The demand for monoclonal antibody-based products in Saudi Arabia have a high success rate in clinical development and is reported that the probability of FDA approvals for mABs in Phase 1 of development in ~14.1% that is almost twice the approval rate of small molecule drugs (~7.6%). On the other hand, the IAVI report states that with the onset of pandemic worldwide many biopharmaceutical companies sell mABs based products at affordable prices. For example, in South Africa, Roche sells its breast cancer mAB "trastuzumab" as both Herceptin the original brand as a second brand called "Hercelon". Apart from that, as availability of these mABs is limited, various pharmaceutical companies are conducting clinical trials in middle-income counties. For example, Merck is conducting clinical trials in several middle-income countries such as South Africa, Colombia, and Malaysia. Such aforementioned factors have positive influence in the regional market thereby witnessing high adoption of monoclonal antibody in Middle East and Africa region amid COVID-19 pandemic.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the monoclonal antibodies market. The Middle East & Africa monoclonal antibodies market is expected to grow at a good CAGR during the forecast period.

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 3,198.9 Million |

| Market Size by 2028 | US$ 5,741.1 Million |

| CAGR (2021 - 2028) | 8.7% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Source

|

| Regions and Countries Covered |

Middle East and Africa

|

| Market leaders and key company profiles |

|

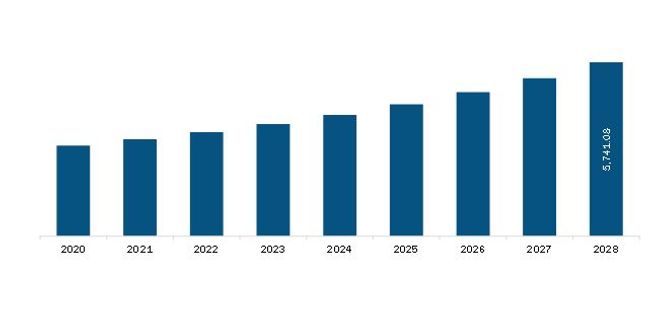

The Middle East and Africa Monoclonal Antibodies Market is valued at US$ 3,198.9 Million in 2021, it is projected to reach US$ 5,741.1 Million by 2028.

As per our report Middle East and Africa Monoclonal Antibodies Market, the market size is valued at US$ 3,198.9 Million in 2021, projecting it to reach US$ 5,741.1 Million by 2028. This translates to a CAGR of approximately 8.7% during the forecast period.

The Middle East and Africa Monoclonal Antibodies Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East and Africa Monoclonal Antibodies Market report:

The Middle East and Africa Monoclonal Antibodies Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East and Africa Monoclonal Antibodies Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East and Africa Monoclonal Antibodies Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)