecast period.

The Middle East & Africa Resistant Starch Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Resistant Starch Market report:

The Middle East & Africa Resistant Starch Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Resistant Starch Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Resistant Starch Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)